Goodbye Libor, hello basis traders: unpacking the surge in global interest rate derivatives turnover

Structural and cyclical factors have driven a surge in turnover of interest rate derivatives (IRDs) since 2022 – both in over-the-counter (OTC) and exchange-traded (XTD) markets. The reform of benchmark rates and the shift away from Libor has fundamentally reshaped OTC markets, with overnight index swaps becoming the dominant instrument. In XTD markets, positions in government bond futures have risen dramatically, fuelled by hedge funds exploiting arbitrage opportunities through the cash-futures basis trade. Meanwhile, the sharp shifts in monetary policy since 2022 boosted turnover, especially for exchange-traded money market futures for major currencies. By contrast, growth in turnover for emerging market currencies was driven primarily by OTC contracts. Further market deepening may be held back by the complex geography of central clearing and the lack of markets for XTD government bond futures.1

JEL classification: E43, G12, G21, G23.

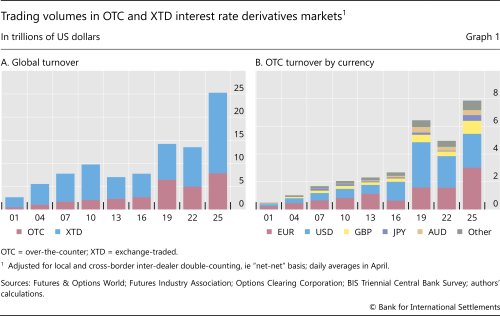

Global turnover in over-the-counter (OTC) and exchange-traded (XTD) interest rate derivatives (IRDs) surged by 87% between April 2022 and April 2025, reaching $25 trillion per day (Graph 1.A).2 Turnover rose particularly strongly in XTD markets, to $17.4 trillion per day, driven mainly by futures referencing short-term rates as well as government bond futures. In OTC markets, turnover reached $7.9 trillion per day in April 2025, as overnight index swaps (OIS) emerged as the dominant OTC instrument with the shift to "nearly risk-free" rates.

These developments reflect both cyclical and structural factors that have reshaped the IRD market. Key factors include the finalisation of the benchmark rate reform in major markets, the rise of arbitrage trades by hedge funds in government bond futures and shifts in monetary policy expectations that have boosted trading in contracts referencing short-term rates.

IRD markets have undergone fundamental structural changes since the Great Financial Crisis. The G20 OTC derivatives markets reform increased transparency and led to centralised clearing and electronic trading (Ehlers and Hardy (2019)). In addition, the reform of benchmark interest rates replaced London interbank offered rates (Libor) for unsecured lending in the interbank market with "nearly risk-free" rates, which are mostly overnight rates for either secured or unsecured lending (Huang and Todorov (2022)).

Key takeaways

- Average daily turnover in markets for interest rate derivatives grew by 87% between April 2022 and 2025, driven by both over-the-counter and exchange-traded markets.

- The benchmark rate reform with its shift away from Libor, the rise of the cash-futures basis trade and fundamental shifts in monetary policy have spurred growth and structural changes.

- Emerging market economy interest rate derivatives also expanded rapidly, but challenges like the absence of government bond futures and the complex geography of clearing remain.

This benchmark reform solidified the dominance in OTC markets of overnight index swaps (OIS) – contracts that swap a fixed rate for an overnight rate – in major currencies. The reform's effects were particularly pronounced in US dollar and sterling markets, where risk-free rates (RFRs) are now the primary benchmarks. By contrast, markets for euro contracts are somewhat distinct, as the euro interbank offered rate (Euribor) – the reformed interbank offered rate (IBOR) – coexists with RFRs like the euro short-term rate (ESTR) (EMMI (2019)). A similar duality of reformed IBORs and RFRs also exists for other currencies like the Australian, New Zealand and Singapore dollars.

