III. Central banks and payments in the digital era

![]() Watch the video (00:02:08)

Watch the video (00:02:08)

with Hyun Song Shin, Economic Adviser and Head of Research

Listen to the podcast (00:10:49)

with Hyun Song Shin

Key takeaways

- Central banks play a pivotal role in maintaining the safety and integrity of the payment system. They provide the solid foundation by acting as guardians of the stability of money and payments. The pandemic and resulting strain on economic activity around the world have confirmed the importance of central banks in payments.

- Digital innovation is radically reshaping the provision of payment services. Central banks are embracing this innovation. They promote interoperability, support competition and innovation, and operate public infrastructures - all essential for easily accessible, low-cost and high-quality payment services.

- Central banks, as critical as ever in the digital era, can themselves innovate. In particular, central bank digital currencies (CBDCs) can foster competition among private sector intermediaries, set high standards for safety and risk management, and serve as a basis for sound innovation in payments.

Introduction

A vital function of the financial sector is to provide efficient ways for households and businesses to make and receive payments. A sound and well functioning payment system facilitates economic activity and supports long-run economic growth.1

Payment systems today build upon a two-tier structure provided by the central bank together with commercial banks. The central bank plays a pivotal role by ensuring trust in money, a core public good for the economy at large, while the private sector leads on innovation in serving the public. The central bank supplies the ultimate safe medium to settle both wholesale and retail transactions, while commercial banks supply the bulk of retail payment instruments.

Over the past few decades, payment systems have undergone a radical transformation. New payment methods and interfaces have taken shape, and many more innovations are under way.2 While these developments raise new challenges, the core role of the central bank in payment systems remains. The private sector can provide the innovation, ingenuity and creativity to serve customers better, but history illustrates that private sector services thrive on a solid central bank foundation. Whether promoting interoperability, setting standards or levelling the competitive playing field, there are strong arguments for the public sector to play a role. In fact, today the central banks' role is as important as ever, if not more so.

Central banks are actively pursuing a range of policies to tackle existing shortcomings. The objective is to ensure that households and businesses have access to safe and efficient payment options. Central banks can choose to stand at the cutting edge of innovation themselves, not least in their direct provision of services to the public at large. One option at the frontier of policy opportunities is the issuance of CBDCs, which could amount to a sea change. CBDCs could offer a new, safe, trusted and widely accessible digital means of payment. But the impact could go much further, as they could foster competition among private sector intermediaries, set high standards for safety, and act as a catalyst for continued innovation in payments, finance and commerce at large.

This chapter discusses the foundations of money and payment systems, payment trends and policies. It concludes with a short discussion of the future of payments.

Money and payment systems: the foundation

While we use money every day, its theoretical definition can be elusive.3 Still, we all recognise it when we see it. Money has taken different forms through the ages, but one of its defining features has been serving as a medium of exchange, accepted as payment for goods and services (Box III.A).4 In addition, money serves as a store of value and a unit of account. This chapter focuses primarily on the medium of exchange function, also called means of payment, and on the supporting system.5

A payment system is a set of instruments, procedures and rules for the transfer of funds among participants.6 Payment systems are generally classified as either retail or wholesale. A retail payment system handles a large volume of relatively low-value payments, in such forms as credit transfers, direct debits, cheques, card payments and e-money transactions. A wholesale payment system executes transactions between financial institutions. These payments are typically large-value and need to settle on a particular day and sometimes by a particular time.

As money has evolved through the centuries, so have the means of payment. The pace of change is especially rapid today. Indeed, payments continue to be the financial service most affected by shifts in demand, technology and new entrants.7 Despite improvements, households and businesses demand safer and ever faster payments. They increasingly expect payments to be mobile-first, fully digital and near instant, whether online or at the point of sale. Moreover, the current pandemic could accelerate the shift to digital payments.

At the same time, some new entrants have tried to capitalise on the existing shortcomings. Three such attempts stand out: the rise (and fall) of Bitcoin and its cryptocurrency cousins;8 Facebook's proposal to develop Libra - a private global stablecoin arrangement;9 and the foray of big tech and fintech firms into financial services.10 Some of these have failed to gain much traction; others are perceived as a threat to jurisdictions' monetary sovereignty; while many have yet to address a host of regulatory and competition issues. Nevertheless, all have propelled payment issues to the top of the policy agenda.

The foundation of a safe and efficient payment system is trust in money.11 In a fiat money system, where money is not backed by a physical asset, such as gold, trust ultimately depends on the general acceptance of pieces of paper that cannot be redeemed in anything but themselves. General acceptance is what ultimately makes them valuable, alongside confidence that payments made with them can irrevocably extinguish obligations ("finality"). In countries around the world, central banks have become the designated institution to pursue this public interest.12

In pursuit of this objective, the central bank issues two types of liabilities. One is physical cash (banknotes and coins) for use by the general public, the most common form of money over the centuries and across countries. Physical cash is accepted (ie exchanged for goods and services) by virtue of a combination of its legal tender status (which makes payments with physical cash final) and central banks upholding their commitment to safeguard its value. The other type of liability - commercial banks' deposits with the central bank (ie reserves) - is for use in wholesale transactions. Like cash, central bank money is safe and, with legal support, underpins payment finality. Payments are further supported by central bank credit - essential to oil the payments machine. What makes both forms of money special is not just that they have no (or very low) credit risk but also that they represent, by construction, the most liquid asset in the system.

History indicates that the most effective and efficient payment system is a two-tier one. In it, banks compete with each other at the interface with ultimate users while the central bank provides the foundation. Commercial banks offer accounts to households and businesses which, in turn, have accounts with the central bank to settle payments among themselves.13 In a two-tier system, maintaining confidence in commercial bank money is essential. To do so, several institutional mechanisms have been put in place, with the central bank playing pivotal roles. Ultimately, commercial bank money derives its value from the promise of being convertible into central bank money at par and on demand. In order to buttress that promise, the central bank also acts as the ultimate source of liquidity (ie as lender of last resort). Prudential regulation and supervision - often performed by the central bank - limit the risk of banks' failure while deposit insurance schemes can help prevent runs and ensure that holders of transaction deposits are reimbursed should a failure occur.

Payment systems are complex markets with multiple participant types. They involve not only banks but also non-bank payment service providers (PSPs) offering payment services to end users. Generally, banks and other PSPs offer consumer-facing or retail services at the "front end". This can include providing so-called "digital wallets" and mobile interfaces that give users access to their bank account or store credit card details. Some banks and other PSPs play key roles in clearing, settlement and processing at the "back end" (Box III.B).

This complexity has some similarity to a town market that brings together different types of buyers and sellers. It may appear complex, but it can be an efficient form of exchange once strong institutional backing is in place. Central banks help organise the payments marketplace by playing the three key roles of operator, catalyst and overseer (Box III.A).14 They can provide the critical institutional infrastructure, set and oversee implementation of standards, and encourage the provision of a high-quality range of services, thereby promoting innovation and competition.

Central banks can also improve the services they supply directly to ultimate users by staying at the technological frontier. To that end, a number of central banks are considering issuance of CBDCs. CBDCs can serve both as a complementary means of payment that addresses specific use cases and as a catalyst for continued innovation in payments, finance and commerce.

Supporting the payments marketplace also requires preserving its safety and integrity. Just as a sound and smooth functioning payment system underpins economic growth, so can disruptions to a payment system cause major economic damage. Economic activity can grind to a halt if payments do not function. And compromised integrity can lead to a loss of confidence. Localised distress can spread across domestic and international financial markets, extending the damage.

To maintain the safety and integrity of payment systems, the central bank must mitigate various threats. A first threat is systemic risk, which can arise in an interconnected payment system when the inability of a system participant to perform as expected causes other participants to be unable to meet their obligations when due; this can propagate credit or liquidity risks throughout the system. Central banks have expended considerable effort in recent decades to mitigate such risks.15 A second threat is fraud; wholesale payments, given that they are large-value and complex, are a primary target. A third and related threat is counterfeiting, which applies to cash, and possibly also to CBDCs. A fourth threat is illicit financing and money laundering - the process of disguising the illegal origin of criminal proceeds. In this general context, cyber threats have grown in importance. More than ever, there is a broad range of entry points through which to compromise a payment system. The international community has been actively engaged in mitigating these and other threats, including through work conducted in international organisations and standard-setting bodies.

