Bank loan loss provisioning during the Covid crisis

The Covid-19 crisis prompted a re-evaluation of banks' asset quality under conditions of extreme uncertainty. The crisis also represents the first major test of the newly introduced accounting standards for expected credit loss (ECL) provisioning. How have banks and supervisors approached these challenges?

ECL provisioning standards mandate that banks and other firms take provisions against expected credit losses on assets that are not accounted for at fair value. The expectations are based on a number of inputs, including model-based forecasts, historical experience and current conditions as well as bank management's judgment. As part of the standards and related regulatory guidance, global banks have also enhanced their qualitative and quantitative disclosures. The ECL standards replace the earlier incurred loss (IL) approach, under which banks only set aside provisions upon actual evidence that the borrower will not (or is strongly unlikely to) repay. Developed in the aftermath of the Great Financial Crisis of 2007–09, these standards are part of the IFRS 9 "Financial Instruments" standard under International Financial Reporting Standards (IFRS), and are known as Current Expected Credit Loss (CECL) under the United States Generally Accepted Accounting Principles (US GAAP). IFRS 9 was mandated for IFRS reporters from the first quarter of 2018, and CECL from the first quarter of 2020 for the largest banks subject to US GAAP.

In response to the uncertainties introduced by the Covid crisis, authorities granted banks greater leeway as to how to implement ECL provisioning. International standard setters have reiterated the inherent flexibility in the standards, emphasising the key role of judgment, and have stressed that banks should take account of the positive effects from policies to support the economy during the pandemic. National supervisors have conveyed similar messages. Standard setters have also acted to alleviate the impact of the transition from IL to ECL on capital.

National supervisors have conveyed similar messages. Standard setters have also acted to alleviate the impact of the transition from IL to ECL on capital.

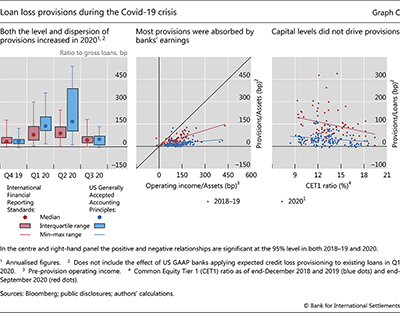

The initial Covid-19 shock triggered significant upward revisions to banks' forward-looking assessment of credit losses. For a sample of 70 large, internationally active banks reporting under ECL accounting, provisions totalled $161 billion in the first half of 2020, compared with $50 billion in the second half of 2019. Relative to loans, the median of annualised provisions rose from 35 basis points in the second half of 2019 to 105 basis point in the first half of 2020. Along with this higher level, the Covid crisis brought more dispersion across banks in provisions as a share of loans. Provisions were somewhat higher as a share of loans for US GAAP banks than for IFRS reporters (Graph C, left-hand panel), perhaps reflecting the use of lifetime credit risk in determining provisions under the US GAAP framework rather than one-year risk for most loans in the IFRS approach.

Along with this higher level, the Covid crisis brought more dispersion across banks in provisions as a share of loans. Provisions were somewhat higher as a share of loans for US GAAP banks than for IFRS reporters (Graph C, left-hand panel), perhaps reflecting the use of lifetime credit risk in determining provisions under the US GAAP framework rather than one-year risk for most loans in the IFRS approach.

Provisions in 2020 were significantly higher for banks with higher pre-provision earnings but were not strongly related to bank capital (Graph C, centre and right-hand panels, red dots). The positive relationship between announced provisions and earnings had been weaker in 2018–19 (blue dots). This relationship strengthened in 2020 when, faced with a substantial increase in credit risk, banks may have felt more comfortable taking larger provisions if this still left them with positive net earnings. Another possible reason is that higher interest margins could have been earned on riskier loans that subsequently required higher provisions in bad times. Contrary to the relationship between provisions and earnings, banks with higher capital ratios did not take more provisions in 2020; if anything, the relationship was slightly negative (right-hand panel). This suggests that, to the extent that strategic concerns affected provisioning in 2020, they did not relate to capital preservation, possibly reflecting the banks' initially strong capital positon. It could also be that those banks that took higher provisions in 2020 had entered the crisis with relatively riskier loan portfolios, and hence higher risk weights and lower risk-weighted capital ratios.

As the economic outlook improved in the second half of 2020, banks reduced their quarterly provisions, and some even took negative provisions. In the third quarter, the total provisions of the banks in our sample declined to $29.5 billion, approaching pre-Covid levels. Dispersion across banks also fell. At the end of the year, the 57 banks that had published fourth quarter financial data at the time of writing took an aggregate of $20 billion in provisions, with the median provisions-to-loans ratio across institutions amounting to 29.7 basis points. Six of these banks announced negative provisions, ie a reduction in loan loss reserves. These reductions remained substantially smaller than the amount of loan loss reserves added during the previous three quarters.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily reflect the views of the Bank for International Settlements.  See Basel Committee on Banking Supervision, Measures to reflect the impact of Covid-19, April 2020; and International Accounting Standards Board, "IFRS 9 and Covid-19", 27 March 2020.

See Basel Committee on Banking Supervision, Measures to reflect the impact of Covid-19, April 2020; and International Accounting Standards Board, "IFRS 9 and Covid-19", 27 March 2020.  The transition arrangements had been set out in Basel Committee on Banking Supervision, Regulatory treatment of accounting provisions – interim approach and transitional arrangements, March 2017. In 2020, the Basel Committee allowed banks more flexibility in phasing in the capital impact of the new frameworks.

The transition arrangements had been set out in Basel Committee on Banking Supervision, Regulatory treatment of accounting provisions – interim approach and transitional arrangements, March 2017. In 2020, the Basel Committee allowed banks more flexibility in phasing in the capital impact of the new frameworks.  A portion ($18.5 billion) of the 2020 increase in provisions by the 19 US GAAP banks in this group included the one-time impact of the application of the ECL approach to existing loans on 1 January 2020. All findings in the box exclude this increase.

A portion ($18.5 billion) of the 2020 increase in provisions by the 19 US GAAP banks in this group included the one-time impact of the application of the ECL approach to existing loans on 1 January 2020. All findings in the box exclude this increase.  For differences between the IFRS 9 and CECL frameworks, see B Cohen and G Edwards, "The new era of expected credit loss provisioning", BIS Quarterly Review, March 2017, pp 39–56.

For differences between the IFRS 9 and CECL frameworks, see B Cohen and G Edwards, "The new era of expected credit loss provisioning", BIS Quarterly Review, March 2017, pp 39–56.