Corporate debt: post-GFC through the pandemic

Take a look at the interactive graphs, which help readers explore some of the data used in the June 2021 edition of the BIS Quarterly Review.

Debt securities markets have grown globally. Exploring the BIS international debt securities statistics, we find that the offshore affiliates of non-financial corporates (NFCs) have played an important role since the Great Financial Crisis. For NFCs from emerging market economies (EMEs) in particular, debt issuance through such affiliates – mainly in US dollars – has been closely linked with global financial conditions. Against the backdrop of a temporary spike in credit risk premia after the pandemic's outbreak, issuance has been robust throughout the past year. Combining data on both international and domestic debt securities reveals that borrowing by advanced economy firms and by hard-hit EME industries has surged.1

JEL classification: F30, G15.

With the shift towards market-based finance after the Great Financial Crisis (GFC), debt securities assumed a greater role in the international financial system (Shin (2013); Aldasoro and Ehlers (2018); CGFS (2021)). Post-GFC, debt issuance grew faster than bank lending and its relationship with global financial conditions strengthened (Avdjiev et al (2020)). Most recently, the economic fallout of the Covid-19 shock and the attendant policy responses have further shaped these trends.

To assess the post-GFC market for non-financial corporate (NFC) debt, we draw on the BIS international debt securities (IDS) statistics and one of their more granular inputs, Dealogic.2 Our focus is thus on the direct market-based provision of credit to the production side of the economy, which most recently bore the brunt of the pandemic. For the bulk of our analysis, we organise the data by borrowers' nationality – ie the country of the issuer's headquarters – rather than residence - as typically done in a capital flows context. Given the increasingly globalised structures of NFCs, our approach matches the perspective of decision-making entities (Avdjiev et al (2016); Bertaut et al (2019); Coppola et al (2021)). We maintain this perspective when we combine international and domestic debt issuance to study developments during the pandemic at the level of industrial sectors and credit ratings.

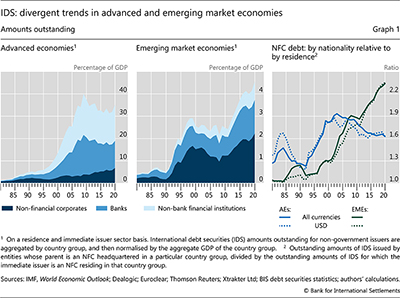

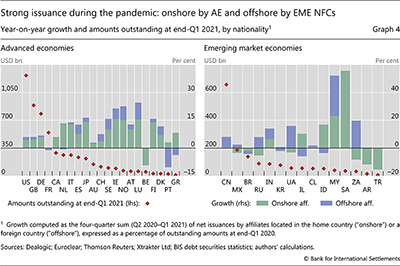

Over the past decade, NFCs' international debt has grown steadily and has responded to global financial conditions, with "offshore" affiliates – ie offices located outside the country of headquarters – playing a key role.3 Outstanding amounts expanded from 3.9% of GDP in 2009 to 6.8% at end-2020 for borrowers in advanced economies (AEs), and from 1.2% to 2.2% of GDP for borrowers in emerging market economies (EMEs). The post-GFC link between global financial conditions and IDS issuance has been particularly strong for corporates headquartered in EMEs. To a large extent, this link has surfaced in US dollar-denominated issuance through these firms' offshore affiliates (Kim and Shin (2021)). At end-Q1 2021, the outstanding amounts in all currencies at such affiliates stood at 55% of overall IDS volumes for EME NFCs, compared with below 30% for AE NFCs.

Key takeaways

- The international debt securities (IDS) of non-financial corporates (NFCs) have expanded since the Great Financial Crisis, rising from 3.9% to 6.8% of GDP in advanced economies (AEs) and from 1.2% to 2.2% in emerging market economies (EMEs) between 2009 and 2020.

- Offshore affiliates are particularly important for EME corporates, accounting for more than half of their outstanding IDS and contributing to a tight link between issuance and global financial conditions.

- Since the pandemic's outbreak, overall debt issuance by NFCs from AEs and hard-hit EME sectors has surged, while average credit spreads have been wider than over the preceding year.

