Emerging markets' reliance on foreign bank credit

This article examines the importance of foreign banks in the provision of credit to emerging market borrowers. It documents this along two dimensions: the share of total credit provided and the concentration of claims from different foreign banking systems. The share of credit from foreign banks in total credit to emerging market economies has fallen since the Great Financial Crisis, but still stands at 15-20% on average, with the remainder provided by domestic banks or non- bank creditors. On the other hand, concentration in the market share of foreign creditor banking systems has risen. The official sector tends to be less reliant on foreign banks for credit, but more concentrated in its foreign banking system creditors than the private sector.1

JEL classification: F34, G21.

Internationally active foreign banks are important providers of credit for borrowers in emerging market economies (EMEs). They straddle national borders with their operations and thus may provide a conduit for the transmission of financial conditions to (and from) EMEs (Cetorelli and Goldberg (2011, 2012), Ongena et al (2015), Schnabl (2012)). While foreign banks can provide needed credit to EME borrowers and help boost financial capacity, excessive reliance on them can make EMEs vulnerable to foreign developments, with negative events leading to a contraction in credit and positive events fuelling a domestic credit boom that could potentially result in financial stress as it turns to bust (Avdjiev, Binder and Sousa (2017), Borio et al (2011)).

This article examines the importance of foreign banks in EMEs, explores how the volume and landscape of foreign bank lending have changed over time, and highlights differences by type of claims and borrower sector. It introduces a new measure of foreign bank reliance which captures how much of an EME's total credit is obtained from foreign banks. The first section discusses and documents this measure. Foreign bank reliance has been declining since the Great Financial Crisis (GFC), in favour of credit from domestic banks and non-banks, but with significant differences across countries and sectors. The second section documents the recent evolution of concentration in market share among foreign creditor banking systems in lending to specific EMEs. Concentration is high, especially for local currency lending, and has been increasing since the crisis. The last section explores the correlation of foreign bank concentration with foreign bank reliance. On average, the reliance on foreign banks moves opposite from the concentration among foreign creditor banking systems over time.

Key takeaways

- Emerging market borrowers' reliance on foreign bank credit has been decreasing since the Great Financial Crisis (GFC). The decline was driven by stagnation in foreign bank credit and expansion of credit from domestic banks and non-bank creditors.

- Emerging market borrowers obtain 15-20% of their credit from foreign banks on average, as of the second quarter of 2018, with a little over half of that in the form of local lending in local currency.

- Concentration amongst foreign creditor banking systems is high in emerging market economies. The share of foreign bank credit from a country's top three creditor banking systems has been increasing since the GFC and was over 75% as of Q2 2018.

- There are substantial differences across emerging market economies and sectors in terms of both foreign bank reliance and concentration of foreign creditor banking systems.

Reliance on foreign bank credit

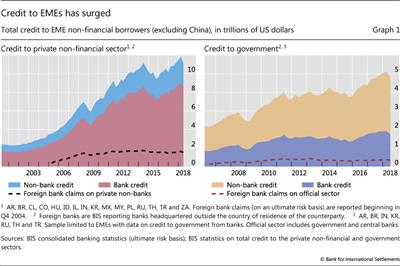

Credit to non-financial borrowers in EMEs2 has increased rapidly over the past decade from both bank and non-bank sources. Banks are the main source of credit to the private non-financial sector (77% of the total in the second quarter of 2018; Graph 1, left-hand panel). Credit from non-banks has been expanding, their claims growing at an average annual rate of 4.5% over the past decade.3 Credit from BIS reporting foreign banks4 rose in the lead-up to the GFC, but has increased little since.

Credit to EME governments, on the other hand, is largely provided by non-bank creditors (Graph 1, right-hand panel). Credit to governments is typically in the form of debt securities, which may influence the composition of creditors. Banks provide about one third of the credit, largely from domestic banks.

Foreign bank reliance (FBR) in EMEs has varied across countries, sectors and time. FBR denotes the fraction of total credit to non-financial borrowers in a country (or a sector within a country, such as non-financial corporations) that is accounted for by the consolidated claims of foreign banks (box).5 This measure also includes bond financing and borrowing from non-bank creditors, which has increased and become a substantial source of credit for many EMEs.

