International finance through the lens of BIS statistics: residence vs nationality

Statistics used in international economics generally adopt a residence view, centred on an economy and the units located there. This is natural for understanding the geography of capital flows and other macroeconomic issues. However, the system of national accounts does not reflect the extent of globalisation and the rise of multinational firms and financial intermediaries. Their balance sheets straddle national borders, and their decisions affect many countries in ways that are obscured in residence statistics. This feature uses BIS statistics to show how a nationality view, which groups balance sheets by the country of headquarters, can provide insights on policy-relevant issues such as foreign currency debt, deglobalisation and financial openness. 1

JEL classification: E01, F23, F36, G15.

The unit of analysis in statistics used in international economics is "the economy". It comprises institutional units with a physical presence under a common jurisdiction, typically a country and its residents (United Nations (2008)). This is the basis on which economic activity is measured. In this residence view, anything outside a country's border is external, thereby defining international trade and finance. This geographical lens is appropriate for analysing many issues, such as capital flows. The system of national accounts (SNA), the balance of payments (BoP), the international investment position (IIP), the International Monetary Fund (IMF) Coordinated Portfolio Investment Survey (CPIS) and Coordinated Foreign Direct Investment Survey (CDIS) are all compiled on a residence basis.

In reality, firms' balance sheets straddle national borders. Balance sheets are the locus of financial transmission and thus relevant for financial stability analysis. Multinational banks and corporates have operations around the world, and their decisions affect multiple economies at the same time. Against this backdrop, the residence view can limit understanding of issues involving ownership and control. A growing literature recognises the value of adopting a nationality view, which groups (or consolidates) economic units with the affiliates they control abroad. The nationality view complements the residence view by revealing who drives changes in international assets and liabilities.

Key takeaways

- Most international statistics are compiled on a residence basis. The alternative nationality view, available in BIS statistics, groups balance sheets by the country of headquarters.

- Moving from a residence to a nationality view shows the importance of multinational banks and firms in international finance and helps to reassess the role of financial centres.

- The nationality view provides insights about countries' foreign currency debt, financial openness and the drivers of cross-border financial positions.

The nationality view has a long history in BIS banking statistics. The expansion of international banking activity in financial centres in the 1970s led central banks and regulators to ask banks to consolidate offshore positions with those of their head offices. Consolidated reporting also became best practice in G10 countries and forms the basis of the Basel Framework for regulating internationally active banks. These efforts led to enhancements to the BIS international banking statistics (IBS), which for decades have had the dimensions needed for both a residence and nationality view (in contrast to other benchmark statistical collections used in international finance).

This feature is a primer on how BIS statistics can be used to understand topics in international finance from both a residence and nationality perspective. Moving from residence (entities in Switzerland) to nationality (Swiss entities anywhere in the world) fundamentally alters the interpretation of international statistics. The difference in the respective financial positions can be large: a shift to nationality makes financial centres "disappear" as assets (and liabilities) are reallocated to the countries where the parent companies that own (owe) them are headquartered. This in turn reveals just how concentrated international finance is in large multinational lenders and borrowers from a handful of countries. A shift in their globally consolidated balance sheets has implications far beyond their home country.

The nationality view sheds new light on many topics of policy interest. It provides debt measures that are better aligned with what national issuers ultimately owe. The nationality view also reveals who drives changes in cross-border banking. For example, financial retrenchment in the wake of the Great Financial Crisis (GFC) of 2007–09 was seen by some as broad-based deglobalisation but in fact was largely driven by European banks scaling back their foreign operations. Lastly, measures of countries' "financial openness" that account for multinational banking show most countries to be more open than previously thought.

The rest of this feature is organised as follows. The first section covers definitions and concepts that distinguish the residence view from the nationality view. The second compares how much, and for which countries, measures of international assets and liabilities differ under these two views, using BIS statistics and vendor data. The third section describes three examples where the nationality view provides new insights: foreign currency debt, the post-GFC retrenchment in global banking and the financial openness of countries. The final section concludes.

