International finance through the lens of BIS statistics: bank exposures and country risk

The BIS consolidated banking statistics (CBS) are one of the few data sets to provide banks' consolidated exposures to individual countries. The consolidated perspective shifts the focus from where banking activity takes place to who drives this activity and bears the risks. Originating after the Latin American debt crisis of the 1980s, the CBS provide the most comprehensive measures of banks' consolidated exposures to countries and sectors. They have helped policymakers, market participants and researchers understand bank exposures, country risk, and how financial stresses spill over from one country to another.1

JEL classification: F23, F31, F36, G15.

Sovereign defaults, sanctions, payment moratoriums, financial and economic crises, wars and natural disasters: all such events have macroeconomic consequences that expose creditor banks to potential losses. The largest global banks operate in scores of countries; their balance sheets straddle national borders. A bank's capital will be affected by losses no matter where they happen. Moreover, losses on exposures to one country can have implications for borrowers elsewhere, as banks adjust their global balance sheets in response. Understanding how stresses propagate through banks' balance sheets across countries is a key aspect of financial stability analysis. Data on the geography – ie country and sector – of banks' global exposures are a critical input that is unavailable in most bank disclosures.

This feature is a primer on how BIS international banking statistics can be used to understand the geography of banks' country exposures. Examples include Japanese banks' global expansion in the 1980s; European banks' retrenchment after the 2007–09 Great Financial Crisis (GFC) and the 2010–12 euro area sovereign debt crisis; and, more recently, banks' unwinding of exposures to Russia after the sanctions imposed in 2014 and 2022.

Key takeaways

- The BIS consolidated banking statistics (CBS) track banks' exposures to country risk, ie the risk arising from macroeconomic events or policies in a given jurisdiction.

- The CBS are compiled following supervisory practices, and thus provide information about on-balance sheet positions as well as other potential off-balance sheet exposures.

- Consolidation in the CBS shifts the focus from where banking activity takes place to who drives this activity. The CBS reveal the size, type and evolution of banks' exposures to countries.

Understanding such developments requires statistics that capture the geography of banks' consolidated worldwide exposures. These should reveal the countries to which banks are exposed, and the countries in which they operate. The long list of credit events and crises since the 1970s are recurrent reminders of the need to measure banks' exposure to transfer risk – the risk of non-payment by obligors in a particular jurisdiction due to policies taken in that jurisdiction – and to country risk more generally – the risk associated with the economic, business, political and social environment in which the debtor operates.

While supervisory authorities monitor the geography of individual home banks' exposures, the BIS consolidated banking statistics (CBS) provide a global view. Consolidation follows the contours of the banks' global balance sheets, including those of affiliates abroad, and allocates all positions to the country of banks' headquarters (ie home country) where decisions that affect the whole balance sheet are made (eg French banks). Intragroup positions are netted out, leaving only positions with unaffiliated entities. This makes the CBS ideal for measuring banks' financial exposures. The CBS thus complement residence-based banking statistics (eg banks located in France) by revealing who drives changes in global banking positions.

The CBS are a key input for various areas of policy interest. First, for more than four decades, they have been a primary tool to assess banks' aggregate potential losses. They complement micro-level supervisory data and facilitate analysis of how crises spill over across borders. Moreover, the CBS have in some cases yielded early warnings of perceived changes in borrowers' creditworthiness. As concerns about country risk mount, banks may seek third-party guarantees before rolling over maturing credits, hedge their exposures in derivatives markets or curtail credit to borrowers that lack corporate parent guarantees.

Second, the CBS record the maturity structure of banks' claims. This helps in assessing the flexibility banks have to unwind outstanding positions and provides critical information for national authorities about the risk of a sudden stop to countries' external debt flows. When global banks retrenched in the wake of the GFC, countries that had borrowed mainly short-term saw outsize contractions in credit.

The CBS thus shed light on the way banks adjust their exposures in response to material changes in country risk. For instance, as Greece's credit rating fell in 2010, banks shed exposures to borrowers in Greece and transferred risk out of the country. In 2022, cross-border claims and guarantees on entities in Russia also declined substantially, more so than the local operations of foreign banks in Russia.