The foreign banks do not behave uniformly, with some operating more like domestic banks by setting up locally funded subsidiaries. Thus, a key distinction in the data is that between international claims (IC), ie cross-border claims and local claims in foreign currency, and local claims in local currency (LCLC). While the numerator of the FBR measure sums these two components, they often behave differently: LCLC are usually funded locally and so may be more insulated from foreign developments. Local lending and locally funded banks have been shown to be more stable in the face of external funding shocks (Avdjiev and Wooldridge (2018), Ehlers and McGuire (2017), McCauley et al (2017), Ongena et al (2015), Schnabl (2012)).

Reliance on foreign banks has decreased since the crisis

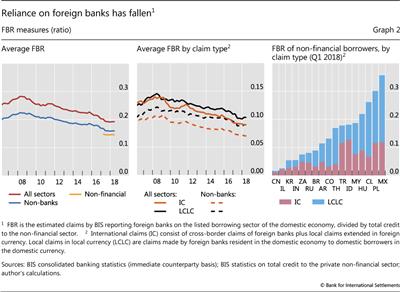

Across different measures, FBR increased leading up to the GFC, but has been steadily decreasing since (Graph 2, left-hand panel). On average, EME borrowers in the sample received over a quarter of their total credit from foreign banks prior to the GFC (including domestic bank borrowers). Most of that credit went directly to non-bank borrowers rather than indirectly via the local banking system.6 Within this category, non-financial borrowers, for which data are only available at the end of the sample, record a slightly lower FBR.7

Measuring reliance on foreign bank credit

Foreign banks (ie those with headquarters outside the borrower's country of residence) have been prominent players in EMEs. Nevertheless, lack of comparable, complete data makes it difficult to measure how important a role they may play. This box discusses how the BIS banking and total credit data can be used to construct measures of foreign bank reliance, and what these measures capture.

Foreign bank participation rates

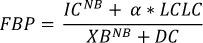

A first pass at a measure of foreign bank reliance, the foreign bank participation (FBP) rate, looks at the share of total credit from bank creditors provided by foreign banks (Ehlers and McGuire (2017), McGuire and Tarashev (2005)):

XBNB is cross-border bank credit to non-bank borrowers (from the BIS locational banking statistics). DC is domestic bank credit to non-bank borrowers (from the IMF International Financial Statistics). Thus, the denominator captures all credit provided by bank creditors, extended either locally or cross-border. The numerator is total foreign bank credit provided to non-banks in the economy (derived from the BIS consolidated banking statistics (CBS)), which comprises cross-border lending by foreign banks and local lending by the local affiliates of foreign banks. IC indicates international claims, which comprise cross-border credit and local credit extended in foreign currencies. LCLC is local credit extended in the local currency. The IC data are broken down by borrowing sector, allowing one to focus on, for instance, the non-bank sector, but LCLC does not include this sectoral counterparty breakdown in the time series. That breakdown is estimated by multiplying LCLC by α, the share of credit to non-banks in IC (Ehlers and McGuire (2017)).

Thus, the denominator captures all credit provided by bank creditors, extended either locally or cross-border. The numerator is total foreign bank credit provided to non-banks in the economy (derived from the BIS consolidated banking statistics (CBS)), which comprises cross-border lending by foreign banks and local lending by the local affiliates of foreign banks. IC indicates international claims, which comprise cross-border credit and local credit extended in foreign currencies. LCLC is local credit extended in the local currency. The IC data are broken down by borrowing sector, allowing one to focus on, for instance, the non-bank sector, but LCLC does not include this sectoral counterparty breakdown in the time series. That breakdown is estimated by multiplying LCLC by α, the share of credit to non-banks in IC (Ehlers and McGuire (2017)).

