II. A monetary lifeline: central banks' crisis response

![]() Watch the video (00:02:19)

Watch the video (00:02:19)

with Agustín Carstens, General Manager, and Claudio Borio, Head of the Monetary and Economic Department

Listen to the podcast (00:21:23)

with Agustín Carstens and Claudio Borio

Key takeaways

- In the face of an unprecedented crisis caused by the Covid-19 pandemic, central banks were again at the forefront of the policy response. In concert with fiscal authorities, they took swift and forceful action, tailored to the specific nature of the stress.

- Central banks' role as lenders of last resort has seen another important evolution. There has been a marked shift towards providing funds to the non-bank private sector and, in emerging market economies, towards interventions in domestic currency asset markets.

- In the post-crisis period, much higher sovereign debt and heightened uncertainty about the overall economic environment - particularly the inflation process - could further complicate the trade-offs central banks face.

Faced with an unprecedented global sudden stop, central banks were again at the forefront of the policy response. They moved swiftly and forcefully to prevent a potential financial collapse from exacerbating the damage to the economy. They stabilised the financial system, cushioned the adjustment for firms and households, and restored confidence to the extent possible.

In contrast to the Great Financial Crisis (GFC) of 2007-09, the Covid-19 turmoil was fundamentally a real shock generated by measures to address a public health emergency. Banks and the financial sector more generally were not the source of the initial disturbance. Rather, they became embroiled in the turmoil triggered by the precipitous economic contraction. Central banks found themselves facing the Herculean challenge of reconciling a real economy where the clock had stopped with a financial sector where it kept ticking. With firms and households bearing the brunt of the shock, much of the response sought to ease the financial strains they faced while being tailored to countries' specific circumstances.

This chapter examines central banks' responses against the backdrop of an evolving financial and economic landscape. It first outlines their salient features and underlying objectives. It then highlights some key considerations that guided the interventions, with specific reference to the historical role of central banks as lenders of last resort. Finally, it looks ahead to the medium-term challenges central banks may face in the post-pandemic world.

Central banks' crisis management: a shifting state of play

The Covid-19 crisis brought to the fore once again central banks' core role in crisis management. As global economic and financial conditions deteriorated rapidly, central banks formed a critical line of defence. The policy response was broad-based, tailored to the nature of the shock and to country-specific financial system features. Preventing market dysfunction was critical to preserving the effectiveness of the monetary transmission mechanism, maintaining financial stability and supporting the flow of credit to firms and households. In aiming to fulfil this objective, central banks deployed their full array of tools and acted in their capacity as lenders of last resort - a function that has historically been at the core of their remit. Importantly, the interventions were consistent with their mandates which, notwithstanding cross-country differences in emphasis, are ultimately to pursue lasting price and financial stability - necessary conditions for sustainable growth.

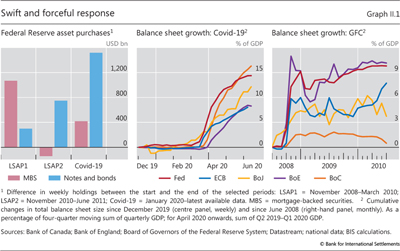

Apart from cutting interest rates swiftly and forcefully, down to the effective lower bound in a number of countries, central banks deployed their balance sheets extensively and on a very large scale. They injected vast amounts of liquidity into the financial system and committed even larger sums through various facilities. For instance, the Federal Reserve purchased over $1 trillion of government bonds in the span of about four weeks. This was roughly equal to the total amount of government bonds purchased under the large-scale asset purchase (LSAP) programmes between November 2008 and June 2011 (Graph II.1, left-hand panel). Similarly, the ECB launched a facility to buy up to €1.35 trillion of securities, or around half of the total amount purchased under its Asset Purchase Programme between 2014 and 2018. In a matter of weeks, the balance sheets of the central banks of the major economies expanded substantially (centre panel), mostly exceeding their increase during the GFC (right-hand panel).

Other central banks, in both advanced and emerging market economies (EMEs), also implemented a broad range of measures targeting various market segments. These actions went hand in hand with large-scale fiscal packages designed to cushion the blow to the real economy (Chapter I). They were also complemented by supervisory measures aimed at supporting banks' ability and willingness to lend. In addition, as stress in the offshore dollar markets became particularly acute, the Federal Reserve extended its network of swap lines to as many as 14 central banks.

The various measures had different proximate objectives. Some of them, such as the initial interest rate cuts, had the more traditional aim of supporting demand and offsetting tighter financial conditions. At the time of the cuts, markets by and large continued to function well. But as the crisis deepened, the evaporation of confidence caused major dislocations, forcing central banks to focus on stabilising the financial sector and supporting credit flows to the private sector.

What does this task involve more precisely? And how has it evolved in the light of changes in the structure of the financial system and the nature of the stress? Answering these questions requires examining more closely central banks' goals, tools, proximate objectives and strategies in crisis management.

Objectives and crisis toolkit

The overriding goal in crisis management is twofold. First, it seeks to prevent long-lasting damage to the economy by ensuring that the financial system continues to function and that credit to households and firms continues to flow. Second, it aims to restore confidence and shore up private expenditures. These goals require the central bank to draw on its three main functions: as the authority responsible for monetary policy, as lender of last resort and, where charged with such duties, as bank regulator and supervisor.

The relationship between the monetary policy and lender of last resort functions is complex and nuanced. The objectives of the two functions differ - the former is focused on steering aggregate demand, the latter on stabilising the financial system. At the same time, the instruments increasingly overlap. Pre-GFC, central banks relied largely on adjustments to short-term interest rates to steer aggregate demand, but since then they have relied much more on adjustments to their balance sheet - the typical lender of last resort tool. Operations that offer funding to banks at favourable rates conditional on their lending to firms and households, for example, supply central bank liquidity to influence aggregate demand. Moreover, the two objectives are intertwined. Central bank interventions to restore market functioning stabilise the financial system, thereby establishing the confidence needed to ensure the smooth transmission of monetary policy. Thus, it may be hard to draw a clear line between the two functions.

The tools at central banks' disposal can be divided into four main categories.

The broadest tool and typically the first line of defence is short-term interest rates. By influencing the cost of funds for the entire financial system, policy rates have a wide reach. They also send a powerful signal, which can help shore up confidence in times of stress. Notably, steering expectations of future interest rates through forward guidance has become an increasingly important part of monetary policy. While interest rate cuts in crises are common, they are far from universal, given that shocks and institutions vary. In EMEs, in particular, stabilising the exchange rate often requires raising interest rates to stem capital flight.

The second set of tools is lending to financial institutions. This includes repurchase operations, which are the bread and butter of liquidity management during normal times, as well as traditional standing facilities / discount windows, which can also act as liquidity backstops for institutions in need. Moreover, targeted lending operations can be tailored to support funding in specific market segments. They can also involve foreign currency - for example, through foreign exchange swaps - to alleviate currency-specific funding pressures.

The third set of tools is outright asset purchases (and sales). These operations alter relative asset supplies in markets and influence the liquidity of specific market segments. Thus, their impact on asset valuations can be more direct than that of other tools.1 They also convey signals about the future course of policy and help manage expectations, thereby reducing uncertainty. The assets involved range from government bonds to private sector securities, such as commercial paper, corporate bonds, equity and foreign exchange.

Finally, as regulatory and supervisory agencies, central banks may adjust regulations that directly affect financial intermediaries and markets. These include what are typically regarded as monetary policy tools, such as reserve requirements. But, depending on central banks' powers, they may also involve other tools, such as capital and liquidity requirements and even capital flow management measures. Whenever the central bank does not have control over these tools, they need to be deployed in coordination with the relevant authorities.

Lender of last resort and the evolving financial landscape

Given the magnitude of the shock that triggered the current crisis, central banks deployed their full arsenal of tools, sometimes in unprecedented ways. The specific type of intervention varied with the nature of the stress and countries' characteristics, particularly the structure of the financial system and the conditions of its major players. Table I.1 in Chapter I illustrates examples of the key measures implemented in the major advanced economies (AEs) and a sample of EMEs.