The feature proceeds as follows. The first section covers the origin of the CBS and the underlying concepts (further detailed in a box and the annex). The second and third sections examine concentration in banking and the measurement of country risk. The fourth section explores how the CBS are useful in analyses of policy-relevant topics. The final section concludes.

Origin and evolution of the CBS

The origin of the CBS lies in the expansion of international banking activity in the Caribbean and other financial centres in the 1970s, when little information was available about such activity. Many central banks had for decades collected residence-based data to compile the BIS locational banking statistics (LBS). They directed banks to report claims – ie loans, holdings of debt securities and other financial instruments – booked at offices abroad with those of their head offices. Banks began reporting claims with maturity and geographical breakdowns, although only vis-à-vis emerging market economies (EMEs).2

The evolution of the CBS has followed the lessons from the history of financial crises (Caruana (2017)). The collection was formalised in response to the Latin American debt crisis in the 1980s. At the time of the Mexican sovereign default in 1982, attention was focused on transfer risk, ie the risk associated with policy measures with a territorial scope that prevent the withdrawal of funds from a country, such as capital controls and payment moratoriums (McGuire and Wooldridge (2005)). Banks were asked to fully consolidate their foreign claims – ie claims on borrowers residing outside their home country – with inter-office positions netted out. This measure includes cross-border claims as well as local claims – ie claims of a bank's foreign affiliate on residents of the host country. This approach differs substantially from the LBS and other data sets used in international finance that aggregate balance sheets from a (residence-based) national accounts perspective rather than (consolidated) supervisory perspective.3 The BIS first published the CBS on an immediate counterparty basis (CBSI) in 1983 based on data reported by 15 countries (see technical annex), with claims broken down by the country where the contractual borrower resides.

With the Asian financial crisis of 1997–98, attention shifted from transfer risk to the broader concept of country risk, which refers to country-wide events (eg economic, political, social) that could expose banks to losses. Measurement of country risk exposures requires more comprehensive data than for transfer risk exposures. For example, guarantees and collateral received that offset exposures can lower banks' exposure to country risk. At the same time, banks' have potential exposures which are not included in claims that can increase exposure to country risk.

The CBS were thus adjusted to provide more information that better reflected banks' approach to risk management. This included reporting of guarantees received and other credit enhancements that result in the reallocation of exposures from the country of the immediate counterparty to that of the ultimate obligor (see box).4 In addition, in response to banks' growing derivatives and asset management business, they began to separately report their derivative exposures.5 Finally, banks began to report their potential exposures to countries in the form of undisbursed credit commitments and guarantees provided. The BIS in 2005 began publication of the CBS on a guarantor basis (CBSG), which captures these elements.

Further enhancements were introduced in the wake of the GFC, which highlighted the need for better data on major banking systems' funding and lending (Avdjiev et al (2015)). Coverage of banks' balance sheets was expanded to include their domestic positions, ie positions vis-à-vis residents of the home country. And additional granularity on the sector of banks' counterparties was added, notably banks' exposures to non-bank financial counterparties (García-Luna and Hardy (2019)). Successive rounds of expansion thus resulted in the structure of the CBS available today (see box and annex).

Concentration in banks' country exposures

The consolidated perspective of the CBS shifts the focus from where banking activity takes place to who drives this activity. Multinational banks, like corporates, have operations in, and exposure to, countries around the world, and their decisions affect multiple economies at the same time. Thus, the country exposure of banks and the impact of corporate decisions are better understood by focusing on their consolidated balance sheets (McGuire and von Peter (2012)).

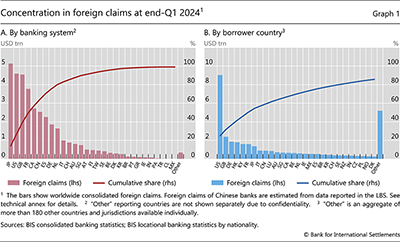

Taking a consolidated perspective reveals a remarkable degree of concentration in decision-making in international banking. Banks headquartered in a mere four countries (Japan, the United Kingdom, the United States and France) accounted for half of global foreign claims at end-Q1 2024 (Graph 1.A).6 These four countries are home to 17 of the 29 global systemically important banks (G-SIBs) that have operations in more than 160 jurisdictions. With consolidation, financial positions booked by affiliates in financial centres (eg the Cayman Islands) "disappear" as assets (and liabilities) are reallocated to the countries where the parent companies that own (owe) them are headquartered (McGuire et al (2024a)).