Foreign bank reliance

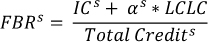

The FBP measure misses the important increase in bond financing and financing by non-bank creditors to emerging market borrowers in recent years (Aldasoro and Ehlers (2018), Avdjiev, Gambacorta, Goldberg and Schiaffi (2017)). Thus, a more comprehensive measure of credit in the denominator can more accurately capture the role of foreign banks in total credit provision. In 2013, the BIS began publishing series on total credit to the non-financial sector for individual countries (data extending to before 2013). These series capture credit extended in the form of currency and deposits, loans and debt securities from all lenders over a long time horizon (Dembiermont et al (2013), Dembiermont et al (2015)). These series allow us to estimate foreign bank reliance (FBR) as:

The s superscript indicates the borrowing sector, as both the CBS and total credit data permit decompositions by the borrowing sector (eg private non-financial sector or official sector). To estimate the sector split of LCLC, the ultimate risk (UR) data from the CBS are used, which break down total claims (IC + LCLC) by the borrowing sector. This may provide a more accurate estimate than applying the shares from IC, especially if LCLC is large relative to IC.

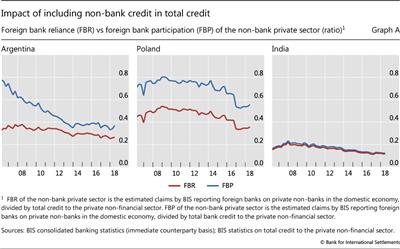

The inclusion of non-bank credit in the denominator makes a large difference for many EMEs (Graph A, left-hand and centre panels), but some still rely very little on bonds and other non-bank credit (Graph A, right-hand panel).

Role of the domestic financial sector

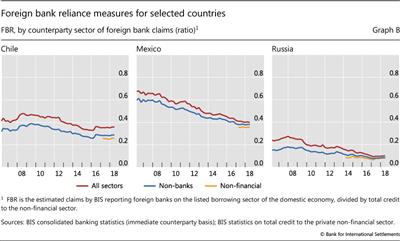

Foreign banks can provide credit directly to EME borrowers, either cross-border or via a local affiliate, or they can do so indirectly by lending to local banks or non-bank financials. Thus, examining credit from foreign banks directly to non-financial EME borrowers may underestimate the role of foreign banks in credit provision. However, including foreign bank claims on the domestic financial sector may also overstate the role of foreign banks if the financial sector in turn uses those funds to extend credit abroad. Alternative measures for the numerator shed light on the potential range of values for FBR: foreign bank claims on all sectors, foreign bank claims on the non-bank sector and foreign bank claims on the non-financial sector (Graph B). As it turns out, while including claims on banks in the numerator increases the FBR measure somewhat, non-bank financials do not contribute very much to the measure generally.

Besides the non-financial sector as a whole, it is useful to consider how reliant individual sectors of the economy (such as the private and official sectors) may be on foreign banks. Data to separate non-banks into financial and non-financial creditors are only available with recent enhancements to the BIS data. When disaggregating the borrower sector further, such as examining the private and official sectors, assumptions about the allocation of foreign bank credit lent indirectly through domestic banks become more tenuous. Thus, for those sectors it is safer to focus on a foreign bank reliance measure which is confined to direct credit provision.

DC corresponds to domestic claims or domestic credit to non-bank borrowers from monetary authorities and depository corporations (IMF International Financial Statistics). Some countries additionally provide domestic credit series including non-bank financial creditors. The DC series is no longer actively produced and maintained by the IMF across countries, and so cannot be used for recent data. For the construction of FBP in this box, total credit to the private non-financial sector from bank creditors is used, available from the BIS series on total credit.

DC corresponds to domestic claims or domestic credit to non-bank borrowers from monetary authorities and depository corporations (IMF International Financial Statistics). Some countries additionally provide domestic credit series including non-bank financial creditors. The DC series is no longer actively produced and maintained by the IMF across countries, and so cannot be used for recent data. For the construction of FBP in this box, total credit to the private non-financial sector from bank creditors is used, available from the BIS series on total credit.  Using the previous method with IC on an immediate counterparty basis results in a very similar estimate. Using the total claims series from the ultimate risk data in the numerator also results in a similar series, but the immediate counterparty data are used in order to show the breakdown between IC and LCLC. The ultimate risk data are available from Q4 2004.