Box III.A

The payment system, trust and central banks

Why do we pay? We pay because we are not trustworthy in the eyes of most. To quote John Moore and Nobu Kiyotaki: evil is the root of all money. In this world, the payment system can be a force for good.

In this world, the payment system can be a force for good.

The payment system started with debt as people traded only with those they knew and trusted. Trade with strangers required a method to substitute for a public record of reputation. Societies coordinated on using physical objects, such as shells, gems or precious metals. It was agreed that the transfer of these objects by one individual to another would forever extinguish the debt claim of that individual held by the other. In technical terms, the payment was considered final. Finality is defined as the irrevocable and unconditional transfer of an asset in accordance with the terms of the underlying contract. The exchange occurs at a legally defined moment and cannot be reversed. Legal rules characterise the circumstances under which a payment is final. Without it, one cannot trust that a transfer of (bank) funds necessarily constitutes a payment.

Legal rules characterise the circumstances under which a payment is final. Without it, one cannot trust that a transfer of (bank) funds necessarily constitutes a payment.

Once societies adopted a monetary convention, rulers quickly realised they could gain from controlling the supply of money. Merchants trading coins knew the issuer, as rulers minted their profile on a side of each coin. The value of this money was backed by the degree of trustworthiness of its issuer. However, absent sound governance, rulers could not be trusted, and debasement was not uncommon.

Demands for sound governance and a more efficient payment system were often reasons to establish a central bank. In many countries the public authority gave special issuing rights to an existing private bank. The institution then acted as a banker to commercial banks. This two-tier system is the epitome of the current account-based monetary system.

The central bank underpins the two-tier system in at least three key ways.

First, the central bank provides a medium of exchange (or means of payment) that also serves as the unit of account. A common unit of account greatly simplifies the measurement of relative prices. As a result, exchange of goods and services can be done more efficiently.

Second, the central bank provides the infrastructure that, together with a sound legal framework, facilitates swift and final settlement of debt in central bank money. Central bank money plays a key role in the final settlement of claims: in the case of cash, for many of the smallest transactions by consumers and businesses; and in the case of bank reserves, for the settlement of large and time-critical interbank transactions, which ultimately support all payments in the economy. Central bank money provides "ultimate settlement" because claims on the central bank are typically free of the credit and liquidity risks associated with other settlement assets. This is particularly relevant, as the finality of payments made with some digital assets relying on decentralised validation protocols has been questioned.

Third, the central bank is the ultimate source of trust in the system. It provides trust through its role as an operator of core infrastructures such as wholesale systems. Moreover, the central bank acts as a catalyst for change and as an overseer, promoting safe and efficient payment arrangements.

N Kiyotaki and J Moore, "Evil is the root of all money", American Economic Review, 92, no 2, pp 62-6, 2002.

N Kiyotaki and J Moore, "Evil is the root of all money", American Economic Review, 92, no 2, pp 62-6, 2002.  See Committee on Payment and Settlement Systems, The role of central bank money in payment systems, August 2003; and C Kahn and W Roberds "The economics of payment finality," Federal Reserve Bank of Atlanta, Economic Review, Second Quarter 2002.

See Committee on Payment and Settlement Systems, The role of central bank money in payment systems, August 2003; and C Kahn and W Roberds "The economics of payment finality," Federal Reserve Bank of Atlanta, Economic Review, Second Quarter 2002.

Today's payment systems: key facts

Access, costs and quality

Today's payment systems, like other large (digital) marketplaces, are diverse, complex and the result of a long evolution. To start with, the difference between retail and wholesale payment systems is substantial. Retail payments make up nearly 90% of the total volume of payments (ie number of transactions), yet less than 1% of the total value.16 Wholesale payment systems have seen frequent but discrete updates (Box III.C). In retail payments, since 1950, many countries have adopted electronic payments and seen the rapid growth of credit and debit cards,17 the introduction of automated teller machines (ATMs), the advent of web- and mobile phone-based payments and, more recently, the entry of large non-bank providers offering e-payment services.18 Among retail payments, global values of card and e-money payments have risen, while those of cash withdrawals and cheques have declined. On aggregate, roughly 90-95% of cash withdrawals and retail electronic payments are domestic.19 While all of these developments have enhanced payment services, certain shortcomings are apparent.

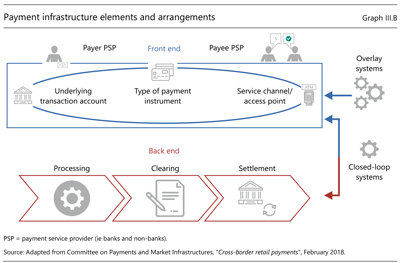

Box III.B

The payment system deconstructed

A payment system is a set of instruments, procedures and rules among participating institutions, including the operator of the system, used for the purposes of clearing and settling payment transactions. Its infrastructure usually involves payments flowing through a "front end" that interacts with end users and a number of "back end" arrangements that process, clear and settle payments (Graph III.B).

The front-end arrangements initiate the payment. They encompass the following elements:

- Underlying transaction account (eg deposit transaction) represents the source of the funds.

- Payment instrument (eg cash, cheque, card), which can vary across PSPs and use cases.

- Service channel (eg bank branch, automated teller machine (ATM), point-of-sale (POS) terminal, payment application) connects the payer/payee and PSP.

The back-end arrangements generally focus on specific stages of the payment chain:

- Processing encompasses authentication, authorisation, fraud and compliance monitoring, fee calculation, etc.

- Clearing is the process of transmitting, reconciling and, in some cases, confirming transactions prior to settlement.

- Settlement is the process of transferring funds to discharge monetary obligations between parties.

Overlay systems provide front-end services by using existing infrastructure to process and settle payments (eg ApplePay, Google Pay, PayPal). These systems link the front-end application to a user's credit card or bank account. Closed-loop systems (eg Alipay, M-Pesa, WeChat Pay) provide front-end to back-end services, have back-end arrangements largely proprietary to their respective firms, and do not interact with or depend much on the existing payment infrastructure.

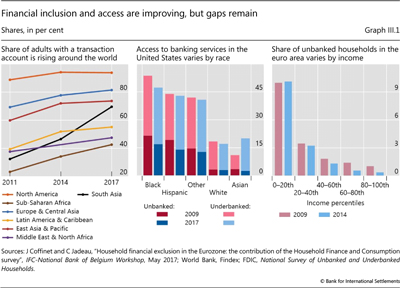

Access to payment services has increased over time, yet is still far from universal. Access to basic accounts has been rising, particularly in South Asia (eg India), East Asia (eg China) and sub-Saharan Africa (Graph III.1, left-hand panel). Yet more remains to be done to provide transaction services to all. Lacking a transaction account, 1.7 billion adults globally, and hundreds of millions of firms, are tied to cash as their only means of payment. Low-income individuals, women and small businesses are still much more likely to lack access to formal payment services.20 Even in advanced economies, some groups lack access to bank accounts and the associated payment options; nearly half of Black and Hispanic US households are unbanked or underbanked (centre panel). In the euro area, 10% of low-income households are unbanked (right-hand panel). In some emerging market and developing economies, fewer than half of firms have an account;21 lack of access to formal payment services, eg to pay suppliers and employees and to accept funds from customers, hinders firms' access to other services such as credit.

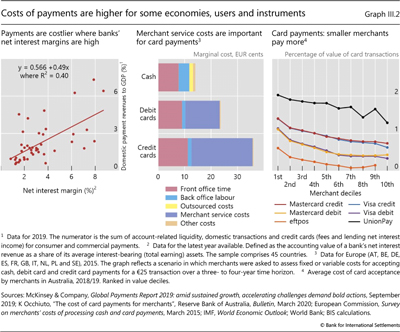

Costs are relatively high in the retail segment and are influenced by the form of payments and the degree of competition. Retail payments tend to be more expensive for users, in aggregate, where credit cards dominate.22 Moreover, card payments are a lucrative source of revenue for financial institutions and card networks. Both features reflect the fact that these institutions use payments as a competitive moat. Overall, the ratio of domestic payment revenues to GDP (a rough proxy for costs) is higher where banks' net interest margins are higher (Graph III.2, left-hand panel), pointing to lack of competition. In Latin America, for example, credit card fees amount to over 1% of GDP.23 This indicates the potential for reducing costs without weighing on economic activity.