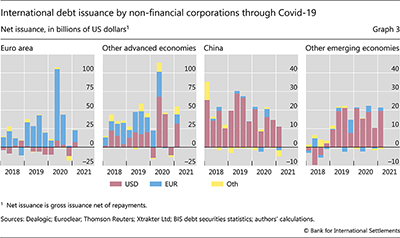

Since the outbreak of the pandemic, NFCs' debt issuance has held up. Dollar issuance was generally strong for both AE and EME borrowers through Q1 2021 and so was euro issuance for AE borrowers, with a record surge in Q2 2020. From a sectoral perspective, we find that EME industries hard-hit by the pandemic stepped up their borrowing while the rise in AE issuance was evenly spread. This occurred on the back of credit spreads that were on average higher over the 12 months up to Q1 2021 than over the preceding year.

We proceed as follows. In the first section, we review long-term patterns in the outstanding amounts of NFCs' IDS and show the importance of accounting for offshore activity.4 In the second section, we study NFCs' debt issuance since the start of the pandemic. Along the way, Box A reviews the criteria for classifying a security as an IDS and Box B investigates the post-GFC link between global financial conditions and NFCs' international debt issuance.

International markets for NFC debt

NFCs stand out as a sector for the steady post-GFC growth in their IDS volumes. After reviewing long-term trends in outstanding amounts of NFC IDS from the commonly used residence perspective, we discuss the importance of organising the statistics from the perspective of borrowers' nationality. Doing so lets us identify substantial additional debt on the part of both AE and EME NFCs and provides us with more accurate measures of foreign currency borrowing.

Growth of NFCs' international debt securities

International debt issued by NFCs has expanded significantly over the past 30 years. Outstanding amounts grew from around $0.5 trillion in 1990 to $7.7 trillion at end-2020. This has increased the role of debt securities markets in the international financial landscape, as international bank lending has been subdued (CGFS (2021)).

In AEs, NFCs' international debt has been steadily growing relative to these countries' GDP since the late 1990s. From 1.7% in 1997, this ratio rose to 3.9% in 2009 – the peak of the GFC – and to 6.8% by end-2020. This contrasts with the evolution of the much larger IDS volume issued by the financial sector, which spiked at 36% of GDP in 2009 but has since lagged behind GDP growth, falling to 28% by end-2020.

The international debt of corporates located in EMEs grew sharply in two phases. Strong issuance during the 1990s raised outstanding amounts from 0.2% of GDP in 1990 to 1.7% by 1999 (Graph 1, centre panel). While high GDP growth in the 2000s brought this ratio down, to 1.2% in 2009, a subsequent boost in issuance took it steadily up to 2.2% by end-2020. NFCs dominate non-sovereign issuance in EMEs, notwithstanding the growing amounts issued by financial firms in these countries.

Both supply and demand factors help explain the post-GFC growth in the international debt of EME-resident NFCs, especially in US dollars. For one, growing interest rate differentials vis-à-vis the United States made it attractive for borrowers in EMEs to issue long-dated dollar-denominated IDS (McCauley et al (2015)). And AEs' accommodative monetary policy drove investors to search for yield in EMEs. This demand was also bolstered by improved EME prospects on the back of institutional stability and successful growth-oriented macroeconomic policies (CGFS (2021)).

NFCs' international debt securities issued through offshore affiliates

Indebtedness needs to be assessed at the level of the ultimate obligor. This obligor can incur debt issued either directly from its headquarters or through affiliates that reside in another country ("offshore"). Such affiliates are typically located in offshore financial centres (OFCs) or AEs with highly developed financial markets.5 Since residence-based statistics miss borrowing through these affiliates, they may provide a misleading picture of firms' indebtedness (Avdjiev et al (2016); Coppola et al (2021)).