Using the previous method with IC on an immediate counterparty basis results in a very similar estimate. Using the total claims series from the ultimate risk data in the numerator also results in a similar series, but the immediate counterparty data are used in order to show the breakdown between IC and LCLC. The ultimate risk data are available from Q4 2004.  Given data constraints, the sector definitions do not always line up perfectly. Since the data enhancements for foreign bank claims on the private non-financial sector have not been available until recently, claims on the private non-bank sector are used in the numerator for time series plots of FBR for the private non-financial sector. For the official sector, foreign bank claims include claims on both the government and the central bank, whereas the total credit series captures credit to the government only. For EMEs, central bank liabilities are small, but this measure may not be appropriate for countries whose central banks have employed quantitative easing measures.

Given data constraints, the sector definitions do not always line up perfectly. Since the data enhancements for foreign bank claims on the private non-financial sector have not been available until recently, claims on the private non-bank sector are used in the numerator for time series plots of FBR for the private non-financial sector. For the official sector, foreign bank claims include claims on both the government and the central bank, whereas the total credit series captures credit to the government only. For EMEs, central bank liabilities are small, but this measure may not be appropriate for countries whose central banks have employed quantitative easing measures.

After the GFC, average reliance on foreign bank credit steadily decreased from 28% of the total in Q3 2008 to 19% by Q2 2018 (15% for direct credit to the non-financial sector). This reduction reflects a stagnation in credit from foreign banks as well as an increase in credit from both domestic banks and non-bank creditors (Graph 1).8 In general, both IC and LCLC reliance declined following the GFC, but IC dropped by more, indicating a relative increase in local currency borrowing from foreign banks (Graph 2, centre panel).

The cross section shows substantial differences in FBR among EMEs (Graph 2, right-hand panel). Mexico (0.36), Poland (0.30) and Chile (0.26) have the highest, while Israel (0.03) and China (0.02) have the lowest. In most cases, countries with a higher FBR are host to foreign banks with large local operations (ie a large amount of LCLC). Indonesia (0.13) and Turkey (0.12) have the highest reliance in the form of IC.

Reliance on foreign banks remains higher for the private sector than the official sector

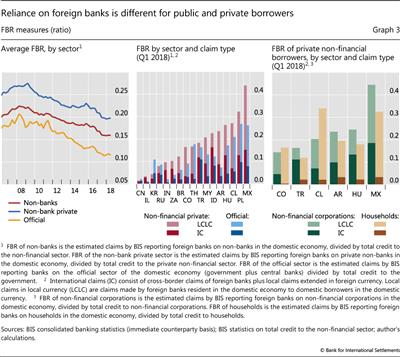

The decline in FBR following the GFC was common to both the official and private sectors (Graph 3, left-hand panel). The private sector is more reliant on foreign banks on average, with the share averaging around 0.2 in 2018 for private and 0.1 for official sector borrowers.

There are significant differences in FBR for the two sectors in the cross section, even within the same country, both in terms of size and composition (Graph 3, centre panel). Mexico's private sector is the most reliant, receiving nearly 50% of its credit directly from foreign banks (including foreign banks operating locally), and China's is the least. Regarding the official sector, Poland's and Mexico's are the most reliant on foreign bank credit, while Israel's is the least. Within the private sector, households rely less on foreign banks than do non-financial corporations, and borrow overwhelmingly in the form of LCLC (Graph 3, right-hand panel).9 Firms in Mexico get nearly 20% of their credit in the form of IC, which comprises cross-border credit and local credit in foreign currency and thus may reflect a significant amount of foreign currency borrowing from banks.

While FBR captures the role that foreign banks play in providing credit, it does not capture the full range of ways in which a country's financial system may be exposed to developments in other jurisdictions. For example, credit from domestic banks may be funded with bonds and foreign currency liabilities, which may prove to be more volatile than funding with domestic deposits (McGuire and von Peter (2016)). On the other hand, the credit provided by foreign banks could be largely funded from domestic sources, as is the case in Mexico, making it less vulnerable to foreign developments despite the banks' foreign ownership.

