Global banks' local presence: a new lens

Banks operate internationally through networks of branches and subsidiaries, also known as foreign banking offices (FBOs). Newly collected system- and entity-level data across two dozen host countries confirm stylised facts on these entities' balance sheets and establish new ones. Subsidiaries, which resemble local banks in their focus on domestic currency and retail business, have reduced their share of FBO assets over the past decade, in favour of branches, which are tailored to flexibly provide international services. This shift may raise financial stability concerns, not least because branches' asset growth has been more responsive than subsidiaries' to financial and economic conditions outside host jurisdictions. Judging by the evolution of liquidity and intragroup positions, host supervisors have influenced branches' operations in advanced economies but less so in emerging market ones. 1

JEL classification: F30, G15, G21.

International banks develop and maintain their customer networks through local offices in several host countries. These foreign banking offices (FBOs) take two forms: subsidiaries and branches. The choice between the two reflects the holding company's global business model. A model focused on corporate and investment banking delivers international services through branches that are largely wholesale-funded and legally part of the parent, thus reporting to the parent's supervisors in the home country. By contrast, a multinational retail bank tends to rely on locally incorporated and supervised subsidiaries that behave much like the domestically headquartered banks of the host country, not least in their reliance on retail funding. The characteristics of each type – the flexibility and responsiveness of branches, and the stable local relationships of subsidiaries – have important implications for the transmission of stress across borders.

This feature contributes to the understanding of global banks' local presence, focusing on structural and behavioural differences between foreign branches and subsidiaries as reflected in their balance sheets. It does so by combining the aggregate perspective of the BIS international banking statistics (IBS) with a novel database that includes standardised, detailed balance sheet histories of FBOs in 24 host jurisdictions from advanced economies (AEs) and emerging market economies (EMEs). We use these data to complement previous analyses of FBOs that relied on either more granular single-country or less specific multi-country data.

Key takeaways

- The share of foreign banking offices in host banking system assets has remained stable since 2010, with shifts from advanced to emerging market economy parents – mostly Chinese – and from subsidiaries to branches.

- Branches pose higher risks to host countries than subsidiaries do, because of more volatile asset growth, greater responsiveness to home country conditions, and weaker control by host authorities.

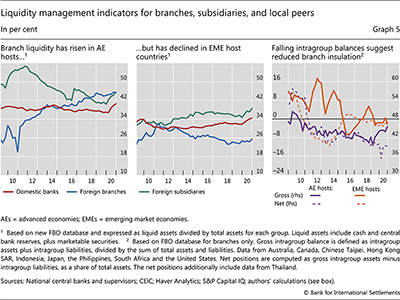

- The recent rise in branches' liquidity ratios in advanced economies and the broader decline in their intragroup positions suggest a tightening of host authorities' control.

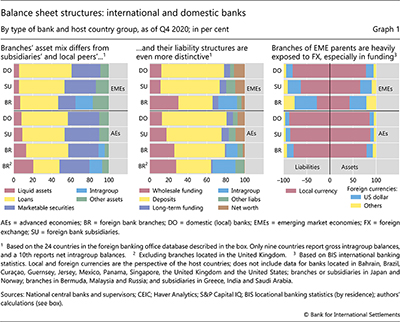

Our main contribution is threefold. First, based on the new database, we validate the commonly held view that branches and subsidiaries have distinct balance sheet structures. Previously established for just a handful of individual countries, our confirmation of this stylised fact underscores two points: subsidiaries' balance sheets resemble those of local banks; and branches rely more on fickle wholesale funding and hold relatively large intragroup positions.

Second, we document two new stylised facts. While FBOs' combined share of host country banking assets has been stable over the past decade, this masks two underlying shifts: the gains by FBOs headquartered in EMEs – especially China – at the expense of their AE peers; and the decline of subsidiaries' share in FBO assets, in both AE and EME hosts. In addition, using entity-level information, we show that subsidiaries are less profitable as a group than local peers. This may help explain the reduction in global banks' reliance on subsidiaries.

Finally, we use the new data to confirm and refine previous findings on the higher volatility of branch assets and to study trends in FBO liquidity ratios. Not only are branches' assets and loans more volatile than those of subsidiaries, but they are also particularly responsive to home country financial and economic conditions. It is therefore unsurprising that several host prudential authorities have long expressed a preference for subsidiaries, and a few have actively adopted measures to "ring-fence" branch activities. Using newly constructed liquidity indicators and data on branch intragroup positions, we present evidence that authorities have recently tightened constraints on branches in AE hosts, although less so in EME hosts.