Foreign claims are not quite as concentrated on the counterparty side, although the United States stands out as an obligor to roughly a quarter of the global total (Graph 1.B). Claims on the United States are prominent due to the dominance of the US dollar in international finance and the size of the US economy; many non-US banks hold US Treasuries and have local operations in the United States that extend credit to corporates and other borrowers there (McGuire et al (2024b)). Claims on three financial centres, the Cayman Islands, Hong Kong SAR and the United Kingdom, are also substantial, jointly accounting for 16% of global foreign claims.7 The remaining 59% of foreign claims are distributed across more than 200 jurisdictions.

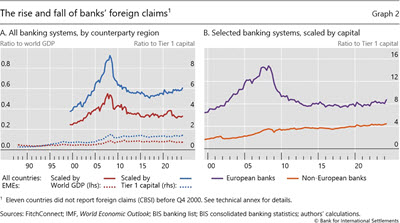

Banks' foreign claims have evolved significantly over time, outpacing global economic activity and bank capital in some periods. In the run-up to the GFC, total foreign claims soared to more than 50% of global GDP (Graph 2.A, solid red line), which significantly stretched banks' regulatory capital bases (solid blue line). The retrenchment in the wake of the GFC reflected a massive deleveraging, mainly by European banks, and stricter regulation that required banks to hold more regulatory capital (Graph 2.B). Other banking systems, eg US, Japanese and Canadian banks, saw smaller disruptions in the trajectory of their foreign claims relative to capital.

Measuring exposure to country risk

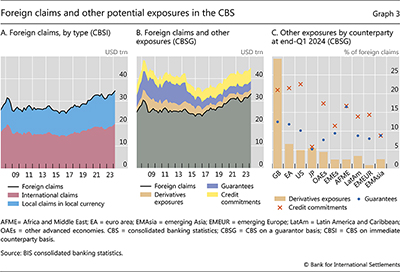

For monitoring exposure to transfer risk, the most appropriate data are international claims on an immediate borrower basis (CBSI). Transfer risk arises from both components of international claims: cross-border claims as well as local claims denominated in foreign currencies, which are often funded from abroad. By contrast, local claims in local currencies are usually funded by local deposits in local currency – a typically stable form of funding – and so are not affected by restrictions on external payments. This is why they are not part of international claims (but are part of foreign claims; see box).8

By contrast, measures of exposure to overall country risk should be broadened to capture all exposures, as tracked in the CBSG. Local currency claims extended locally in host countries, as well as international claims, are subject to country risk. Thus, total foreign claims, which include both of these components, is the more appropriate measure for country risk exposure. Foreign claims are typically 60–80% greater than international claims in aggregate, as local positions in local currency can be significant (Graph 3.A). Large international banking groups often acquire local claims by taking over domestic banks operating in a particular country.

Further reading

The CBS on a guarantor basis (CBSG) captures additional exposures to country risk beyond just loans and securities holdings (ie claims). These data also include derivatives – which are reported separately from claims in the CBS – and contingent exposures. Derivatives facilitate leveraged trading; hence, small movements in the price of the underlying instrument can result in large changes in exposures. Further, borrowers may draw down lines of credit and call on guarantees provided by banks, especially in times of stress. Such contingent exposures raise banks' actual country risk exposure when drawn.9 These off-balance sheet exposures add another 30% on average to aggregate foreign claims, while derivatives add 6% (Graph 3.B). For some counterparty countries, derivatives and contingent exposures can boost foreign exposures significantly, up to 63% in the case of borrowers in the United Kingdom (Graph 3.C). The outsize derivatives exposures on the United Kingdom mainly reflect the role of London as a centre for derivatives clearing.

