Global liquidity: changing instrument and currency patterns

Updated 24 September 2018: Figures on the y axis of Graph 1, right-hand panel have been corrected.

International (cross-border and foreign currency) credit, a key indicator of global liquidity, has continued to expand in recent years to 38% of global GDP. This growth has been driven by international debt securities issuance, while the role of banks has diminished - both as lenders and as investors in debt securities. The aggregate trend has been more pronounced for advanced economy than emerging market borrowers. For individual countries, however, the growth of bank loans and that of debt securities have tended to move in tandem, highlighting the cyclical nature of global liquidity. The US dollar has become even more dominant as an international funding currency - in particular for emerging market borrowers. However, dollar exposures in emerging market economies vary substantially across countries and sectors.1

JEL classification: G10, F34, G21.

Global liquidity - the ease of financing in international financial markets - remains at the centre of policy debates (Cohen et al (2017), CGFS (2011), Borio et al (2011)). In the run-up to the 2007-09 Great Financial Crisis (GFC), the supply of international credit - comprising cross-border credit and credit in foreign currency whether or not it crosses a border - expanded rapidly. When the crisis hit, international credit evaporated, exposing financial vulnerabilities in both advanced and emerging market economies (EMEs).2 Against the backdrop of major central banks' highly accommodative monetary policies, this key indicator of global liquidity picked up markedly since 2010, in particular in EMEs.

In contrast to the pre-GFC period, the increase in international credit since 2010 has been driven primarily by debt securities rather than bank loans (Avdjiev et al (2017), Turner (2013)). At the same time, the US dollar has become even more dominant as the prime currency of denomination since the GFC (Maggiori et al (2018)). This "second phase" of global liquidity implies that global financing conditions have become more sensitive to developments in the bond market, and even more tightly linked to US monetary policy (Shin (2013)). EME borrowers may be particularly vulnerable if they have relied heavily on US dollar-denominated debt securities, as international bond investors tend to retreat quickly when US rates rise. But EMEs' US dollar debt exposures can differ substantially not only across countries but also across sectors. In some EMEs the private corporate sector has been the main borrower of US dollars, while in others it has been the sovereign.

Key takeaways

- International credit (bank loans plus debt securities) to non-banks, a key indicator of global liquidity, has continued to expand in recent years, from 33% of global GDP in Q1 2015 to 38% in Q1 2018.

- The composition of international credit shifted from bank loans to debt securities, whose share in the total rose from 48% in Q1 2008 to 57% in Q1 2018.

- Global banks' international debt securities holdings fell from 40% of the total outstanding at end-March 2008 to 27% at end-March 2018, reinforcing the diminishing role of banks in driving international credit.

- The US dollar has become even more dominant as the prime foreign currency for international borrowing. Dollar credit to the non-bank sector outside the US rose from 9.5% of global GDP at end-2007 to 14% in Q1 2018.

- The growth in dollar borrowing by EMEs has been especially strong, but dollar exposures vary substantially both across countries and in terms of sectoral composition.

This feature documents and analyses the shift from international bank loans to debt securities in international credit, as well as the currency composition, building on the BIS global liquidity indicators (GLIs). The first section presents global trends and recent developments. The second contrasts the developments in advanced economies and EMEs. It documents how the shift away from bank loans towards debt securities has been more pronounced for advanced economies than for EMEs as a whole. At the country level, however, growth of bank loans and that of debt securities have moved in tandem for both advanced and emerging market economy borrowers. The third section focuses on EME foreign currency borrowing and highlights the different sectoral composition of US dollar credit across countries.

Recent trends in global liquidity

The quarterly BIS GLIs capture one aspect of the ease of global financing conditions.3 They track the behaviour of international credit, which is an informative signal for the build-up of vulnerabilities (Aldasoro et al (2018)). The GLIs build on the BIS locational banking statistics and the BIS international debt securities statistics, as well as national data. This feature focuses on international credit (bank loans plus debt securities) to the non-bank sector4 as a key element that directly influences domestic credit conditions and external vulnerabilities in recipient countries (see box).5 It underestimates the true level of non-banks' international borrowing, as it focuses on bank loans and debt securities. In particular, derivatives, such as FX swaps, could add substantially to the foreign currency obligations of non-banks.6