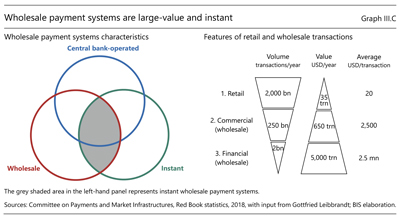

Box III.C

The evolution of wholesale payment systems

Most countries have multiple payment systems, each catering to distinct market segments. These systems can be categorised along three key dimensions (Graph III.C, left-hand panel): payment type (wholesale or retail); operator (central bank or private sector); and settlement mode (instant or deferred). Wholesale payment systems (WPS) process large-value and time-critical payments. These payments are typically interbank, and also involve other financial entities. Most WPS are operated by the central bank and settle payments on an instant ("real-time") basis. Given their importance, WPS are subject to global standards for financial market infrastructures.

Given their importance, WPS are subject to global standards for financial market infrastructures. WPS participants generally have accounts at the central bank and are subject to supervision and oversight. In addition, whether privately or publicly owned/operated, WPS are overseen by central banks and other agencies. This scrutiny underpins the safety, efficiency and finality of payments in all segments, thus providing a public good. Compared with retail systems, WPS tend to settle fewer transactions, but much larger values (Graph III.C, right-hand panel).

WPS participants generally have accounts at the central bank and are subject to supervision and oversight. In addition, whether privately or publicly owned/operated, WPS are overseen by central banks and other agencies. This scrutiny underpins the safety, efficiency and finality of payments in all segments, thus providing a public good. Compared with retail systems, WPS tend to settle fewer transactions, but much larger values (Graph III.C, right-hand panel).

WPS have evolved markedly since the start of the millennium. In addition to the move to real-time settlement, the range of entities allowed to participate has expanded beyond banks to include financial market infrastructures, payment service providers and, more recently, non-bank PSPs, fintechs and even big techs.

In addition to the move to real-time settlement, the range of entities allowed to participate has expanded beyond banks to include financial market infrastructures, payment service providers and, more recently, non-bank PSPs, fintechs and even big techs. WPS have also lengthened their operating hours in response to user demand and the inception of fast retail payment systems. In fact, some WPS already operate on (or near) a 24/7/365 basis (eg SPEI in Mexico) and others are considering moving towards this benchmark.

WPS have also lengthened their operating hours in response to user demand and the inception of fast retail payment systems. In fact, some WPS already operate on (or near) a 24/7/365 basis (eg SPEI in Mexico) and others are considering moving towards this benchmark.

WPS are likely to continue evolving. Technology will be a big part of both the drivers for change and the solutions for WPS. For instance, the increased popularity of retail fast payments among consumers may force WPS to further extend operating hours. Moving to new and more efficient technological solutions can help WPS reduce their "downtime" for maintenance. The increased prominence of fintechs and big techs in payments may change participants' needs and expectations. Application programming interfaces (APIs, or sets of definitions and protocols that allow different applications to communicate with each other) and cloud computing services (which allow on-demand scalability) may help address these changing demands.

Exceptions exist: eg in Canada and Hong Kong SAR, the WPS is not owned/operated by the central bank; and in the United States, there are two WPS, Fedwire Funds and CHIPS, the latter being privately owned and operated.

Exceptions exist: eg in Canada and Hong Kong SAR, the WPS is not owned/operated by the central bank; and in the United States, there are two WPS, Fedwire Funds and CHIPS, the latter being privately owned and operated.  See CPMI-IOSCO (2012), which applies to systemically important WPS (in practice, a very wide group).

See CPMI-IOSCO (2012), which applies to systemically important WPS (in practice, a very wide group).  This refers to "direct" participants of the WPS (CPMI Glossary). Direct participants can act as a gateway for other financial and non-financial entities to access the services of the WPS.

This refers to "direct" participants of the WPS (CPMI Glossary). Direct participants can act as a gateway for other financial and non-financial entities to access the services of the WPS.  See eg BIS, "Payment and settlement systems: trend and risk management", 64th Annual Report, Chapter VIII, June 1994; and Committee on Payment and Settlement Systems, "New developments in large-value payment systems", May 2005.

See eg BIS, "Payment and settlement systems: trend and risk management", 64th Annual Report, Chapter VIII, June 1994; and Committee on Payment and Settlement Systems, "New developments in large-value payment systems", May 2005.  See A Carstens (2019b).

See A Carstens (2019b).

Processing costs differ across payment instruments. Cash, debit and credit cards each involve different front-end costs, ie the costs incurred in processing payment transactions at the counter.24 Cash also requires back office processing. For debit and credit cards, nearly all of the processing costs are "merchant service costs" - fees that the merchant pays to the bank issuing the cards, the bank acquiring the card payment and the card network operators (Graph III.2, centre panel).

Indeed, card networks typically involve three or four parties to process transactions, with various and sometimes opaque fees. These include interchange fees among banks and licence fees to card networks.25 Even across cards, fees vary considerably; premium cards come with additional perks for users - particularly higher-income ones - paid for with an annual fee, but also with higher costs for merchants (nearly double the costs of non-premium cards). Those costs are not always transparent to end users; and even if they are, misaligned incentives mean that the choices of payment method do not consider overall system efficiency. Authorities have taken a range of actions to lower card fees.26 Still, costs tend to be higher for smaller firms (Graph III.2, right-hand panel) and for lower-income users.

Payments across borders are not only typically slow and opaque, but also especially costly.27 Lower-value payments, such as remittances, are the prime example. Cash transfers are the most expensive, reflecting both handling costs and lack of competition wherever cash is the only option. Costs vary also with the number and type of firms involved. Most cross-border payments flow through a network of correspondent banks. Remittances transferred this way are the most expensive, at 10% of value, while those sent through money transfer operators (MTOs)28 are nearly half of the cost, at 6% of value. Regions with fewer channels through which to send remittances, such as Africa, face higher than average costs, making the poorest regions the hardest hit.29

Finally, there is scope to improve the quality of payment services in terms of convenience, transparency and speed. Despite greater demand for payments in real time (or very close to it), methods such as cross-border bank transfers often take days to clear and settle.30 Granted, domestically, many countries are implementing new retail systems that offer nearly instant execution and continuous availability, some even around the clock, but they are not universally available.31 Overall, the quality of payment services still falls short of evolving customer expectations.

The Covid-19 pandemic has highlighted both the progress achieved and the remaining shortcomings in payments. The ability to use contactless payments in physical stores and for online purchases has supported economic activity. Yet digital payments are still not sufficiently convenient or accessible to all. Current efforts to improve their adoption, including in order to allow government-to-person payments to vulnerable groups, could enhance financial inclusion (Box III.D).

Box III.D

Payments amid the Covid-19 pandemic

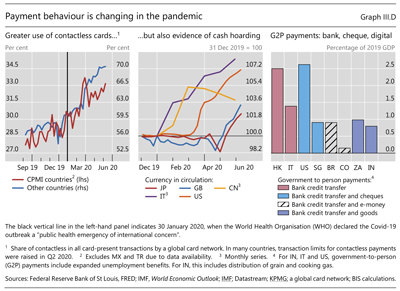

The Covid-19 pandemic has led to marked changes in retail payments, for at least four reasons. First, public concerns about viral transmission from cash have risen. Scientific evidence suggests that risks are low compared with other frequently touched objects. Yet consumers in many countries have stepped up their use of contactless cards (Graph III.D, left-hand panel), and the pandemic could drive greater use of digital payments.