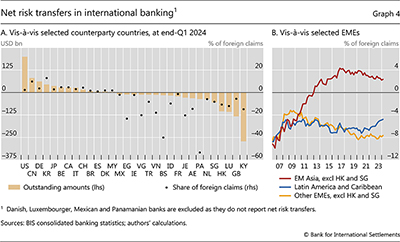

Shifting to a guarantor basis also takes into account credit risk mitigants, eg guarantees and collateral received, and credit protection bought via derivatives. These have the effect of transferring risk from the country where the immediate counterparty resides to that where the ultimate guarantor resides. For example, if a country were to declare an external debt moratorium, then guarantees provided by the foreign parent of a borrower resident in the country (ie an outward risk transfer) can reduce a reporting bank's exposure to transfer risk. At the same time, claims on overseas affiliates of banks headquartered in the crisis-stricken country would increase a reporting bank's exposure (ie an inward risk transfer). In addition to guarantees, the purchase of credit protection (eg a credit default swap) and collateral provided by the borrower can also lead to outward risk transfers. In any case, the overall level of exposures stays the same, but the counterparty country for those exposures (and hence the transfer or country risk faced by the bank) changes.

Risk transfers in fact significantly alter the geography of banks' exposures. In March 2024, banks' claims on major financial centres (eg the Cayman Islands, Luxembourg and the United Kingdom) were some 6–15% lower once risk transfers are taken into account (Graph 4.A). This reflects the fact that many of the immediate counterparties in these locations have parents elsewhere that provide guarantees to the creditor banks. These parents tend to be located in large economies (eg the United States, China and Germany) that are home to multinational firms. Accordingly, banks' positions vis-à-vis these economies on a guarantor basis (CBSG) are larger than on an immediate counterparty basis (CBSI).

Risk transfers evolve with the riskiness of borrower countries and the mix of creditor banks (Graph 4.B). They reflect the creditworthiness of counterparty countries: net inward risk transfers (and so exposures) to major EMEs tend to increase as their sovereign credit ratings improve (Aldasoro and Ehlers (2017)). The closeness of creditor banks to a region also matters. For example, reporting banks transferred around 8% of their exposures out of emerging Asia in early 2007; by 2013, they reported net transfers into the region (red line). Underlying this shift was a change in the composition of creditor banking systems: as European banks retreated in the wake of the GFC, banks from Chinese Taipei, Hong Kong SAR, Japan and Singapore increased their exposures to emerging Asia (Aldasoro and Ehlers (2017)).

Understanding banks' ultimate vulnerabilities to credit events in particular countries requires a deeper analysis that takes into account banks' business models (Avdjiev and Wooldridge (2018)). While a bank may have large exposures to a given country, it may have little capital at stake. For example, a multinational bank with a subsidiary in a crisis-stricken country could choose to sell the subsidiary, or even let it fail and simply write down the capital that the bank had invested in the subsidiary. In this case, the bank's exposure would be limited to its equity participation plus any intragroup funding and guarantees it provided. The decision of whether to exercise this option depends on a myriad of factors including the size of the equity stake and intragroup funding, the ownership structure (eg wholly owned or joint venture), the financial health of the overall banking group, the regulatory framework and the reputational risks associated with letting a subsidiary fail. The CBS do not provide the information needed to examine such scenarios.

Banks' exposures and financial stability

Banks' exposure to country risk comes in many forms, and banks have several options to manage it. Problems in one part of a global bank's balance sheet (eg exposure to country A) often have implications for other parts (eg lending to country B), as banks adjust their global balance sheet.10 This section highlights cases where a consolidated view of banks' operations and exposures is essential for understanding issues of financial structure and stability.

The rise of local banking

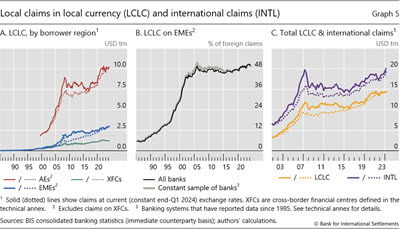

The global operations of large banks create country exposures for the consolidated group through the local positions of their affiliates. In the 1980s, banks' exposures to EMEs were largely international claims (cross-border claims and local claims in foreign currencies), in part led by a boom in Japan and the expansion of banks headquartered there. In the 1990s and up to the GFC, major banks expanded their global operations by setting up local affiliates for local currency business in many countries. The largest offices were in advanced economies, where local currency claims grew to over $10 trillion, but operations in EMEs also steadily expanded (Graph 5.A). Such local currency positions are typically funded by local currency liabilities, so a higher share of such positions lowered banks' exposure to both transfer risk and currency risk.