The feature is structured as follows. The first section reviews the relationship between the types of FBO and the corresponding balance sheets. It includes a box with a high-level overview of the new FBO database. The second documents broad patterns regarding the presence of FBOs in host country banking systems. The third refines earlier findings on the volatility of foreign banking offices. The fourth reviews liquidity across FBOs and intragroup funding trends for branches. The final section concludes with policy considerations.

International business models and balance sheet structures

Banks' international business models fall into two stylised types: centralised global and decentralised multinational. These vary by customer and product focus, funding model (eg, wholesale versus retail) and the choice between branches or subsidiaries for local presence in foreign countries (CGFS (2010)).

A centralised global bank caters mainly to financial institutions and multinational corporates with services such as trade finance, treasury management and transaction banking that span currencies and jurisdictions. It funds itself in wholesale markets and holds significant positions in US dollars or other major currencies. It manages capital, credit and liquidity centrally, and operates through a limited number of financial hubs. If a local presence is required, this model favours branch entities. Branches are legally and financially embedded within their parent and are overseen primarily by the parent's home authority. Less encumbered by local rules and oversight, these branches manage credit and funding in a way that caters largely to the parent banks' broader needs. This may include the transfer of liquidity to and from other nodes in the bank's global network. As a flip side to this flexibility, branches are typically excluded from the host country's deposit insurance scheme and therefore have limited access to local retail deposits.

The decentralised multinational model, on the other hand, focuses on local currency credit provision in multiple countries. It relies mainly on local funding in host jurisdictions and operates mainly through locally incorporated and capitalised subsidiaries.2 These entities are regulated primarily by local authorities and submit to the oversight of, and restrictions on, the transmission of resources away from the host country. In return, they are granted access to domestic insured deposits (McCauley et al (2010), Cerutti et al (2007), Fiechter et al (2011)).

Extensively documented mostly for FBOs in the United States and the overseas offices of US parents, these stylised characterisations apply more broadly. A newly constructed balance sheet database, spanning 24 host jurisdictions (box), reveals that these patterns prevail across both AEs and EMEs (Graph 1, left-hand and centre panels).3 Local banks and subsidiaries of foreign banks have a similar structure of assets and liabilities, notably a focus on customer lending (rather than interbank, securities and derivatives exposures) and a heavy reliance on retail deposit funding. By contrast, branch balance sheets have large intragroup positions and a greater reliance on wholesale funding than foreign subsidiaries or local banks. This is especially the case in AE host countries other than the United Kingdom.4 In addition, data from the BIS IBS, which allow for a system-level currency split that is not available in the bank-level database, document branches' larger foreign currency positions, especially on the funding side (right-hand panel).

Foreign banks' local presence: stable overall, mix evolving

On the surface, the local presence of FBOs has remained stable. Below the surface, however, two significant shifts in assets have taken place: from AE- to EME-headquartered FBOs (mainly Chinese); and from subsidiaries to branches.

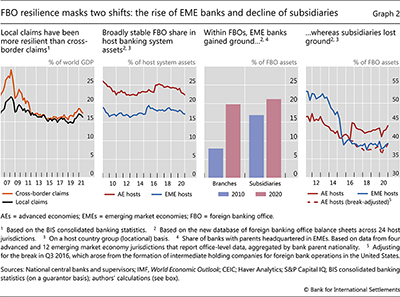

International banks have maintained their local presence in host countries over the past decade. Indeed, the remarkable and well documented rise and fall in banks' international positions around the Great Financial Crisis (GFC) captures mainly the ebbs and flows in cross-border credit (Graph 2, first panel).5 Over this period, global banks maintained the breadth of their geographic presence (Aldasoro et al (2022), Cerutti and Zhou (2017), Claessens and van Horen (2014), McCauley et al (2019)). Indeed, aggregate BIS data suggest that, as a group, FBOs' local claims remained rather stable despite the decline in foreign credit in the wake of the GFC. The refined perspective afforded by the FBO database also suggests that the share of FBOs in host country banking system assets has remained stable across both AE and EME hosts (Graph 2, second panel).

The broad stability of international banks' local presence masks two important underlying developments within FBOs. The first relates to the significant gains by the FBOs of banks headquartered in EMEs (Cerutti et al (2018)). Between 2010 and 2020 and across 16 host jurisdictions reporting office-level data, the share of these banks' branches in total FBO assets rose from 8% to 20% (Graph 2, third panel). The increase was from 17% to 21% in the case of subsidiaries. To be sure, this is partly explained by the well documented retreat of AE banks – especially European ones – from foreign banking, including through FBOs (McCauley et al (2019)). But it also reflects the overall growth and development of EME banking systems and the emergence of large EME-headquartered banks with regional or global aspirations.

