Margin leverage and vulnerabilities in US Treasury futures

Box extracted from Overview chapter "Resilient risk-taking in financial markets"

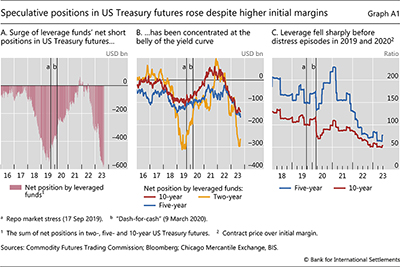

Speculative positions by leveraged investors in US Treasuries are back. Over recent months, leveraged funds have built up net short positions in US Treasury futures of about $600 billion (Graph A1.A), with more than 40% of the net "shorts" concentrated in two-year contracts (Graph A1.B).*  These funds had been at a comparable level of net shorts in the run-up to the repo market turmoil of September 2019 (marker a) and the US Treasury market dislocations of March 2020 (marker b). This box examines current developments in the light of those experiences. It focuses on the often overlooked leverage associated with futures trading, and how sudden fluctuations in this "margin leverage" may give rise to destabilising margin spirals.

These funds had been at a comparable level of net shorts in the run-up to the repo market turmoil of September 2019 (marker a) and the US Treasury market dislocations of March 2020 (marker b). This box examines current developments in the light of those experiences. It focuses on the often overlooked leverage associated with futures trading, and how sudden fluctuations in this "margin leverage" may give rise to destabilising margin spirals.

Back in September 2019 and March 2020, price discrepancies between futures and the underlying cash bonds (the cash-futures "basis") encouraged highly leveraged funds to engage in relative value trades. Recent evidence suggests that the same type of trade may be driving the current build up. When Treasury futures are priced at a premium relative to cash bonds, a common relative value trading strategy consists of selling futures forward (building short positions in futures), matched by purchases of bonds (long positions in the cash market). Such a trade generates profits because the futures and cash prices eventually converge on the futures contract's expiration date. Since the basis is typically narrow, investors need to boost profits through very high leverage, ie they commit little own capital and borrow the rest. A key way of levering up involves the long positions: investors borrow cash in the repo market (usually having to roll over daily) by posting their US Treasury holdings as collateral.

When Treasury futures are priced at a premium relative to cash bonds, a common relative value trading strategy consists of selling futures forward (building short positions in futures), matched by purchases of bonds (long positions in the cash market). Such a trade generates profits because the futures and cash prices eventually converge on the futures contract's expiration date. Since the basis is typically narrow, investors need to boost profits through very high leverage, ie they commit little own capital and borrow the rest. A key way of levering up involves the long positions: investors borrow cash in the repo market (usually having to roll over daily) by posting their US Treasury holdings as collateral.

A less discussed aspect of the leverage involved in the cash-futures basis trade stems from futures markets. When entering a futures contract, traders need to post initial margin (IM), ie cash or highly liquid assets that the central counterparty (CCP) keeps as collateral to protect itself against counterparty credit risk. The ratio of futures contract value relative to the IM determines the allowed leverage. For instance, if traders initiate a futures position for $100 with an IM of $20, they are effectively borrowing $80 and the leverage of the position is 5x (= 100 / 20). Leverage in actual US Treasury futures was very high before the pandemic, at about 175x and 120x on average for five- and 10-year Treasuries, respectively (Graph A1.C). It has declined since 2021, as the increased volatility in the US Treasury market has led to higher required IMs, but is still elevated, at about 70x and 50x, respectively. A rise in IM requirements mechanically induces deleveraging, as traders have to either post additional cash to fulfil IM requirements, or close their positions.

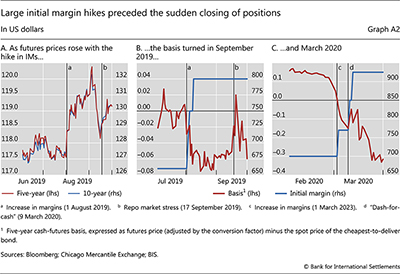

A disorderly reduction in margin leverage exacerbated fixed income market distress in both September 2019 and March 2020. The two episodes were preceded by significant hikes in IMs (Graph A1.C, drops before vertical markers), to which leveraged relative value traders appeared to respond at least in part by unwinding their positions. This was evident from the jump in the price of US Treasury futures on the day of the IM rise, in early August 2019 (Graph A2.A). As cash bond prices outpaced the rise in futures prices amid increased volatility, the basis inverted, creating further incentives for winding down the trades (Graph A2.B, red line). The ensuing dynamics placed protracted upward pressure on futures prices (Graph A2.A). Similar market dynamics were observed in March 2020, exacerbating the heightened volatility in US Treasury markets caused by uncertainty and lockdowns (Graph A2.C).

Given these experiences, the current build-up of leveraged short positions in US Treasury futures is a financial vulnerability worth monitoring because of the margin spirals it could potentially trigger. While this channel was well recognised in the March 2020 "dash-for-cash" episode, other factors garnered more attention in the context of the September 2019 repo market stress.

other factors garnered more attention in the context of the September 2019 repo market stress. Yet the margin deleveraging in August 2019 may have presaged the funding market disruptions that followed a month later. Margin deleveraging, if disorderly, has the potential to dislocate core fixed income markets.

Yet the margin deleveraging in August 2019 may have presaged the funding market disruptions that followed a month later. Margin deleveraging, if disorderly, has the potential to dislocate core fixed income markets.

* The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

Hedge funds' net short positions reflect liquidity provision to asset managers, and can be underpinned by a variety of trading strategies.

Hedge funds' net short positions reflect liquidity provision to asset managers, and can be underpinned by a variety of trading strategies.  See S Aramonte, A Schrimpf, and H S Shin, "Margins, debt capacity, and systemic risk", BIS Working Papers, no 1121, September 2023.

See S Aramonte, A Schrimpf, and H S Shin, "Margins, debt capacity, and systemic risk", BIS Working Papers, no 1121, September 2023.  See D Barth, R Kahn and R Mann, "Recent developments in hedge funds' treasury futures and repo positions: is the basis trade 'back'?", Board of Governors of the Federal Reserve System, FEDS Notes, August 2023.

See D Barth, R Kahn and R Mann, "Recent developments in hedge funds' treasury futures and repo positions: is the basis trade 'back'?", Board of Governors of the Federal Reserve System, FEDS Notes, August 2023.  S Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid-19 crisis", BIS Bulletin, no 2, April 2020.

S Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid-19 crisis", BIS Bulletin, no 2, April 2020.  See eg F Avalos, T Ehlers and E Eren, "September stress in dollar repo markets: passing or structural?", BIS Quarterly Review, December 2019, pp 12–14.

See eg F Avalos, T Ehlers and E Eren, "September stress in dollar repo markets: passing or structural?", BIS Quarterly Review, December 2019, pp 12–14.