Non-bank financial institutions remain a key driver of non-US banks' dollar funding

Box extracted from special feature "Unpacking international banks' deposit funding"

Non-bank financial institutions (NBFIs) have grown in importance as a source of US dollar funding for banks headquartered outside the United States (non-US banks) .

. Rising US policy rates since early 2022 and their limited pass-through to the interest rates of traditional bank deposits generated strong incentives for dollar depositors to seek higher returns outside banks, largely at NBFIs that track policy rates more closely.

Rising US policy rates since early 2022 and their limited pass-through to the interest rates of traditional bank deposits generated strong incentives for dollar depositors to seek higher returns outside banks, largely at NBFIs that track policy rates more closely. This dollar funding can find its way back to banks when they borrow from NBFIs.

This dollar funding can find its way back to banks when they borrow from NBFIs.

This box examines recent trends in the dollar funding of non-US banks. It analyses funding developments by combining insights from two data sets. First, the BIS international banking statistics (IBS) provide a comprehensive aggregate picture of non-US banks' dollar funding up to Q1 2023, but do not allow for a granular instrument split. Second, monthly data on the investments of money market funds (MMFs), an important source of secured and unsecured dollar funding for banks, reveal a more detailed instrument breakdown up to mid-2023.

Second, monthly data on the investments of money market funds (MMFs), an important source of secured and unsecured dollar funding for banks, reveal a more detailed instrument breakdown up to mid-2023.

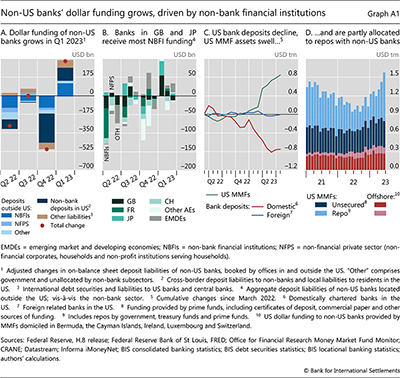

The IBS show that the global dollar funding of non-US banks increased by $326 billion (or 3%) in the first quarter of 2023. This broke a streak of three consecutive contractions (Graph A1.A). The surge had two main sources: deposit funding from NBFIs booked outside the United States (+$119 billion), and deposit funding from non-banks booked at affiliates in the United States (+$123 billion).

Zooming in on deposit funding booked outside the United States, recent enhancements to BIS data reveal NBFIs' prominent role as funding providers to non-US banks' affiliates in the United Kingdom and Japan (Graph A1.B). Funding from NBFIs to banks located in these two jurisdictions almost single-handedly accounted for the aggregate increase in NBFI deposit funding to non-US banks during Q1 2023. Together with the funding provided to banks in France, it had contributed strongly to the decline observed in previous quarters. By contrast, the non-financial sector played a small role in the net swings in dollar funding to non-US banks outside the US.

The growing size of MMFs was a key driver of the recent increase in dollar funding of non-US banks. US MMF assets swelled in the first half of 2023 alongside a decline in traditional deposits (eg excluding repos) in US domestically chartered banks (Graph A1.C). This pattern suggests a reallocation of funds from low-yielding bank deposits to MMFs. In turn, MMFs – and especially those located in the US – strengthened their already pivotal role as a dollar funding source for non-US banks. The dollar funding provided to non-US banks by MMFs (located both inside and outside the United States) rose by almost $550 billion (or 53%) during the first half of 2023 (Graph A1.D). Most of this increase (+$439 billion) came in the form of repos provided by MMFs located in the US and was concentrated in the second quarter (light blue bars). Funding sourced from MMFs located outside the United States also rose during the first half of 2023, but more modestly (+$36 billion overall, well below the +$74 billion provided by US MMFs through unsecured funding).

The key role of NBFIs in general – and MMFs in particular – as funding providers to banks underscores their growing interconnectedness. As most recently evidenced by the March 2020 market turmoil, MMFs can be a flighty source of funding. Stronger reliance on them can thus be a source of bank vulnerabilities.

As most recently evidenced by the March 2020 market turmoil, MMFs can be a flighty source of funding. Stronger reliance on them can thus be a source of bank vulnerabilities.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  According to the BIS international banking statistics, close to 20% of non-US banks' dollar liabilities come from NBFIs. This is most likely a lower bound, as some of banks' debt securities – which have "unallocated" counterparties – are probably held by NBFIs.

According to the BIS international banking statistics, close to 20% of non-US banks' dollar liabilities come from NBFIs. This is most likely a lower bound, as some of banks' debt securities – which have "unallocated" counterparties – are probably held by NBFIs.  See G Afonso, C Huang, M Cipriani, H Abduelwahab and G La Spada, "Monetary policy transmission and the size of the money market fund industry: an update", Liberty Street Economics, Federal Reserve Bank of New York, 17 August 2023.

See G Afonso, C Huang, M Cipriani, H Abduelwahab and G La Spada, "Monetary policy transmission and the size of the money market fund industry: an update", Liberty Street Economics, Federal Reserve Bank of New York, 17 August 2023.  In the IBS, deposit funding includes traditional customer deposits as well as interbank funding and repos, but excludes certificates of deposit, commercial paper and other instruments grouped under debt securities.

In the IBS, deposit funding includes traditional customer deposits as well as interbank funding and repos, but excludes certificates of deposit, commercial paper and other instruments grouped under debt securities.  Data do not allow a more granular split of the non-bank sector for positions booked in the United States. For further detail, see I Aldasoro and T Ehlers, "The geography of dollar funding of non-US banks", BIS Quarterly Review, December 2018, pp 15-26.

Data do not allow a more granular split of the non-bank sector for positions booked in the United States. For further detail, see I Aldasoro and T Ehlers, "The geography of dollar funding of non-US banks", BIS Quarterly Review, December 2018, pp 15-26.  See I Aldasoro, W Huang and E Kemp, "Cross-border links between banks and non-bank financial institutions", BIS Quarterly Review, September 2020, pp 61–74.

See I Aldasoro, W Huang and E Kemp, "Cross-border links between banks and non-bank financial institutions", BIS Quarterly Review, September 2020, pp 61–74.  See I Aldasoro, E Eren and W Huang, "Dollar funding of non-US banks through Covid-19", BIS Quarterly Review, March 2021, pp 31–40.

See I Aldasoro, E Eren and W Huang, "Dollar funding of non-US banks through Covid-19", BIS Quarterly Review, March 2021, pp 31–40.