The increasing share of EME banks in FBO assets mainly reflects the outward expansion of Chinese banks. This expansion sought primarily to facilitate trade and investment flows rather than to establish retail franchises, a direction that favoured the development of branch networks. Accordingly, Chinese banks' share of total branch assets in our sample rose to 14% by end-2020, from below 4% a decade earlier, in line with their greater share of total cross-border lending. These banks' share of total subsidiary assets across host countries remained stable at about 3%.6

The second structural development in the composition of FBO assets is the shift from subsidiaries to branches, in both AE and EME host countries. Subsidiaries' share in total FBO assets in AE hosts declined by 2.4 percentage points over the decade ending in 2020. This occurred despite a jump of almost 5 percentage points in Q3 2016 that reflects the formation of intermediate holding companies for foreign banks' various operations in the United States (Graph 2, fourth panel). Adjusting for that break, the decline in the share of subsidiaries would amount to about 7.3 percentage points. In EME hosts, the subsidiaries' share of FBO assets fell 14.1 percentage points over the same period. The mirror image of these developments is the corresponding rise in the share of branches across AE and especially EME hosts. This shift might have implications for credit volatility, as discussed in the next section.

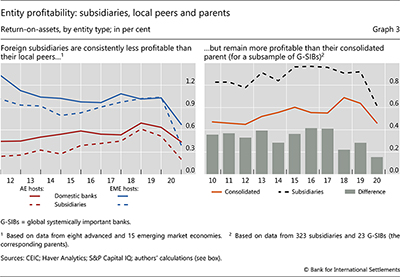

The relative decline of subsidiaries might reflect trends in financial performance. Subsidiaries have faced important headwinds in their local business, a key part of their business model. For one, local banking margins have fallen in many economies, particularly EMEs. In addition, foreign subsidiaries compete for customers against domestic peers with greater local scale and, in many countries, improving services. This might underlie the persistently lower returns of subsidiaries (Graph 3, left-hand panel, dashed versus solid lines).

To be sure, a subsample of global systemically important banks suggests that subsidiaries still generate higher returns than their parents (Graph 3, right-hand panel). However, the differential appears to have narrowed in recent years, partly reflecting the reduction of penalties and other charges booked at headquarters (Caparusso et al (2019)). Perhaps in response to prospects for future relative performance erosion, several large global banks have recently announced plans for subsidiary divestitures.

Credit volatility and host/home conditions

FBOs can be a source of strength for the countries that host them but may also contribute to stress. While they can enhance competition and add to the volume and diversity of financial services, they may also exacerbate credit volatility through their strong responsiveness to developments outside host jurisdictions. The literature has found that this responsiveness is more pronounced for branches, in part due to their higher reliance on wholesale funding (Albertazzi and Bottero (2013), Danisewicz et al (2017), de Haas and van Lelyveld (2010), Jeon et al (2013), McGuire and von Peter (2016)).

- R N McCauley, P McGuire and G von Peter (2010): The architecture of global banking: from international to multinational?, BIS Quarterly Review, March.

-

R McCauley, A S Bénétrix, P M McGuire (2019): Financial deglobalisation in banking?, Journal of International Money and Finance, Volume 94, pp 116-131, June.

-

P M McGuire and G von Peter (2016): The resilience of banks' international operations, BIS Quarterly Review, March.

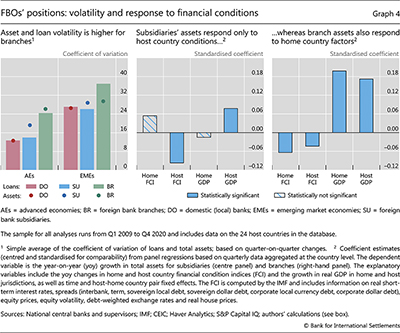

Evidence based on the new cross-country bank-level database is consistent with the notion that branches are less stable in their lending than subsidiaries. We see this by comparing the volatility of branches' loan growth with that of subsidiaries.7 While subsidiaries resemble local banks, the loan volatility of branches is about 75% and 41% higher than that of subsidiaries in AE and EME hosts, respectively (Graph 4, left-hand panel). This difference is statistically significant. A similar picture emerges for total assets, although the difference between branches and subsidiaries becomes statistically not significant.