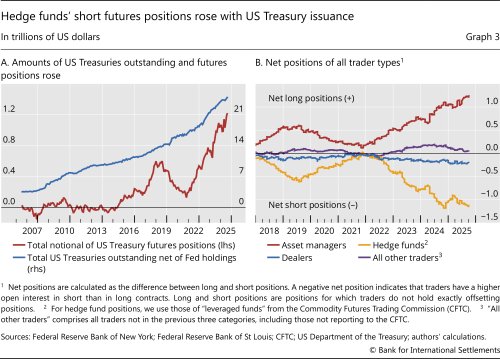

By construction, XTD markets always featured centralised trading and clearing of standardised contracts. Yet XTD markets have also seen significant changes that spurred turnover growth. One such change has been the rise of the cash-futures basis trade, which exploits spreads between government bonds and the corresponding futures prices. Hedge funds have taken large short positions in government bond futures in recent years to exploit this spread, with asset managers taking the other side of the trade. This has happened amid growing government debt supply and ample availability of repurchase agreement (repo) funding (Hermes et al (2025)). In combination, the basis trade has raised activity in long-term XTD contracts, particularly in US Treasury futures.

Additionally, the sharp shifts in monetary policy since 2022 have acted as a cyclical driver of turnover growth. As the Federal Reserve and European Central Bank began signalling and implementing rate hikes after years of near zero interest rates, volatility in short-term rates picked up. This spurred hedging and speculative activity, particularly in XTD futures that reference short-term rates ("money market futures") and contributed to the rapid growth in IRD contracts linked to short-term rates after 2022.

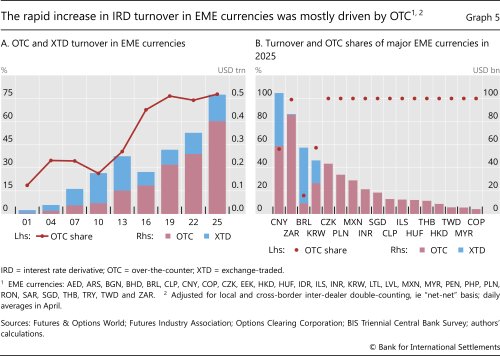

Finally, turnover in IRD contracts in emerging market economy (EME) currencies has also grown significantly, albeit from a low base. In contrast to advanced economy currencies, where both OTC and XTD markets are developed, turnover in EME IRDs has been overwhelmingly driven by OTC markets. However, some notable exceptions, eg turnover in Chinese renminbi, Brazilian real and Korean won contracts, demonstrate how policy initiatives can foster the development of XTD markets. In most other EME jurisdictions, the market for government bond futures is dormant. In addition, EMEs face unique challenges in the OTC market due to the complex geography of clearing and trading activity. This highlights the remaining barriers to a deepening of these markets.

Benchmark reform and structural shifts in OTC IRD markets

The shift to new benchmark rates, finalised in major markets by mid-2023, has transformed OTC IRD markets. The reform transitioned most currencies from Libor to "nearly risk-free" rates, which are based on the more active market for overnight transactions. Libor was based on interbank transactions, which raised concerns over the viability of the rate due to shrinking interbank deposit volumes as well as over-manipulation (CFTC (2012); FSA (2012); FSB (2014)).

However, the benchmark reform was implemented differently across jurisdictions. Libor was fully phased out for the US dollar, sterling, the Swiss franc and the Japanese yen by mid-2023. Other currencies adopted a dual approach of creating new RFRs which coexist with reformed versions of IBORs. This is the case for the euro and several other currencies including the Australian, New Zealand and Singapore dollars.

This coexistence of IBORs with RFRs reflects the ongoing demand for credit-sensitive term rates, which can capture credit and term liquidity risks better. These risks are inherent in IBORs like Libor, which was originally designed to reflect banks' unsecured term funding costs. Additionally, credit-sensitive IBORs are forward-looking and provide certainty about interest payments at the start of a contract period. This is important for instruments like loans or bonds with fixed payment schedules, for which the borrower needs certainty about the interest payments in advance. By contrast, RFRs such as SOFR (the secured overnight funding rate) in the United States and SONIA (the sterling overnight index average) in the United Kingdom are much less sensitive to credit risk as they are overnight rates. In the case of SOFR, the benchmark rate is based on collateralised transactions to further minimise credit risks.