The trend of global banks towards local banking in EMEs levelled off after the GFC but may again be on the rise. The share of foreign claims on EMEs that came from local offices rose rapidly from 6% at end-1985 to 50% at end-2005 (Graph 5.B). Since 2015, local and international claims have again been growing steadily to reach $15 trillion and $20 trillion at end-Q1 2024, respectively (Graph 5.C).

Maturity of international claims

When analysing countries' external vulnerabilities, it is important to monitor banks because of the typically short maturity of their claims. The CBS provide a maturity breakdown for international claims on individual countries, and a separate breakdown by sector.11 This information is also useful for borrower countries, complementing International Investment Position (IIP) data to monitor risks in external positions.

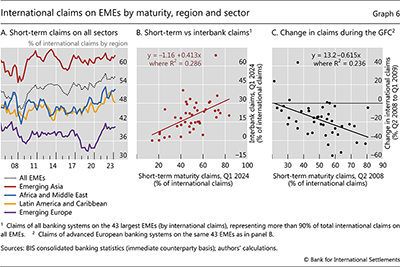

The maturity of banks' exposures differs systematically across borrower countries. Claims on EMEs in Asia, for instance, tend to have a larger short-term component than those on other regions, especially emerging Europe (Graph 6.A). The differences in the short-term share have remained fairly constant over time. To some extent, the short-term share reflects the sectoral distribution of banks' claims, since interbank positions tend to be short-term (Graph 6.B).12

Details on the sector and maturity of bank claims provide crucial insights into banks' ability to adjust their exposure to country risk and the implications for the borrowing countries. Banks can quickly unwind their interbank positions due to their short-term nature. They can also reduce sovereign exposures by selling holdings of government bonds (possibly taking a loss on the market value), which shifts the risk to other creditors without reducing the funding obtained by the issuer.

The maturity of bank credit matters greatly during a crisis. The experience of EME borrower countries during the GFC illustrates this point. For many, credit from banks accounted for the bulk of their total external debt. As the GFC unfolded, European banks – saddled with losses on their real estate exposures and faced with a need to deleverage – retrenched their global positions in part by letting their short-maturity claims run off. In a sample of the top 43 EME borrower countries, a 10 percentage point higher share of short-term borrowing from European banks on the eve of the GFC (end-Q2 2008) translated into a contraction in international claims some 6 percentage points larger than otherwise (Graph 6.C). The maturity breakdown in the CBS is thus a useful barometer for how quickly bank credit can evaporate (Avdjiev et al (2018)).

Grappling with country risk

Banks have a number of different strategies to reduce exposures to risky countries. As concerns about country risk mount, banks may cut lending, seek third-party guarantees before rolling over maturing credits or hedge their exposures using derivatives. In some cases, banks may find it more cost-effective to buy protection against credit risks rather than sell their exposures outright or wait for them to mature. The CBS provide an aggregate view of these risk management strategies.

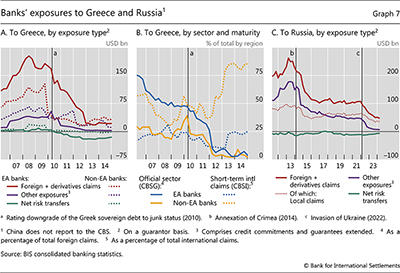

Consider banks' exposures to Greece during the euro area crisis. As Greek sovereign bonds grew risky, ultimately being downgraded to junk status in 2010, banks reacted by curtailing foreign claims on Greek borrowers, transferring risk out and decreasing other exposures like credit commitments (Graph 7.A). For banks from outside the euro area, this included selling a Greek subsidiary in 2009, as well as shedding exposures generally. By end-2011, non-euro area banks ended up with smaller exposures to Greece on their balance sheets than their off-balance sheet credit commitments and guarantees. By contrast, euro area banks had, by end-2012, shifted most of the risk from their remaining Greek exposures to other counterparties.