The evolution of assets also shows that subsidiaries are sensitive to host country developments, whereas branches are more tightly linked to conditions abroad. Subsidiaries' assets respond to local conditions – both financial, as proxied by an index of financial conditions, and real, as proxied by real GDP growth (Graph 4, centre panel). However, they appear relatively insensitive to parent country conditions, in line with their greater reliance on local funding, exposure to local credit risk and stronger legal and regulatory insulation from their parents. Branch asset growth, by contrast, is more sensitive to home country financial and economic conditions, while also being affected by host country conditions (Graph 4, right-hand panel). This suggests that branches pose a higher risk of transmitting foreign shocks, consistent with the findings of Avdjiev et al (2019).

Branch liquidity management and host supervision

Several host authorities have expressed concern about the behaviour of branches (Faykiss et al (2013), Turtveit (2017)). In addition to branches' responsiveness to home country conditions and the greater procyclicality of the wholesale funding they rely on, host supervisors have limited influence over branches' balance sheets. Hosts are typically not the primary supervisors for branches, nor do they generally receive standard supervisory information on the global strength and risk profiles of branch parents.

Reflecting these concerns, in recent years some host supervisors appear to have introduced measures to tighten control over branch operations. While these are often informal and difficult to observe directly,8 effective measures should leave their imprint on FBO balance sheets. For one, pressures to tighten control over branches' liquidity positions should result in higher liquidity ratios. In addition, supervisory measures could also be reflected in reduced intragroup borrowing and lending, hence containing the transmission of shocks between branches and their parents and affiliates.

Trends in liquidity ratios suggest that AE host supervisors have exerted greater influence on foreign branches than that exerted by EME hosts. Foreign branches in AEs went from having lower liquidity ratios than both foreign subsidiaries and local banks in 2010, to having the highest ratios by 2020 (Graph 5, left-hand panel).9 Branches in EMEs, by contrast, have cut their liquidity ratios over the past decade, while foreign subsidiaries have maintained them at low levels (Graph 5, centre panel).

Given their limited cross-border reach, host authorities closely watch the scale of branches' intragroup liquidity management. For the few host jurisdictions that report branches' intragroup balances in the FBO database,10 gross intragroup positions have declined on average relative to FBOs' total balance sheets (Graph 5, right-hand panel). This general trend – which is similar in both AEs and EMEs – is consistent with an attenuation of international branch networks, perhaps reflecting stricter host supervision. The sharp decline in branches' net intragroup assets, particularly in AE host countries, may indicate increased funding from parents or affiliates in other jurisdictions. Alternatively, it may reflect the desire of host authorities to insulate the local office from the credit risk of its parent and other overseas affiliates.

Conclusion

The footprint and behaviour of international banks' various FBOs remain key to understanding global bank business models, capital flows and the cross-border transmission of financial stress. Analysts have long understood that branches and subsidiaries differ in their strategic purpose and behaviour, and their response to and amplification of stress in the international financial system.

The database introduced in this feature provides a new lens for studying global banks' local presence. Branches and subsidiaries have long coexisted, although the weight of subsidiaries has declined somewhat in relative terms. Differences between the balance sheet structures of branches and subsidiaries hold across a broad set of AEs and EMEs, reflecting the fundamentally distinct strategic roles of the two forms of international presence. Branches are more volatile providers of credit than subsidiaries, responding more strongly to conditions in home countries. Even though policy measures can be difficult to detect in the data, empirical patterns suggest that AE host supervisors are effectively tightening controls on branches, with evidence for EME hosts more mixed.

Ultimately, bank strategies and public policy should aim to strike an appropriate balance between the benefits and risks of global banks' integration. While periods of financial stress underscore the attractiveness of preventive ring-fencing, the optimal level of integration over a complete financial cycle is still not clear (Claessens (2019), FSB (2019)). However, more granular information, available to both home and host regulators, could allow a better balance between the efficiency of operations and risk mitigation. Two important steps forward in this respect are the development and publication of contingency plans for the resolution of complex international banking groups, and banks' (confidential) contributions to cross-border exposure databases. Standardised information on the positions of banking groups' foreign subsidiaries and branches would represent a further advance.

References

Albertazzi, U and M Bottero (2013): "The procyclicality of foreign bank lending: evidence from the global financial crisis", Bank of Italy, Working Papers, no 926.

Aldasoro, I, B Hardy and M Jager (2022): "The Janus face of bank geographic complexity", Journal of Banking & Finance, vol 134, January.

Avdjiev, S, U Aysun and R Hepp (2019): "What drives local lending by global banks?", Journal of International Money and Finance, vol 90, pp 54–75.

Caparusso, J, Y Chen, P Dattels, R Goel and P Hiebert (2019): "Post-crisis changes in global bank business models: a new taxonomy", IMF Working Papers, WP/19/295.