Concepts and definitions

The residence view is centred on an economy, defined as the set of resident institutional units.2 Residence is determined on the basis of physical presence and being subject to the jurisdiction of the government of a territory (United Nations (2008)). An economy is typically delineated by a country border and is the unit of survey on which the SNA is compiled. Many economic indicators, eg gross domestic product (GDP) or population, have long been measured on this basis.

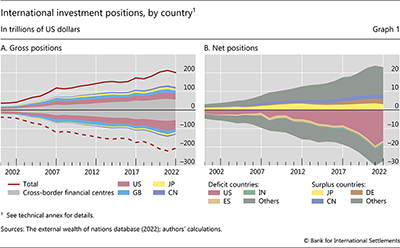

What falls outside the country border is designated as external. The current account, ie the gap between domestic saving and investment, records flows of goods, services and income between residents and non-residents. The financial account shows the corresponding acquisition and disposal of financial assets and liabilities with non-residents. Capital flows between countries are in turn aggregated, cumulated and revalued every period, giving rise to the IIP, ie the outstanding stock of external assets and liabilities (Graph 1.A).

By referencing a particular economy, residence-based statistics relate international finance to macroeconomic developments in that economy, such as GDP, consumption and saving. Gross external positions yield measures of countries' financial development and integration (Lane and Milesi-Ferretti (2007, 2018), Broner et al (2023)). Countries' positive and negative net external positions (Graph 1.B), which reflect cumulative current account surpluses and deficits, underpin discussions about global financial imbalances (eg Bernanke (2005)). The geography of capital flows also sheds light on a range of issues, including the flow of petrodollars, BoP crises and boom-bust cycles in emerging market economies (EMEs) (Borio et al (2011)).

In line with available statistics, academic work in international economics and finance tends to take the country as the unit of analysis. Furthermore, the perimeters of both currency use and balance sheets are often assumed to align with the country border, an analytical simplification known as the "triple coincidence" (Avdjiev et al (2016)). Accordingly, canonical models in international economics derive external positions from the macroeconomic analysis of individual countries (eg Obstfeld and Rogoff (1996), Tille and van Wincoop (2010)).

In reality, corporate balance sheets, and thus the impact of corporate decisions, straddle country borders. The mere existence of multinational firms violates the assumptions of the triple coincidence. Financial intermediaries, such as banks or corporate financing arms, strategically choose their location to take advantage of the benefits that come with concentration in financial centres (eg London) and/or secrecy, taxation and regulation (eg Caribbean financial centres) (Lane and Milesi-Ferretti (2018), Bertaut et al (2021), Pogliani et al (2022)). This reroutes capital flows via third countries, inflating global capital flows and gross external positions. The financial centres in Graph 1.A (grey areas) accounted for roughly a quarter of global external positions but for only 3% of global GDP (Pogliani et al (2022)).

As a result, residence-based statistics have limitations for analysing issues where ownership and control play a role. As multinational firms adjust their global balance sheets, they transmit shocks from one region to another. A country's external position does not belong to its nationals alone; it can be driven to a large extent by the activity of foreign-owned entities located there. On the flip side, policymakers take interest in the worldwide debt obligations of their domestically headquartered firms, regardless of where they borrow. In short, residence-based statistics obscure the international impact of multinationals' decisions.

Assessing such issues requires a view based on nationality, where the organising principle for economic units is control. This is the view most natural to multinational firms and intermediaries that manage their global balance sheets. The nationality view groups the balance sheets of resident units with those of the non-resident affiliates they control (with intragroup positions netted out); it excludes the balance sheets of resident units controlled by foreign entities (McGuire and von Peter (2009), IAG (2015), Avdjiev et al (2018)). Typically, the nationality of the consolidated group is the country of its headquarters; in the IBS it is the country of the supervisor of the global consolidated banking group (typically the country of its headquarters) (BIS (2019)).