The divergence in approaches across currencies and the demand for credit-sensitive term rates have shaped how IRDs are used and, in turn, the structure of the OTC market. Turnover of OTC IRDs in currencies that use RFRs based on unsecured rates has surged. Most notably, this applies to the euro and sterling (Graph 1.B). In contrast, OTC turnover in currencies with RFRs based on secured lending has remained relatively stagnant. This includes US dollar IRDs, where SOFR has become the primary benchmark. The different pace of growth in turnover across segments has altered the currency composition of OTC IRD markets.

The reform's impact is also evident in the composition of instruments, which reflects the mechanics of hedging interest rate risks. As a forward-looking rate known at the beginning of the coupon period, Libor closely reflects banks' expected borrowing costs over a future period (Schrimpf and Sushko (2019)). By contrast, most RFRs are backward-looking and track the evolution of actual overnight rates over a given period. The coupon in RFR-based instruments is hence known only at the end of the relevant period and is calculated by compounding overnight rates during that period. As the coupons in RFR-based swaps capture the daily realisation of overnight rates, they are "fixed" every day. This is structurally different from Libor-based swaps, in which the coupons are fixed for much longer periods of three or six months. The longer fixed periods for Libor created so-called fixing risk, which arises from the mismatches in coupon fixings on different dates. This fixing risk is significantly smaller in RFR-based swaps due to the overnight fixings of RFRs (see Box A in Huang and Todorov (2022) for more details).

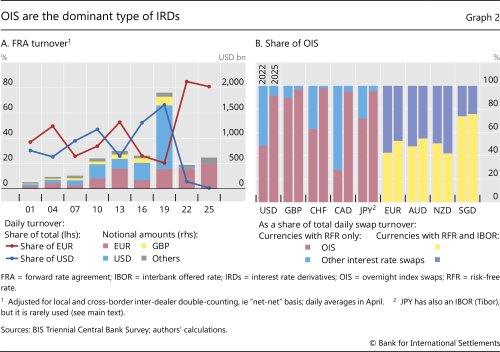

With greater adoption of RFRs that have lower fixing risks, the use of forward rate agreements (FRAs), which were employed to hedge fixing risks in Libor-based markets, has declined significantly (Graph 2.A). On top of this, FRAs are, by construction, based on forward-looking rates, making them incompatible with backward-looking RFRs (Huang and Todorov (2022)). As a result, turnover of US dollar-, sterling- and yen-denominated FRAs has virtually disappeared in the post-Libor world. However, euro-denominated FRAs, which accounted for roughly 80% of global FRA turnover in 2025, are an exception owing to the continued demand for Euribor-based contracts. These give rise to fixing risks and thus necessitate FRA hedging. Still, the share of FRAs in euro-denominated IRD turnover declined from 25% in 2022 to 17% in 2025.

OIS, which align naturally with the backward-looking nature of RFRs, have become the dominant instrument in OTC IRD markets. Their rise has been particularly pronounced in currencies that adopted an RFR-only approach, including the US dollar, sterling, the Swiss franc and the Canadian dollar. In these markets, OIS now account for over 90% of all swap turnover, reflecting the widespread adoption of RFRs as benchmarks for interest rate swaps (Graph 2.B). Globally, the share of OIS in OTC IRD turnover reached 65% in 2025, up from 42% in 2022.

In the euro area and other jurisdictions like Australia and New Zealand, however, the coexistence of the reformed IBORs and new RFRs has resulted in a more gradual transition. While OIS have gained traction, accounting for 53% of euro interest rate swap turnover, Euribor-based contracts remain prominent, suggesting a persistent demand for credit-sensitive term rates (Graph 2.B). Similar duality, where IBORs coexist with RFRs, is also observed in other currencies like the Australian and New Zealand dollars, where OIS account for about half of swap turnover, and in the Singapore dollar.