Concentration among foreign bank lenders

Another aspect that may influence the vulnerability of EME credit to foreign developments is the exposure to individual national banking systems (eg French banks, Spanish banks). For instance, if an EME gets all of its foreign bank credit from banks headquartered in just one foreign country, developments in that country may have a significant effect on credit provision. As already noted, the distinction between IC and LCLC is crucial in understanding how these effects play out. To capture the concentration of credit from foreign banking systems, this section examines the share of total foreign bank claims from the top three national banking system creditors, noting the differences between concentration in IC and LCLC credit.10

Concentration has increased since the crisis

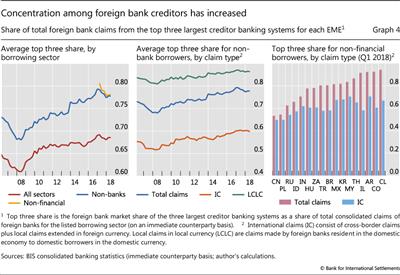

Concentration was declining leading up to the GFC, but has been increasing since (Graph 4, left-hand panel).11 This rise was reflected in both the IC and LCLC credit from foreign banks (centre panel). IC tends to be much less concentrated in all countries, as banks from many jurisdictions lend cross-border (right-hand panel). In contrast, LCLC tends to be more concentrated on average. In general, concentration is high, with 70-80% of claims on the non-bank sector typically coming from the top three foreign banking systems.

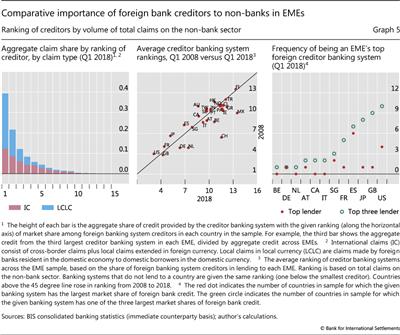

Across EMEs, the share of foreign bank credit from the top creditor foreign banking system is quite high. The top ranked creditors provide 40% of total foreign bank credit for the sampled countries, while the second highest ranked creditors provide around 20% (Graph 5, left-hand panel). The top foreign creditor banking systems tend to have very large local currency claims, reflecting the presence of locally funded affiliates. Banking system creditors with lower rankings tend to have more IC claims.

Even though the foreign bank credit landscape tends to be quite concentrated, the importance of specific lending banking systems can vary over time. Following the GFC, several creditor banking systems, such as those of Belgium, Germany, the Netherlands and Switzerland, became comparatively less important (in terms of their claims volume) across EMEs (Graph 5, centre panel). This reflects in part the failure and restructuring of large internationally active banks in Belgium and the Netherlands, as well as a general deleveraging of the large European banking systems. Banks in Australia, Canada, Japan and Spain, among others, expanded post-crisis (McCauley et al (2017)).

A small number of creditor banking systems tend to be the largest players across all EMEs. The United States and United Kingdom are among the three largest creditor banking systems in more of these EMEs than any other BIS reporting banking system, followed by Japan, Spain and France. However, the Spanish banking system is most often the top lender in an EME (Graph 5, right-hand panel).12

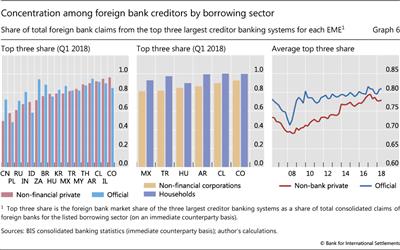

Concentration rose for both the private and official sectors

Patterns of concentration among foreign bank lenders differ by borrowing sector. Credit to the official sector tends to be more concentrated than its private sector counterpart, but with heterogeneity across countries (Graph 6, left-hand panel). For example, credit to the South African official sector tends to be concentrated in just its top three creditor banking systems, while credit to the private sector in China is much more dispersed. Households are especially concentrated, with essentially 100% of their foreign bank borrowing from just three banking systems (centre panel). This fits with the previous facts: namely, that households tend to borrow from foreign banks mainly in local currency; and local currency operations are more concentrated (with relatively few foreign banking systems setting up local currency operations).

There has been some convergence in concentration in private sector and official sector borrowing over time. For both sectors, the low point of concentration across creditor banking systems was at the onset of the GFC, since which concentration ratios in both private and official sector lending have steadily increased and drawn closer (Graph 6, right-hand panel).

Correlation between FBR and concentration

Having considered the reliance on foreign banks and the concentration among foreign lenders, this section examines these measures jointly to get a more complete picture of the activity of foreign banks in EMEs.