There are many reasons why debt is issued via offshore affiliates. First, a more secure legal environment in a foreign jurisdiction could encourage issuance there. Second, issuing abroad and transferring the funds back could generate tax or administrative-cost savings and face less demanding regulatory frameworks (McCauley et al (2013)). Third, firms may face less restrictive capital controls on intercompany lending – classified as direct investment in the balance of payments (BOP) – relative to other cross-border flows. Fourth, in EMEs with less developed domestic bond markets, issuing offshore allows NFCs to reach a deeper investor base, particularly for foreign currency borrowing, and hence reduce borrowing costs (Black and Munro (2010)). Additionally, an affiliate could issue debt to finance its own activities in its country of residence.6

NFCs do indeed issue a substantial amount of international debt through offshore affiliates. To illustrate this, we arrange the IDS in two alternative ways. We first focus on the location of the immediate issuer (as in the left-hand and centre panels of Graph 1) and keep only debt for which that issuer is an NFC ("residency basis"). We then shift focus to the parent company ("ultimate issuer"), keeping only the debt of entities whose ultimate parents are NFCs and grouping the data according to the nationality of these parents ("nationality basis"). The outstanding amount of IDS has been consistently larger on a nationality basis than on a residency basis, most recently by a factor of 1.6 for AE NFCs and 2.3 for EME NFCs (Graph 1, right-hand panel). Typical of such an outcome is eg a Brazilian corporate that has issued half of its international debt from Brazil and the rest through a UK affiliate.

Further reading

Accounting for all debt securities is important for measuring not only the level of indebtedness but also for analysing firms' exposure to various risk factors. For instance, residence-based measures materially understate international debt in US dollars, (Graph 1, right-hand panel, dashed lines), playing down firms' vulnerability to exchange rate movements. More generally, abstracting from debt issued through international financial centres – which are at the core of global markets – can be misleading about exposures to global financial conditions. We expand on these points in Box B.

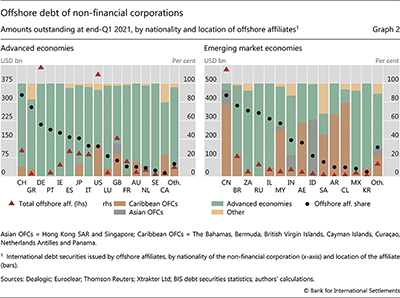

Aggregate trends mask significant heterogeneity in NFCs' reliance on offshore affiliates for their international debt. Among AEs, the highest share of IDS issued offshore is by Swiss NFCs, at 90% (Graph 2, left-hand panel). German NFCs have the largest offshore IDS volume (red triangles), accounting for about 60% of their overall IDS. Across these and other euro area corporates, 80% of the outstanding amounts stem from offshore affiliates within the euro area. In turn, US NFCs stand out both for their large volume of IDS issued offshore, as well as their relatively large reliance on (mostly Caribbean) offshore financial centres. Other NFCs that are prone to tapping offshore financial centres, such as UK and Canadian corporates, are less reliant on foreign affiliates overall.

Offshore affiliates are particularly important for EME corporates – accounting for 55% of international debt at end-Q1 2021,7 compared with less than 30% for AE NFCs. Six EME nationalities have more than half of their international debt at such affiliates (Graph 2, right-hand panel). At the top of the list is China, whose NFCs have more offshore debt than those of all other EMEs combined (red triangles), mainly in the Cayman Islands and the British Virgin Islands.8 The other heavy users of affiliates outside the country of headquarters – ie Brazilian, Russian, South African and Israeli NFCs – borrow offshore primarily in AEs, notably the Netherlands and Luxembourg. At the same time, offshore debt is negligible for NFC nationals of some large EMEs, such as Korea.

NFCs' debt issuance through the Covid-19 pandemic

The Covid-19 pandemic increased firms' financing needs around the globe and tested their access to credit. To explore the market for credit to NFC parents over the past year, we consider quarterly net issuance (gross issuance net of repayments) with a currency breakdown in the IDS statistics and investigate to what extent it originates from offshore affiliates. Since the effect of the pandemic has differed starkly across industries and has led to an increase in downgrades, we also examine the more granular Dealogic data at the level of issuer industries and by credit ratings.

International issuance since the pandemic's outbreak

AE NFCs issued IDS in record amounts to address their financing and liquidity needs after the start of the pandemic. The second quarter of last year saw their net issuance9 rise to $221 billion, nearly double the next largest quarterly volume on record ($122 billion in Q4 2012) (Graph 3, first and second panels). While the issuance of US dollar-denominated securities was certainly notable, the surge in euro-denominated issuance was particularly large. NFCs headquartered in the United States accounted for more than half of the dollar issuance in Q2 2020. Those headquartered in euro area countries drove the euro issuance, led by German and Dutch NFCs, and joined by Swiss NFCs in particular. NFC funding through debt markets remained strong thereafter, except for Q4 2020, when repayments by German, US and French firms drove the aggregate net issuance numbers into negative territory.