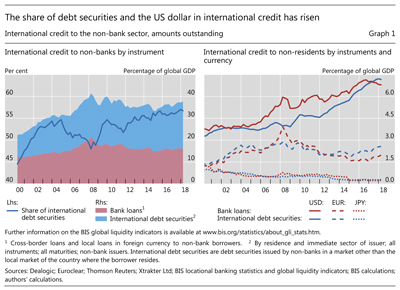

The post-GFC compositional shift in global liquidity has exhibited two main features. The first is the move from international bank loans to debt securities (Graph 1, left-hand panel). Cross-border and locally extended credit in foreign currency to the non-bank sector - as a share of global GDP - rose sharply in the run-up to the GFC. Bank loans grew especially fast in the last pre-crisis years. After falling sharply during the GFC, they have since remained essentially flat. By contrast, outstanding international debt securities have risen steadily since then, from 48% in the first quarter of 2008 to around 57% of total international credit in the first quarter of 2018.

The second defining feature is the rise of foreign currency US dollar credit (McCauley et al (2015a)). US dollar-denominated debt securities issued by non-US residents have been the key driver of this trend, surpassing bank loans for the first time in the second half of 2017 (Graph 1, right-hand panel). The overall amount of dollar credit to the non-bank sector outside the United States has climbed from 9.5% of global GDP at end-2007 to 14% in the first quarter of 2018. Since end-2016, however, the growth in dollar credit has been flat.

International credit to non-banks and the BIS global liquidity indicators

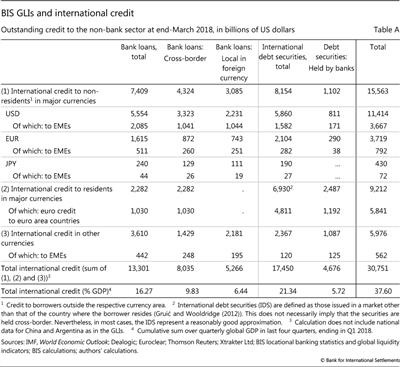

International credit to non-banks - the measure used throughout this feature - builds on the various measures in the BIS global liquidity indicators (GLIs). A key measure of the GLIs is credit to non-residents (ie foreign currency credit), which measures credit to borrowers outside the jurisdiction where a currency is issued, for three major currencies (US dollar, euro and Japanese yen). For instance, US dollar credit to non-residents comprises all US dollar bank loans to and debt securities issued by residents outside the United States - be it cross-border or locally raised.

which measures credit to borrowers outside the jurisdiction where a currency is issued, for three major currencies (US dollar, euro and Japanese yen). For instance, US dollar credit to non-residents comprises all US dollar bank loans to and debt securities issued by residents outside the United States - be it cross-border or locally raised. International credit to non-banks encompasses credit to non-residents in the three major currencies (Table A, row 1) but adds cross-border credit to residents (ie cross-border local currency credit) in these currencies (row 2) as well as cross-border and locally extended foreign currency credit in all other currencies (row 3). A significant part of the amount in row 2 ($5.8 trillion or 63% at end-March 2018) consists of euro-denominated cross-border credit to euro area countries.

International credit to non-banks encompasses credit to non-residents in the three major currencies (Table A, row 1) but adds cross-border credit to residents (ie cross-border local currency credit) in these currencies (row 2) as well as cross-border and locally extended foreign currency credit in all other currencies (row 3). A significant part of the amount in row 2 ($5.8 trillion or 63% at end-March 2018) consists of euro-denominated cross-border credit to euro area countries.

Credit to non-residents in the GLIs can be broken down by instrument into bank loans and debt securities. However, banks do not just grant loans. They also can be significant holders of international debt securities (Table A, fifth column). As a result, it is misleading to identify securities issuance with capital market financing, as is often done. At end-March 2018, BIS reporting banks held about $4.7 trillion in international debt securities, more than a quarter of the total outstanding. Summing total bank loans (first column) and their debt securities holdings (fifth column) yields international bank claims on the non-bank sector - another key GLI.

The GLIs are residence-based and therefore do not include credit borrowed by offshore entities.

The GLIs are residence-based and therefore do not include credit borrowed by offshore entities.  See www.bis.org/statistics/e2_1.pdf.

See www.bis.org/statistics/e2_1.pdf.  See www.bis.org/statistics/e1.pdf.