The importance of the financial structure merits special attention. The lender of last resort function has historically evolved in line with financial market development. Traditionally, central bank emergency lending was synonymous with credit provision to banks. As capital markets developed and the importance of market-based finance increased, the reach of emergency lending broadened. In modern financial systems, markets, like banks, may be subject to "runs" driven by similar underlying forces. A sudden increase in market participants' uncertainty about asset valuations or counterparties' financial strength can cause them to disengage from markets. This can trigger a self-reinforcing spiral involving declines in market and funding liquidity and heightened counterparty credit risk that can lead to the breakdown of key financial markets.2

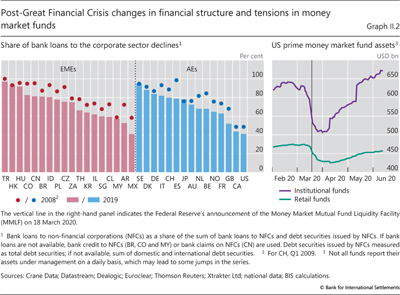

The GFC heralded a clear shift in the role of lender of last resort beyond banks. During the GFC, central banks broke new ground with the scale and breadth of their measures, particularly in terms of eligible counterparties and collateral. The current crisis has taken this evolution further. A striking feature this time has been the prevalence of interventions aimed at non-bank financial institutions, including entities such as mutual funds. This is in line with the growing role of market-based financing, particularly for the non-financial corporate sector (Graph II.2, left-hand panel). As a result, central banks, particularly in AEs, have increasingly been acting as market-makers or dealers of last resort.

This was evident early in the Covid-19 crisis in response to acute strains on money market mutual funds. In a dynamic reminiscent of the GFC, a flight to safety resulted in large-scale redemptions from prime money market funds in the United States. Some $160 billion or approximately 15% of assets under management were withdrawn in March alone (Graph II.2, right-hand panel). This had large knock-on effects on crucial funding markets, particularly on that for commercial paper, where prime money market funds are key investors. As a result, funding costs in these markets soared and issuance dropped. The disruptions reverberated globally, given that non-US firms and banks rely heavily on these markets, contributing to a global shortage of US dollar liquidity (see below). The Federal Reserve reacted swiftly, establishing a facility to backstop money market funds. This stemmed redemptions and averted a wider market breakdown. In response to similar strains, the Bank of Thailand and the Reserve Bank of India also introduced facilities to provide liquidity to money market mutual funds through banks. Such backstops have proven effective in shoring up confidence and easing tensions.

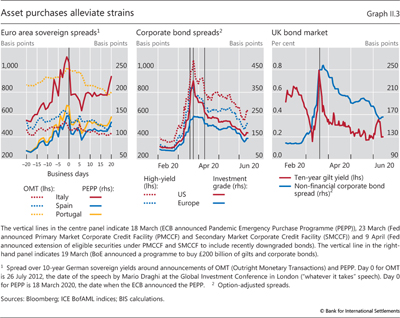

More broadly, central banks targeted a wide range of market segments through outright asset purchases. Most notably, they undertook large-scale purchases of government bonds, either by ramping up existing programmes or by establishing new ones. The Federal Reserve was particularly forceful, committing to purchasing unlimited amounts of US Treasuries and agency mortgage-backed securities, and subsequently breaking new ground by buying municipal debt. The Bank of Japan also committed to unlimited government bond purchases. The central banks of several AEs and EMEs, including Australia, Canada, India and Korea, launched programmes for the first time. The purchases helped stabilise bond markets despite prospective sharp increases in issuance as governments fought the pandemic. In the euro area, the announcement of the Pandemic Emergency Purchase Programme (PEPP) helped narrow sovereign bond spreads, just as the announcement of Outright Monetary Transactions had back in 2012 (Graph II.3, left-hand panel).

Many central banks also bought private sector assets. All major AE central banks established or expanded facilities to fund purchases of a wide range of securities, including commercial paper, corporate bonds, asset-backed securities and equity. The purchases were aimed at preserving market functioning in the face of fire sales and at supporting the issuance of new securities. They thus channelled funds directly to the non-bank private sector.

Strains in corporate bond markets loomed large. Amid a global flight to safety, liquidity dried up and spreads spiked. Central bank interventions were a key stabilising force. Cases in point include the announcements of the ECB's PEPP, which included purchases of corporate bonds, on 18 March and the Federal Reserve's primary and secondary market bond purchase programmes on 23 March. Both immediately tightened spreads in the respective jurisdictions (Graph II.3, centre panel), including on high-yield bonds, which were initially excluded. High-yield spreads tightened further in the United States on 9 April, when some of those bonds became eligible. Similarly, the Bank of England's announcement that it had significantly stepped up its purchases of corporate and government bonds on 19 March was instrumental in alleviating market strains amidst signs of dysfunction (right-hand panel). Some EME central banks also stepped in to stabilise corporate bond markets, reflecting their greater importance in local financial systems (see below).

A striking example of how far a lender of last resort may need to go in more market-based systems is the dislocation in the US Treasury market in March (Box II.A). A confluence of two factors caused the turmoil: an abrupt de-risking by highly leveraged players, who needed to unwind their long Treasury positions in the face of large margin calls, and dealers' limited capacity to absorb the securities, given their already crowded inventories. As a result, the US Treasury market suffered one of its most severe bouts of volatility ever. Avoiding serious dislocations in this key market was paramount, given the critical role that government bonds play in the financial system. The Federal Reserve responded with massive purchases of Treasuries. The episode highlights how the financial condition of key market players - in this case dealers with limited balance sheet capacity and highly leveraged hedge funds - can influence the scope and focus of emergency operations.

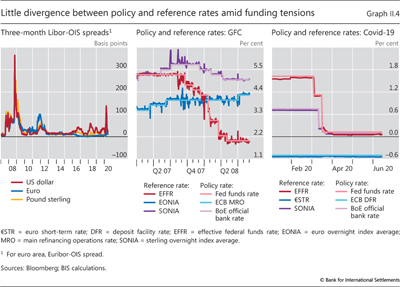

This was also evident in the interbank market. One important difference between this episode and the GFC is banks' much stronger position, thanks to the large capital and liquidity buffers built since then (Chapter I, Graph I.13). As a result, counterparty credit risk among banks has not been a significant source of tension on this occasion (Graph II.4, left-hand panel). By contrast, during the GFC, doubts about banks' creditworthiness generated severe strains in the interbank market and the resulting interest rate volatility compromised central banks' ability to maintain policy rates close to their targets (centre panel). A major thrust of the interventions during the GFC was thus to alleviate problems related to the distribution of reserves among banks. Given banks' stronger positions, as well as the abundance of excess reserves, this was not an issue this time around (right-hand panel).

Reaching the last mile domestically ...

Given the unique nature of the Covid-19 crisis, firms and households directly bore the brunt of the fallout. Thus, an overarching objective of central banks' response was to channel funding to them for the length of the lockdowns, thereby covering the "last mile".3 Broadening the reach to encompass the non-financial private sector represents yet another step in the evolution of the lender of last resort function.

Beyond the purchases of commercial paper and corporate bonds mentioned above, central banks relied heavily on targeted lending operations to banks at low funding costs. The operations required that banks onlend the funds to firms. Almost all the countries surveyed in Table I.1 in Chapter I took this step. China, Brazil, Japan, Singapore, Sweden, Switzerland and the United Kingdom all set up new facilities, mostly targeted at small and medium-sized enterprises (SMEs). The ECB and the Bank of Korea cut interest rates on pre-existing facilities. In addition, the Federal Reserve established programmes to purchase loans originated by banks to a broad spectrum of firms. The extent of this funding support for the non-bank private sector was unprecedented.

Also prominent and unique to this episode were wide-ranging regulatory and supervisory measures to avoid bank deleveraging, many taken by central banks themselves. They took steps and made public statements that effectively eased capital and other regulatory constraints and/or implied a more flexible supervisory stance and interpretation of accounting standards.4 Authorities softened capital and short-term liquidity regulations in most countries and encouraged banks to make full use of existing buffers above regulatory minima. For instance, where previously activated, they released the countercyclical capital buffers (Hong Kong SAR, Switzerland and the United Kingdom). In a major move, the Federal Reserve exempted bank holdings of Treasury securities and cash reserves from the supplementary leverage ratio capital charge. Reserve requirements were also cut or eliminated in many jurisdictions, particularly in EMEs.

