Retail payments in Latin America and the Caribbean: present and future

Retail payment services in Latin America and the Caribbean are characterised by high costs and insufficient access for large swathes of the region's population. To overcome these limitations, some of the larger central banks in the region have taken the lead to introduce fast retail payments and develop an open banking ecosystem. Several others have launched central bank digital currency pilots. The shift to digital payments, which is supported by these policy initiatives, is likely to receive further impetus from the Covid-19 pandemic.1

JEL classification: E42, E58.

Despite the widespread adoption of mobile and internet technology, countries in Latin America and the Caribbean (LAC) have not been at the forefront of payment innovation. Relative to other regions, retail payment services in LAC continue to involve high costs for end users and be of subpar efficiency, partly reflecting low competition among financial institutions and limited compatibility among different payment solutions. Along with low income levels, high informality and low financial literacy, high costs contribute to limiting the access to electronic and digital payments for large swathes of the region's population.

However, conditions in LAC are ripe for a change. Central banks and other public authorities have recently launched important initiatives to improve national payment systems, which complement developments in the private sector. In recent years, the region has seen a sharp rise in the number of fintech firms offering more convenient ways to pay, and big tech firms have begun to integrate payment services into their e-commerce or social media platforms. However, private sector incentives are not always aligned with social goals. Central banks are the ultimate source of trust in money and payments and therefore play a key role in maintaining the safety and integrity of payment systems as well as ensuring that private sector innovation is channelled towards improving competition, consumer protection and financial inclusion, and preserving financial stability (BIS (2020)).

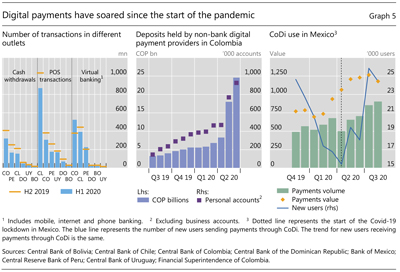

These efforts to improve payment services have received further impetus from the Covid-19 outbreak. Both the volume and value of digital payments have been rising faster than before the pandemic. Many individuals had a strong incentive or no alternative other than to use digital payments during lockdowns, and governments relied on them to disburse social benefits more rapidly and efficiently. Having become more familiar with digital payments, new users might continue to make frequent use of them once the pandemic ends.

Key takeaways

- Limited access to retail payment services and their high costs are significant challenges in Latin America and the Caribbean.

- Central banks in the region have undertaken major initiatives aimed at promoting more efficient and inclusive payment systems.

- The Covid-19 pandemic should reinforce the momentum of these policy initiatives, as it has accelerated the shift to digital payments and underscored the need for more inclusive and lower-cost payments.

This special feature first sets the stage by describing the key shortcomings of national retail payment services in LAC. It then turns to the main policy initiatives that aim to make domestic retail payments faster, more affordable and more inclusive. It finally documents how Covid-19 and the related mobility restrictions have accelerated the use of digital payments.

The main shortcomings of retail payment services in LAC

Retail payment systems share a number of features. They handle a large volume of low-value individual payments. But they have operational limits. In many countries, payment orders can be placed only on working days during certain hours, and their execution and finalisation normally takes one or more working days. In addition, even when retail payment systems are relatively fast, lack of competition between payment service providers and weak interoperability between existing retail payment mechanisms makes them costly for end users. Combined with other structural factors such as low income levels and poor financial literacy, the result is insufficient access by the population to payment instruments other than cash, which in turn severely restricts access to broader financial services such as credit and insurance. Despite some improvement over recent years, these issues continue to be particularly severe in LAC.

Weak interoperability and low competition drive high user costs

Interoperability is the technical or legal compatibility that enables a payment system or mechanism to be used in conjunction with other systems or mechanisms. It allows participants in different systems to conduct, clear and settle payments or financial transactions across those systems. In particular, interoperability does not require users and providers to participate in multiple systems (CPMI (2016a)).

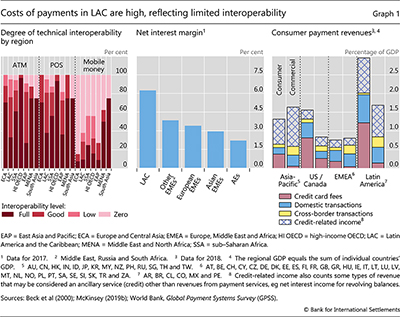

In LAC, such compatibility is much more limited than in other regions. For example, full interoperability of automated teller machines (ATMs) and point of sale (POS) terminals is present in only a third of LAC countries, compared with 75% in Asian emerging market economies (EMEs) and 97% in advanced economies. Furthermore, interoperability in LAC has not kept pace with technological innovation. Only 10% of LAC jurisdictions offer full interoperability for mobile money services, compared with 75% in Asian EMEs and 25% of sub-Saharan African countries (Graph 1, left-hand panel). The boom of digital wallets, which has led to various systems that do not communicate with each other (closed loop systems), has reinforced this effect.

