Fast retail payment systems

Fast (retail) payment systems (FPSs) have been (or are being) developed in many jurisdictions. An FSP is a system in which the transmission of the payment message and the availability of the final funds to the payee occur in real time or near real time on as near to a 24/7 basis as possible.

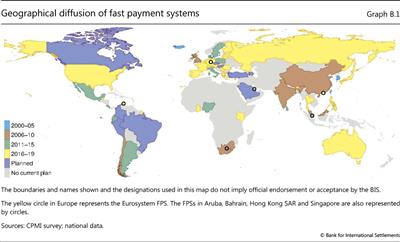

While closed-loop systems can also be near real-time and available 24/7, FPSs are payment infrastructure that facilitates payments between account holders at multiple PSPs rather than just between the customers of the same PSP. Currently, 55 jurisdictions have FPSs, and this number is projected to rise to 65 in the near future (Graph B.1). While the adoption speed is fairly similar to that of wholesale RTGS systems, early adopters are predominantly emerging market rather than advanced economies.

While closed-loop systems can also be near real-time and available 24/7, FPSs are payment infrastructure that facilitates payments between account holders at multiple PSPs rather than just between the customers of the same PSP. Currently, 55 jurisdictions have FPSs, and this number is projected to rise to 65 in the near future (Graph B.1). While the adoption speed is fairly similar to that of wholesale RTGS systems, early adopters are predominantly emerging market rather than advanced economies.

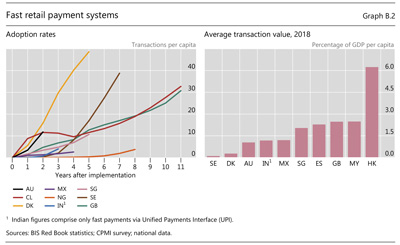

Take-up and usage vary significantly across jurisdictions (Graph B.2, left-hand panel). The FPSs in Chile and the United Kingdom, which have been operating for 10 years, processed just over 30 payments per capita in 2018. In contrast, those in Sweden and Denmark were launched more recently but processed more payments per capita - 40 and 48, respectively - in 2018. This is largely due to the popularity and strong growth in the use of mobile payment apps that are the front end of the FPS in these jurisdictions. In Australia, growth in transaction volumes has also been very rapid, reaching an annualised rate of around 12 fast payments per capita per year in just the second year of operation.

The average transaction value of faster payments varies significantly, suggesting that FPSs are used for a variety of retail payments (Graph B.2, right-hand panel). The average transaction value of fast payments in Denmark and Sweden are less than 0.3% of GDP per capita, indicating they are used mainly for person-to-person payments. At the other end of the scale, the average transaction value of fast payments in Hong Kong SAR is over 6%, suggesting that they are used mainly for payments involving businesses (eg payment of rent).

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements.  Committee on Payments and Market Infrastructures, Fast payments - enhancing the speed and availability of retail payments, November 2016.

Committee on Payments and Market Infrastructures, Fast payments - enhancing the speed and availability of retail payments, November 2016.