The nationality view has a long history in BIS banking statistics. The expansion of international banking activity in Caribbean and other financial centres in the 1970s left offshore activity outside the purview of statistics. Central banks therefore asked banks in their jurisdiction to consolidate any positions booked by their offshore offices with those of their head offices. In 1977, the Basel Committee on Banking Supervision (BCBS) reviewed home-host information sharing and the need to consolidate bank balance sheets to capture the activity of subsidiaries everywhere, in line with what was becoming best practice in G10 countries (Goodhart (2011)). These efforts led to the introduction of a nationality breakdown in the BIS locational banking statistics (LBS) and to the collection of the BIS consolidated banking statistics (CBS) starting in 1983. While the nationality view has long been recognised in policy circles (Borio (2013), Tissot (2016), IAG (2015)), a growing academic literature now appreciates its importance (as surveyed by Florez-Orrego et al (2023)).

Even so, many benchmark statistics used in international finance lack the dimensions needed for a complete nationality view (Box A). The BoP/IIP are residence based, as are the key bilateral (country-to-country) CPIS and CDIS data sets. While the BIS LBS and CBS provide a nationality view for the banking sector, comparable data for the non-bank sector are partial at best. As shown in the next section, vendor data on the issuance of debt securities, used to compile the BIS international debt securities (IDS) statistics, and on syndicated loans can be used to consolidate non-banks' liabilities (although coverage is incomplete). However, non-banks' consolidated asset positions remain a blind spot, in particular for insurance companies, funds and asset managers with international operations.

Moving from residence to nationality

How far do BIS statistics go in providing a nationality view of international finance? As shown below, consolidation makes many financial centres "disappear", as it reallocates positions to the parent countries of the entities operating there. This, in turn, reveals the extent of concentration in international finance and underscores the significance of large multinational lenders and borrowers headquartered in a handful of countries. Consider the bank and non-bank sectors in turn, using IBS, IDS and vendor data on syndicated loans.

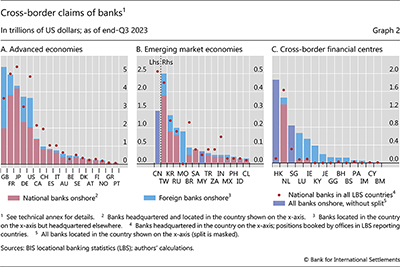

Banks play an important role in intermediating international financial flows.3 Activity is highly concentrated in a small number of international banks. The 30 global systemically important banks (G-SIBs) headquartered in just 11 countries operate in more than 160 jurisdictions. The IBS reporting population includes far more than the 30 G-SIBs. Even so, banks headquartered in just five countries accounted for well over half of global cross-border claims; each of these banking systems recorded more than $3 trillion.

Further reading

Multinational banks drive in part the differences between the residence and nationality views for individual countries (Graph 2).4 In financial centres, the lion's share of cross-border bank positions is booked by foreign banks (blue bars) rather than by banks headquartered there (red bars). The flip side is that banks of a given nationality book cross-border positions from their offices around the world (red dots). Those positions booked outside their home country affect host countries' external positions. Going from residence (bars) to nationality (dots) makes financial centres shrink (eg Luxembourg, Cayman Islands). It also increases the prominence of those countries that are home to multinational banking groups (eg China, Switzerland, United States).