Box II.A

Dislocations in the US Treasury market

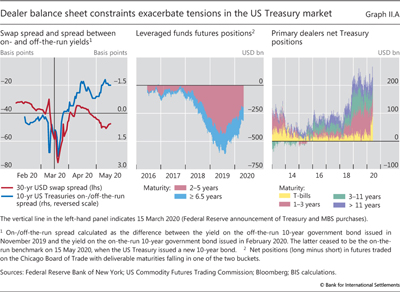

In March 2020, the US Treasury market suffered one of its most severe bouts of volatility. After an initial phase of investor de-risking that saw the 10-year yield fall to historical lows, the market experienced a snapback in yields and extreme turbulence. Long-dated Treasuries were hit especially hard, with the spread between 30-year yields and corresponding interest swap rates widening dramatically (Graph II.A, left-hand panel).

Long-dated Treasuries were hit especially hard, with the spread between 30-year yields and corresponding interest swap rates widening dramatically (Graph II.A, left-hand panel). The spread between bond yields and interest rate swap rates can be an indicator of financial intermediaries' balance sheet constraints, because holding bonds entails using up balance sheet space while swaps do not (off-balance sheet). Hence, the widening of the spread between 30-year yields and corresponding interest rate swap rates points to dealers' limited balance sheet capacity and/or unwillingness to take on additional positions in bonds. At the same time, large differences in yields between on-the-run and off-the-run bonds signal a breakdown in arbitrage.

The spread between bond yields and interest rate swap rates can be an indicator of financial intermediaries' balance sheet constraints, because holding bonds entails using up balance sheet space while swaps do not (off-balance sheet). Hence, the widening of the spread between 30-year yields and corresponding interest rate swap rates points to dealers' limited balance sheet capacity and/or unwillingness to take on additional positions in bonds. At the same time, large differences in yields between on-the-run and off-the-run bonds signal a breakdown in arbitrage.

The severe dislocation in one of the world's most liquid and important markets was startling. It reflected a confluence of factors. A key driver was the rapid unwinding of so-called relative value trades, which involve buying Treasury securities funded using leverage through repos while at the same time selling the corresponding futures contract. Investors, typically hedge funds, employ such strategies to profit from differences in the yield between cash Treasuries and the corresponding futures. Given that these price discrepancies are typically small, relative value funds amplify the return (and, by extension, losses) using leverage. One indication of the popularity of such trades was the growing short positions in futures held by leveraged funds (Graph II.A, centre panel). As volatility picked up and margin calls surged, liquidity in futures markets evaporated. Futures-implied yields dropped more rapidly than bond yields, causing mark-to-market losses for relative value investors who had sold futures and bought bonds. To meet the margin calls, positions were rapidly unwound, notably by selling bonds to cover their short positions in futures. This pushed the prices of Treasuries lower (their yields higher), resulting in a "margin spiral". The market turbulence then spread more widely, including to the large class of hedge funds that follow rules-based investment strategies (so-called systematic funds).

The market turbulence then spread more widely, including to the large class of hedge funds that follow rules-based investment strategies (so-called systematic funds).

Under normal circumstances, dealers would be able to alleviate market stress by absorbing sales and building up an inventory of securities. But dealers' Treasuries inventories were already stretched, especially from 2018 onwards, as dealers had to absorb a large amount of issuance as well as accommodate rundowns of Treasuries holdings by the Federal Reserve as part of its balance sheet normalisation (Graph II.A, right-hand panel). In addition, banks' internal capital management practices - which tighten the leverage ratio constraint on balance sheet-intensive business units - may have also reduced dealers' demand for Treasuries.

Policy response

As a precursor to this episode, dislocations in the US repo market in September 2019 involved much the same players, with dealer balance sheet constraints again being a contributing factor. Back then, repo demand from hedge funds to maintain arbitrage trades between bonds and derivatives contributed to a repo funding squeeze. With dealer banks holding already large US Treasury positions, reluctance to accommodate the higher demand for repo funding compounded the shortage and led to a sharp spike in the secured overnight financing rate (SOFR). The Federal Reserve had to step in to provide ample repo funding and absorb Treasury collateral from the market.

Back then, repo demand from hedge funds to maintain arbitrage trades between bonds and derivatives contributed to a repo funding squeeze. With dealer banks holding already large US Treasury positions, reluctance to accommodate the higher demand for repo funding compounded the shortage and led to a sharp spike in the secured overnight financing rate (SOFR). The Federal Reserve had to step in to provide ample repo funding and absorb Treasury collateral from the market.

This time around, to alleviate the severe market impairment, the Fed rapidly scaled up purchases of US government bonds and agency mortgage-backed securities in mid-March. This was instrumental in freeing up dealers' balance sheets, helping to restore market functioning. The spread between Treasury yields and swap rates narrowed substantially, as did the gap between on-the-run and off-the-run bonds, indicating more willingness to arbitrage bond mispricing. Interestingly, the spread compression did not immediately follow the announcement of stepped-up purchases on 15 March (shown as the vertical line in left-hand panel of Graph II.A), but emerged progressively when Treasuries were actually purchased. This suggests that buying Treasuries directly from dealers' inventories was more effective in stabilising the market than seeking to induce other players to do so, such as by providing liquidity via repo operations, where take-up was relatively subdued.

Subsequent measures were aimed at further alleviating strains in the Treasury market. One was the temporary relaxation of the regulatory supplementary leverage ratio by excluding Treasuries and bank deposits at the central bank from calculation of the capital charge. The other was the establishment of a repo facility for foreign central banks (FIMA Repo Facility) by the Federal Reserve. The facility allows them to obtain US dollar liquidity by posting their holdings of US Treasuries as collateral. The former relaxes banks' balance sheet constraints, while the latter reduces sales of Treasuries in the market, especially by EME central banks, whose currencies were under pressure.

See A Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid-19 crisis", BIS Bulletin, no 2, April 2020.

See A Schrimpf, H S Shin and V Sushko, "Leverage and margin spirals in fixed income markets during the Covid-19 crisis", BIS Bulletin, no 2, April 2020.  An interest rate swap is a derivative contract that can be used to hedge or speculate on the future interest rate path. In a fixed-for-floating swap, one party agrees to make payments based on the preagreed fixed interest rate, and to receive payments on floating rates, typically Libor, from the other.

An interest rate swap is a derivative contract that can be used to hedge or speculate on the future interest rate path. In a fixed-for-floating swap, one party agrees to make payments based on the preagreed fixed interest rate, and to receive payments on floating rates, typically Libor, from the other.  See M Brunnermeier and L Pedersen, "Market liquidity and funding liquidity", Review of Financial Studies, vol 22, no 6, 2009.

See M Brunnermeier and L Pedersen, "Market liquidity and funding liquidity", Review of Financial Studies, vol 22, no 6, 2009.  See F Avalos, T Ehlers and E Eren, "September stress in dollar repo markets: passing or structural", BIS Quarterly Review, December 2019, pp 12-14.

See F Avalos, T Ehlers and E Eren, "September stress in dollar repo markets: passing or structural", BIS Quarterly Review, December 2019, pp 12-14.

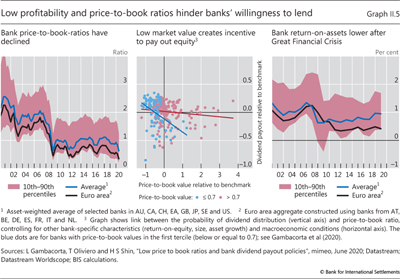

A number of authorities complemented these measures with dividend restrictions so as to bolster further banks' capital resources. Banks have a natural incentive to continue paying dividends, especially when price-to-book ratios languish below one (Graph II.5, left-hand panel). This constellation signals that investors value dividends more than retained earnings. Indeed, the evidence indicates that lower price-to-book ratios go hand in hand with a higher probability of dividend payments (centre panel).

However, these measures were not sufficient to sustain lending effectively. They provided banks with the means to lend, but not with the corresponding incentive: the darkening economic prospects naturally acted as a deterrent. That is why a number of governments issued guarantees, sometimes covering up to 100% of the loan (such as in Germany, Hong Kong and Switzerland).

Even in such conditions, lending may be hampered by low profitability, which limits the ability to take risk and constrains capital accumulation. This is especially so for European banks (Graph II.5, right-hand panel). Indeed, banks in general have come under pressure on dimming prospects. They have had to raise loan loss provisions sharply, and their long-term rating outlooks have deteriorated (Chapter I, Graph I.14). Thus, in encouraging credit extension and the use of capital buffers, authorities had to strike a balance between supporting bank lending in the short term and ensuring that banks remained sufficiently well capitalised and liquid to underpin the eventual economic rebound.