Lower levels of interoperability have important implications. They normally translate into higher costs to process a transaction and a longer time for the funds to reach the payee. Additionally, weak interoperability may limit competition among payment service providers (PSPs), mostly banks, thus helping keep high margins on the transactions they process. In LAC, banking competition – as proxied by net interest margins – is among the weakest across regions (Graph 1, centre panel). All of this translates into fees charged to final users that are the highest among EMEs. For example, total fees charged to consumers and merchants reached 4% of GDP in 2018 (right-hand panel). From this total, credit card fees – the most important source of LAC banks' payment revenues – amounted to over 1% of GDP, well above the 0.4% in Asia and 0.2% in Europe and some African countries. Similarly, the cost of domestic transactions for consumers was above 0.7% of GDP in the region, compared with 0.2% in Asia-Pacific.

True interoperability is unlikely to develop spontaneously. As it is a public good, private operators may not always have sufficient incentives to coordinate and invest in making their payment infrastructure more compatible. Besides, as noted above, incumbents and new players may not have the incentive to allow competing PSPs to interact in a way that is conducive to a competitive level playing field (BIS (2020)). Thus, unsurprisingly, interoperability tends to be strongly shaped by public policy.

In this regard, LAC countries have adopted three general models. The first – in Argentina, Brazil, Costa Rica, Mexico and Peru – is a market-wide approach requiring that most PSPs seamlessly transfer retail payments among themselves.2 The second – adopted in Chile, Colombia and Paraguay – is a focused approach in which interoperability is required or encouraged, either for only a given set of payment types or for only some PSPs.3 The third model – adopted in El Salvador, Guatemala and Nicaragua – is one with no specific requirement for interoperability, as it assumes that private initiatives should flourish first and then coordinate to become mutually compatible.

Low level of access to digital payments

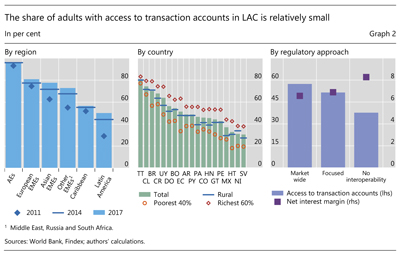

As the world has transitioned to digital payments, LAC residents' access to payment services has lagged behind that of residents of other regions. In 2017, on average across LAC countries, only 49% of adults had access to transaction accounts to make and receive payments.4 This compares with 92% in advanced economies, 80% in emerging Asia and 70% in other EMEs (Graph 2, left-hand panel).

The average figures, however, mask great heterogeneity across LAC countries, as well as within countries. In Brazil and Costa Rica, the share of adults with access to transaction accounts is closer to that of EMEs in other parts of the world (70% and 68%, respectively), but in El Salvador, Haiti and Nicaragua, account ownership is a mere 30%. Within countries, access to transaction accounts is lower in rural areas, where infrastructure tends to be less developed and banks less present, and for low-income individuals, who are less likely to meet minimum fund requirements for opening a transaction account (Graph 2, centre panel). In all LAC countries but Trinidad and Tobago, the share of adults with access to transaction accounts is at least 16 percentage points higher among the richest 60% of the population relative to the poorest 40%.

Regulation concerning interoperability (see above) also seems to matter. Access to transaction accounts is, on average, highest among countries that have adopted a market-wide approach (57%), followed by those that have adopted the focused approach (52%). Unsurprisingly, it is the lowest in jurisdictions with no current requirements for interoperability (38%) (Graph 2, right-hand panel). In addition, net interest margins – our proxy for competition in the banking sector – tend to be higher in countries with no requirements for interoperability, highlighting the link between interoperability and competition in payment services (right-hand panel).

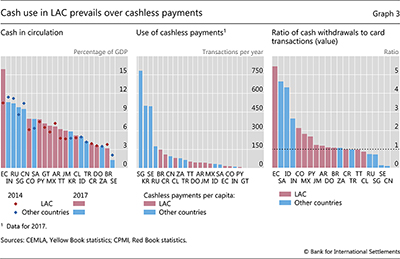

Access issues are also evident in cash and cashless payments in LAC. Cash in circulation is relatively high in most of the region's countries and has increased in some in the past few years (Graph 3, left-hand panel), although part of the rise may be due to store-of-value motives (Bech et al (2018)). High cash use, in turn, goes hand in hand with a low number of cashless payments. On average, people in LAC countries make 50 cashless payments a year, which is nine times lower than in advanced economies and almost a quarter lower than in other EMEs. Again, this average hides large variation across countries, from less than one payment per person per year in Guatemala to 149 in Brazil (centre panel). Preference for cash over cashless payments occurs even among banked users: the value of cash withdrawals at ATMs, a proxy for cash use by the banked, is systematically higher than card payments across the region (right-hand panel).