Scientific evidence suggests that risks are low compared with other frequently touched objects. Yet consumers in many countries have stepped up their use of contactless cards (Graph III.D, left-hand panel), and the pandemic could drive greater use of digital payments. Second, as in past periods of uncertainty (eg the expected Y2K glitch in 2000 and the Great Financial Crisis of 2007-09), precautionary holdings of cash have risen in some economies (centre panel) - even as its use in daily transactions has fallen. Third, as physical stores temporarily closed, e-commerce activity surged.

Second, as in past periods of uncertainty (eg the expected Y2K glitch in 2000 and the Great Financial Crisis of 2007-09), precautionary holdings of cash have risen in some economies (centre panel) - even as its use in daily transactions has fallen. Third, as physical stores temporarily closed, e-commerce activity surged. Fourth, cross-border transactions have collapsed. As mobility dropped, cross-border credit card transactions by Visa fell 19% in March 2020 relative to the same month in 2019, and remittances are projected to fall by about 20% in 2020 as migrants face job loss and uncertainty.

Fourth, cross-border transactions have collapsed. As mobility dropped, cross-border credit card transactions by Visa fell 19% in March 2020 relative to the same month in 2019, and remittances are projected to fall by about 20% in 2020 as migrants face job loss and uncertainty.

The pandemic has highlighted both progress and shortcomings in payments. Digital payments have allowed many economic activities (eg purchase of groceries and other essential goods) to continue online during the pandemic. Yet due to unequal access, low-income and vulnerable groups face difficulties in paying or receiving funds. Some central banks have warned that refusal by merchants to accept cash could place an undue burden on those with limited payment options. To reach the unbanked, some government-to-person (G2P) payments have relied on paper cheques, which take longer to process and may pose higher risks of fraud than bank transfers. Elsewhere, authorities have used new digital payment options (Graph III.D, right-hand panel). The crisis has amplified calls for greater access to digital payments by vulnerable groups and for more inclusive, lower-cost payment services going forward.

To reach the unbanked, some government-to-person (G2P) payments have relied on paper cheques, which take longer to process and may pose higher risks of fraud than bank transfers. Elsewhere, authorities have used new digital payment options (Graph III.D, right-hand panel). The crisis has amplified calls for greater access to digital payments by vulnerable groups and for more inclusive, lower-cost payment services going forward.

See R Auer, G Cornelli and J Frost, "Covid-19, cash and the future of payments", BIS Bulletin, no 3, 3 April 2020.

See R Auer, G Cornelli and J Frost, "Covid-19, cash and the future of payments", BIS Bulletin, no 3, 3 April 2020.  See M Arnold, "Banknote virus fears won't stop Germans hoarding cash", 25 March 2020.

See M Arnold, "Banknote virus fears won't stop Germans hoarding cash", 25 March 2020.  See L Leatherby and D Gelles, "How the virus transformed the way Americans spend their money", 11 April 2020.

See L Leatherby and D Gelles, "How the virus transformed the way Americans spend their money", 11 April 2020.  See Visa, "Form 8-K", 30 March 2020; and World Bank, "World Bank predicts sharpest decline of remittances in recent history", 22 April 2020.

See Visa, "Form 8-K", 30 March 2020; and World Bank, "World Bank predicts sharpest decline of remittances in recent history", 22 April 2020.  See Bank of Canada, "Bank of Canada asks retailers to continue accepting cash", 13 April 2020; and Reserve Bank of New Zealand, "Cash and other payment systems ready for COVID-19", 19 March 2020.

See Bank of Canada, "Bank of Canada asks retailers to continue accepting cash", 13 April 2020; and Reserve Bank of New Zealand, "Cash and other payment systems ready for COVID-19", 19 March 2020.

Industrial organisation: network effects in payments

The key to identifying the most promising policies to address the above shortcomings and improve payments is to understand their industrial organisation. Payments are conducted in complex markets that give rise to network effects and interactions among system participants. These network effects and interactions can influence the design of policies to encourage competition and innovation and help shed light on the important role central banks can play.

Network effects arise when the value of using a network increases with the participation of additional users.32 In the case of payment systems, these effects arise because the more people use a particular payment network, the more appealing it is for others to join. Digital platforms exhibit such a characteristic in a particularly strong way.

Network effects can be a mixed blessing, however. While they naturally give rise to a virtuous circle of economic gains, they can also heighten the risk of the emergence of dominant firms, which destroy competition and generate costs to society. The policy challenge is to secure the gains while avoiding the costs.

Payment systems are networks with participants that fall into two groups - PSPs and users.33 The PSPs compete with each other, but this competition takes place in the presence of complex interactions that bring subtle trade-offs. In this context, the public provision of the core infrastructure can be important in reconciling competing policy objectives. It can allow network effects to thrive while promoting a competitive level playing field. The central bank performs such a function by supplying the accounts on which payments settle. In this sense, the central bank is instrumental in the provision of a key public good.

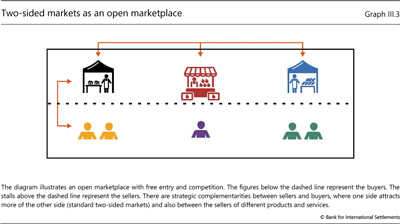

The underlying economics is best conveyed through the example of a town market, like those found in the public squares of many cities (Graph III.3). These markets offer sellers a public space in which to set up their stalls, and customers the opportunity to explore and sample the wares of a range of sellers. Such a marketplace is a network with positive externalities between sellers and buyers. The prospect of more buyers visiting the market makes it more attractive for sellers, and vice versa.

These markets can generate spillover benefits between participants while at the same time preserving competition. The stallholders who sell vegetables compete with each other on the price and quality of produce. However, when there are stallholders selling different goods, they will all directly benefit from the induced arrival of new buyers. For instance, cheese merchants will attract buyers of cheese, but these cheese buyers are also potential customers for the vegetable sellers. In this way, sellers may actually benefit from the presence of other sellers, ie there are so-called "strategic complementarities" between sellers. In this way, when sellers offer differentiated goods, the entry of a seller offering new products may generate benefits for the other sellers due to the new buyers attracted to the market as a whole.

Moreover, town markets can benefit from a public infrastructure that helps level the playing field. The town market in a public square can be seen as a publicly provided platform where service suppliers and users can interact freely to reap economic benefits. In order to achieve this, artificial barriers or other impediments to the interactions of buyers and sellers are eliminated. Nevertheless, sellers will be subject to minimum standards. Public authorities that operate the market also set rules for operating hours, organisation of stands, price transparency, and food quality and safety.

Payment systems are like town markets. The vegetable sellers and the cheese sellers correspond to the PSPs, while the buyers correspond to the users of payment services. These PSPs may offer differentiated products to customers by bundling other digital services, such as e-commerce, ride hailing or messaging and social media services, with basic payment functionality. In that case, since users value these services differently, their bundling with payment functionality is analogous to the contemporaneous presence of cheese and vegetable sellers in the town market.

The network effects between PSPs and users in the payment system is apparent from this analogy. A large potential user base attracts PSPs that wish to cater to the users, while a rich selection of PSPs will attract more users. Just like the sellers in the town market that sell the same good, PSPs that provide similar offerings will compete on price and quality.

And just like town markets, payment systems may benefit from public infrastructure. Here, central banks can provide the core foundation of payment systems in ways to promote economic gains for users. One example is the development in recent years of fast retail payments that settle on the central bank's balance sheet. As with the town market, such a system is a platform operated by the central bank or a public utility. Like sellers in town markets, PSPs in such systems offer a range of services to the public. Central banks set technical standards, operating hours and other rules. They can endorse or require the use of common addressing standards, open APIs for data sharing and other elements to ensure a competitive level playing field as well as interoperability between PSPs. This allows the users of one PSP to benefit from access to other users who are customers of another PSP.

We may contrast the town market with a full-service department store that offers a similar range of products, but within the confines of the single store. Such a department store can be compared to PSPs that offer the full range of differentiated services, but exclude other PSPs' offerings. When visiting one particular department store, the buyer cannot purchase products from a rival one. Thus, even if the department store (the PSP) offers a full range of goods, there is no guaranteed interoperability with another PSP.