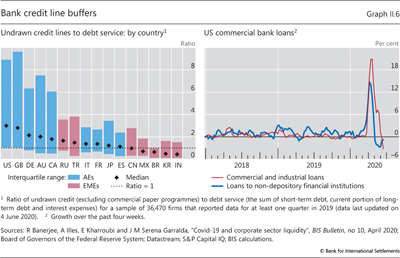

The centrality of banks in this crisis, despite the larger role played by markets, reflects two financial system features. First, most financial systems are still bank-centric. In this sense, banks remain the main final node connecting finance to firms and households (Graph II.2, left-hand panel). And they play this key role even in more market-based financial systems, such as that of the United States, where small businesses still rely on bank loans rather than corporate bonds. Second (and often underappreciated), banks and capital markets are not simply different forms of finance; they are joined at the hip. Banks rely on markets for their funding and as an income source. Markets rely on banks in their capacity as market-makers and arrangers of transactions, for funding and, above all, for backup credit facilities. As such, banks and capital markets complement each other, especially in times of stress.5

Indeed, the current crisis has highlighted just how important recourse to bank credit lines is. While financing in the form of such lines varies across countries, they are ubiquitous. Based on a sample of 36,000 listed and large unlisted firms across 16 advanced and emerging market economies, undrawn credit lines amounted to around 140% of debt service for the median firm at the end of 2019, with firms in AEs generally having higher credit lines relative to EMEs (Graph II.6, left-hand panel). As the commercial paper market froze, firms drew heavily on them, as evidenced by the spike in commercial and industrial loans on US commercial banks' balance sheets. These increased by nearly $700 billion or 30% during March through May (right-hand panel). It is fair to say that banks are both the first and the last mile. And in this crisis, it was banks, not capital markets, that played the role of "spare tyre" in the financial system.6

... and extending the reach globally

For central banks with an international currency, the role of crisis manager cannot stop at its country's borders. The clearest illustration is the Federal Reserve, given that the US dollar is the world's dominant currency.

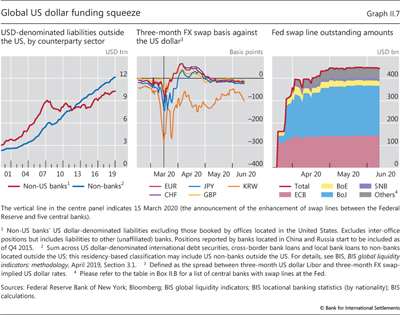

Over the past two decades, the use of the US dollar in global financial transactions has ballooned. US dollar liabilities of non-US banks outside the United States grew from about $3.5 trillion in 2000 to around $10.3 trillion by the end of 2019. For non-banks located outside the United States, they have grown even more rapidly and now stand at roughly $12 trillion, almost double what they were a mere decade ago (Graph II.7 left-hand panel). There is also a significant amount of off-balance sheet dollar borrowing via FX derivatives, primarily through FX swaps. Funding pressures therefore tend to show up in these markets.

Against this backdrop, it is not uncommon for offshore US dollar markets to come under stress in times of market turbulence. Many non-US financial institutions and firms cannot draw on a US dollar deposit base or raise funds directly in US money markets, and so are reliant on FX swaps. During the Covid-19 crisis, just as during the GFC, global investors' rapid de-risking led to a scramble for dollars, which appreciated substantially. With bank funding under heavy pressure, possibly compounded by tighter risk constraints from the dollar appreciation, the supply of dollar funding dried up in many parts of the world. As a result, cross-currency basis swaps - a barometer of the imbalance between demand and supply of dollar funding - widened significantly (Graph II.7, centre panel).

In response, the Federal Reserve acted swiftly (Box II.B). To ease dollar funding shortages in various jurisdictions, it utilised standing swap lines established during the GFC with five major AE central banks and reopened them for another nine. The amounts and maturities were also increased, and the pricing made more favourable. On announcement, the swap lines had an immediate impact on the cross-currency basis (Graph II.7, centre panel). The gap narrowed further as the swap lines were utilised, particularly by the Bank of Japan and the ECB (right-hand panel). Subsequently, in order to help a broader set of countries liquefy their FX reserves and relieve selling pressure on US Treasuries, the Fed opened a repo facility. This allowed central banks to borrow US dollars directly from the Federal Reserve using their holdings of US Treasuries as collateral rather than having to do so in the market, possibly in unfavourable market conditions, or to sell them. With the GFC as precursor, the role of the Federal Reserve as a global lender of last resort has been further cemented.

Emerging market economies weather a perfect storm

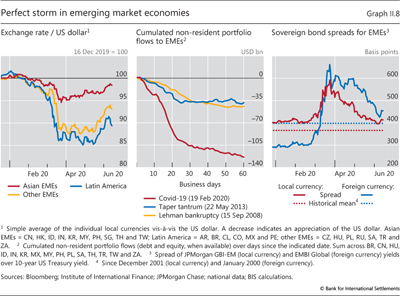

For many EMEs, the pandemic crisis was akin to a perfect storm. On top of the steep drop in domestic activity from containment measures, many EMEs had to contend with disruptions to global value chains and a collapse in export receipts, exacerbated by plummeting commodity prices. The retrenchment in capital inflows, which triggered large exchange rate depreciations and a sharp tightening of financial conditions, further strengthened the raging winds (Graph II.8, left-hand panel). Particularly affected were countries with high foreign currency debt, with substantial participation of foreign institutional investors in local government bond markets (see below) and exposed to large carry trades. Indeed, capital outflows dwarfed those during previous stress episodes (centre panel). Spreads on local currency bonds spiked alongside those on foreign currency bonds (right-hand panel). For some countries, declines in remittances, reductions in foreign direct investment inflows and reversals of carry trades compounded the problem (Chapter I).

Box II.B

Market stress in US dollar funding markets and central bank swap lines

A significant portion of the international use of major reserve currencies, such as the US dollar, takes place offshore. Dollar liabilities (ie loans and debt securities) on the balance sheets of banks and non-banks outside the United States amounted to over $22 trillion at end-2019 (Graph II.7, left-hand panel). On top of this, off-balance sheet US dollar obligations incurred via derivatives such as FX swaps were even larger, with estimates ranging up to $40 trillion. An FX swap allows an agent to obtain US dollars on a hedged basis, which is functionally equivalent to collateralised borrowing.

An FX swap allows an agent to obtain US dollars on a hedged basis, which is functionally equivalent to collateralised borrowing.

A key barometer of US dollar funding conditions is the FX swap basis - the difference between the dollar interest rate in the money market and the implied rate from the FX swap market. With frictionless arbitrage, covered interest parity holds and the basis should be close to zero - otherwise almost riskless profits can be reaped from borrowing in one market and lending in the other. A negative basis means that borrowing dollars through FX swaps is more expensive than borrowing in the cash money market.

Since the Great Financial Crisis (GFC) of 2007-09, the basis for key currencies has widened, driven by both demand and supply factors. On the demand side, institutional investors (eg portfolio managers, insurance companies and pension funds) outside the United States hold large dollar asset portfolios and use FX swaps to partially hedge the currency risk. Their portfolios have grown substantially over the past decade, boosting the demand for dollar borrowing via FX swaps. At the same time, the supply of hedging services from global banks has fluctuated with the risk capacity of these intermediaries. Tighter risk management and the associated balance sheet constraints have reduced banks' ability to arbitrage the basis away. As a result, the basis has become more variable and sensitive to fluctuations in demand for US dollar funding and banks' risk-taking capacity. The tensions escalate in times of stress, when demand for US dollars via FX swaps typically increases and banks' risk-taking capacity declines. As a result, obtaining US dollars through the FX swap market becomes more expensive and the basis becomes negative.

On the demand side, institutional investors (eg portfolio managers, insurance companies and pension funds) outside the United States hold large dollar asset portfolios and use FX swaps to partially hedge the currency risk. Their portfolios have grown substantially over the past decade, boosting the demand for dollar borrowing via FX swaps. At the same time, the supply of hedging services from global banks has fluctuated with the risk capacity of these intermediaries. Tighter risk management and the associated balance sheet constraints have reduced banks' ability to arbitrage the basis away. As a result, the basis has become more variable and sensitive to fluctuations in demand for US dollar funding and banks' risk-taking capacity. The tensions escalate in times of stress, when demand for US dollars via FX swaps typically increases and banks' risk-taking capacity declines. As a result, obtaining US dollars through the FX swap market becomes more expensive and the basis becomes negative.