See www.bis.org/statistics/e1.pdf.

The shift from bank loans to debt securities

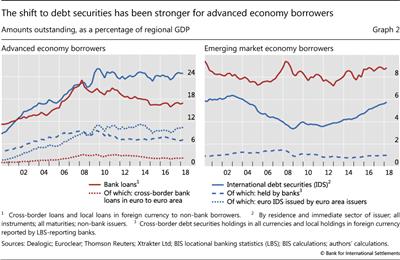

The shift towards international debt securities has been most pronounced in advanced economies (Graph 2, left-hand panel). Bank loans to this group of borrowers has been declining - with the decline accelerating after the euro zone sovereign debt crisis. This was to a large extent driven by European banks reducing their international loan exposures in response to the GFC and the euro area debt crisis - in particular those denominated in US dollars to US residents (McCauley et al (2017), Borio and Disyatat (2011)). Both euro-denominated cross-border bank loans and debt securities of euro area borrowers remained fairly stable and had little effect on the overall trend in the corresponding aggregates for advanced economies.

In EMEs, outstanding international debt securities have risen strongly as a share of GDP since 2010, albeit from a lower level than bank loans (Graph 2, right-hand panel). In contrast to advanced economies, bank loans to and debt securities issuance by EMEs have been growing in tandem in recent years. A tell-tale sign of the ease of financing conditions for EME borrowers has been the ability of sub-investment grade sovereigns to issue US dollar-denominated debt securities.7

The distinction between bank loans and debt securities obscures the fact that a significant share of debt securities is held by banks and therefore represents bank credit. Just as they have done with bank loans, global banks have also reduced their international debt securities holdings. In particular in advanced economies, global banks seem to have reduced both loan and debt security positions, consistent with the rising role of non-banks in driving global liquidity. In EMEs, this trend is particularly visible in the contrast between the strong growth in international debt securities and flat bank holdings of debt securities (Graph 2, right-hand panel, solid blue versus dashed blue lines). Despite a 13 percentage point decline over the past decade, global banks' international debt securities holdings still account for a significant share in the total outstanding (27% at end-March 2018).

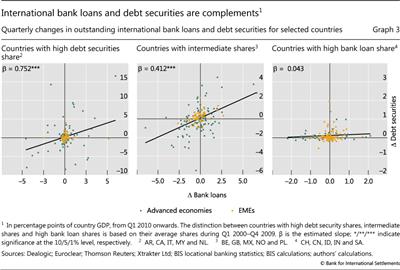

The highly aggregated view of advanced and emerging market economies conceals the complementarity of international bank loans and debt securities at the country level.8 The fall in bank loans for advanced economy borrowers as a whole is effectively driven by four countries: France, Germany, the United Kingdom and the United States. At the country level, however, growth of bank loans is on average positively related to growth of debt securities for both advanced economy and EME borrowers (Graph 3).

The link between bank borrowing and debt securities issuance has tended to be the weakest for countries with a historically high bank loan share. In the extreme case where a borrower in a given country does not have access to debt securities markets, or has a strong preference for bank loans, any international borrowing will naturally be through bank loans. Indeed, for borrower countries with a high bank loan share, changes in international credit are almost entirely due to bank loans on average (Graph 3, right-hand panel). For borrower countries with historically high debt security shares, on the other hand, there is a strong positive relationship between changes in outstanding international bank loans and debt securities (left-hand panel). Borrower countries with intermediate shares still exhibit complementarity, but to a lesser degree (centre panel). In other words, there is a strong common and cyclical component for different instruments of international credit for countries that do not heavily rely on bank loans.

Foreign currency credit to EMEs

In all major emerging market regions, the growth of US dollar-denominated credit has outpaced that in other foreign currencies. The high share of dollar borrowing foreshadows risks that could materialise in the case of a persistent dollar appreciation.9 A stronger dollar increases tail risks for global investors holding a diversified portfolio of EME assets (Avdjiev et al (2016)), which can lead to widespread reductions in EME exposures - especially of dollar bonds. This mechanism is likely to have contributed to the recent bout of turbulence in EMEs (see "Divergences widen in markets", BIS Quarterly Review, September 2018).