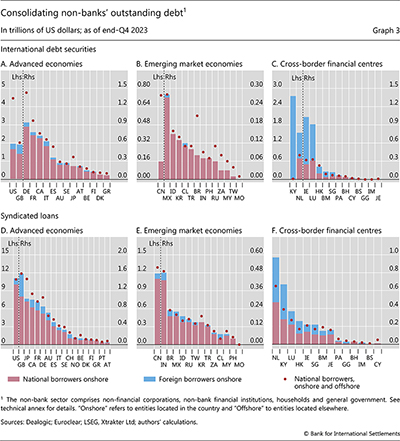

For non-banks, available data provide only a partial nationality view since comprehensive statistics on their consolidated financial holdings (assets) do not exist for most countries. A portion of non-banks' liabilities, however, can be tracked using the BIS IDS and vendor data on syndicated loans (Graph 3). For example, corporates resident in the Cayman Islands issue bonds in international markets (Graph 3.C, stacked bars), but the obligors are predominantly subsidiaries of foreign firms (Graph 3.C, blue bars). Foreign obligors also owe the bulk of outstanding debt issued by residents of the Netherlands, Ireland, Hong Kong SAR, Luxembourg, Singapore and Bermuda. From a nationality perspective, the amounts owed by entities headquartered in these countries (except Hong Kong SAR) is considerably less than total resident issuance, and thus the red dots lie below the total of the stacked bars.

For many advanced and emerging market economies, this pattern is reversed (Graphs 3.A and 3.B). Due to offshore issuance, US, Japanese, Chinese and Brazilian obligors' global consolidated debt (red dots) is significantly higher than the amounts owed by residents of the home country (stacked bars). This reflects the reallocation of the debt of foreign obligors in financial centres (Graph 3.C, blue bars) to the amounts owed by nationals of advanced and emerging market economies.

In syndicated loans, the gap between the residence and nationality views is not as wide (Graph 3, bottom panels). Still, in financial centres, the bulk of loans are to foreign resident borrowers. Reallocating these by nationality again pushes the red dots above the stacked bars for several advanced and emerging market economies.

Insights from a nationality perspective

Adopting a nationality view helps in understanding many policy-relevant phenomena that are obscured in residence-based statistics. Consider three examples.

Foreign currency debt

The first example, which follows directly from the discussion above, shows that several countries have incurred more foreign currency debt than is evident in residence-based statistics. This is not a new point. Gruić and Wooldridge (2012), McCauley et al (2015) and Aldasoro et al (2021) examined the debt of non-bank borrowers in several large EMEs and found that the offshore issuance of corporate bonds significantly increased debt amounts in several cases. Coppola et al (2021) conduct a systematic reallocation of corporate bonds to the ultimate obligors, redrawing the global map of bond obligations.

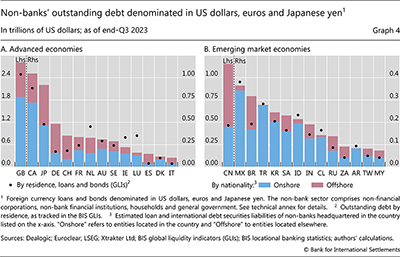

BIS statistics go a long way towards providing a nationality-based view of countries' foreign currency debt. The BIS global liquidity indicators (GLIs) provide estimates of non-banks' US dollar-, euro- and Japanese yen-denominated debt on a residence basis, shown as black dots in Graph 4.5 The stacked bars show estimated amounts on a nationality basis, constructed using the IDS and syndicated loans to reallocate obligations to the country of the ultimate obligor.6

Some countries owe more foreign currency debt on a nationality basis when debt incurred by offshore affiliates is taken into account. Among advanced economies, Japanese non-banks have considerably larger dollar liabilities than the residence-based measure indicates (Graph 4.A). This is mainly because of syndicated loans obtained by offshore affiliates of Japanese companies (contained in the red bar). Similarly, German non-banks' nationality-based measure is also larger, due to both bond issuance by and loans to corporate affiliates offshore. By contrast, for some countries, the nationality debt measure is actually lower than the residence measure. This is most obvious for Luxembourg, the Netherlands and Ireland, which host foreign affiliates that tap international debt markets (and which were treated as cross-border financial centres in Graphs 2 and 3).