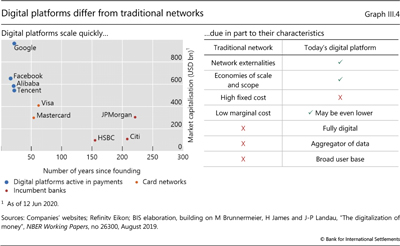

The analogy with full-service department stores in the payment context is firms that harness the data-network-activities (DNA) loop to exclude competitors.34 In this case, the nature of competition becomes one between platforms - "platform competition" for short. Competition between firms with large, established digital platforms characterised by scalability and a broad user base can tip in favour of a dominant player or a small number of such dominant players who can achieve market power in payments very quickly (Graph III.4, left-hand panel). As the platform and its range of activities grow, the greater attraction of the platform fosters a DNA feedback loop. As a result, competitors that lack interoperability with that platform will be at a competitive disadvantage and will shrink. These types of markets are particularly prone to "tipping", when a single firm reaches a critical mass of users in its network, threatening to dominate the market by attracting all (or most) users. And, once dominant, they can entrench their position. They can do so for instance by using their competitive advantage in data to cross-subsidise services and retain customers.

Big tech and fintech firms, whose core strategy centres on technological innovation and personal data, represent a major competitive threat to incumbent PSPs. Their digital platforms embody the traditional characteristics of networks (ie network externalities, economies of scale and scope, large fixed costs of building the network, and low marginal cost of adding new users) alongside additional features (Graph III.4, right-hand panel). Firms with large digital platforms can leverage their platform to aggregate large quantities of data to further target their services; offer great diversity to users thanks to the cross-service nature of their technology; and develop links between different activities as they exploit data - the key input to their activities. Payment services become easy add-ons, given a broad user base, across both services and borders, and no need for a physical presence (ie bank branch offices). In such instances, and in order to preserve fair competition and drive further efficiency in payments, central bank interventions may be needed.

Central bank policies to improve efficiency

The combination of traditional and new market failures calls for central bank policy approaches that combine a number of roles. In their role as operator, many central banks directly offer and run payment infrastructures. As catalyst, central banks can support interoperability to foster competition. As overseer, central banks (and other authorities) may develop and implement new policies and standards. Finally, central banks could combine these elements to support the development and introduction of CBDCs. In all cases, central banks need to ensure the safety and integrity of the payment system.

As operator: providing public infrastructures

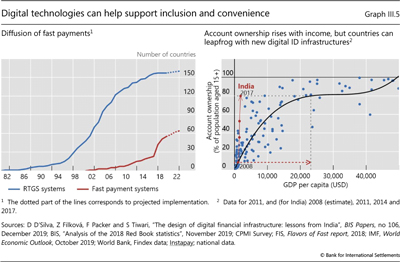

Central banks' direct provision and operation of public infrastructures can promote competition, reduce rents and support high standards of safety and risk management. As an example, currently 55 jurisdictions offer fast (or near instant) retail payments (Graph III.5, left-hand panel). Central banks run or play a key operational role in many such systems, such as TARGET Instant Payment Settlement (TIPS) in the euro area, the Faster Payment System (FPS) in Hong Kong SAR, Cobro Digital (CoDi) in Mexico and PIX in Brazil. In India, the unified payments interface (UPI) was set up with central bank guidance and support. New initiatives like the open-source Mojaloop software may allow further progress while avoiding dominance by a few players.35 The spread of fast retail payment systems is following a similar trajectory to that of wholesale real-time gross settlement (RTGS) systems two decades ago.

As providers of public infrastructures, central banks leverage new technology to improve and enhance payment systems. In the United States, the Federal Reserve has announced FedNow, a proposal for a fast payment system that would deliver real-time retail interbank services around the clock. The Bank of England is updating its wholesale payment system with an eye to enabling digital interoperability, eg with tokens.

These improvements are also designed to mitigate threats - both existing and emerging - to the safety and security of payment systems. Events over the past several years highlight how payment fraud is becoming increasingly sophisticated. The Committee on Payments and Market Infrastructures (CPMI) has developed a comprehensive strategy to reduce the risk of wholesale payment fraud related to endpoint security.36 For retail payments, preventing payment fraud is a critical element of consumer protection.

An additional component of the public infrastructure, closely related to core payment systems in some jurisdictions, is digital identity (ID) systems. Such systems can help improve access, cost and quality in payments, including by enhancing financial inclusion. Government-provided digital ID systems, such as Aadhaar in India, MyInfo in Singapore and e-identity in Estonia, have facilitated compliance with anti-money laundering and combating the financing of terrorism (AML/CFT) rules and reduced onboarding costs.37 In many instances, the central banks have promoted the use of digital ID systems; in others, private sector initiatives have also played a role.38

The combination of publicly provided digital ID and an open API payment network is especially powerful. In India, such a combination has brought a large share of the previously unbanked into the formal financial system and lowered the costs of opening accounts.39 By mandating bank accounts to link to Aadhaar for authentication, the Reserve Bank of India (RBI) has facilitated this progress. Account ownership rose from roughly 10% to 80% over 2008-17 - a level comparable to that of countries with much higher GDP per capita (Graph III.5, right-hand panel).

Central banks can also enhance competition by expanding participation of non- bank PSPs in their systems. Historically, participation has primarily been limited to banks, counterparties to a central bank's open market operations and government agencies. Over the past two decades, however, central banks have significantly increased participation in settlement accounts in terms of both the type of entity (beyond banks) and domicile (ie beyond domestic entities).40 Initially, access was extended to financial market infrastructures (FMIs) and central counterparties and subsequently, in some countries, to non-bank PSPs. More recently, prospective providers of digital tokens and new forms of banks have started to approach some central banks. In the United Kingdom, Switzerland, Singapore, Hong Kong SAR and China, central banks have also granted access to non-banks, albeit on a more limited scale than for banks.41 That said, such steps are not universal. In some jurisdictions, notably the United States and Japan, participation is still restricted to banks.

Ultimately, whether a jurisdiction decides to expand participation to non-bank PSPs depends partly on inherited institutional, legal and economic factors that differ across countries. Even so, with the emergence of new private sector payment technologies, some jurisdictions may have scope to revisit this policy. The benefits of enhanced eligibility include boosting competition. Costs include the introduction of new risks, particularly if new players are subject to less stringent regulation than banks. Broader access could also have consequences for monetary policy implementation and lender of last resort policies.

As catalyst: promoting interoperability

Interoperability is the technical and regulatory compatibility that enables one system to work seamlessly with others. It can help level the competitive playing field, further enhance efficiency directly, and support entry and innovation. In our town market analogy, interoperability corresponds to having an open market where buyers can approach many different stallholders. It includes the adoption of the food and safety standards that merchants observe when advertising and selling their wares, and underpins transparent pricing. Similarly, payment system interoperability allows participants in different systems to execute, clear and settle payments or financial transactions across those systems.

True interoperability may not always occur without public intervention. Here, the central bank has a critical catalytic role. By operating the core of the infrastructure - the foundation - the central bank controls a vital part of the payment chain and plays an important role in defining the standards for interoperability. In a two-tier system, commercial banks process and communicate with the underlying payment infrastructure that the central bank provides so as to allow settlement on its balance sheet. In the presence of closed-loop, vertically integrated systems, such as Alipay, the role of the central bank is still essential to allow settlement between firms on a net basis.