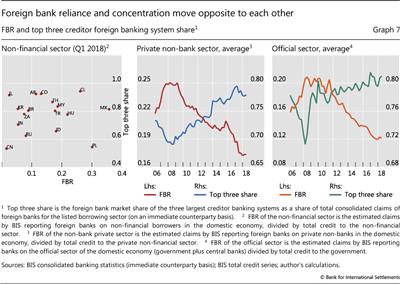

The cross section shows a mildly positive correlation between FBR and concentration (Graph 7, left-hand panel). For instance, a few countries, such as Mexico and Chile, exhibit both a relatively high reliance on foreign banks and a fairly high concentration across national creditor banking systems. Excluding Poland, which is a major exception to this pattern, the correlation is 0.31.

Over time, however, concentration and FBR tend to move in opposite directions (Graph 7, centre and right-hand panels). This is especially stark for the private non-bank sector (corr = -0.94). The negative correlation is striking, with reliance increasing and concentration decreasing leading up to the GFC, while following the GFC these trends reversed. Credit to the official sector shows the same negative correlation (- 0.64).

This strong negative correlation in the time series reveals much about the landscape of credit provision by foreign banks in EMEs. Leading up to the GFC, banks from many foreign countries lent to EMEs, contributing to an increase in the FBR measure and a fall in concentration. After the crisis, domestic banks and non-bank creditors expanded into EME lending. Aggregate credit from foreign banks remained about the same, but the composition of lenders became more concentrated, as some creditors retreated from EME lending and others expanded.

Looking ahead, the diversity of funding sources may be important for EMEs to monitor. Diversifying funding sources can reduce the risk of sudden reversals of credit from foreign developments in a single creditor country. Moreover, the type of funding provided by creditors is important in determining the risk of credit reversals. Local funding has proven to be more stable through financial crises, while cross-border and foreign currency funding has been less so (Ehlers and McGuire (2017)). Bond credit and credit from non-banks are growing sources, but may bring new risks and financial stability concerns (Shin (2013)). Recent developments highlighted in this article have proven mixed in terms of funding diversity: LCLC lending plays an increasingly prominent role for foreign bank creditors to EMEs, but concentration across creditor banking systems has increased and credit from non-banks has risen.

References

Aldasoro, I and T Ehlers (2018): "Global liquidity: changing instruments and currency patterns", BIS Quarterly Review, September, pp 17-27.

Avdjiev, S, S Binder and R Sousa (2017): "External debt composition and domestic credit cycles", BIS Working Papers, no 627, April.

Avdjiev, S, L Gambacorta, L Goldberg and S Schiaffi (2017): "The shifting drivers of global liquidity", BIS Working Papers, no 644, June.

Avdjiev, S and P Wooldrige (2018): "Using the BIS consolidated banking statistics to analyse country risk exposures: A primer illustrated with banks' exposures to Turkey", BIS Quarterly Review, September, pp 14-16.

Borio, C, R McCauley and P McGuire (2011): "Global credit and domestic credit booms", BIS Quarterly Review, September, pp 43-57.

Cerutti, E, C Koch and S-K Pradhan (2018): "The growing footprint of EME banks in the international banking system", BIS Quarterly Review, December, pp 27-37.

Cerutti, E and H Zhou (2018): "The Chinese banking system: much more than a domestic giant", VoxEU, 9 February.

Cetorelli, N and L Goldberg (2011): "Global banks and international shock transmission: evidence from a crisis", IMF Economic Review, vol 59, no 1, pp 41-76.

--- (2012): "Banking globalization and monetary transmission", Journal of Finance, vol 67, no 5, pp 1811- 43.

Dembiermont, C, M Drehmann and S Muksakunratana (2013): "How much does the private sector really borrow? A new database for total credit to the private non-financial sector", BIS Quarterly Review, March, pp 65-81.

Dembiermont, C, M Scatigna, R Szemere and B Tissot (2015): "A new database on general government debt", BIS Quarterly Review, September, pp 69-87.

Ehlers, T and P McGuire (2017): "Foreign banks and credit conditions in EMEs", BIS Papers, no 91, March.

Ehlers, T and P Wooldridge (2015): "Channels and determinants of foreign bank lending", BIS Papers, no 82, October.