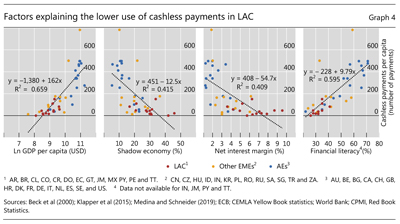

The limited use of non-cash payment instruments in the region can be explained by a number of broad factors. One is the lower level of per capita income relative to other regions, which is also typically associated with poorer internet, mobile and electricity infrastructure (Graph 4, first panel). A second factor is the larger shadow economy (second panel), which makes traceable payments less attractive. A third factor is the lower degree of competition – as proxied by high net interest margins – which drives up costs of payments for users (third panel) (BIS (2020)). Finally, a low level of financial literacy (fourth panel) also plays a role, as less informed potential users may perceive alternatives to cash as unsafe, unreliable or too complicated.

Improving national retail payment services in LAC

Wider use of the internet and mobile phones, as well as the large margins earned by PSPs, have made LAC an attractive market for new firms and the adoption of innovative and more convenient payment methods. Indeed, in recent years the region has witnessed the rapid growth of fintech firms. The largest share – 25% of the total number in 2020 (according to Pitchbook Data) – are active in the area of payment services, offering, for example, payment gateways, aggregators, digital wallets and mobile POS.5 In addition, some big techs have already entered the market or attempted to do so. For instance, in several countries Mercado Libre's Mercado Pago allows users to both pay for goods on its e-commerce platform and pay utility bills and for goods in some bricks-and-mortar stores. Notable also is Facebook's June 2020 attempt to launch a payment service associated with WhatsApp in Brazil. The central bank temporarily suspended this service in order to assess its risks to the domestic payment system and implications for competition (Central Bank of Brazil (2020b)).6

These private initiatives, however, do not necessarily guarantee the safety and integrity of payments, nor greater affordability and inclusiveness. While the private sector is in a better position to develop and adapt new technology to end users' needs, central banks and other public authorities play an essential role in ensuring adequate levels of safety and security, coverage and competition. Central banks and other authorities can impose common standards (on risk management, messaging formats, etc), promote competition, take the initiative to encourage and coordinate projects among multiple private sector operators, invest in building part or the entire basic infrastructure and/or directly operate it (BIS (2020), CPMI (2016b) and Carstens (2019)).

In LAC, there are three promising initiatives under the leadership of central banks and other public authorities. The first is the establishment of fast retail payment systems that are accessible at low or no cost to users. The second is providing a favourable environment for open banking. The third are pilot programmes for central bank digital currencies (CBDCs).

Fast retail payment systems

Fast retail payment systems (FRPS) have two essential characteristics. They are fast, allowing payments to be processed and made final – that is, irrevocable – in real or near real time (a few seconds at most). And they are available continuously, 24 hours a day, every day (Bech et al (2020) and CPMI (2016b)).

In the development of FRPS, the LAC region still lags behind other parts of the world, even though a few countries have made material progress. Some of the FRPS in use, for example in Colombia and Chile, lack extensive coverage and a wide range of use cases.7 By contrast, Mexico and Brazil have recently completed ambitious projects that target both speed and availability of services. The two projects resulted in payment platforms that are regulated and operated by the respective central banks. In September 2019, the Bank of Mexico launched CoDi®, which builds on the infrastructure of SPEI, the Bank of Mexico's real-time gross settlement (RTGS) system, as well as on the existing mobile operators' networks. In turn, the Central Bank of Brazil made its platform, Pix, operational on 16 November 2020.

CoDi and Pix promise to offer attractive alternatives to traditional retail payment services in their respective jurisdictions. For one, they feature an option8 that allows individuals to send and receive payments at no cost. Furthermore, merchants' cost to receive payments is lowered to zero in CoDi and significantly reduced in Pix,9 with the additional advantage of settlement within 10 seconds. By contrast, merchants in Brazil may need to wait two days for funds from a traditional bank transfer. At the same time, CoDi and Pix promote better access by allowing simplified accounts – which are easier to open, do not require minimum holdings and charge lower or no fees – to also benefit from fast retail payments. The box summarises and compares the two platforms' main characteristics.10

Open banking

Open banking is the sharing through application programming interfaces (APIs) of data by bank and non-bank financial institutions with third parties. In turn, these third parties can leverage the data to improve the range and quality of financial services offered to consumers and businesses. The data shared could include individuals' and firms' personal and financial information (including that related to bank accounts), with their permission.

Open banking holds the promise of enhancing market competition for payment services, especially by easing access by new entrants that can apply their technological know-how and creativity to offer more convenient and lower-cost payment instruments. In particular, APIs may facilitate new ways of initiating payments, for example through better integration with e-commerce and social media platforms and specialised software. Combined with inexpensive fast payments, data-sharing can thus make digital payments even more attractive to larger parts of the population. In addition to greater convenience, users can benefit from better transparency as third parties may offer portals or other services through which they can easily compare prices and conditions.