A number of initiatives to improve interoperability in payments are under way. Open banking is one important initiative, supported and encouraged in a number of jurisdictions by the central bank. Open banking allows users to authorise financial service providers to access their financial transaction data held at other providers, using secure online channels and APIs. Its goal is to promote a level playing field and reduce or eliminate closed, proprietary networks of individual service providers, including for payments. While APIs have been around since the 1960s, they have stepped into the mainstream and are now critical to promoting competition among digital platforms. To facilitate access, APIs need to have common standards and be open. In many jurisdictions, central banks and regulators have facilitated these initiatives, eg by publishing open API standards and technical specifications.42

Making payment options expedient for consumers requires interoperability between different payment instruments and arrangements. While some forms of interoperability simply improve the user's experience, others are essential. For payment systems, interoperability can be vertical and/or horizontal. Vertical interoperability, ie along the payment chain, is a technical necessity. By connecting the front end to the back end - or core infrastructure - of the system, it allows the parts of the chains offering different and complementary services to work together. For person-to-person payments, for example, front-end processors (such as Zelle in the United States) capture and authorise the payment from users. They then communicate with the back-end processors, which in turn move the money from the sender's bank to the receiver's bank, by connecting to the clearing and settlement systems.43

Horizontal interoperability, on the other hand, allows competing PSPs to interact in a way that is conducive to a competitive level playing field. By analogy with the town square market, many types of sellers and buyers can all interact in the common marketplace. Horizontal interoperability may exist at different points along the payment chain. Front-end mechanisms that enable customers and merchants to use different payment services are convenient. For example, one interoperable point-of-sale interface is preferred over separate interfaces for each brand of credit card. But interoperability across different back-end infrastructures is necessary to enable smooth interoperation of payments across different platforms and the seamless transfer of different settlement assets.

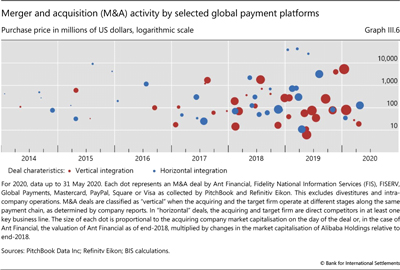

If a single platform captures a large market share at the front end, it has no incentive to become horizontally interoperable. This presents an acute challenge in the presence of digital platforms. While such platforms may have interoperability within their system - for example, to offer additional services to their users - they will tend to limit horizontal interoperability if the market for the specific service has already tipped in their favour. Such platforms may offer (temporarily) low prices (even below cost) in one business line to build up market share in another. They may also seek to acquire competitors directly or partner with banks.44 Adding payment services helps to retain customers in their "zone", while bundling services with payments attracts new customers. The recent spike in merger and acquisition activity by large digital payment firms (Graph III.6), particularly large horizontal acquisitions, ie acquiring competitors, suggests this possibility.

Domestically, markets and authorities continuously work to harmonise the multiplicity of standards and procedures. For example, when ATM networks were first developed in many countries, customers had to use their particular ATM network, as other networks would not accept the cards. However, over time, and due to competition as well as legal and regulatory actions, these networks became better linked, offering more choice, lower prices and greater convenience.45

Payment systems and, more generally, FMIs around the world are becoming more standardised. They are implementing a common industry standard (called ISO 20022) for sending cross-border payment messages. Yet standards alone are insufficient to achieve full interoperability; they call also for coordinated efforts to minimise variability in implementation. For example, SWIFT, a global provider of financial message services, has launched an industry programme to reduce variability in the deployment of ISO 20022.

Across borders and payment systems, achieving interoperability is more complex when it requires joining or linking separate infrastructures. While such interlinking arrangements are not new, they are relatively rare and the volumes and values processed by existing interoperable systems are often still very low (both in absolute terms and relative to domestic systems).46

Interoperability initiatives are unlikely to develop spontaneously. The public sector has a pivotal role as catalyst to support standardisation and open access. Indeed, central banks (and other public sector authorities) are working to enhance interoperability in a number of ways. In the United Kingdom and the European Union, for example, the authorities have focused on developing standards on uniform address formats and open APIs. These efforts allow consumers to "port" their data from one provider to another. Globally, ensuring that safety and integrity standards are common and robust and that measures are consistently implemented is paramount. For example, the Financial Action Task Force (FATF) standards for combating money laundering and related threats to the integrity of financial systems are recognised by and applied in nearly every country in the world.

Even with public sector intervention, making payment systems interoperable poses considerable difficulties. This is especially the case when changes are required to legacy IT systems, either in infrastructures or at individual institutions. Differences in the development and implementation of API standards across borders have also created complications. As with implementation of new standards, a number of legal and regulatory issues need to be resolved, including with regard to customer consent to share data and liability if a consumer is harmed by misuse of data. Across borders, differences in the development and implementation of APIs are particularly challenging and could hinder efforts to achieve interoperability.47

The G20 has made enhancing cross-border payments a priority in 2020 and has asked the Financial Stability Board (FSB) in coordination with the CPMI to lead the work to address cross-border payment frictions. The identified frictions include fragmented and truncated data formats, complex processing of compliance checks, limited operating hours, legacy technology platforms, long transaction chains, funding costs and weak competition. Potential solutions to alleviate these frictions focus on areas such as public and private sector commitment; regulatory, supervisory and oversight frameworks; data and market practices; as well as improvements to existing and new payment infrastructures and payment arrangements.48

As overseer: guiding and regulating

History shows that legislation and regulation can promote innovation by altering incentives for the private sector and by influencing market structure. Central banks have often played a role in advising on, writing or implementing such rules. That said, lessons from other network industries indicate that market dominance is not easily remedied and requires continuous policy interventions. The US telecommunications industry presents an instructive example.49 In the 1980s, US anti-trust authorities required the monopoly player (AT&T) to divest its local subsidiaries. As anti-competitive issues persisted, the public sector passed legislation to promote competition at all service levels. While the emergence of new communication channels, such as internet and mobile phone service, boosted competition, this alone was insufficient to promote robust competition in internet services. It took additional legislation about a decade later to foster it.

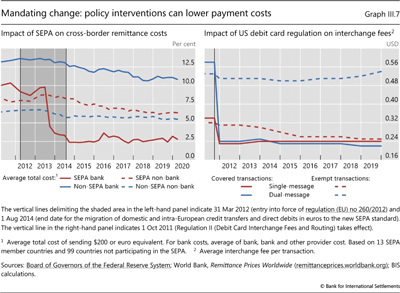

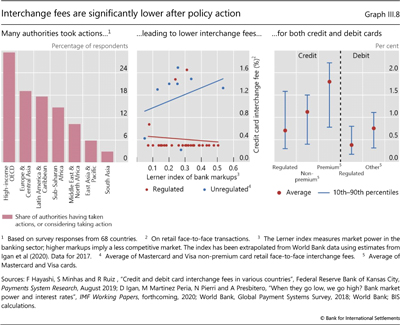

Policy can enhance efficiency and reduce costs. For example, the US Check 21 Act - a federal law effective in 2004, designed by the Federal Reserve - made cheque images legal tender, enabling banks to process cheques in a manner similar to debit cards. By doing away with the physical transportation of cheques, it made processing faster, cheaper and more efficient. Another example is the introduction of the Single Euro Payments Area (SEPA) for euro credit transfers and direct debits.50 Under EU regulations, formulated with input from the ECB and national central banks, such payments and transfers between bank accounts in two different SEPA countries were to be priced equal to a regular, local transfer. As a result, the average cost of transfers in the zone declined substantially (Graph III.7, left-hand panel). A third example is use of caps on interchange fees. In the United States, fees on covered (regulated) debit card transactions fell dramatically after regulations took effect in 2011, while those on exempt cards remained stubbornly high, even after nearly 10 years (right-hand panel). More generally, across countries where authorities have introduced caps on credit and debit card fees, costs are lower than elsewhere for any given degree of competition (Graph III.8).51

Digital platforms raise challenges for traditional anti-trust or market power analysis. Today, the price structure of platforms does not conform to textbook models of monopoly pricing (eg when they offer "free" services in exchange for the provision of data). Likewise, even where prices for retail customers are declining, lack of competition may be slowing innovation.52 Thus, there is a need to reassess regulatory approaches, including by looking across platforms globally and enhancing cooperation among central banks and other authorities.

Ensuring safety and integrity

Any policy action must take into consideration the safety and integrity of the payment system. This relies heavily on work conducted by multiple authorities. Legal, professional and ethical standards are key. Compliance with anti-money laundering standards is critical for integrity. Digital ID, electronic know-your-customer (KYC) systems and a variety of regtech and suptech applications have reduced the costs of ensuring AML/CFT compliance.52 That said, diligence is needed to ensure that compliance remains strong.