The sector and maturity composition of exposures to Greece shifted during this retreat. Half of euro area banks' claims were on the official sector in Q1 2010, but this share fell to nearly zero by 2012 (Graph 7.B). Non-euro area banks similarly reduced their claims on the official sector to near zero. As they cut long-term exposures, however, they increased their short-term claims. This may have reflected a high spread on such lending as well as these banks' trepidation about lingering exposure to Greek counterparties.

The Russian invasion of Ukraine and associated sanctions provide another example of banks adjusting their exposures to rising country risk. Foreign claims on Russia fell following the annexation of Crimea in 2014, and fell further after the 2022 invasion as many countries imposed wide-ranging sanctions (Graph 7.C). Risk transfers out of Russia remained relatively small during this period. While banks maintained some foreign claims, other exposures were all but eliminated. Before 2014, other exposures (notably guarantees) were as large as three quarters the size of foreign claims. However, guarantees sharply declined from Q1 2014 to end-2021, by 71% to reach $47 billion. In 2022, strict financial sanctions probably made credit commitments and guarantees incalculable, causing those on Russia to fall sharply to just 4% of their peak values. The few exposures left were mainly from banks that kept their local affiliates in Russia.

Conclusion

The history of recurrent financial crises shows that economic events in one country or region can have ramifications elsewhere. Often, stresses propagate across the balance sheets of creditor banks. This reflects the high degree of concentration in international banking and the wide geographic reach of global banks. The largest of these banks have local operations in scores of countries, but decision-making is concentrated in a select few.

Monitoring such a globalised financial system requires statistics that both reflect this concentration and capture these geographic exposures. The BIS CBS were designed with this need in mind. They allow users to evaluate how losses vis-à-vis particular countries and sectors might diminish bank capital. And supplementary information in the CBS sheds light on banks' use of guarantees, credit derivatives and collateral to shift risk away from riskier borrowers rather than winding down outstanding positions.

The CBS have been a key tool in global monitoring since the 1980s. They have been used for forensic analysis of system-level losses during the Asian financial crisis in the 1990s, the GFC in 2007–09, the European sovereign debt crisis in 2010–12 and, more recently, the Russian annexation of Crimea in 2014 and the full-scale invasion of Ukraine in 2022.

The recent rise in geopolitical tensions has sparked debate about geo-financial fragmentation, and whether the world is moving towards a multi-polar economic order (Qiu et al (2024)). Residence-based financial statistics, such as the BIS LBS and the IMF's Coordinated Portfolio Investment Survey and Coordinated Direct Investment Survey go a long way in mapping out the geography of global financial positions, and are thus essential in monitoring financial fragmentation moving forward. The CBS complement these statistics with crucial information about which national banking systems drive this process.

References

Aldasoro, I and T Ehlers (2017): "Risk transfers in international banking", BIS Quarterly Review, December 2017, pp 15–22.

Aldasoro, I, B Hardy and M Jager (2022): "The Janus face of bank geographic complexity", Journal of Banking and Finance, vol 134 (106040).

Avdjiev, A, B Berger and H S Shin (2018): "Gauging procyclicality and financial vulnerability in Asia through the BIS banking and financial statistics", BIS Working Papers, no 735.

Avdjiev, S, P McGuire and P Wooldridge (2015): "Enhanced data to analyse international banking", BIS Quarterly Review, September 2015, pp 53–68.

Avdjiev, S and P Wooldridge (2018): "Using the BIS consolidated banking statistics to analyse country risk exposures", BIS Quarterly Review, September, pp 14–16.

Caruana, J (2017): "International financial crises: new understandings, new data", keynote speech at the launch of the book Alexandre Lamfalussy: selected essays, National Bank of Belgium, 6 February.

Casanova, C, B Hardy and M Onen (2021): "Covid-19 policy measures to support bank lending", BIS Quarterly Review, September, pp 45–59.