Open banking also makes it easier and less costly for both customers and financial institutions to open new transaction accounts. By streamlining processes that are usually slow and often entail a long paper trail, data-sharing among financial institutions could, for example, reduce the cost of complying with know-your-customer (KYC) procedures and anti-money laundering and combating the financing of terrorism (AML/CFT) regulations. The reduction in costs could, in turn, be passed on to users. Finally, by allowing for more personalised services, open banking could lead to transaction accounts better suited to the unbanked or underbanked.

Further reading

To realise these benefits, open banking can benefit from active participation by central banks and other authorities as catalysts of private sector initiatives and overseers. Specifically, authorities may want to prevent network effects, as well as economies of scale and scope, from leading to the emergence of dominant players that would restrict competition and earn excessive rents. To promote competition, authorities therefore need to require or encourage APIs to share common standards and financial institutions to not impede data access (BIS (2019)). In addition, because open banking users' trust could easily be lost, authorities would need to put in place and monitor robust safeguards to protect personal and financial data against unauthorised use, hacking and fraud. In case data are stolen or misused, legal responsibilities and liabilities need be clearly specified and dispute settlement processes available to users.

In LAC, public initiatives to develop open banking are well advanced in Mexico and Brazil. In March 2018, Mexico published its Fintech Law, which requires banks and fintechs to develop APIs with common standards to enable registered third parties' access to information regarding product offers, aggregated data about their operations and, with clients' permission, individual transaction data (Diario Oficial de la Federación (2018)). However, to date the standards for such APIs are yet to be defined. Likewise, as part of its "competitiveness initiative" and jointly with the Pix project, in 2019 the Central Bank of Brazil launched its open banking model. It issued the regulation needed to enable sharing of registration and transaction data and has set up a gradual rollout plan.11 At the same time, it asked industry participants to develop concrete proposals for the standardisation of APIs (Central Bank of Brazil (2020a)).12 Other countries, eg Argentina and Peru, currently have no explicit rules or guidance that either require or prohibit the sharing of customer-permissioned data by banks with third parties (BCBS (2019)).

CoDi and Pix

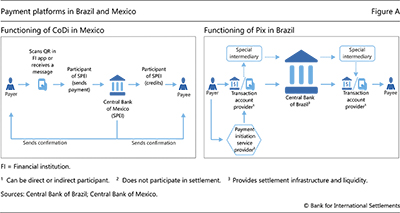

CoDi in Mexico and Pix in Brazil are fast retail payment systems (FRPS) that allow users to execute and finalise payments in real time and are available 24 hours a day, every day of the year, through a platform operated by the respective central banks.

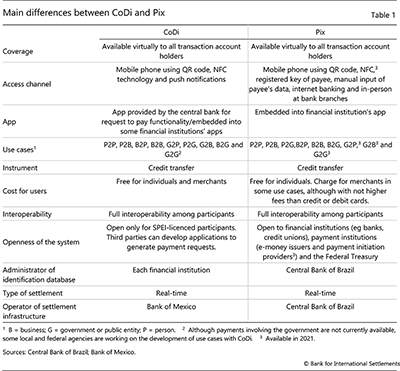

CoDi and Pix share many common features but also present some differences (Table 1). From the viewpoint of final users, coverage is identical. Both are available virtually to all transaction account holders for sending payments. However, some participating institutions cannot receive payments within CoDi. By contrast, in Pix it is compulsory for all participating PSPs to provide their customers with all the functionalities for initiating and receiving instant payments in their mobile applications. As for access channels, both systems allow payments through mobile devices when a quick response (QR) code is scanned or by using near field communication (NFC) technology.

By contrast, in Pix it is compulsory for all participating PSPs to provide their customers with all the functionalities for initiating and receiving instant payments in their mobile applications. As for access channels, both systems allow payments through mobile devices when a quick response (QR) code is scanned or by using near field communication (NFC) technology. CoDi also incorporates push notifications, while Pix allows users to start a payment by using the payee's data.

CoDi also incorporates push notifications, while Pix allows users to start a payment by using the payee's data. Use cases currently vary, although they should ultimately converge. Specifically, CoDi is currently available only for payments between persons and businesses, while Pix also enables payments to the government. In 2021 Pix will also allow payments from government agencies to persons and businesses, and in Mexico some governmental agencies are presently working to develop use cases with CoDi.

Use cases currently vary, although they should ultimately converge. Specifically, CoDi is currently available only for payments between persons and businesses, while Pix also enables payments to the government. In 2021 Pix will also allow payments from government agencies to persons and businesses, and in Mexico some governmental agencies are presently working to develop use cases with CoDi.

One important difference between CoDi and Pix concerns their openness (Figure A). CoDi allows participation by only financial institutions that are members of SPEI, the Bank of Mexico's real-time gross settlement (RTGS) system – but lets third parties develop applications that generate payment requests. By contrast, Pix admits three types of institutions. First are payment initiation providers – the authorised third parties that carry out payment initiation at the request of a customer but do not participate in the financial settlement of the transaction.