Cyber security is another priority. As perpetrators become increasingly sophisticated, the risks that cyber threats pose to financial stability are escalating.54 In this context, the level of cyber resilience, which contributes to payment systems' operational resilience, can be a decisive factor in the overall resilience of the financial system and the broader economy. The CPMI and the International Organization of Securities Commissions (IOSCO) have published detailed guidance on cyber resilience for financial market infrastructures, and the FSB has developed effective practices for cyber incident response and recovery.55

Innovation is introducing new issues in consumer protection - that is, in preventing unfair, deceptive and fraudulent business practices. New payment products may have hidden costs, and faster or more convenient services may also speed up theft.56 Public authorities regularly cooperate to see that consumers know their rights and how to respond when they may have been abused.57

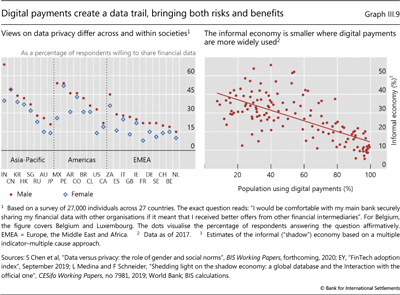

Alongside these innovations come calls for adjustment to data privacy regulation. New technologies make greater use of personal (payments) data. But for good reason, such data are often well protected with privacy rules, which in turn influence access, cost and quality.58 The balance between efficiency and privacy goals will vary across jurisdictions. Some consumers attach a high premium to their data privacy. Others are more willing to share data if this improves financial services (Graph III.9, left-hand panel).59 The use of personal data in the current pandemic, including for contact tracing, may change views towards privacy.60 Regardless, policy interventions should help safeguard consumers' desire for privacy without unnecessarily increasing costs and making institutions less willing to serve financially excluded populations.

At the same time, digital innovation can also support broader policy goals. For instance, greater use of digital payments goes hand in hand with a smaller informal economy (Graph III.9, right-hand panel). Creating a digital record of payments can allow businesses and individuals to build up a transaction data history to access credit and other financial services. In addition, it can make tax collection, law enforcement and social protection more effective, as well as expand the coverage of supervision and regulation of financial services.

To achieve their policy objectives, central banks will need to cooperate with other bodies. Securities regulators, competition authorities, financial intelligence units and consumer and data protection authorities also have regulatory interests in and influence on various aspects of payment services. Addressing the various policy objectives requires striking a delicate balance, as well as cooperation and coordination. Arrangements between these agencies to exchange views and collaborate on relevant issues are key.

CBDC: designing safe and open payments for the digital economy

CBDCs are a prime example of how central banks can stand at the cutting edge of innovation themselves. Technology - in particular, in the field of digital currency - opens up opportunities for payment systems. CBDCs combine this innovative technology with the tried and trusted foundation of the central bank. It is central banks' choice to harness these forces for the common good. They can combine their role as catalyst, overseer and operator, and develop an entirely new set of payment arrangements that run on digital currencies.

CBDCs have the potential to be the next step in the evolution of money, but a thoughtful approach is warranted. CBDC issuance is not so much a reaction to cryptocurrencies and private sector "stablecoin" proposals, but rather a focused technological effort by central banks to pursue several public policy objectives at once. These objectives include financial inclusion; guaranteeing safety and integrity in digital payments; establishing resilient, fast and inexpensive payments; and encouraging continued innovation in payments.

Wholesale digital money is not new - the financial sector has had direct access to such central bank money for decades. However, a wholesale CBDC, if well designed, has the potential to increase efficiency. For example, "programmability" could enable the automatic and near instant delivery of a traded security once a payment is received and verified. In this way, a wholesale CBDC can enhance safety and speed and potentially simplify the post-trade clearing and settlement cycle.61 A wholesale CBDC could also help mitigate the risk of fraud and cyber attacks; in particular, its technology could improve the irrevocability of digital record-keeping.

The implications of a retail CBDC would be more far-reaching. Such an innovation would provide general users with direct access to central bank money, and potentially offer a safe, reliable and universally accessible settlement instrument - just as cash does now. The benefits would have to be carefully weighed against the implications for the functioning of the financial system, such as the risk of disintermediation, including accelerating bank runs at times of stress, and a potentially larger central bank footprint in the financial system.62 The monetary policy implications would also warrant attention. In contrast to cash, retail CBDCs could be interest-bearing, influencing monetary policy transmission, including by reducing the effective lower bound on nominal policy rates.

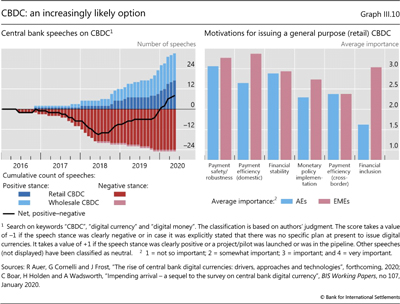

Over the last several years, central banks and policymakers have become more favourably disposed towards issuance of wholesale and retail CBDCs.63 They have featured more positively in central bank communications since late 2019 (Graph III.10, left-hand panel). The motivations for retail CBDCs are numerous and vary across jurisdictions. A 2019 survey of 66 central banks revealed that safety and efficiency of domestic payments are most important, while inclusion is a key motive among emerging market and developing economies (right-hand panel).64 Recently, the need to address the declining use of cash has received increasing attention. As consumers migrate to electronic payments, for online transactions as well as in-person purchases, cash usage is declining precipitously in some jurisdictions.65 The Covid-19 crisis, and the attendant rise of electronic payments, are likely to boost CBDC development across the globe (Box III.D).

Technically, a successful retail CBDC would need to provide a resilient and inclusive digital complement to physical cash. As such, a CBDC must have all the features and more that make cash so attractive. The basic elements are trust in the issuing entity, legal tender status, guaranteed real-time finality and wide availability. But CBDC must also be equivalent to cash in other dimensions. First, CBDCs need to be user-friendly. Schoolchildren, seniors, and every age group in between handle banknotes and coins with ease; some central banks have even designed features to make banknotes accessible for the blind.66 Second, CBDCs must be highly resilient to infrastructure outages and cyber attacks. Such events could wreak havoc if there was a disruption to electronic payments and cash was no longer generally used. Third, CBDCs need to guarantee the safety and integrity of payments. Just like cash, they need to be counterfeit-proof. And just like other digital means of payment, they need to safeguard the user's privacy while allowing for effective law enforcement. There are opportunities with CBDCs to improve tracing and potentially improve anti-money laundering compliance. But societies' preference may differ regarding how to balance better tracing with privacy protection.

More generally, CBDCs can coexist with both cash and current electronic payment options. They could be made fully consistent with the two-tiered payment system, allowing the public and private sectors to focus on their respective comparative advantages. Central banks can focus on ensuring trust, stability and integrity in payments. For their part, the private sector is best placed to undertake the consumer-facing activity of CBDCs. Designs would need to mitigate the risk of funds flowing out of banks and into the CBDC, in particular in times of stress. One possibility that is worth exploring is remunerating CBDC holdings at a lower interest rate than the rate paid on commercial bank reserves at the central bank.67 Alternatively, central banks could restrict the amount of CBDC that households and businesses can hold, eg through caps.68

A substantial role for the private sector raises the need to guarantee compliance with regulatory standards, ensure open competition and allow innovation to flourish. The central bank may grant private sector intermediaries the privilege to distribute CBDC to retail clients, but new entrants and new technologies will be subject to existing regulatory standards. A level playing field is necessary for the sake of incumbents, but also for newcomers. And the technical design and accompanying legal framework should ensure open competition among the various private sector intermediaries, including by avoiding the creation of closed-loop payment systems or introducing frictions when consumers want to switch providers. Guaranteeing open competition also pertains to the collection, use and sharing of data. In particular, starting with a clean slate, the CBDC design should find a new balance between allowing for data portability, safeguarding privacy and mitigating the risks of money laundering and illicit financing.

Ensuring that the retail CBDC allows for ongoing competition requires not only open competition, but also that the central bank operate an infrastructure that fosters innovation. This calls for a flexible and adaptable central bank-operated infrastructure. PSPs must be able to access the CBDC via multiple channels, including back-end interfaces and APIs. A level playing field in terms of access combined with adaptability should foster private sector innovation.