In EMEs too, several countries stand out (Graph 4.B). Chinese non-banks have outstanding dollar debt in excess of $1 trillion when offshore issuance is included, more than double the residence measure (black dot). A similar picture emerges for Brazilian and South African non-banks (in terms of ratio if not size). Offshore debt also contributes noticeably to the dollar debt of Saudi Arabian, Indian and Malaysian non-banks. The greater liabilities of borrower countries in turn imply that lenders have larger exposures to those borrowers than is apparent from residence-based statistics. Coppola et al (2021) highlight the rise in exposures to BRICS countries (Brazil, Russia, India, China and South Africa) after including offshore bond issuance.

Deglobalisation in banking?

Consider next the evolution of international banking in the aftermath of the GFC. Some observers asserted that global finance had passed its high-water mark and that financial deglobalisation had begun.7 The decline in cross-border banking positions from most major banking locations seemed to confirm this.

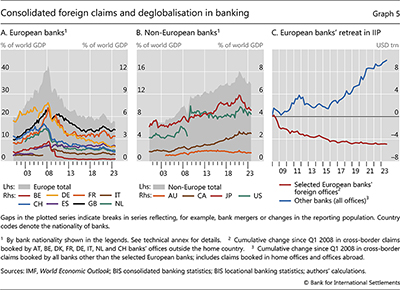

Viewing this through the lens of consolidated balance sheets reveals the banking systems driving these changes. McGuire and von Peter (2009), IMF (2015) and McCauley et al (2019) show that rather than being a general shift, the retreat of global banking was driven by a few banking systems. European banks cut their global operations as they deleveraged their unsustainably risky balance sheets (Graph 5.A). By contrast, US, Canadian, Japanese, Australian and other banking systems maintained or continued to grow their foreign claims (Graph 5.B). These patterns do not come to light as forcefully in the residence view.

Because European banks had offices of significant size in many countries, their post-GFC deleveraging affected many host countries' IIP positions. Between 2008 and 2016, selected European banking systems shed a cumulative $5 trillion in cross-border claims in their foreign offices alone (Graph 5.C, red line).8 By contrast, other banks with offices in the same countries expanded their cross-border claims by more than $2 trillion. In short, changes in the balance sheets of European banks' foreign affiliates had a larger effect on the external bank asset positions of host countries than did those of all the other banks located in these host countries (including those with head offices in these countries).

Towards a consolidated wealth of nations

Finally, consider the financial openness of economies. How strong is the trend toward greater international financial integration, especially after the GFC? Lane and Milesi-Ferretti (2007, 2018) have addressed this question by tracking countries' external assets and liabilities as a ratio to GDP. Their work has sparked a line of research that examines country portfolios and valuation effects (Lane and Shambaugh (2010a, 2010b), Gourinchas and Rey (2014) and Bénétrix et al (2015)).

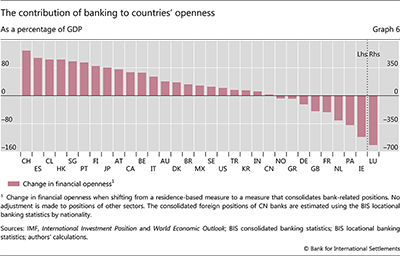

However, measures of financial integration need not start and stop at the border. Foreign ownership and control add a whole new dimension to financial integration, one that the residence perspective ignores. If Australians own banks in New Zealand, it makes both countries more open: Australia adds to its foreign assets through the local and cross-border claims of its banks in New Zealand; New Zealand adds to its foreign assets because residents' local deposits in Australian banks are claims on foreign entities. In general, banks' positions booked in affiliates abroad add to openness both at home and abroad.

A partial measure of consolidated openness redraws the border around countries' banking operations. As a first step, cross-border bank positions in the IIP of a given country are replaced with the consolidated foreign claims of banks headquartered there. Consolidated foreign claims exclude interoffice positions but include banks' cross-border and local positions booked by their foreign affiliates abroad. In a second step, the deposits of the country's residents placed in foreign banks operating there are added, since these are claims on a foreign institution.9 These steps transform a country's bank-related external assets to foreign assets. The same steps can be taken on the liability side, allowing openness to be defined as foreign assets and liabilities to GDP. Graph 6 shows how these steps contribute to financial openness, keeping other sectors' positions unchanged.