In principle, the coexistence of two different reference rates should give rise to the use of so-called basis swaps. These instruments allow the exchange of interest rate payments in one reference rate versus another. Surprisingly, however, their scale remains very limited – including for euro-denominated IRDs (less than 1% of total turnover).

The euro area's dual approach contributed to the rising share of euro-denominated contracts in global turnover (Box A). Euro-denominated OTC IRD turnover nearly doubled between 2022 and 2025, reaching $3 trillion in daily averages and surpassing US dollar turnover, which stagnated at $2.3–2.4 trillion (Graph 1.B).

In Japan, the benchmark reform has also been accompanied by unique dynamics. While the Tokyo overnight average rate (TONA) has become the dominant RFR, the Tokyo interbank offered rate (Tibor), a reformed IBOR, is maintained for domestic contracts since some market participants still require a credit-sensitive term rate to hedge longer-term funding costs or manage credit risk. The publication of Tibor for offshore euro-yen contracts, however, ceased at the end of 2024. As a result, the bulk of yen IRD turnover is now concentrated in OIS (Graph 2.B).

The cash-futures basis trade and XTD positioning

The cash-futures basis trade has emerged as an important factor behind the growth in XTD markets, particularly in longer-term government bond futures. The basis trade exploits the price difference between cash government bonds and their futures contracts. Typically, hedge funds take long positions in cash government bonds such as US Treasuries, financed through repos, while simultaneously shorting government bond futures contracts. This arbitrage captures the so-called basis spread, which arises from factors like balance sheet costs for dealers, liquidity premia and delivery options in futures (cheapest-to-deliver dynamics). The trade profits when the basis converges, often at the futures' expiry. But it exposes participants to funding risks if margins spike, as has happened in stress events (Schrimpf et al (2020); Barth and Kahn (2020)). The rise of the basis trade could heighten systemic risks if the trade unwinds during a funding squeeze, as the closing of hedge funds' leveraged positions could amplify volatility (Aramonte et al (2021)).

A confluence of factors has underpinned the basis trade's prominence in recent years.3 Most importantly, rising government debt to fund fiscal deficits and quantitative tightening have led to an increase in the supply of outstanding US Treasuries that must be absorbed by the market (Graph 3.A). Given dealers' balance sheet constraints, hedge funds have increasingly stepped into the market as marginal buyers of government bonds as part of a " basis" trade where they simultaneously enter into a short futures position4 with asset managers taking the other side. As a result, hedge funds now hold record positions in US Treasuries. Data from the Commodity Futures Trading Commission indicate that net positions of asset managers in Treasury futures have more than quadrupled since 2022, while hedge funds' net short positions have expanded commensurately (Graph 3.B).

While the basis trade has been particularly impactful in US dollar markets, similar trades are present in other major government bond markets, such as for German bunds and Canadian and Japanese government bonds. That said, they are probably smaller in scale and a more recent phenomenon. However, another hedge fund trade, the swap spread trade, has gained size in the past year (see box B).

Turnover driven by shifts in monetary policy expectations

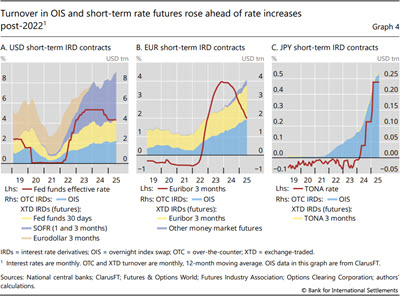

The sharp shifts in monetary policy since 2022 have been a key cyclical driver of IRD turnover growth, particularly in short-term contracts. For years, policy rates in the United States and the euro area had remained near zero, reducing volatility in short-term rates and limiting the need for hedging or speculative trading. This changed when major central banks began signalling rate hikes in early 2022, followed by actual tightening in March (United States) and July (euro area). Interest rate volatility surged as a result.