If the CBDC design succeeds in taking these various considerations into account, central banks could harness technological progress in the field of digital currencies and offer a stable and trusted digital unit of account, with guaranteed finality of payments. In this way, CBDCs could become a complementary means of payment that addresses both specific use cases and market failures as well as a catalyst for continued innovation in payments, finance and commerce at large.

That said, research on CBDCs is still in its early stages, and development efforts will take some time. Given their transformative nature, central banks are carefully considering all design options and determining which ones are the best fit for the specific circumstances of each jurisdiction. As insights advance, the exchange of information among central banks is critical. Through tight cooperation, central banks can benefit from peer learning and develop common approaches.

The BIS is closely supporting central banks in their CBDC research and design efforts (Box III.E). The institution is part of an international group of central banks assessing the potential case for CBDC issuance. The BIS Innovation Hub is developing a wholesale CBDC, which will allow for new forms of tokenised trading and settlements.69 The BIS-based CPMI surveys global CBDC research and development efforts on an annual basis.70 In its analytical publications, the BIS continues to shed light on the underlying economic and technological design challenges.

Box III.E

Designing retail CBDC: shaping the future of payments

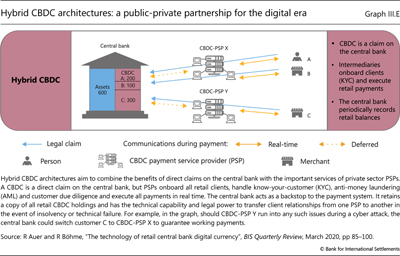

The issue of how to design retail CBDCs was examined in the March 2020 BIS Quarterly Review dedicated to the future of payments. It shows that the bar for a technical design is high. The foundational design consideration for a CBDC needs to balance the operational role of the central bank and private intermediaries. Intermediaries can run into technical difficulties or solvency issues. A CBDC should be safe from such outages. CBDC payment intermediaries need to offer valuable services that have the same convenience, innovation and efficiency as in today's payments. One approach that makes for a safe means of payment while allowing the private-public partnership to continue is a "hybrid" CBDC. In this architecture, private intermediaries execute real-time payments and handle all customer-facing aspects, including ongoing customer due diligence. In addition, the central bank operates a backup infrastructure, enabling it to protect the payment system during a financial crisis or cyber attack (Graph III.E).

It shows that the bar for a technical design is high. The foundational design consideration for a CBDC needs to balance the operational role of the central bank and private intermediaries. Intermediaries can run into technical difficulties or solvency issues. A CBDC should be safe from such outages. CBDC payment intermediaries need to offer valuable services that have the same convenience, innovation and efficiency as in today's payments. One approach that makes for a safe means of payment while allowing the private-public partnership to continue is a "hybrid" CBDC. In this architecture, private intermediaries execute real-time payments and handle all customer-facing aspects, including ongoing customer due diligence. In addition, the central bank operates a backup infrastructure, enabling it to protect the payment system during a financial crisis or cyber attack (Graph III.E).

See A Carstens "Shaping the future of payments", BIS Quarterly Review, March 2020, pp 17-20; R Auer and R Böhme, "The technology of retail central bank digital currency", BIS Quarterly Review, March 2020, pp 85-100; and R Auer, G Cornelli and J Frost, "Taking stock: ongoing retail CBDC projects", BIS Quarterly Review, March 2020, pp 97-8.

See A Carstens "Shaping the future of payments", BIS Quarterly Review, March 2020, pp 17-20; R Auer and R Böhme, "The technology of retail central bank digital currency", BIS Quarterly Review, March 2020, pp 85-100; and R Auer, G Cornelli and J Frost, "Taking stock: ongoing retail CBDC projects", BIS Quarterly Review, March 2020, pp 97-8.

Conclusion

Central banks provide the solid foundation for payment systems, underpinning trust in money while supporting private sector innovation. Over centuries, in their roles as operator, catalyst and overseer, central banks have encouraged the private sector to provide payments that are safe, efficient and widely accessible. The innovations in money and payments that central bank have spurred have promoted increasingly efficient and convenient payments.

While the fundamental roles of central banks in payment systems will endure, payments will continue to evolve. Today, the digitalisation of the economy and greater access to communication have hastened the replacement of cheques and cash with card and mobile payments. In many parts of the world, cash will continue to decline as a means of payment. Many technologies aim to improve payment access and security, including the use of biometrics. If anything, the demand for faster, more convenient and safer payments is likely to accelerate with the Covid-19 crisis.

Rapid technological progress presents central banks and other authorities with both options and challenges regarding how best to enhance efficiency and adapt payment systems. Across policy options, some general principles apply. First, competition and innovation, notably supported by interoperability, best encourage progress on access, cost and quality. When properly channelled, they can also improve safety. Second, to be successful, private sector innovation should be guided by the public sector with a view to improving efficiency and ensuring safety, integrity and trust. Third, cooperation between the public and private sectors, domestically and internationally, is paramount.

While authorities will foremost need to support competitive private sector markets that harness new digital technologies, new public payment instruments may gain traction. Central banks too can naturally play a key role. In particular, CBDCs, if properly designed, have the potential to give rise to a new payment mechanism that is interoperable by default, fosters competition among private sector intermediaries, and sets high standards for safety and risk management.

The current crisis may accelerate changes in payments - yet it also harbours new risks. Even though the pandemic has underscored the interdependence of countries, policy responses have been primarily national. As authorities have limited cross-border movement and implemented social distancing measures, international economic activity has come to an abrupt halt. Going forward, enhancing coordination and taking steps to prevent or reduce fragmentation in cross-border payment systems are public sector priorities. This is particularly important given that issues of competition policy and data privacy have so far been addressed primarily at the national level and in the light of the rising tide of economic nationalism.71

Here, too, central banks can be a force promoting international policy coordination, supporting not just domestic payment systems but, above all, their cross-border integration. In international committees such as the FSB and the CPMI, central banks can benefit from peer learning and develop common approaches. In international forums like the G20, central banks and governments can agree on mutually beneficial stances on payment policy. International coordination ensures that advancements in payments support greater efficiency and cross-border integration. International collaboration on innovative financial technology within the central banking community, such as through the newly established BIS Innovation Hub, is accelerating progress on these policy goals.

Endnotes

1 See D Humphrey, M Willesson, G Bergendahl and T Lindblom, "Benefits from a changing payment technology in European banking", Journal of Banking and Finance, 30, 2006; and R Levine, "Finance and growth: theory and evidence", Handbook of Economic Growth, 2005.

2 See M Bech and J Hancock, "Innovations in payments", BIS Quarterly Review, March 2020, pp 21-36.

3 See N Kocherlakota, "Money is memory", Journal of Economic Theory, vol 81, no 2, 1998, pp 232-51.

4 See N Kiyotaki and R Wright, "A search-theoretic approach to monetary economics", American Economic Review, vol 83, no 1, 1993, pp 63-77; C Gu, F Mattesini, C Monnet and R Wright, "Banking: a new monetarist approach", Review of Economic Studies, 80, 2013, pp 636-62; I Schnabel and H S Shin, "Money and trust: lessons from the 1620s for money in the digital age", BIS Working Papers, no 698, February 2018; J Frost, H S Shin and P Wierts, "From stablecoin to proto-central bank: lessons from the rise and fall of the Bank of Amsterdam", BIS Working Papers, forthcoming; U Bindseil, "Early French and German central bank charters and regulations", ECB, Occasional Paper Series, no 234, September 2019; and C Borio, "On money, debt, trust and central banking", CATO Journal, vol 39, pp 267-302, Spring/Summer 2019.

5 In the chapter, the terms "medium of exchange" and "means of payment" are used interchangeably.

6 See Committee on Payments and Market Infrastructures and International Organization of Securities Commissions (CPMI-IOSCO), Principles for Financial Market Infrastructures, April 2012, p 8.

7 See K Petralia, T Philippon, T Rice and N Véron, "Banking disrupted? Financial intermediation in an era of transformational technology", Geneva Report 22, September 2019.

8 See BIS, "Cryptocurrencies: looking beyond the hype", Annual Economic Report 2018, June, Chapter V.