On a consolidated basis, most economies exhibit a greater degree of financial openness than on a residence basis (Graph 6). In aggregate, the consolidated measure is greater by 18% of GDP (weighted average) than the traditional measure based on residence. In addition, the measured openness rises for most economies (22 out of the 31 shown), with the median economy appearing more financially open by about 30% of GDP. Extending this exercise to the balance sheets of multinational firms, where possible, would raise consolidated openness even further (BIS (2015), Avdjiev et al (2018), Sanchez Pacheco (2023)).

Conclusion

This feature presents how BIS statistics can be used to understand topics in international finance from both a residence and nationality perspective. The latter groups balance sheets by the country of headquarters, based on the organising principle of ownership and control. This is needed to assess the global impact of decisions taken by multinational firms and intermediaries.

The nationality view fundamentally alters our understanding of countries' and sectors' international positions. The bulk of the positions recorded in financial centres are reallocated to the countries where firms are headquartered. This reallocation yields new measures of countries' indebtedness and their financial openness and reveals the importance of multinational firms and intermediaries in international finance. Understanding who drives changes in international positions, and whom these changes ultimately affect, is crucial for monitoring financial stability.

This cannot be seen in most international financial statistics. BIS statistics are an exception. The BIS IBS provide a joint residence- and nationality-based view of banks' asset and liability positions as well as a similar picture for non-banks, but only for their international bond liabilities. A blind spot is the consolidated asset side of non-banks' balance sheets. The question of who ultimately owns the trillions of dollars' worth of government and corporate bonds traded across borders becomes increasingly salient as non-bank financial institutions gain a larger share in the global financial system.

References

Aldasoro, I, B Hardy and N Tarashev (2021): "Corporate debt: post-GFC through the pandemic" BIS Quarterly Review, June, pp 1–14.

Avdjiev, S, M Everett, P Lane and H S Shin (2018): "Tracking the international footprints of global firms", BIS Quarterly Review, March, pp 47–66.

Avdjiev, S, R McCauley and H S Shin (2016): "Breaking free of the triple coincidence in international finance," Economic Policy, vol 31, no 87, pp 409–51.

Bank for International Settlements (2015): BIS 85th Annual Report, 2014/15.

----- (2019): "Reporting guidelines and practices for the BIS international banking statistics", July.

Bénétrix, A, P Lane and J Shambaugh (2015): "International currency exposures, valuation effects and the global financial crisis", Journal of International Economics, vol 96, supplement 1, pp 98–109.

Bernanke, B (2005): "The global saving glut and the US current account deficit", remarks at the Sandridge Lecture, Virginia Association of Economics, Richmond, Virginia, 10 March.

Bertaut, C, B Bressler and S Curcuru (2021): "Globalization and the reach of multinationals implications for portfolio exposures, capital flows, and home bias", Journal of Accounting and Finance, vol 21, no 5.

Borio, C (2013): "The Great Financial Crisis: setting priorities for new statistics", BIS Working Papers, no 408, April.

Borio, C, R McCauley and P McGuire (2011): "Global credit and domestic credit booms", BIS Quarterly Review, September, pp 43–57.

Broner, F, T Didier, S Schmukler and G von Peter (2023): "Bilateral international investments: the big sur?", Journal of International Economics, vol 145, November, 103795.

Coppola, A, M Maggiori, B Neiman and J Schreger (2021): "Redrawing the map of global capital flows: the role of cross-border financing and tax havens", The Quarterly Journal of Economics, vol 136, no 3, pp 1499–556.

Eichengreen, B (2016): "Globalization's last gasp", Project Syndicate, 17 November.