EME NFCs generated steady IDS flows throughout 2020, denominated largely in US dollars (Graph 3, third and fourth panels). This was the case both for Chinese corporates – which account for 37% of EME NFCs' total international debt, the highest share by nationality – and for all other EME corporates as a group. Such steady borrowing may seem at odds with the dramatic retrenchment in portfolio investment flows to EMEs over the same period, as revealed by BOP data (BIS (2020)). In contrast to our nationality perspective on the IDS statistics, BOP data are collected on a residency basis, thereby allocating portfolio debt (bond) inflows to the country of the issuer (eg an offshore centre) rather than that of the issuer's parent (eg an EME).10 In addition, portfolio flows in BOP data can arise when the ownership of securities changes between resident and non-resident investors on the secondary market, whereas IDS statistics capture primary market activity only. Importantly, the 2020 retrenchment in bond flows was driven mainly by less demand for local currency EME debt (CGFS (2021)), which is typically issued domestically and thus excluded from IDS statistics (as explained in Box A).

Offshore affiliates maintained their different roles for EME and AE NFCs after the onset of the pandemic (Graph 4). For US, UK and German NFCs, the largest AE issuers, most of the year-on-year growth as of end-Q1 2021 was accounted for by issuance from the country of headquarters (left-hand panel, red diamonds and green bars). The picture reverses for EME NFCs: their offshore affiliates have played a dominant role during the pandemic (right-hand panel, purple bars).11 For instance, such affiliates led the increase in issuance in the case of China and India, offset the contractions in issuance from the country of headquarters in the case of Mexico and Russia, and drove the overall contraction in the case of Brazil.

Industry-level overall debt issuance, credit ratings and spreads

The aggregation in the IDS statistics may mask important pandemic-related developments stemming from differences in NFCs' borrowing needs and creditworthiness (Aramonte and Avalos (2020)). We thus turn to Dealogic data and consider gross issuance of both domestic and international debt securities by individual private NFC parents.12 For consistency with the above analysis, we again organise the data by parents' nationality.13

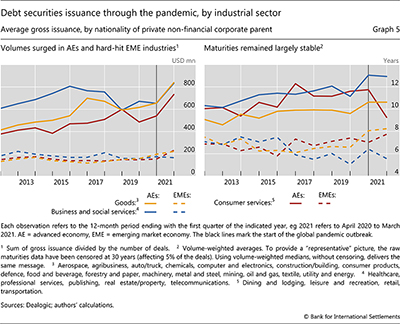

After the pandemic's outbreak, debt issuance picked up materially and ubiquitously in AEs but only for strongly hit sectors in EMEs. We distinguish three industry categories: "business and social services" (eg healthcare, telecoms) that received a boost from the pandemic; "goods" (eg manufacturing, construction) where the effect of the pandemic has been neutral; and "customer services" (eg restaurants, transportation) that were adversely affected. The issuance volume of AE corporates in the former two categories increased by more than 40% over the 12 months up to end-March 2021. NFCs in "customer services" industries also expanded issuance, by about 30% in AEs and 25% in EMEs,14 probably seeking to compensate for cash-flow shortfalls. In the background, the number of issues remained generally flat, but amounts raised per issue spiked (Graph 5, left-hand panel).

NFCs generally secured their new funding at longer maturities (Graph 5, right-hand panel). For four out of the six industry-nationality groups, the volume-weighted average maturity over the 12 months to end-March 2021 was at least as long as at any point over the previous decade. The notable exception is the hard-hit AE "customer services", where maturities dropped by 2.5 years on average.