This created new demand for hedging and opportunities for speculation, and turnover for short-term IRD contracts picked up strongly. For the two major currencies, the US dollar and the euro, a key driver of the increase in turnover was XTD futures referencing short-term rates – often dubbed "money market futures" (Graphs 4.A and 4.B). In the United States, futures referencing one- and three-month SOFR alone generated an average daily turnover of $4.5 trillion (12-month average for April 2025) – more than a third of the global turnover of XTD contracts. Fed funds futures contributed another $2.1 trillion in turnover on the average day over the same period. For euro-denominated contracts, the reformed interbank rate Euribor still serves as an important benchmark rate, as explained above, and Euribor futures have contributed significantly to the growth in turnover (Graph 2.B). However, OIS contracts were also important, matching the turnover of Euribor futures. Shifts in monetary policy also affected the composition of FX derivatives trading, with the rise in turnover of short rate forwards (Huang et al (2025), in this issue).

Monetary policy changes also had ripple effects on hedging activity in other currencies, particularly the yen. The Bank of Japan's decision in 2024 to end yield curve control and resume using short-term rates as its primary policy tool introduced volatility into a previously calm market for short-term rates. In contrast to US dollar- and euro-denominated IRDs, the market for XTD money market futures denominated in yen has traditionally been very small. The increase in hedging demand and speculation therefore boosted mainly OTC-traded instruments like OIS, which could also explain the dominance of OIS over other swaps, including those linked to TIBOR (Graph 2.B). As a result of the increase in OIS trading, total yen OTC turnover surged more than sixfold in 2025 compared with 2022.

The growth in OTC IRD markets for EME currencies and remaining challenges

Like IRDs in the major currencies, turnover in IRD contracts in EME currencies also grew rapidly, reaching $0.5 trillion in April 2025 (Graph 5.A). Yet market depth is still lacking. For example, while EME currencies accounted for 29% of global foreign exchange (FX) market turnover in April 2025 (Wooldridge (2025), in this issue), their share in OTC IRD markets remained lower at just 5.1%. When examining daily IRD turnover relative to the size of the outstanding government bonds market, EME currencies lag even further behind advanced economy currencies, at a ratio of just 0.07% compared with 35%.

One striking difference to IRDs in advanced economy currencies is that EME IRD turnover has been concentrated in OTC rather than XTD markets. There are some notable exceptions, however, where XTD markets are well developed (Graph 5.B). The major EME currencies for which XTD markets hold a non-negligible turnover share are the Chinese renminbi, Brazilian real and Korean won. XTD market development for these currencies, however, has followed different paths. In Brazil and Korea, XTD markets have been well established for over 25 years.5 In China, by contrast, regulators and industry groups began promoting XTD markets in the mid-2010s. The share of XTD turnover in the Chinese renminbi rose from 0% in 2013 to 44% in April 2025, spurred by the 2015 introduction of the 10-year Chinese government bond futures contract on the China Financial Futures Exchange.

Further reading

Despite these successes, activity in XTD markets in other EME currencies remains muted or non-existent. This may be due to a lack of demand for interest rate hedging by EME banks more generally, which tend to match the interest rate sensitivity of their assets and liabilities instead (Caballero et al (2023); Ehlers and Packer (2013)). As the volume of outstanding local currency government bonds has risen and is expected to rise further, XTD futures could play a more prominent role in the management of interest rate risk – not only for banks but also for a wider range of financial institutions that will absorb these bonds.6

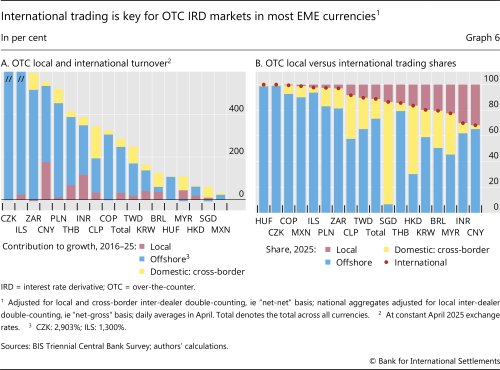

Much of the increase in turnover of OTC IRD for EME currencies over the last decade has been driven by trades in foreign locations (Graph 6.A) rather than domestic markets. For example, IRDs denominated in central and eastern European currencies and the South African rand are predominantly recorded at sales desks in the United Kingdom (Graph 6.B). Similarly, OTC IRDs in Asian currencies are mostly recorded in Hong Kong SAR and Singapore, while Latin American currencies see a disproportionate share of turnover recorded at sales desks in the United States.