Koch, C and E Remolona (2018): "Common lenders in emerging Asia: their changing roles in three crises", BIS Quarterly Review, March, pp 17-28.

McCauley, R, A Bénétrix, P McGuire and G von Peter (2017): "Financial deglobalisation in banking?", BIS Working Papers, no 650, June.

McCauley, R, P McGuire and V Sushko (2015): "Dollar credit to emerging market economies", BIS Quarterly Review, December, pp 27-41.

McGuire, P and N Tarashev (2005): "The international banking market", BIS Quarterly Review, June, pp 15-30.

McGuire, P and A Van Rixtel (2012): "Shifting credit patterns in emerging Asia", BIS Quarterly Review, December, pp 17-18.

McGuire, P and G von Peter (2016): "The resilience of banks' international operations", BIS Quarterly Review, March, pp 65-78.

Ongena, S, J-L Peydro and N van Horen (2015): "Shocks abroad, pain at home? bank-firm-level evidence on the international transmission of financial shocks", IMF Economic Review, vol 63, no 4, pp 698-750.

Schnabl, P (2012): "The international transmission of bank liquidity shocks: Evidence from an emerging market", Journal of Finance, vol 67, no 3, pp 837-932.

Shin, H S (2013): "The second phase of global liquidity and its impacts on emerging economies", keynote address at Federal Reserve Bank of San Francisco Asia Economic and Policy Conference, Federal Reserve Bank of San Francisco, 3-5 November.

1 The author thanks Stefan Avdjiev, Claudio Borio, Stijn Claessens, Benjamin Cohen, Robert McCauley, Patrick McGuire, Swapan-Kumar Pradhan, Hyun Song Shin and Philip Wooldridge for valuable comments. Deimante Kupciuniene provided excellent research assistance. The views expressed in this article are those of the author and not necessarily those of the BIS.

2 EMEs in this article are a subset of countries designated as EMEs in the BIS statistics, selected based on data availability in the total credit series and consolidated banking statistics: Argentina, Brazil, Chile, China, Colombia, Hungary, India, Indonesia, Israel, Malaysia, Mexico, Poland, Russia, South Africa, South Korea, Thailand and Turkey.

3 For these countries, credit in the form of international debt securities has grown at an average annual rate of 11% over the past decade. See also McCauley et al (2015) and Avdjiev, Gambacorta, Goldberg and Schiaffi (2017) for evidence and discussion on the growing importance of bonds for foreign currency credit to EMEs.

4 Foreign banks are those whose headquarters are located outside the counterparty's country of residence.

5 Foreign banks in this measure are only those with headquarters in BIS reporting countries. While this probably includes the bulk of foreign claims, some important lenders (eg China) are excluded.

6 As the denominator is total credit to the non-financial sector, including all sectors in the numerator (ie including banks and non-bank financials) carries the implicit assumption that credit to the domestic financial sector is passed through to domestic non-financial borrowers. Thus, the three lines provide a range of possible FBR values. See the box for a discussion.

7 This indicates that the time series for non-bank borrowers may be informative about the time series for non-financial borrowers, which captures only direct credit provision from foreign banks.

8 FBR could be biased by the exclusion of foreign banks which do not report to the consolidated banking statistics, most notably Chinese banks (Cerutti et al (2018), Cerutti and Zhou (2018), Koch and Remolona (2018), McGuire and Van Rixtel (2012)). Including data of Chinese nationality banks from the locational banking statistics, covering Chinese banks located in China as well as in other BIS reporting countries, results in very similar FBR estimates.

9 The reporting of data breakdowns for non-financial corporations and households in the CBS does not start until the fourth quarter of 2013, and is not uniform across all CBS reporting countries. EMEs which have a major lender that does not report this more granular counterparty breakdown are dropped from the right-hand panel of Graph 3.

10 Alternative measures of concentration, such as a normalised Herfindahl index, reveal similar patterns.

11 This indicates that the earlier findings of Ehlers and Wooldridge (2015) of increasing concentration among Asia-Pacific borrowers is a general trend among EMEs and has largely continued.

12 China does not report data to the CBS, but anecdotal evidence indicates that the Chinese banking system would be a highly ranked creditor for several EMEs. See Cerutti et al (2018) and Koch and Remolona (2018) for a discussion.