Market dislocation and the policy response

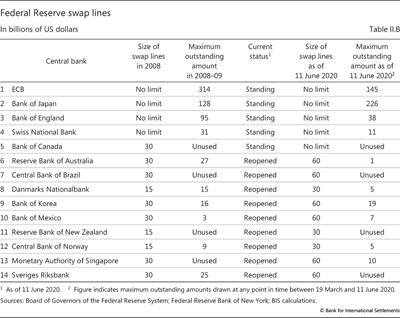

As the Covid-19 pandemic intensified in March 2020, US dollar funding costs rose sharply, approaching levels last seen during the GFC. In response, the Federal Reserve activated the standing swap lines established during the GFC with five major central banks (Table II.B). Besides having no prespecified amount limits, the interest rate charged was reduced to just 25 basis points over the US dollar overnight index swap (OIS) rate and the duration extended to 84 days. On 19 March, the Federal Reserve re-established temporary bilateral swap lines with nine additional central banks. These swap lines, also set up during the GFC, had expired. The amount available varied across jurisdictions. In addition, on 31 March the Federal Reserve put in place a temporary repo facility that allowed central banks, including those without established swap lines, to obtain dollar liquidity by pledging US Treasury and agency securities as collateral.

In response, the Federal Reserve activated the standing swap lines established during the GFC with five major central banks (Table II.B). Besides having no prespecified amount limits, the interest rate charged was reduced to just 25 basis points over the US dollar overnight index swap (OIS) rate and the duration extended to 84 days. On 19 March, the Federal Reserve re-established temporary bilateral swap lines with nine additional central banks. These swap lines, also set up during the GFC, had expired. The amount available varied across jurisdictions. In addition, on 31 March the Federal Reserve put in place a temporary repo facility that allowed central banks, including those without established swap lines, to obtain dollar liquidity by pledging US Treasury and agency securities as collateral.

These policy measures assuaged market fears, and the basis for most currencies narrowed. Utilisation of the swap lines was larger for the yen, the euro and sterling, though generally not smaller than during the GFC (Table II.B). Correspondingly, the basis for these currencies narrowed significantly. This suggests that, in addition to the announcements, the actual drawdowns helped ease market tensions. Indeed, countries that did not utilise the swap lines heavily, such as Korea, still saw significant basis spreads.

While FX swaps and forwards create debt-like obligations, they do not show up on the balance sheet, and are thus not counted as debt. For an estimate of this "hidden dollar debt", see C Borio, R McCauley and P McGuire, "Foreign exchange swaps: hidden debt, lurking vulnerability", VoxEU, February 2020.

While FX swaps and forwards create debt-like obligations, they do not show up on the balance sheet, and are thus not counted as debt. For an estimate of this "hidden dollar debt", see C Borio, R McCauley and P McGuire, "Foreign exchange swaps: hidden debt, lurking vulnerability", VoxEU, February 2020.  See C Borio, R McCauley, P McGuire and V Sushko, "Covered interest parity lost: understanding the cross-currency basis", BIS Quarterly Review, September 2016, pp 45-64; and B Erik, M Lombardi, D Mihaljek and H S Shin, "The dollar, bank leverage and real economic activity: an evolving relationship", BIS Working Papers, no 847, March 2020.

See C Borio, R McCauley, P McGuire and V Sushko, "Covered interest parity lost: understanding the cross-currency basis", BIS Quarterly Review, September 2016, pp 45-64; and B Erik, M Lombardi, D Mihaljek and H S Shin, "The dollar, bank leverage and real economic activity: an evolving relationship", BIS Working Papers, no 847, March 2020.  See S Avdjiev, E Eren and P McGuire, "Dollar funding costs during the Covid-19 crisis through the lens of the FX swap market", BIS Bulletin, no 1, April 2020.

See S Avdjiev, E Eren and P McGuire, "Dollar funding costs during the Covid-19 crisis through the lens of the FX swap market", BIS Bulletin, no 1, April 2020.

A number of factors further constrained the policy response in EMEs. The sharp fall in oil prices hit oil exporters especially hard and substantially reduced fiscal revenues. Where oil production is concentrated in state-owned enterprises, such as in Brazil, Colombia and Mexico, the firms' weaker financial condition increased contingent government liabilities and raised the risk premium on government debt. This led to a major contraction in fiscal space, precisely at a time when more fiscal resources were needed to offset the pandemic's damage. More generally, high population density, under-funded public health systems and a sizeable informal sector, mainly in the worst-hit parts of the economy such as small retail businesses, restaurants and tourism, strained many EMEs' capacity to cope and exacerbated the economic hardship.

In this context, the prerogative was to cushion the fallout for the economy. Central banks responded forcefully by promptly easing policy and taking a number of extraordinary measures. In many cases, the response went far beyond that in previous crises. This in part reflected the underlying nature of the shock, which required alleviating strains on firms and households directly. But it also reflected fundamental changes in economic and financial structures as well as in broader policy frameworks over the past decades.

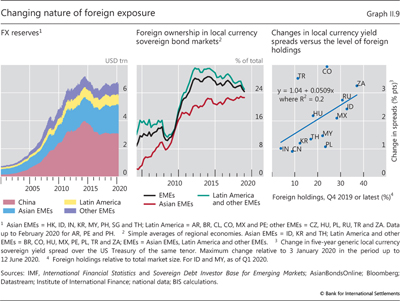

EME central banks' room for policy manoeuvre during crises has typically been narrower than that of AEs, due in large part to exchange rate effects. Cutting interest rates tends to compound the exchange rate depreciation, which can magnify currency mismatches, thereby reinforcing financial headwinds. Moreover, for those countries with less anchored inflation expectations, the depreciation risks raising inflation. Over the years, however, EMEs have implemented policies that have earned them greater degrees of freedom. They have adopted flexible policy frameworks combining inflation targeting with judicious exchange rate intervention, and hence larger FX reserve buffers (Graph II.9, left-hand panel), as well as active use of macroprudential tools.7 And they have developed local currency bond markets. This has better anchored inflation expectations and broadened the range of policy options. It has also bolstered policymakers' ability to address threats to financial stability and made it more feasible to cut interest rates swiftly in a crisis.

And yet, new pressure points have also emerged. The development of local currency bond markets, in particular, went hand in hand with, and in some cases relied on, higher participation of foreign investors (Graph II.9, centre panel). Partly as a result, currency mismatches have shifted from the balance sheets of borrowers to those of investors, who often invest on an unhedged basis. As currencies depreciate, these investors typically incur exchange rate losses alongside those caused by rising domestic currency yields, which tend to move in tandem. Given the size of the exposures relative to domestic markets, stock adjustments in foreign investors' portfolios greatly intensify the interplay between yields and exchange rates. This pattern was again visible during the latest turbulence.8 Countries with higher shares of foreign ownership in local currency bond markets experienced significantly larger increases in local currency bond spreads following the outbreak of Covid-19 (right-hand panel).

Against this backdrop, EME central banks broke new ground in terms of interventions in domestic currency bond markets in order to ensure their smooth functioning. Many, including the central banks of India, Korea, the Philippines, Poland, Turkey and South Africa, implemented government bond purchase programmes for the first time. Others, such as those of Mexico and Brazil, undertook Operation Twist-type transactions, absorbing duration from the market by buying long-term securities and selling short-term ones. Preliminary evidence suggests that the interventions were helpful: bond yields declined and exchange rates stabilised (Box II.C). Some central banks also introduced measures to support corporate bond markets. In Korea and Mexico, for example, they introduced facilities to lend to financial institutions against corporate bond collateral. Similarly, the Bank of Thailand established a corporate bond stabilisation fund to help firms roll over short-term debt.

While this could herald a shift towards greater market-type interventions akin to those of advanced economies, important limitations exist. Shallower markets may constrain the scale of interventions. And weaker institutional settings and less well anchored inflation may give rise to greater concerns about fiscal dominance. This is all the more so given investors' more limited tolerance for these economies' underperformance. At the same time, the need for liquidity support in foreign currency is still as important as ever, given that foreign currency debt - mostly in US dollars - has continued to increase, and that the high participation of foreign investors in domestic securities markets may destabilise exchange rates.

This again highlights the importance of an effective global safety net. There is a general consensus that self-insurance through the accumulation of foreign exchange reserves is sub-optimal. Similarly, there is only so much that individual countries can do to limit exposures through capital flow management safeguards without forgoing the benefits of participation in the global financial system.