On the one hand, these patterns suggest that IRDs in EME currencies exhibit a high degree of internationalisation, consistent with the trend in FX derivatives (Caballero et al (2022)). On the other hand, the share of non-local trading is indicative of the complex geography of central clearing for OTC IRD derivatives, which in turn is influenced by the concentration of clearing in a few global central counterparties (CCPs).7 Clearing of OTC IRDs for EME currencies is essentially concentrated in two key CCPs: the London Clearing House in the United Kingdom and the Chicago Mercantile Exchange in the United States. This presents challenges for deepening IRD markets in EMEs, where local institutions often lack clearing membership at the major CCPs (Box C). Only a few currencies, such as the Malaysian ringgit, Indian rupee and Chinese renminbi, exhibit local trading shares comparable with those of advanced economy currencies (Graph 6.B).

Conclusion

The rapid growth in global IRD turnover from 2022 to 2025 reflects the combined influence of structural and cyclical forces. The benchmark rate reform has reshaped OTC markets, with the transition to nearly risk-free rates making OIS the dominant trading instrument. In XTD markets, the cashfutures basis trade has driven a significant rise in positioning, particularly in US Treasury futures by hedge funds and asset managers. Continued US Treasury issuance alongside quantitative tightening is likely to keep the basis trade active. However, a sudden tightening in funding or margin conditions could trigger leveraged unwinds and amplify volatility across XTD and OTC markets. Shifting monetary policy expectations have also contributed to greater turnover, especially in short rate contracts, as rises in the short rate boosted hedging and speculative demand. In contrast with that for advanced economies, growth in IRD turnover for EME currencies has occurred primarily in OTC markets rather than in XTD markets. The complex geography of clearing and the underdevelopment of XTD markets remain constraints for further market deepening. Regulatory initiatives to improve clearing access and foster local XTD markets could support market development.

References

Aramonte, S, A Schrimpf and H S Shin (2021): "Non-bank financial intermediaries and financial stability", BIS Working Papers, no 972, October.

Avalos, F and V Sushko (2023): "Margin leverage and vulnerabilities in US Treasury futures", BIS Quarterly Review, September, pp 4–5.

Barth, D and J Kahn (2020): "Basis trades and Treasury market illiquidity", OFR Policy Brief, Office of Financial Research.

Brookings (2025): "Risks that non-bank financial institutions pose to financial stability", www.brookings.edu/articles/risks-that-non-bank-financial-institutions-pose-to-financial-stability.

Caballero, J, A Maurin, P Wooldridge and D Xia (2022): "The internationalisation of EME currency trading", BIS Quarterly Review, December, pp 49–65.

----- (2023): "Interest rate risk management by EME banks", BIS Quarterly Review, September, pp 49–61.

Commodity Futures Trading Commission (CFTC) (2012): "CFTC orders Barclays to pay $200 million penalty for attempted manipulation of and false reporting concerning Libor and Euribor benchmark interest rates", www.cftc.gov/PressRoom/PressReleases/6289-12.

Ehlers, T and B Hardy (2019): "The evolution of OTC interest rate derivatives markets", BIS Quarterly Review, December, pp 69–82.

Ehlers, T and F Packer (2013): "FX and derivatives markets in emerging economies and the internationalisation of their currencies", BIS Quarterly Review, December,pp 55–67.

European Money Markets Institute (EMMI) (2019): "Euribor® reform".

Financial Services Authority (FSA) (2012): "Final notice: Barclays Bank Plc".