Florez-Orrego, S, M Maggiori, J Schreger, Z Sun and S Tinda (2023): "Global capital allocation", National Bureau of Economic Research Working Paper Series, no 31599.

Forbes, K (2014): "Financial 'deglobalization'?: Capital flows, banks, and the Beatles", speech to Queen Mary University, London, 18 November.

Forbes, K, D Reinhardt and T Wieladek (2017): "The spillovers, interactions, and (un)intended consequences of monetary and regulatory policies", Journal of Monetary Economics, vol 85, January, pp 1–22.

Ghezzi, P, E Levy Yeyati and C Broda (2009): "The new global balance: financial deglobalisation, savings drain, and the US dollar", VoxEU, 22 May.

Goodhart, C (2011): The Basel Committee on Banking Supervisio : a history of the early years 1974-1997, Cambridge University Press.

Gourinchas, P-O, and H Rey (2014): "External adjustment, global imbalances and valuation effects", in G. Gopinath, E. Helpman and K Rogoff (eds), Handbook of International Economics, vol 4, pp 585–645.

Gruić, B and P Wooldridge (2012): "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December, pp 63–76.

Inter-Agency Group on Economic and Financial Statistics (IAG) (2015): "Consolidation and corporate groups: an overview of methodological and practical issues", an IAG reference document, IFC Report, no. 2, October.

International Monetary Fund (IMF) (2015): Global Financial Stability Report : Navigating Monetary Policy Challenges and Managing Risks, April.

Irving Fisher Committee on Central Bank Statistics (IFC) (2017): "Data needs and statistics compilation for macro - prudential analysis", IFC Bulletin, no 46, December.

----- (2018): Central banks and trade repositories derivatives data", IFC Report, no 7, October.

Lane, P and G M Milesi-Ferretti (2007): "The external wealth of nations mark II: revised and extended estimates of foreign assets and liabilities, 1970–2004", Journal of International Economics, vol 73, no 2, pp 223–50.

----- (2018): "The external wealth of nations revisited: international financial integration in the aftermath of the global financial crisis", IMF Economic Review, vol 66, no 1, pp 189–222.

Lane, P and J Shambaugh (2010a): "Financial exchange rates and international currency exposures", American Economic Review, vol 100, no 1, pp 518–40.

----- (2010b): "The long or short of it: determinants of foreign currency exposure in external balance sheets", Journal of International Economics, vol 80, issue 1, pp 33–44.

McCauley, R, Bénétrix A, P McGuire and G von Peter (2019): "Financial deglobalisation in banking?", Journal of International Money and Finance, vol 94, June, pp 116–31.

McCauley, R, P McGuire and V Sushko (2015): "Dollar credit to emerging market economies", BIS Quarterly Review, December, pp 27–41.

McGuire, P and G von Peter (2009): "The US dollar shortage in global banking", BIS Quarterly Review, March, pp 47–63.

Obstfeld, K and M Rogoff (1996): Foundations of international macroeconomics, MIT Press.

Pogliani, P, G von Peter and P Wooldridge (2022): "The outsize role of cross-border financial centres", BIS Quarterly Review, June, pp 1–15.

Sanchez Pacheco, A (2023): "Consolidated foreign wealth of nations: nationality-based measures of international exposure", Trinity Economics Papers, no 0653, April.

United Nations (2008): "System of National Accounts 2008", released jointly with the European Commission, the OECD, the IMF and the World Bank Group.

Tille, C and E van Wincoop (2010): "International capital flows", Journal of International Economics, vol 80, no 1, pp 157–75.

Tissot, B (2016): "Globalisation and financial stability risks: is the residency-based approach of the national accounts old-fashioned?", BIS Working Papers, no 587, October.

Technical annex

BoP = balance of payments; CBS = consolidated banking statistics; CDIS = Coordinated Direct Investment Survey; CPIS = Coordinated Portfolio Investment Survey; G-SIBs = global systemically important banks; IBS = BIS international banking statistics; IDS = international debt securities; IIP = international investment position; LBS/N = locational banking statistics by nationality; LBS/R = locational banking statistics by residence; SNA = system of national accounts.