Box II.C

Central bank bond purchases in emerging market economies

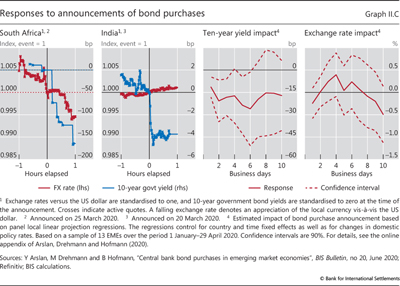

Financial markets in EMEs were hit hard by the Covid-19 turmoil, with large currency depreciation and sharp increases in local currency yields. In response, several EME central banks launched bond purchase programmes, signalling their willingness to act as a buyer of last resort. The overriding objective was to maintain market functioning and support liquidity in local currency bond markets. The design and size of the programmes differ across countries. Most central banks focused on local currency sovereign bond markets. The central banks of Hungary and Colombia also purchased mortgage bonds and bank bonds, respectively, while the Central Bank of Chile bought only bank bonds. Few central banks have explicitly announced the size of their programmes. Where they have done so, the scale is relatively modest, ranging from below 0.2% of GDP to 2.8%.

Initial market reactions suggest that the measures have been successful in improving bond market conditions, pushing down yields and shoring up confidence, as reflected in stronger exchange rates. This is evident in South Africa and India, where high-frequency data are available and the announcements did not coincide with interest rate decisions (Graph II.C, first two panels). In South Africa, in the hour after the announcement, 10-year yields fell by more than 150 basis points and exchange rates appreciated 1%. In India, announcement effects on yields were smaller and exchange rates were largely unchanged. The differences in market reactions between countries seem to reflect differences in initial conditions as well as the scope, scale and communication of the bond purchase programmes.

The positive initial market reactions are confirmed by regression analysis using the full sample of announcements across 13 EMEs (Graph II.C, last two panels). Controlling for domestic central bank interest rate decisions and time period-specific effects (such as Federal Reserve and ECB policy actions), the analysis suggests that on the day of the announcement 10-year yields fell by 10 basis points. The effect persists and further builds in subsequent trading days, reaching a maximum of -25 basis points after six trading days. Bilateral exchange rates against the US dollar appreciated on impact by 0.3% on average, but the effects are not statistically significant at conventional levels and dissipate quickly.

These positive initial market reactions suggest that the programmes were successful in restoring investor confidence and did not lead to higher inflation expectations. This was probably also due to the clearly defined scope of the programmes, which explicitly aimed at restoring confidence in markets rather than at providing monetary stimulus. And by serving to contain the rise in bond yields, the measures also provided useful support to EME economies during the pandemic shock.

See Y Arslan, M Drehmann and B Hofmann, "Central bank bond purchases in emerging market economies", BIS Bulletin, no 20, June 2020.

See Y Arslan, M Drehmann and B Hofmann, "Central bank bond purchases in emerging market economies", BIS Bulletin, no 20, June 2020.

A more complete and lasting solution calls for some form of international coordination. One way is to pool reserves - for example, through regional or bilateral swap lines. Many countries in Asia have progressively implemented such schemes through the Chiang Mai Initiative. Regional pooling, however, is less effective in the face of a global shock, when all countries are hit simultaneously. Another, much discussed, avenue revolves around liquidity provision by supranational institutions such as the IMF. But apart from the fact that access is restricted to countries in good standing and potential problems of stigma, the resources readily available are limited. In this crisis, the IMF has offered $100 billion in emergency financing to a number of mostly developing countries, and could potentially mobilise up to $1 trillion in total lending.9 By comparison, IMF estimates suggest that financing needs of emerging market and developing countries could reach $2.5 trillion.

Absent such comprehensive arrangements, liquidity backstops under the aegis of the central bank issuing the international currency will continue to be the prime safeguard. The Federal Reserve's FX swap lines are not only critical but also consistent with domestic interests. As issuer of the global currency, the United States benefits from lower financing costs. And extending US dollar liquidity helps forestall spillbacks from distress in foreign markets. That said, the swap lines are limited in coverage. Until a lasting political and practical solution is found, EMEs will have to continue to draw on a fragmented combination of mechanisms to meet their liquidity needs.

The evolving crisis playbook

Central banks' current crisis management response represents a further stage in the evolution of a function that was born with the institution itself. The GFC considerably advanced central banks' ability to deal with systemic events both domestically and globally.10 The present crisis has required central banks to go even further. This has been due in large part to the nature of the shock, which has put the focus squarely on alleviating strains for firms and households. The extension of the crisis playbook points to a number of considerations regarding the interventions' forcefulness, boundaries and relationship with fiscal policy.

Vigorous, prompt and mandate-consistent interventions

The sheer scale and ferocity of the Covid-19 crisis meant that central banks were fire-fighting on multiple fronts simultaneously. Experience has shown that in a systemic crisis one cannot afford to fall behind the curve. Building on the long-standing principle laid down by Walter Bagehot of advancing liquidity "freely and vigorously", central banks did so especially forcefully.11

As this episode has amply confirmed, there is a premium on being prompt. Early recognition of the nature and size of the problems combined with swift intervention are critical to short-circuit adverse feedback dynamics and forestall economic damage. In a highly interconnected financial system, strains in one market segment can spill over into others, rapidly escalating into system-wide stress. Moreover, the scale and forcefulness of the measures have an important bearing on confidence. Gradualism cannot succeed. Central banks have learned from the GFC that uncertainty about how central banks will respond to market stress can increase volatility. For example, ambiguity about access to facilities or the associated problem of stigma can hinder the take-up of liquidity and exacerbate tensions. Both words and actions need to speak loudly.

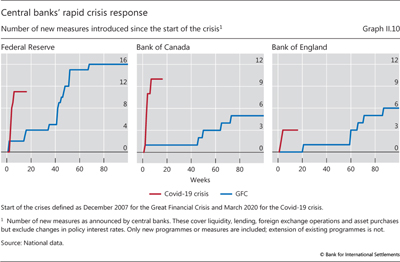

A striking feature of this episode was indeed how quickly central banks sprang into action. Many cut policy rates in emergency meetings and launched numerous facilities in the space of days (Graph II.10). This was partly due to experience. In many AEs, facilities set up during the GFC were still operational, so that central banks could ramp them up quickly. In some cases, previously closed facilities were reactivated. The premium on speed means that central banks will always be at the core of crisis management in financial markets.

At the same time, given the financial system's evolution, the forms of intervention have evolved. As the system has become more complex, the pipes through which the needed liquidity has to flow to reach all key market segments have proliferated. Central banks must stand ready to adjust their operational frameworks, extending liquidity to non-banks as well as banks, depending on circumstances. Moreover, beyond acting as lender of last resort, central banks are increasingly called upon to perform the role of dealer of last resort. They can do so directly, by standing ready to buy securities to support market liquidity; and they can do it indirectly, by freeing up financial institutions' balance sheet capacity through outright securities purchases, which facilitate re-engagement in the market. In addition, they may have to supply foreign currency liquidity.

Importantly, maintaining longer-term credibility and legitimacy requires that central banks take actions that are consistent with their mandates. All the interventions need to be justifiable under the broad monetary policy or lender of last resort remit. Staying within the remit also means limiting as far as possible decisions that may appear to have unjustified distributional consequences, such as when choosing to grant credit to specific firms or sectors. This was evident in the broad-based nature of programmes with simple and objective eligibility criteria based primarily on financial soundness.

Extending boundaries

Confronted with a crisis of unprecedented magnitude, central banks had to reassess where to draw the boundaries of their assistance and what safeguards to adopt. Central banks found themselves pushing hard against traditional demarcations of their remit. In doing so, an important conditioning factor was the political economy context shaped by the crisis.

The nature of the shock is key. In contrast to the GFC, in the Covid-19 episode the financial sector was not the source of the problem as the shock was completely exogenous and generalised. The former meant less recrimination about supporting financial markets and institutions; the latter created political backing for direct assistance to a broad range of participants. Backing was important, particularly in encouraging the fiscal support that enabled central banks to take the necessary actions. In the process, some previous red lines were crossed.