Financial Stability Board (FSB) (2014): Reforming major interest rate benchmarks.

----- (2022): OTC derivatives market reforms – implementation progress in 2022.

----- (2025): Leverage in nonbank financial intermediation: final report.

Glicoes, J, B Iorio, P Monin, and L Petrasek (2024): "Quantifying Treasury cash-futures basis trades", FEDS Notes, Board of Governors of the Federal Reserve System, March.

Hermes, F, M Schmeling and A Schrimpf (2025): "The international dimension of repo: five new facts", working paper, April.

Huang, W, I Krohn and V Sushko (2025): "Global FX markets when hedging takes centre stage", BIS Quarterly Review, December.

Huang, W and K Todorov (2022): "The post-Libor world: a global view from the BIS derivatives statistics", BIS Quarterly Review, December, pp 19–34.

International Monetary Fund (IMF) (2025): Global Financial Stability Report October 2025: shifting ground beneath the calm.

Schrimpf, A, H S Shin and V Sushko (2020): "Leverage and margin spirals in fixed income markets during the Covid-19 crisis", BIS Bulletin, no 2, April.

Schrimpf, A and V Sushko (2019): "Beyond Libor: a primer on the new benchmark rates", BIS Quarterly Review, March, pp 29–52.

US Treasury (2024): "Remarks by Under Secretary for Domestic Finance Nellie Liang.

Wooldridge, P (2025): "Renminbi propels the growth of EME currency trading", BIS Quarterly Review, December.

Technical annex

EONIA = euro overnight index average

ESTR = euro short-term rate

Euribor = euro interbank offered rate

FRA = forward rate agreement (contract to lock in an interest rate on a notional amount for a future period)

IRS = interest rate swap

Libor = London interbank offered rate

OIS = overnight index swap (contract that swaps a fixed rate for an overnight rate)

OTC = over-the-counter

RFR = risk-free rate

SOFR = secured overnight financing rate

SONIA = sterling overnight index average

Tibor = Tokyo interbank offered rate

TONA = Tokyo overnight average rate

Footnotes

1 The views expressed here are those of the authors and not necessarily those of the BIS or its member central banks. The authors thank Gaston Gelos, Branimir Gruic, Bryan Hardy, Patrick McGuire, Benoît Mojon, Daniel Rees, Andreas Schrimpf, Hyun Song Shin, Frank Smets, Vladyslav Sushko, Christian Upper and Philip Woodridge for helpful comments and discussions, as well as Tongshuo Li for excellent research assistance. See the full list of abbreviations and brief descriptions of interest rate derivative instruments in the glossary of this issue.

2 This article uses comprehensive data on OTC IRD markets from the BIS Triennial Central Bank Survey in 2025, as well as monthly data on exchange-traded IRDs collected by the BIS. See www.bis.org/statistics/dataportal/derivatives.htm.

3 See, inter alia, Schrimpf et al (2020); Avalos and Sushko (2023); Glicoes et al (2024); US Treasury (2024); FSB (2025); Brookings (2025); IMF (2025).

4 Hedge funds use the repo market to fund the purchase of the cash government bond and to lever up returns, when earning the difference between the yield on government bonds and the implied yield on the futures contract.

5 XTD contracts in the Korean won are predominantly futures on three- and 10-year government bonds. In contrast, XTD turnover in the Brazilian real is almost entirely driven by futures on the overnight monetary policy rate, which are used primarily for speculation or hedging against changes in monetary policy.

6 Another option to manage the interest rate risks of government bond holdings could be the use of OTC instruments, such as government bond forwards. This, however, would also require further market development across many EME jurisdictions. Overall, forwards (including government bond and other forwards) account for only about 16% of the turnover in EME currencies, amid a very low ratio of IRD turnover to outstanding government bonds compared with advanced economies.

7 While for EME currencies, the share of cleared derivatives is lower than for advanced economies (67% compared with 87% of outstanding derivatives positions), it is still substantial.