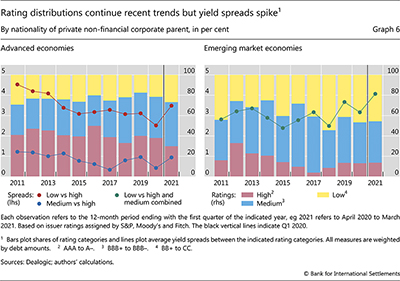

During the pandemic, the distribution of issuer credit ratings has evolved differently between AEs and EMEs (Graph 6, stacked bars). For AEs, the share of debt issued by highly rated NFCs (with a rating of A– or better) has fallen by 8 percentage points. By contrast, the shares of the different rating categories have been stable in the case of aggregate debt issuance by EME NFCs.15 Overall, while downgrades rose after the pandemic's outbreak (BIS (2020)), forceful policy measures have probably contributed to smoother developments across rating categories than might have been expected from the scale of the Covid-19 shock.

The pandemic's outbreak led to a spike in credit spreads, amidst a general rise in uncertainty and risk aversion. Even though spreads have recently declined to pre-pandemic levels in response to forceful policy measures and a brightening health outlook in many jurisdictions, they were higher on average over the 12 months up to Q1 2021 than over the preceding year. Graph 6 (solid lines) illustrates this by comparing yields at issuance between rating categories. In the case of AE issuers, the widening – of 0.5 or 1 percentage point, depending on the comparator categories – reversed a previous trend but the spread still stayed within historical norms. For EME issuers, the spread between high-yield (low-rated) and investment-grade (high- and medium-rated) issuers spiked to above 4%, about 40 basis points higher than its maximum over the preceding decade.16

Conclusion

The market for NFC international debt securities has grown substantially in recent decades, expanding further during the pandemic. As regards EME corporates, a salient finding of our analysis is that their IDS issuance – much of which is in US dollars and conducted through offshore affiliates – responds strongly to global financial conditions. Nevertheless, while these conditions deteriorated with the pandemic, forceful policy measures supported strong debt issuance by both EME and AE corporates.

Our analysis would need to be extended to study potential vulnerabilities, but it still carries important lessons for the monitoring of international debt markets. To investigate whether the pandemic-related issuance has created imbalances, it is necessary to explore data that are richer than the IDS statistics and provide information on borrowers' balance sheets and business models as well as on the terms of recent debt. Such data would shed useful light on whether funds have been efficiently allocated across sectors and firms, whether the increased borrowing has generated pockets of excessive indebtedness and whether credit risk has been properly priced. As regards monitoring the funding needs of corporates, especially those from EMEs, our analysis suggests that it is important to pay close attention to their offshore activity. Such activity may be particularly sensitive to potential changes in global financial conditions as support measures are phased out.

References

Aldasoro, I and T Ehlers (2018): "Global liquidity: changing instrument and currency patterns", BIS Quarterly Review, September, pp 17–27.

Aramonte, S and F Avalos (2020): "Corporate credit markets after the initial pandemic shock", BIS Bulletin, no 26.

Avdjiev, S, V Bruno, C Koch, and H S Shin (2019): "The dollar exchange rate as a global risk factor: evidence from investment", IMF Economic Review, vol 67, pp 151–73.

Avdjiev, S, M Chui and H S Shin (2014): "Non-financial corporations from emerging market economies and capital flows", BIS Quarterly Review, December.

Avdjiev, S, L Gambacorta, L Goldberg and S Schiaffi (2020): "The shifting drivers of global liquidity", Journal of International Economics, vol 124, July.

Avdjiev, S, R McCauley and H S Shin (2016): "Breaking free of the triple coincidence in international finance", Economic Policy, vol 31, no 87, pp 409–51. Also published as BIS Working Papers, no 524.

Bank for International Settlements (2019): Annual Economic Report 2019, Chapter II, "Monetary policy frameworks in EMEs: inflation targeting, the exchange rate and financial stability", pp 31–53.

--- (2020): BIS Annual Economic Report 2020, Chapter I, "A global sudden stop", pp 1–35.

Bertaut, C, B Bressler and S Curcuru (2019): "Globalization and the Geography of Capital Flows", Board of Governors of the Federal Reserve System, FEDS Notes, no 2019-09-06.

Black, S and A Munro (2010): "Why issue bonds offshore?", BIS Working Papers, no 334.

Chui, M, I Fender and V Sushko (2014): "Risks related to EME corporate balance sheets: the role of leverage and currency mismatch", BIS Quarterly Review, September.