By contrast, Pix admits three types of institutions. First are payment initiation providers – the authorised third parties that carry out payment initiation at the request of a customer but do not participate in the financial settlement of the transaction. Second are transaction account providers, or the financial institutions and PSPs that offer accounts – deposits, savings or prepaid accounts – to final users and can participate either directly or indirectly in the settlement infrastructure. Third are special intermediaries – direct participants that do not offer transactional accounts to end users but serve indirect members of Pix by connecting them to the central bank's settlement infrastructure.

Second are transaction account providers, or the financial institutions and PSPs that offer accounts – deposits, savings or prepaid accounts – to final users and can participate either directly or indirectly in the settlement infrastructure. Third are special intermediaries – direct participants that do not offer transactional accounts to end users but serve indirect members of Pix by connecting them to the central bank's settlement infrastructure.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  Some financial institutions do not offer CoDi for payments – that is, their clients cannot generate QR codes. In that case, payees can use a mobile application provided by the Bank of Mexico to create the QR code that initiates the payment.

Some financial institutions do not offer CoDi for payments – that is, their clients cannot generate QR codes. In that case, payees can use a mobile application provided by the Bank of Mexico to create the QR code that initiates the payment.  QR codes are a type of matrix barcode that can store a larger volume of data, be scanned from either paper or a screen, be used even if partially damaged and encrypt information. NFC is a standards-based, short-range (a few centimetres) wireless connectivity technology that enables the wireless transfer of data.

QR codes are a type of matrix barcode that can store a larger volume of data, be scanned from either paper or a screen, be used even if partially damaged and encrypt information. NFC is a standards-based, short-range (a few centimetres) wireless connectivity technology that enables the wireless transfer of data.  The payee's data can be a key or the regular bank details. In Pix, the central bank also manages the unique database that stores the payee's key that identifies their transactional account. The key can be an email address, a mobile phone number, a tax payer number or a random number generated by the system.

The payee's data can be a key or the regular bank details. In Pix, the central bank also manages the unique database that stores the payee's key that identifies their transactional account. The key can be an email address, a mobile phone number, a tax payer number or a random number generated by the system.  The Bank of Mexico will submit a public consultation to allow indirect participants in SPEI to offer CoDi functionalities.

The Bank of Mexico will submit a public consultation to allow indirect participants in SPEI to offer CoDi functionalities.  Online retailers, social media and fintechs including merchant acquirers and startups are examples of such companies.

Online retailers, social media and fintechs including merchant acquirers and startups are examples of such companies.  Participation in CoDi is compulsory for banks that are members of SPEI, with more than 3,000 customer accounts. In Pix, participation is mandatory for all financial and payment institutions licensed by the Central Bank of Brazil with more than 500,000 active customer accounts.

Participation in CoDi is compulsory for banks that are members of SPEI, with more than 3,000 customer accounts. In Pix, participation is mandatory for all financial and payment institutions licensed by the Central Bank of Brazil with more than 500,000 active customer accounts.

The development of open banking more widely in LAC can benefit from international coordination and support. The BIS Representative Office for the Americas is currently coordinating joint efforts by BIS member central banks to build the necessary technical know-how.13 In February 2020, these central banks agreed on setting up the Consultative Group on Innovation and the Digital Economy (CGIDE), tasked with proposing solutions to the technical hurdles involved in establishing a secure open banking environment. Given the sensitive nature of the data exchanged, the first problem tackled by the group was that of identifying and authenticating individuals' requests to initiate a payment or access other financial services online. The analysed solution is a scheme in which a central validator allows users to securely input their financial credentials through a mobile app.14 The sharing of technical know-how on APIs could eventually be a basis for central banks to discuss how to improve cross-border payments in future joint initiatives (CPMI (2020)).

A complementary initiative that could make open banking more effective, especially in boosting financial inclusion, is the large-scale provision of a digital identity by either a trusted private or a public sector entity. Unlike traditional forms of identification such as passports, identity cards or driving licences, a digital ID can be authenticated remotely through digital channels, allowing the same individual to access a multitude of online services, including financial ones.15 In particular, digital ID – along with open banking – can facilitate the opening of bank accounts and reduce the cost of KYC procedures. Most LAC countries have not yet embraced initiatives in this area, however. An exception is Argentina, where 98% of the population has a digital ID. Yet its adoption for accessing financial services is still very low.16

Experience from outside the region, in India, suggests that the combination of fast payment systems, open banking and a national digital ID system is indeed effective in improving the efficiency, convenience and inclusiveness of digital payments (D'Silva et al (2019)). India's FRPS, the Unified Payments Interface (UPI), relies on a national identity system provided as a public good and launched in 2010, Aadhaar. Thanks to this system, more than 1.2 billion Indian residents now have a unique digital identity. UPI leverages on Aadhaar to simplify the authentication process and make it more efficient. In a country where many people lack physical identity documents, Aadhaar led to a remarkable increase in the number of banked people as well as a sharp reduction in the exclusion of marginalised groups (D'Silva et al (2019)).