Doerr, S and P Schaz (2021): "Geographic diversification and bank lending during crises", Journal of Financial Economics, vol 140, no 3, pp 768–88.

García Luna, P and B Hardy (2019): "Non-bank counterparties in international banking", BIS Quarterly Review, September 2019, pp 15–33.

McCauley, R, J Ruud and P Wooldridge (2002): "Globalising international banking", BIS Quarterly Review, March, pp 41–51.

McGuire, P and G von Peter (2012): "The US dollar shortage in global banking and the international policy response", International Finance, vol 15, no 2.

McGuire, P, G von Peter and S Zhu (2024a): "International finance through the lens of BIS statistics: residence vs nationality", BIS Quarterly Review, March, pp 73–88.

--- (2024b): "International finance through the lens of BIS statistics: the global reach of currencies", BIS Quarterly Review, June, pp 1–16.

McGuire, P and P Wooldridge (2005): "The BIS consolidated banking statistics: structure, uses and recent enhancements", BIS Quarterly Review, September, pp 73–86.

Qiu, H, D Xia and J Yetman (2024): "Deconstructing global trade: the role of geopolitical alignment", BIS Quarterly Review, September, pp 33-48.

Wooldridge, P, D Domanski, D and A Cobau (2003): "Changing links between mature and emerging financial markets", BIS Quarterly Review, September, pp 45–54.

Technical annex

All graphs are based on data from the CBS reporting countries (see below for details). China does not report to the CBS.

Graph 1: The bars show worldwide consolidated foreign claims on a guarantor basis (CBSG) for 26 banking systems, and on an immediate counterparty basis (CBSI) for five banking systems that do not report the CBSG.

Graph 2: The 11 countries that started reporting foreign claims (CBSI) after Q3 2000 are AU (Q4 2000), BR (Q4 2002), CL (Q4 2002), GR (Q4 2003), IN (Q4 2001), KR (Q4 2011), MX (Q4 2003), PA (Q4 2002), SG (Q4 2000), TR (Q4 2000), and TW (Q4 2000). They accounted for 3% of total foreign claims in Q4 2000. Annual world GDP figures converted to quarterly frequency by using the end-year figure over the quarters of the same year are used.

Tier 1 capital is reported by 16 European countries (AT, BE, CH, DE, ES, FI, FR, GB, GR, IE, IT, LU, NL, NO, PT and SE) and nine non-European countries (AU, BR, CA, HK, IN, JP, KR, TW and US) in the CBS, with different reporting dates. Missing and/or confidential data are supplemented by bank-level data aggregated at the country level from FitchConnect; growth rates of FitchConnect country-level data where available are used to backdate CBS data. Tier 1 data only for countries for which foreign claims are available (and vice versa) are included.

Graph 5: XFCs are cross-border financial centres as defined in P Pogliani, G von Peter and P Wooldridge, "The outsize role of cross-border financial centres", BIS Quarterly Review, June 2022, pp 1–15. The XFC aggregate in Graph 5 comprises BH, BM, BS, CW, CY, GG, GI, HK, IE, IM, JE, KY, LR, LU, MH, MT, MU, NL, PA, SG, SM, VG and VU. The names of jurisdictions corresponding to ISO codes are provided under the abbreviations on pages iv–vii. Banking systems with long historical data for local claims in local currency are: BE, CA, CH, DE, ES, FR, GB, IT, JP, NL, US. For the denominator (foreign claims), all reporters are included irrespective of whether a country reported local claims in local currency.

The structure of the CBS – detail complementing Box A

This Annex complements Box A with detail on valuation and reporting practices and illustrates the structure of the CBS (Table A). See the glossary for a list of terms related to the BIS international banking statistics.

Valuation. Claims and derivatives are reported on a gross basis at fair value, or at nominal value for non-negotiable assets such as loans and deposits. Quarterly movements in outstanding stocks include changes in asset valuations or writedowns in the original currency. By contrast, credit commitments and guarantees extended are reported at face value so as to measure reporting banks' maximum possible exposure. Recording positions at face or nominal value does not take account of the likelihood of adverse circumstances (nor of the recovery value in the event of a loss). Derivative claims are calculated as the positive market value; contracts which have negative market value are classified as liabilities of the bank. Derivatives include contracts covering foreign exchange, interest rate, equity, commodity and credit risks. However, credit protection bought to hedge an outstanding claim is classified as a risk transfer, whereas credit protection sold is recorded as a guarantee.