Committee on the Global Financial System (CGFS) (2021): "Changing patterns of capital flows", CGFS Papers, no 66, May.

Coppola, A, M Maggiori, B Neiman and J Schreger (2021): "Redrawing the map of global capital flows: the role of cross-border financing and tax havens", Quarterly Journal of Economics, forthcoming.

Gruić, B and P Wooldridge (2012): "Enhancements to the BIS debt securities statistics", BIS Quarterly Review, December, pp 63–76.

Kim, S and H S Shin (2021): "Offshore EME bond issuance and the transmission channels of global liquidity", Journal of International Money and Finance, vol 112.

McCauley, R, C Upper and A Villar (2013): "Emerging market debt securities issuance in offshore centres", BIS Quarterly Review, September.

McCauley, R, P McGuire and V Sushko (2015): "US monetary policy, leverage and offshore dollar credit", Economic Policy, vol 30, no 82, April, pp 187–229.

Miranda-Agrippino, S and H Rey (2020): "U.S. monetary policy and the global financial cycle", Review of Economic Studies, vol 87, no 6, pp 2754–76.

Shin, H S (2013): "The second phase of global liquidity and its impact on emerging economies", keynote address at the Federal Reserve Bank of San Francisco Asia Economic Policy Conference, November 3–5.

1 The authors thank Stefan Avdjiev, Claudio Borio, Michael Chui, Stijn Claessens, Wenqian Huang, Branimir Gruić, Swapan-Kumar Pradhan, Patrick McGuire, Jose María Serena, Hyun Song Shin, Agustín Villar, Goetz von Peter and Philip Wooldridge for valuable comments and suggestions, and Kristina Mićić, Denis Pêtre and Jhuvesh Sobrun for excellent research assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 According to the BIS's definition, an IDS targets a market outside the country where the issuer resides. The BIS IDS statistics approach euro area countries individually.

3 Throughout this article, "international debt" stands for IDS amounts outstanding. We also use the terms "NFC" and "corporate" interchangeably.

4 The accompanying online interactive graphs allow for further exploration at the country/regional level.

5 The IDS will capture the activity of these offshore affiliates to the extent that they issue an international bond relative to where they reside (Box A). See Avdjiev et al (2014) for further discussion of how firms may use the proceeds of debt raised by offshore affiliates.

6 This is more likely the case for non-financial affiliates. As of end-Q1 2021, around 19% and 15% of AE and EME NFCs' offshore IDS was respectively issued through non-financial affiliates.

7 See Chui et al (2014) for an account of how this share grew post-GFC.

8 These affiliates are likely to be shell companies through which Chinese firms access other financial centres, such as Hong Kong SAR. Indeed, issuance-level data from Dealogic reveals that over 76% of the debt issued by Chinese NFCs' Caribbean affiliates over the past decade was either listed in Hong Kong or subject to Hong Kong governing law.

9 Throughout this subsection, "issuance" stands for net issuance.

10 The BOP data indicate robust direct investment debt flows into EMEs since the pandemic outbreak, consistent with offshore affiliates repatriating funds to their parents (Avdjiev et al (2014)).

11 Admittedly, this growth stemmed from domestic affiliates (onshore) in the case of NFC nationalities that do not regularly tap international bond markets, such as Argentina, Saudi Arabia and Turkey.

12 Throughout this subsection, "issuance" means gross issuance. Working only with international issues in Dealogic materially reduces the size of the cross sections, thus precluding meaningful analyses, especially on credit ratings. In turn, our focus on private entities allows us to differentiate issuers according to the general impact of the pandemic on their industries.

13 With domestic debt securities included, parents' nationality now coincides to a larger extent with the issuance location than in the IDS statistics. For our sample period, the coincidence in Dealogic is about 80% for AEs and more than 90% for EMEs.

14 Issuance by private NFCs headquartered in Latin America and the Caribbean drove this increase.

15 A decrease in the share of low-rated (high-yield) Asia-Pacific issuers has been offset by an increase in this share for issuers headquartered in Latin America and the Caribbean and emerging Europe.

16 These results are robust to conditioning on the currency of denomination or on debt maturity – as far as the data allow it – and to excluding Chinese corporates.