Central bank digital currencies

Central bank digital currency (CBDC) could become a new means of payment. Unlike the reserves held by commercial banks at the central bank, this form of safe digital money could be made available to individuals and businesses, complementing physical cash (ie retail CBDCs). As in other regions, many central banks in LAC are currently examining the design and technical characteristics of retail CBDCs that would provide the best balance between possible benefits and risks (see eg CPMI-MC (2018), Bank of Canada et al (2020), Auer and Böhme (2020) and Auer et al (2020b)).

In terms of benefits, retail CBDCs may help overcome the limitations of national payment systems in LAC in at least two ways. First, by offering a convenient and affordable payment instrument, CBDCs may promote financial inclusion and reduce the risk that users switch to less safe or transparent means of payments (eg stablecoins or cryptocurrencies). Second, they may provide a more affordable common means of transferring funds across accounts held at different PSPs domestically, thus reducing the costs associated with low interoperability. Additionally, if and when cash in circulation, cash access points or cash acceptance by payees decrease, CBDCs would guarantee that the public continues to have access to safe central bank money.

Assessment of these potential benefits needs to take into account that FRPS and open banking can offer similar advantages without some of the risks. These include the risk of disintermediation, accelerating bank runs at times of stress, and a potentially larger footprint of the central bank in the financial system. Such risks can, however, be mitigated by remunerating CBDC holdings at a lower rate than the rate paid on commercial bank reserves at central banks (hence at a lower rate than commercial bank deposits). Alternatively, central banks could impose limits on the amount of CBDC that individuals and firms can hold.

Over the past few years, a number of central banks in LAC have completed or are currently conducting pilot projects for the issuance of retail CBDCs. Ecuador was the first country in the world to issue a CBDC, named Dinero Electrónico, in 2014. The project was suspended in 2016. The digital currency had a low level of acceptance among users, especially in rural areas, meaning that access to payments was not materially improved. It was also criticised by commercial banks for not being backed by US dollar reserves at the central bank. In turn, Uruguay's experiment with the E-peso ran from November 2017 to April 2018. It allowed users to pay instantly at registered businesses and to conduct P2P transactions through digital wallets, with limits to the amount that could be stored and transferred. The initial assessment of the pilot project was positive. The E-peso had wider acceptance in the economic sectors that were more concerned with the costs of existing payment platforms. In addition, evidence suggests that the pilot CBDC reached some unbanked population in remote areas. That said, no decision has yet been taken to start a second pilot project, which would include the participation of banks and other financial institutions. Two projects currently in place are the Sand Dollar in the Bahamas, launched as a pilot in December 2019, and DCash in the Eastern Caribbean islands, launched in March 2019. Both aim at allowing individuals and businesses to transfer money and make payments free of charge through non-interest bearing digital wallets subject to transaction limits.

Payments during the pandemic

The adoption and development of digital payments have received a further impulse worldwide from the Covid-19 pandemic. Restrictions on bricks-and-mortar retailers and concerns about viral transmission via cash have given people a stronger incentive to purchase online and to use digital payments (Alfonso et al (2020) and Auer et al (2020a)). In addition, many governments supported the shift to cashless payments. First, they raised transaction limits for contactless payments (Auer, Frost, Lammer, Rice and Wadsworth (2020)) and reduced fees on debit and credit card payments as well as mobile money transactions (Allmen et al (2020)). Second, several governments used digital payments to distribute income support efficiently to those that needed rapid aid instead of relying on paper cheques or physical cash, which take longer to process (Gentilini et al (2020) and Auer, Frost, Lammer, Rice and Wadsworth (2020)). For example, in Colombia, Brazil and Chile, cash transfers to informal workers, heavily hit by the lockdowns, were partly disbursed through digital wallets or basic simplified bank accounts that beneficiaries could open remotely with a national ID document and at no cost.

In LAC, these changes resulted in a significant decline in cash withdrawals and POS transactions in the first half of 2020, matched by a significant expansion in the use of mobile, phone and internet banking (Graph 5, left-hand panel). In Colombia, customers' deposits at non-bank payment providers tripled between March, when the lockdown started, and June 2020 (centre panel). In Mexico, the Covid-19 pandemic gave a significant boost to CoDi use. The number of new customers sending payments through CoDi started to grow soon after lockdown had been announced, reversing the trend observed until then. The volume of transactions accelerated subsequently, and the average payment value increased by almost 35% relative to its pre-pandemic levels (right-hand panel).