Table A lays out the breakdowns available for two reporting bases (CBSI and CBSG) for the latest available data. Overall totals differ because the CBSI are reported by 31 countries, the CBSG by 26 countries (see "reporting countries" below).

Exchange rates. All outstanding stocks are reported in current US dollars. Unlike the locational banking statistics (LBS), no currency breakdown is available for the CBS; positions in other currencies are converted by reporting banks into US dollars at end-of-quarter exchange rates. Therefore, dollar appreciation leads to a reduction in reported claims in other currencies when expressed in dollars, even when actual positions remain unchanged.

Reporting countries. The CBSI data reporting began in Q4 1983 and included 15 reporting countries: Austria, Belgium, Canada, Denmark, France, Germany, Ireland, Italy, Japan, Luxembourg, the Netherlands, Sweden, Switzerland, the United Kingdom and the United States. Since then, another 16 countries have joined. CBSG reporting began in 2005. See the international banking statistics' reporting country list for detail. Seventeen countries reporting the LBS do not report the CBS, notably China, Russia, and a number of cross-border financial centres.

1 This is the third feature in a series showcasing the BIS international banking and financial statistics, following McGuire et al (2024a, 2024b). We thank Iñaki Aldasoro, Douglas Araujo, Stefan Avdjiev, Claudio Borio, Gaston Gelos, Robert McCauley, Swapan-Kumar Pradhan, Andreas Schrimpf and Hyun Song Shin for their helpful comments, and Jhuvesh Sobrun for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 To be precise, banks reported their claims on borrowers residing in non-reporting countries, most of which were EMEs. This feature uses "emerging market economies (EMEs)" as a short form for Emerging markets and developing economies, the set of economies not classified as advanced economies (AEs) in the BIS country grouping convention.

3 Banks' public financial statements usually itemise their consolidated balance sheet by instrument but often lack information on country exposures. By contrast, the EU-wide transparency exercise conducted by the European Banking Authority details banks' sovereign exposures by country.

4 In addition, efforts were made to improve the timeliness, frequency and coverage of the CBS. In 2000, quarterly rather than semiannual publication began, the reporting lag was shortened, additional banking systems joined the reporting population and the counterparty country breakdown was expanded to include (from Q2 1999) all countries instead of only EMEs.

5 Banks derivatives activity expanded in the 1990s (McCauley et al (2002), Domanski et al (2003)). In the LBS, derivatives are included in claims, along with loans, holdings of debt securities and other instruments. In the CBS, derivatives are reported separately from other claims (see Box A).

6 Thirty-one countries report the CBS as of 2024, capturing the bulk of global consolidated banking positions. One major non-reporting country is China; a lower-bound estimate of Chinese banks' consolidated claims can be derived from the BIS locational banking statistics by nationality.

7 Banks' exposures are fully consolidated by nationality; however, on the counterparty side, the definition of a country remains residence-based (box in McGuire et al (2024a)).

8 Local claims in local currencies can be funded in foreign currency from abroad. This increases transfer risk exposures by the amount by which local claims exceed local liabilities in local currencies.

9 This was the case at the onset of the Covid-19 pandemic, as firms drew down existing credit lines, which substantially increased banks' on-balance sheet claims (Casanova et al (2021)).

10 A wide geographic exposure also diversifies bank risk, making them more resilient to local economic shocks in host countries where they have exposure (Doerr and Schaz (2021), Aldasoro et al (2022)).

11 Short-term international claims have a residual maturity of one year or less. Other maturity buckets are up to two years, more than two years and unclassified (eg equities and participations).

12 The same holds for certain positions with non-bank financial institutions (NBFIs). Since the GFC, unsecured interbank lending has given way to secured lending (ie repurchase agreements), much of which are cleared with central counterparties (generally treated as an NBFI counterparty in the CBS).