For many central banks, for example, a key boundary had been direct interventions in corporate bond markets, which could be perceived as engaging in credit allocation. Yet many did so in this crisis as part of a concerted policy effort to cushion the blow to firms which, through no fault of their own, had experienced a sudden liquidity squeeze. The rationale extended also to SMEs, where credit risk is higher, as these were hit especially hard. More generally, supporting businesses, and SMEs in particular, rather than large banks was politically less controversial, if not positively encouraged. The Federal Reserve's aptly named Main Street Lending Program illustrates the importance of placing the interventions in the proper context.

That said, extending reach entails reputational risks. To mitigate potential criticisms of overreach and ensure accountability, the interventions went hand in hand with a high degree of oversight and transparency. The amounts, terms and governance of the operations were published promptly, and the link between actions and goals was clearly articulated. Fees and haircuts on higher-risk securities helped provide a degree of protection against potential losses. And through simple eligibility criteria, judgmental selection of potential beneficiaries was minimised, though at the expense of less targeted assistance.12

Once the immediate crisis passes and the dust settles, the balance of considerations will shift. At that point, exit strategies and reconsideration of potential moral hazard issues will become more prominent.

A key element of exit is to decouple the unwinding of emergency measures from the monetary policy stance. This can be challenging given that the tools for both functions overlap. Clear communication is required. The timeliness of exit is also important. Liquidity support to markets, in particular, should aim to pass the baton of system functioning back to market participants as soon as possible. Thus, central banks have articulated exit strategies to the extent possible and emphasised the temporary nature of the assistance. Some of the facilities involving short-term lending or purchases of commercial paper will expire quickly. Many of the liquidity facilities were also priced in such a way that they would no longer be attractive once normal market functioning resumed. Nevertheless, exiting from the large-scale asset purchases will be harder. Indeed, historically, reductions through sales are rare.13 Economic, rather than purely technical, design considerations are key.

Although moral hazard has been less of an issue in this crisis given its exogenous character, the current experience will inevitably shape expectations of how policy will respond to future financial stress. The broad and forceful provision of liquidity has stemmed market dysfunction, but it has also shored up asset prices across a wide risk spectrum. This could affect the future market pricing of risk - hence a premium on complementary policies. A key initiative would be an effective extension of the regulatory perimeter to the non-bank, capital market segment, such as asset management.14 Strains in this sector, notably runs on money market funds, have played a first-order role in this crisis, as they already had during the GFC.

Well coordinated with fiscal authorities

The greater credit risk central banks took as they reached further in this crisis put the spotlight on the quasi-fiscal nature of emergency liquidity assistance. At the heart of the matter is the elusive distinction between illiquidity and insolvency when judged in real time. The quality of the underlying collateral that central banks acquire in their extension of liquidity can vary significantly and be hard to evaluate. And sometimes it is precisely the acceptance of lower-quality collateral that enables central banks to liquefy specific market segments and stem a panic. As collateral transformation has become an integral part of the lender of last resort function, exposure to credit risk has increased. Indeed, this is by construction if central banks directly purchase private securities. Moreover, the longer the duration of the liquidity support, the greater the risk, not least as illiquidity tends to morph into insolvency as the crisis persists.

Mitigating credit risk for the central bank helps retain a demarcation between monetary and fiscal measures. This is so even when the monetary measures are taken in consultation with, and possibly with the direct support of, the fiscal authorities.

In this crisis, fiscal backing took two forms. The first was through full or partial indemnities, which provide central banks with an equity cushion to absorb losses. For example, the Bank of England's purchases of commercial paper through its Covid Corporate Financing Facility benefit from full indemnity. The second mechanism was through loan guarantees to borrowers. On that basis, for instance, the Swiss National Bank was able to promptly supply funds to banks that pledged the corresponding loans.

Insulating central banks from credit risk in a transparent and effective way supports their operational independence. For one, it mitigates the risk to their financial independence. In addition, it helps avoid the perception that central banks are overstepping their mandate while also limiting political influence. In particular, the arrangements typically specify the eligible assets, the parameters over which consultation with the government is necessary, and reporting requirements. Even so, given the enormous scale of the support, central banks are inevitably drawn closer to credit and fiscal policy. A case in point is the $4 trillion or more in direct lending to firms that may potentially be channelled through the Federal Reserve should all the indemnity in the US stimulus package be utilised.15

Just as fiscal backing supports the lender of last resort function, so central bank interventions can support fiscal policy during crises. In particular, measures to restore orderly market functioning also facilitate government debt issuance. Importantly, these measures are also consistent with the overarching monetary policy objective of maintaining accommodative financial conditions.

Finally, once the acute illiquidity phase of the crisis passes, if more overt solvency problems emerge, the onus of crisis management necessarily shifts from central banks to fiscal authorities. Only the fiscal authorities can transfer real resources outright, as opposed to just providing funding. And only they can, ultimately, support or implement efficient debt restructuring programmes. This crisis has already generated huge income losses for firms, while prospective losses may mount. A surge in corporate defaults is on the cards. This would call for prompt and orderly debt restructuring. Balance sheet clean-ups are critical in re-establishing the conditions for a sustainable recovery. Indeed, history indicates that the way financial crises are managed and resolved can deeply influence the length of the slump as well as the speed and strength of the subsequent recovery.16

Looking ahead

The Covid-19 pandemic is a generation-defining event. Much like the GFC over a decade ago, the legacy of this crisis will linger for a long time to come. It is difficult to look ahead in the midst of a storm, but once the winds subside the task will be to navigate in waters that are familiar in some respects, but potentially more treacherous in others. For central banks, as the economy transits from the illiquidity phase, possibly through the insolvency phase and finally to the recovery phase, the overarching challenge will be to once again help re-establish the basis for sustainable growth in the context of price and financial stability. This will be particularly challenging given the pervasive uncertainty surrounding the path of economic adjustment to the post-Covid world.

With the containment measures lifted in some locations, economic activity has gradually resumed. But the climb back from the depths of the recession could be protracted. Even if contagion waves do not re-emerge, lingering uncertainty may well hold back expenditures and companies may continue to operate at less than full capacity under social distancing rules. For many firms, the losses will never be recouped and pre-existing business models will no longer be viable. To the extent that liquidity problems morph into solvency ones, debt restructuring will absorb precious fiscal space. Banks will incur losses. Depending on how large these turn out to be, banks' ability to support the recovery could be badly affected (Box II.D). At some point, the supervisory stance would need to switch from encouraging the use of buffers to replenishing them.

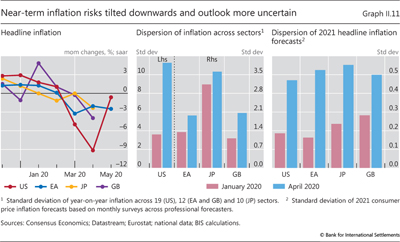

Against this backdrop, near-term inflation risks are skewed to the downside. In the short run, deflationary pressures due to the sharp contraction in aggregate demand will most likely prevail. This is already visible in inflation readings (Graph II.11, left-hand panel). Given that containment and precautionary measures have affected sectors unevenly, the dispersion of sectoral inflation has increased (centre panel). Prices of sectors most severely hit by the lockdown - such as the automotive, clothing and transportation sectors - have dropped, while those for goods whose demand has risen - above all, food and beverages - have increased. At the same time, the near-term inflation outlook has become markedly more uncertain, as reflected in the much wider dispersion of inflation forecasts for 2021 (right-hand panel). This probably largely reflects lingering uncertainty regarding the severity and persistence of the economic contraction, including the risk of further infection waves.

Looking further out, uncertainty over the inflation process is likely to persist due to both demand and supply factors. On the demand side, higher precautionary saving to build buffers and repay debt could continue to dampen expenditures. On the supply side, adjustments to production and work practices under social distancing rules would push up costs. The impact could be particularly pronounced in service sectors characterised by dense gatherings of customers, such as air travel, restaurants and recreation activities. More fundamentally, the pandemic's legacy may partially reverse the structural influences that have acted to keep inflation low over the last few decades. Prominent among these were globalisation and technology, whose end result was to weaken the bargaining power of labour and the pricing power of firms. A trend towards deglobalisation and reshoring of supply chains, possibly reinforced by political developments, would boost prices by increasing costs and lowering productivity. Above all, it would help restore bargaining and pricing power, thereby facilitating inflation.

Box II.D

How much additional lending could the release of bank capital buffers support?