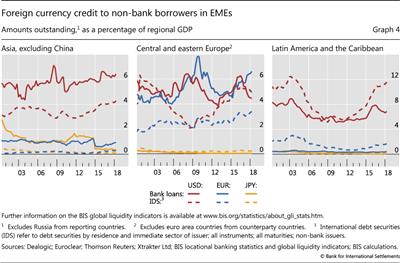

Across the major EME regions, the importance of the dollar as a funding currency varies, however. In emerging Asia, US dollar-denominated credit has been on the rise since 2010 - both as debt securities and as bank loans (Graph 4, left-hand panel). In central and eastern Europe, euro-denominated credit has traditionally played a relatively more important role. Yet the dollar dominates also in this region, despite the strong pickup in euro credit since 2015 (centre panel). In Latin America, US dollar credit has historically dominated and has grown strongly since 2010, driven by debt securities issuance (right-hand panel).

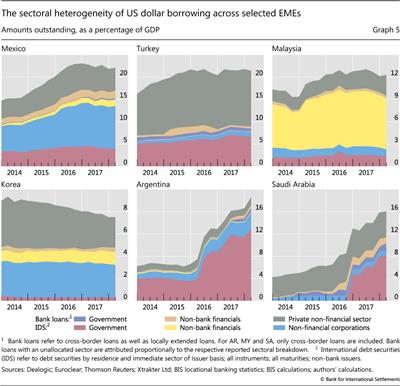

The increase in US dollar borrowing in EMEs has differed across sectors (McCauley et al (2015b)). In some major EMEs, corporate borrowing played a key role. In Mexico, non-financial corporates' dollar debt securities issuance has been a main driver of international borrowing by non-banks (Graph 5, top left-hand panel, blue area). Despite the relative decline in bank loans in the post-crisis period, US dollar bank lending to the private non-financial sector has also expanded in some countries, including Turkey (top centre panel). Dollar borrowing by non-bank financial corporates is less prevalent overall, but plays a large role in Malaysia (top right-hand panel) as well as Korea (bottom left-hand panel). Yet Korea has been unique among the major EMEs in its consistent reduction of overall non-bank US dollar borrowing.

While EME corporates have been significant borrowers of US dollars, sovereign debt issuance has also played an important role. Argentina is a case in point, with a sharp increase in debt securities issuance by the sovereign since early 2016 (Graph 5, bottom centre panel). Similar increases took place in some oil-exporting economies, such as Saudi Arabia (bottom right-hand panel; see also BIS (2017)).

References

Aldasoro, I, C Borio and M Drehmann (2018): "Early warning indicators of banking crises: expanding the family", BIS Quarterly Review, March, pp 29-45.

Avdjiev, S, W Du, C Koch and H S Shin (2016): "The dollar, bank leverage and the deviation from covered interest parity", BIS Working Papers, no 592, November.

Avdjiev, S, L Gambacorta, L Goldberg and S Schiaffi (2017): "The shifting drivers of global liquidity", BIS Working Papers, no 644, June.

Avdjiev, S, R McCauley and P McGuire (2012): "Rapid credit growth and international credit: challenges for Asia", BIS Working Papers, no 377, April.

Bank for International Settlements (2017): "Highlights of the BIS international statistics", BIS Quarterly Review, June, pp 1-11.

--- (2018): BIS global liquidity indicators: methodology, April.

Becker, B and V Ivashina (2014): "Cyclicality of credit supply: Firm level evidence", Journal of Monetary Economics, vol 62 (C), pp 76-93.

Borio, C (2013): "Commentary: Global liquidity: public and private", in Global dimensions of unconventional monetary policy, proceedings of the Federal Reserve Bank of Kansas City Jackson Hole symposium, August, pp 261-73.

Borio, C and P Disyatat (2011): "Global imbalances and the financial crisis: link or no link?", BIS Working Papers, no 346, May.

Borio, C, R McCauley and P McGuire (2011): "Global credit and domestic credit booms", BIS Quarterly Review, September, pp 43-57.

--- (2017): "FX swaps and forwards: missing global debt?", BIS Quarterly Review, September, pp 37-54.

Bruno, V and H S Shin (2015): "Cross-border banking and global liquidity", Review of Economic Studies, vol 82, no 2. Also published as BIS Working Papers, no 458, September.

Cerutti, E, S Claessens and L Ratnovski (2017): "Global liquidity and drivers of cross-border bank flows", Economic Policy, vol 32, no 89, pp 81-125.