Conclusion

The initiatives that central banks and other authorities are taking in a number of LAC countries to make payments more affordable, more convenient and more inclusive are proving very timely. The Covid-19 crisis has led to a sharp increase in the use of digital payments, prompting many new users to appreciate their convenience. For this reason, much of this increase may not be reversed after the pandemic ends. While this puts a premium on further improvements to payment systems, progress remains quite uneven in the region. Much progress is also needed to improve the efficiency of cross-border payments, which remain slow and expensive.

As LAC central banks strive to improve their payment systems, they can count on the BIS to provide support through its various committees and cooperative activities. In collaboration with the BIS Innovation Hub and the Committee on Payments and Market Infrastructures, the Consultative Group on Innovation and the Digital Economy (CGIDE) will play an important role in sharing technical know-how among BIS member central banks. In addition, through its regional office in Mexico City the Bank will disseminate best practices and standards to non-BIS member central banks in the region.

References

Alfonso, V, C Boar, J Frost, L Gambacorta and J Liu (2020): "E-commerce in the pandemic and beyond", BIS Bulletin, forthcoming.

Allmen, U, P Kehera, S Ogawa and R Sahay (2020): "Digital financial inclusion in the times of COVID-19", IMFBlog, July.

Auer, R and R Böhme (2020): "The technology of retail central bank digital currency", BIS Quarterly Review, March, pp 85–100.

Auer, R, G Cornelli and J Frost (2020a): "Covid-19, cash and the future of payments", BIS Bulletin, no 3, April.

--- (2020b): "Rise of the central bank digital currencies: drivers, approaches and technologies", BIS Working Papers, no 880, August.

Auer, R, J Frost, T Lammer, T Rice and A Wadsworth (2020): "Inclusive payments for the post-pandemic world", SUERF Policy Note, Issue n° 193, September.

Bank for International Settlements (2019): "Big tech in finance: opportunities and risks", Annual Economic Report 2019, June, Chapter III.

--- (2020): "Central banks and payments in the digital era", Annual Economic Report 2020, June, Chapter III.

Bank of Canada, European Central Bank, Bank of Japan, Sveriges Riksbank, Swiss National Bank, Bank of England, Board of Governors of the Federal Reserve and Bank for International Settlements (2020): Central bank digital currencies: foundational principles and core features, October.

Basel Committee on Banking Supervision (2019): Report on open banking and application programming interfaces, November.

Bech, M, U Faruqui, F Ougaard and S Picillo (2018): "Payments are a-changin' but cash still rules", BIS Quarterly Review, March, pp 67–80.

Bech, M, J Hancock and W Zhang (2020): "Fast retail payment systems", BIS Quarterly Review, March, pp 28–9.

Beck, T, A Demirgüç-Kunt and R Levine (2000): "A new database on financial development and structure", World Bank Economic Review, vol 14, pp 597–605, updated September 2019.

Cantú, C and B Ulloa (2020): "The dawn of fintech in Latin America: landscape, prospects and challenges", BIS Papers, no 112.

Carstens, A (2019): "The changing colour of money –new directions for payment systems and currencies", The Business Times (Singapore), 13 November.

Central Bank of Brazil (2020a): "Resolução conjunta Nº 1. Dispõe sobre a implementação do Sistema Financeiro Aberto (Open Banking)", 4 May.

--- (2020b): "Nova solução de pagamentos depende de prévia autorização do BC", press release.

Committee on Payments and Market Infrastructures (2016a): Glossary of payments and market infrastructure terminology, October

--- (2016b): Fast payments – enhancing the speed and availability of retail payments, November.

--- (2020): Enhancing cross-border payments: building blocks of a global roadmap: stage 2 report to the G20, July

Committee on Payments and Market Infrastructures and Markets Committee (2018): Central bank digital currencies, March.

Committee on Payments and Market Infrastructures and World Bank (2016): Payment aspects of financial inclusion, April.

Consultative Group on Innovation and the Digital Economy (2020): Enabling open finance through APIs, forthcoming.

D'Silva, D, Z Filková, F Packer and S Tiwari (2019): "The design of digital financial infrastructure: lessons from India", BIS Papers, no 106.

Diario Oficial de la Federación (2018): "Ley para regular las instituciones de tecnologia financiera", Nueva Ley DOF 09-03-2018, March.

Gentilini, U, M Almenfi, P Dale, R Palacios, H Natarajan, R Galicia, A Guillermo, Y Okamura, J Blomquist, M Abels, G Demarco and I Santos (2020): "Social protection and jobs responses to COVID-19: a real-time review of country measures", World Bank Group.

Klapper, L, A Lusardi and P van Oudheusden (2015): Financial literacy around the world: insights from the S&P Global FinLit Survey.

McKinsey & Company (2019a): Digital identification: a key to inclusive growth, April.

--- (2019b): Global Payments Report 2019: Amid sustained growth, accelerating challenges demand bold actions, September.

Medina, L and F Schneider (2019): "Shedding light on the shadow economy: a global database and the interaction with the official one", CESifo Working Paper, no 7981.