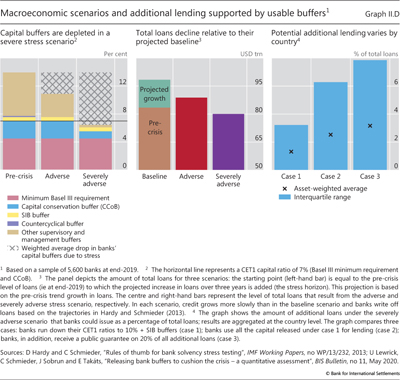

Banks' ability and willingness to lend to the real economy has taken centre stage during the Covid-19 crisis. Whether banks can meet the demand for credit prudently hinges upon the size and usability of their capital buffers. Before Covid-19, banks globally had around $5 trillion above their Pillar 1 requirements (about 45% of their total capital). How much of this capital will be available to support new lending depends on the extent to which banks' capital is depleted by the crisis, as well as banks' willingness to use the buffers. Both are influenced by the degree of policy support.

How much of this capital will be available to support new lending depends on the extent to which banks' capital is depleted by the crisis, as well as banks' willingness to use the buffers. Both are influenced by the degree of policy support.

To estimate the amount of remaining usable buffers, two scenarios are constructed based on historical episodes of stress: one based on the savings and loan crisis in the United States ("adverse scenario") and a graver one similar to the GFC ("severely adverse scenario"). Banks' average regulatory capital ratio (Common Equity Tier 1 to risk-weighted assets) would fall from the current 14% to 10.9% and 6.5% in the adverse and severely adverse scenario, respectively, over three years (Graph II.D, left-hand panel).

Bank loans would fall commensurately (Graph II.D, centre panel). The starting point is loans outstanding at end-2019 (brown bar) and projected loan growth over three years (green bar) based on pre-crisis trend growth in loans. Compared with this starting point, the amount of total loans would be $9.6 trillion (equivalent to 11% of total loans at end-2019) lower for the adverse scenario (red bar) and $18.3 trillion (22%) lower for the severely adverse scenario (purple bar).

To what extent could a release of remaining usable bank buffers counterbalance the decline in loans? Three cases are considered for the severely adverse scenario, which appears more similar to the Covid-19 impact (Graph II.D, right-hand panel). Case 1 assumes that banks employ any remaining usable buffers to expand their balance sheet until their capital ratio declines to 10%. It also assumes that systemically important banks (SIBs), on top of that, maintain their SIB buffers. This case also assumes that each bank keeps the ratio of customer loans to total assets constant, preserving the general structure of its balance sheet. Due to the lack of usable buffers, additional lending amounts to a mere $1.1 trillion (1.3% of total outstanding loans at end-2019).

It also assumes that systemically important banks (SIBs), on top of that, maintain their SIB buffers. This case also assumes that each bank keeps the ratio of customer loans to total assets constant, preserving the general structure of its balance sheet. Due to the lack of usable buffers, additional lending amounts to a mere $1.1 trillion (1.3% of total outstanding loans at end-2019).

Case 2 considers the same drawdown of usable buffers, but features a more targeted use of funds. Specifically, all remaining usable buffers are deployed to fund loans rather than to expand other assets. This case thus implies a stronger expansion in lending than case 1, with additional loans of roughly $2.1 trillion (2.5% of total outstanding loans at end-2019).

Case 3 assesses the potential for additional lending that public support could initiate. The analysis assumes that 20% of all additional loans benefit from a public guarantee (a conservative assumption given that guarantees implemented so far have tended to be much higher), reducing the risk weight on this share of the loan portfolio to zero. This increases the amount of lending that a given amount of capital can support. Additional loans rise to $2.6 trillion (3.1% of total outstanding loans at end-2019).

Overall, the analysis suggests that - despite the build-up of capital over the past few years - usable buffers alone might not be enough to sufficiently support lending in a crisis similar to the GFC; additional policy support would be needed. In providing support, policy needs to strike a balance: on the one hand, it needs to maintain the banking sector's lending capacity; on the other, it needs to preserve the sector's long-term strength, which often implies accelerating consolidation and balance sheet repair.

For more details, see U Lewrick, C Schmieder, J Sobrun and E Takáts, "Releasing bank buffers to cushion the crisis - a quantitative assessment", BIS Bulletin, no 11, May 2020.

For more details, see U Lewrick, C Schmieder, J Sobrun and E Takáts, "Releasing bank buffers to cushion the crisis - a quantitative assessment", BIS Bulletin, no 11, May 2020.  Note that even though the weighted average of banks' capital ratio is 6.5% in the severely adverse scenario, for many banks the ratio is still above 10%. For those banks, there is room to use capital buffers further.

Note that even though the weighted average of banks' capital ratio is 6.5% in the severely adverse scenario, for many banks the ratio is still above 10%. For those banks, there is room to use capital buffers further.  See M Drehmann, M Farag, N Tarashev and K Tsatsaronis, "Buffering Covid-19 losses - the role of prudential policy", BIS Bulletin, no 9, April 2020; and C Borio and F Restoy, "Reflections on regulatory responses to the Covid-19 pandemic", FSI Briefs, no 1, April 2020.

See M Drehmann, M Farag, N Tarashev and K Tsatsaronis, "Buffering Covid-19 losses - the role of prudential policy", BIS Bulletin, no 9, April 2020; and C Borio and F Restoy, "Reflections on regulatory responses to the Covid-19 pandemic", FSI Briefs, no 1, April 2020.

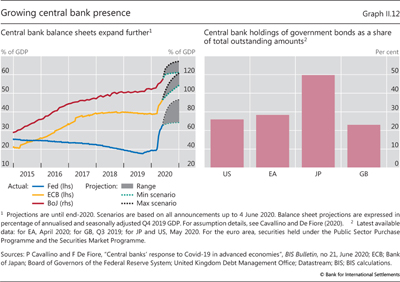

With downward pressures on inflation in all likelihood prevailing in the near term, monetary policy will need to remain accommodative. And with fiscal space more limited, pressure may grow for central banks to do more. Echoing the post-GFC experience, some of the crisis measures enacted may be hard to reverse even when the immediate emergency has passed. Central bank balance sheets, already set to reach record levels in many countries, may expand further (Graph II.12, left-hand panel). For EME central banks, their foray into bond market interventions has already given rise to discussions of possible implementation of quantitative easing programmes.

A distinct feature of the new economic landscape will be much higher debt, especially public sector debt (Chapter I). Apart from the large spike incurred to fight the pandemic, debt may also rise further during the recovery, extending its long-term trend. At the same time, central bank holdings of government debt, already very large in major economies, would quite probably increase and remain on central bank balance sheets for a long time (Graph II.12, right-hand panel).

In such an environment, central banks would be under pressure and face difficult trade-offs. They would do well to adhere to the key principles that have guided them through this crisis so far. Policies need to remain credibly focused on maintaining macroeconomic stability. Actions should remain in line with policy mandates. The goals and reasons for policy actions should be clearly articulated, linking all decisions to the pursuit of the mandates within a coherent framework. Policy flexibility should be retained, including through clear exit strategies consistent with the economic environment. Finally, direct and overt deficit financing should be avoided.

Dealing with high public debt, in particular, requires a two-pronged approach. First and foremost, governments need to safeguard fiscal sustainability. Even as low interest rates relative to growth presently imply favourable debt dynamics, this cannot be taken for granted, not least given that market perception of debt sustainability can change abruptly. Governments must stand ready to take corrective actions to ensure a path of primary fiscal balances consistent with fiscal sustainability. Second, lifting and sustaining higher economic growth is paramount. This puts the onus on growth-friendly fiscal policies as well as structural reforms. Well chosen and implemented expenditures to facilitate the shift to renewable energies would be particularly timely. And just as important, the growth-enhancing effects of globalisation should be preserved.

Absent effective fiscal consolidation and growth-oriented structural reforms, high debt burdens may generate pressure on monetary policy to keep interest rates low. After all, higher inflation combined with financial repression has historically served to reduce debt burdens.17 If so, normalising monetary policy would become harder even if inflation rose.

A key risk is fiscal dominance. This pertains to situations where the stance of monetary policy is subordinated to the government's financing needs. The underlying tension arises because monetary policy has fiscal consequences. Monetary policy works by controlling the cost of borrowing in the economy, invariably also affecting government financing costs. And that impact has grown as central banks have deployed their balance sheets more extensively and moved further out the maturity spectrum to control interest rates. As a result, the fine line between monetary policy and government debt management has become blurred. Discussions of monetary financing further erode the distinction between monetary and fiscal policy (Box II.E).