Cross-border financial centres comprise the following 22 jurisdictions, as defined in Pogliani, von Peter and Wooldridge (2022): BH, BM, BS, CW, CY, GG, GI, HK, IE, IM, JE, KY, LR, LU, MH, MT, MU, NL, PA, SG, SM and VG. The names of jurisdictions corresponding to ISO codes are provided under the Abbreviations on page viii to x.

Graph 1: Cross-border financial centres comprise the 22 jurisdictions mentioned above.

Graph 2: Cross-border financial centres comprise the subset of 15 jurisdictions that report the BIS locational banking statistics: BH, BM, BS, CW, CY, GG, HK, IE, IM, JE, KY, LU, NL, PA and SG. Data for Russia (RU) relate to Q4 2021.

Graph 3: Data refer to the non-bank sector as immediate borrowers and all sectors as ultimate borrowers. Cross-border financial centres comprise the same 15 jurisdictions as in Graph 2.

Graph 4: Data for outstanding debt on a residence basis (black dots) are from the BIS global liquidity indicators (GLIs; see www.bis.org/statistics/gli/gli_methodology.pdf). Stacked bars are estimates of outstanding debt on a nationality basis. Data for onshore and offshore bond liabilities are from the IDS. Onshore loans are estimated as the GLI measure of cross-border and local loans from the BIS locational banking statistics minus the syndicated loans received by foreign entities in that country; offshore loans are syndicated loans to foreign affiliates of non-banks headquartered in that country. No adjustment is made for loans that are not syndicated.

Graph 5: "Europe-total" comprises banks headquartered in 18 jurisdictions: AT, BE, CH, DE, DK, ES, FI, FR, GB, GR, IE, IT, LU, NL, NO, PT, SE and TR. "Non-Europe total" comprises banks headquartered in 13 jurisdictions: AU, BE, CA, CL, IN, JP, KR, MX, PA, US, HK, SG and TW.

1 This is the first feature in a series to showcase the BIS international banking and financial statistics and their uses. We thank Iñaki Aldasoro, Doug Araujo, Stefan Avdjiev, Claudio Borio, Gaston Gelos, Branimir Gruić, Bryan Hardy, Benoit Mojon, Andreas Schrimpf, and Hyun Song Shin for their helpful comments, and Swapan-Kumar Pradhan for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 All institutional units are allocated to one of five sectors: non-financial corporations, financial corporations, general governments, households and non-profit institutions. Each institutional unit is resident in only one economic territory.

3 Banking is reflected in several functional categories of the IIP. Loans and deposits are recorded in "other investment". This category makes up a greater share in economies where banks have a more significant role. It accounted for 40% or more of external liabilities for 100 economies, with only 16 of these being advanced economies.

4 Graph 2 shows bank sector claims; the IBS afford a similar view of bank sector liabilities.

5 The GLIs are compiled by adding cross-border and local loans to non-banks (from the IBS) to outstanding international bonds (in those currencies) issued by resident non-banks (from the IDS). The figures in Graph 4 include debt denominated in a foreign currency (eg euro-denominated debt is excluded in the figures for euro area countries).

6 The adjustment of the residence-based loan portion of the GLI is done using syndicated loans, for which the residence and nationality of the borrower is available. However, not all loans are syndicated; no adjustment is made for non-syndicated loans.

7 See Ghezzi et al (2009). Forbes (2014), Forbes et al (2017) and Eichengreen (2016).

8 Moreover, European banks also shed local claims booked by their foreign affiliates around the world, which is not reflected in any country's external position.

9 Existing statistics identify the immediate counterparty but do not allow us to pierce through possibly several layers of ownership all the way to the ultimate beneficial owner (see Box A). In practice, this means that the counterparties to local bank positions are assumed to be nationals of that location.