1 We thank Claudio Borio, Carlos Cantú, Stijn Claessens, Angelo Duarte, Jon Frost, Daniel Garrido, Wenqian Huang, Thomas Lammer, Benoît Mojon, Daniel Reiss, Tara Rice, Hyun Song Shin, Takeshi Shirakami and Nikola Tarashev for helpful comments and suggestions. We are also grateful to Cecilia Franco and Rafael Guerra for excellent research assistance. The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

2 In Brazil and Mexico, all major financial institutions must connect with each other with no (explicit) cost to individuals. In Argentina, the central bank has required interoperability between bank and digital accounts. In Costa Rica, the central bank has established an infrastructure that allows bank account holders to initiate payments through mobile phones. In Peru, the government has led a project to offer a fully interoperable mobile money service based on a single brand – BIM. Pagos Digitales Peruanos operates the brand and centralises all commercial, operating and marketing efforts for the wallet, while financial entities and mobile money issuers compete to attract users.

3 In Paraguay, there is interoperability for person-to-person (P2P) and person-to-business (P2B) transactions across banks, but transfers from mobile money to bank accounts are not yet possible. In Chile, regulators have focused on opening up the market for new card transaction processors. In Colombia, there is interoperability among banks, but the recent regulation for non-bank PSPs does not include interoperability requirements.

4 Transaction accounts are defined as accounts (including e-money/prepaid accounts) held with banks or other authorised and/or regulated PSPs, which can be used to make and receive payments and to store value (CPMI-WB (2016)).

5 In 2019, payment fintechs received over $1 billion in investment. Major deals that year included a $725 million investment in Argentina's Prisma Medios de Pago, a $400 million in Brazil's Nubank, a $150 million investment in Argentina's Ualá and a $100 million investment in Mexican Clip (Cantú and Ulloa (2020)). Most firms are working closely with traditional actors such as banks, payment agencies and insurance firms.

6 At the time of writing, Facebook was expected to soon be authorised to start P2P transfers in WhatsApp.

7 In both Colombia and Chile, the systems are owned by groups of private commercial banks and operated by privately owned automated clearing houses (ACHs). However, these are limited in coverage and use cases. In Colombia, the Botón de Pagos PSE enables P2B online payments via bank accounts, and Transfiya offers instant payments for P2P transactions with only nine financial institutions as participants. In Chile, the Centro de Compensación Automatizado (CCA) currently conducts over one million transactions per day for most banks in the country in real time, but only for some use cases (P2B and P2P payments).

8 Although CoDi and Pix will be available for consumers, regular bank transfers will be still in use. For example, users can still send money through TED in Brazil, although at a cost and with non-immediate settlement.

9 Pix allows banks and other participants to charge merchants a fee for transactions, although it is expected that competition among PSPs will drive the fees down.

10 Another promising initiative has been launched in Argentina. In close collaboration with the private sector, the central bank has issued new regulation, Transferencias 3.0, to make instant payments more affordable and widespread. It aims to allow all types of payments with full interoperability among banks and non-bank PSPs, at no cost for individuals and at very low cost for businesses. In the initial stage, starting in December 2020, users will be able to use a single QR code to initiate payments from any account, at either a bank or a non-bank PSP.

11 Implementation will take place in four phases. Financial institutions should give access to: (i) information about their products by November 2020; (ii) customers' registry information and transactional data by May 2021; (iii) payment initiation services by August 2021; and (iv) information about their foreign exchange products, investments, insurance and open pension funds by October 2021 (Central Bank of Brazil (2020a)). In addition, the central bank is planning to start its first set of regulatory sandboxes in 2021 to promote innovative business models, competition, financial inclusion and enhanced supervision processes.

12 Outside LAC, several countries had already introduced open banking regulations requiring banks to share customer-permissioned data and third parties to register with a particular regulatory or supervisory authority. Examples include: the EU's revised Payment Services Directive (PSD2), in force since 2016, which applies only to payment services; UK's Open Banking, in force since January 2018; and Australia's Consumer Data Right (CDR) bill, enacted in July 2020, which allows the largest banks' clients to securely share some of their banking data with other accredited banks and fintech firms.

13 BIS members in LAC are the central banks of Argentina, Brazil, Chile, Colombia, Mexico and Peru.

14 The scheme's main features are presented in CGIDE (2020). Participating central banks are not necessarily endorsing open banking or the analysed scheme. The latter is only meant to serve as a general reference to help authorities develop their own country-specific solution.

15 According to McKinsey (2019a), extending full digital ID coverage to all sectors of the economy could unlock economic value equivalent to 3–13% of GDP in 2030.

16 To boost financial inclusion, two additional policies were adopted. First, as of January 2019 the presentation of the digital identity (DNI) is enough to physically or remotely open a universal free account, ie a general purpose transaction account without opening or maintenance costs offered by all banks. Second, as of October 2019 citizens can carry a copy of their national digital ID on their smartphones, which can be used as an authentication mechanism in financial institutions.