Cerutti, E and G H Hong (2018): "Portfolio inflows eclipsing banking inflows: alternative facts?", IMF Working Papers, no 18/29, February.

Cohen, B, D Domanski, I Fender and H S Shin (2017): "Global liquidity: a selective review", Annual Review of Economics, vol 9, pp 587-612.

Committee on the Global Financial System (2011): Global liquidity - concept, measurement and policy implications, CGFS Papers, no 45, November.

Ehlers, T and P McGuire (2017): "Foreign bank and credit conditions in EMEs", BIS Papers, no 91, pp 101-23.

Gruić, B and P Wooldridge (2012): "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December, pp 63-76.

Hofmann, B, I Shim and H S Shin (2017): "Sovereign yields and the risk-taking channel of currency appreciation", BIS Working Papers, no 538, May.

Maggiori, M, B Neiman and J Schreger (2018): "International currencies and capital allocation", NBER Working Papers, no 24673, May.

McCauley, R, A Bénétrix, P McGuire and G von Peter (2017): "Financial deglobalisation in banking?", BIS Working Papers, no 650, June.

McCauley, R, P McGuire and V Sushko (2015a): "Global dollar credit: links to US monetary policy and leverage", BIS Working Papers, no 483, January.

--- (2015b): "Dollar credit to emerging market economies", BIS Quarterly Review, December, pp 27-41.

Rey, H (2013): "Dilemma not trilemma: the global financial cycle and monetary policy independence", in Global dimensions of unconventional monetary policy, proceedings of the Federal Reserve Bank of Kansas City Jackson Hole symposium, August, pp 285-333.

Shin, H S (2013): "The second phase of global liquidity and its impact on emerging economies", keynote address at Federal Reserve Bank of San Francisco Asia Economic Policy Conference, 3-5 November.

Turner, P (2013): "The global long-term interest rate, financial risks and policy choices in EMEs", BIS Working Papers, no 441, February.

1 The authors would like to thank Stefan Avdjiev, Claudio Borio, Stijn Claessens, Ben Cohen, Robert McCauley, Patrick McGuire, Swapan-Kumar Pradhan, Hyun Song Shin, Nikola Tarashev and Philip Wooldridge for helpful comments and Zuzana Filková for excellent research assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS.

2 Global liquidity can affect domestic financial conditions through a variety of transmission channels, including advanced country monetary policies and international spillovers (Cerutti et al (2017), McCauley et al (2015a), Rey (2013)). International credit is an important driver of credit conditions in EMEs (Ehlers and McGuire (2016), Avdjiev et al (2012)).

3 CGFS (2011) notes that due to the elusive nature of the concept of global liquidity, a single measure is unlikely to capture all its relevant aspects. Borio (2013) qualifies that liquidity cannot be observed, but only its footprints. Important footprints other than international credit include indicators of risk perceptions and tolerance (eg the VIX) and of the terms and conditions at which funding is granted or assets are bought and sold (eg cost of funding, collateral terms, bid-ask spreads).

4 Credit to the non-bank sector includes credit to non-bank financial corporations.

5 The BIS GLIs track various measures of international credit. See www.bis.org/statistics/about_gli_stats.htm. For methodological details, see BIS (2018).

6 Similar to banks, non-bank financials such as investment or pension funds are likely to have large FX swap positions. See Borio et al (2017) for an estimation of the very large volume of banks' effective US dollar borrowing via FX swaps.

7 Along with an increase in issuance volumes, the number of sovereigns with access to international debt markets has expanded (for example, it now includes the governments of Ghana and Jordan).

8 Many factors can affect the degree of complementarity or substitutability, in particular country-specific ones. Cerutti and Hong (2018) find evidence of a substitution of bank loans for debt securities for some advanced economy corporate and sovereign borrowers as well as EME sovereign borrowers. Becker and Ivashina (2014) find evidence of substitution at the firm level.

9 A strengthening bilateral dollar exchange rate can affect non-financial corporates by weakening their balance sheets (Bruno and Shin (2015)). This depends on the degree of hedging, for which only scant information is available. A stronger dollar can also affect sovereigns, as it tends to raise sovereign yields and CDS spreads more generally (Hofmann et al (2017)).