Cerutti, E, G Dell'Ariccia and M Martinez Peria (2007): "How banks go abroad: branches or subsidiaries?", Journal of Banking & Finance, vol 31, no 6, pp 1669–92.

Cerutti, E, C Koch and S Pradhan (2018): "The growing footprint of EME banks in the international banking system", BIS Quarterly Review, December, pp 27–36.

Cerutti, E and H Zhou (2017): "The global banking network in the aftermath of the crisis: is there evidence of de-globalization?", IMF Working Papers, WP/17/232.

Cetorelli, N and L Goldberg (2011): "Liquidity management of U.S. global banks: internal capital markets in the great recession", NBER Working Papers, no 17355.

--- (2012): "Banking globalization and monetary transmission", Journal of Finance, vol 67, no 5.

Claessens, S (2019): "Fragmentation in global financial markets: good or bad for financial stability?", BIS Working Papers, no 815.

Claessens, S, and N van Horen (2014): "Foreign banks: trends and impacts", Journal of Money, Credit and Banking, vol 46, no s1, February.

Committee on the Global Financial System (CGFS) (2010): "Funding patterns and liquidity management of internationally active banks", CGFS Papers, no 39.

Danisewicz, P, D Reinhardt and R Sowerbutts (2017): "On a tight leash: does bank organizational structure matter for macroprudential spillovers?", Journal of International Economics, vol 109, pp 174–94.

De Haas, R and I van Lelyveld (2010): "Internal capital markets and lending by multinational bank subsidiaries", Journal of Financial Intermediation, vol 19, pp 1–25.

Faykiss, P, G Grosz and G Szigel (2013): "Transforming subsidiaries into branches – should we be worrying about it?", MNB Occasional Papers, no 106.

Fiechter, J, I Otker-Robe, A Ilyina, M Hsu, A Santos and J Surti (2011): "Subsidiaries or branches: does one size fit all?", IMF Staff Discussion Note, no 11/14.

Fillat, J, S Garett and A Smith (2018): "What are the consequences of global banking for the international transmission of shocks? A quantitative analysis", NBER Working Papers, no 25203.

Financial Stability Board (FSB) (2019): "FSB Report on Market Fragmentation", June.

Forbes, K, D Reinhardt and T Wieladek (2016): "Banking de-globalization: a consequence of monetary and regulatory policies?", in "Macroprudential policy", BIS Papers, no 86, pp 49–56.

Hills, R, J Hooley, Y Korniyenko and T Wieladek (2015): "International banking and liquidity risk transmission: lessons from the United Kingdom", Bank of England, Staff Working Papers, no 562.

Hoggarth, G, J Hooley and Y Korniyenko (2013): "Which way do foreign branches sway? Evidence from the recent UK domestic credit cycle", Bank of England, Financial Stability Papers, no 22.

Jeon, B, M Olivero and J Wu (2013): "Multinational banking and the international transmission of financial shocks: evidence from foreign bank subsidiaries", Journal of Banking and Finance, vol 37, pp 952–72.

McCauley, R, P McGuire and G von Peter (2010): "The architecture of global banking: from international to multinational?", BIS Quarterly Review, March, pp 25–37.

McCauley, R, A Bénétrix, P McGuire and G von Peter (2019): "Financial deglobalisation in banking?", Journal of International Money and Finance, vol 94, pp 116–31, June.

McGuire, P and G von Peter (2016): "The resilience of banks' international operations", BIS Quarterly Review, March, pp 65–78.

Turtveit, L (2017): "Branches of foreign banks and credit supply", Norges Bank Economic Commentaries, no 3.

Wong, E, A Tsang and S Kong (2014): "Implications of liquidity management of global banks for host countries – evidence from foreign bank branches in Hong Kong", HKIMR Working Papers, no 21/2014.

1 The authors thank Claudio Borio, Stijn Claessens, Marc Farag, Bryan Hardy, Patrick McGuire, Hyun Song Shin, Nikola Tarashev and Philip Wooldridge for valuable comments and suggestions, and Swapan-Kumar Pradhan and Max Yarmolinsky for excellent research assistance. The views expressed in this article are those of the authors and do not necessarily reflect those of the Bank for International Settlements or the International Monetary Fund (IMF), its Executive Board, or IMF management.

2 The key exceptions to local funding are the periodic yet infrequent equity capital injections from and distributions to subsidiaries' parent entities.

3 Throughout this feature, calculations of average shares are on a volume-weighted basis, with balances for each country expressed in US dollars at current exchange rates. The stylised facts and results presented are robust to accounting for exchange rate valuation effects.

4 The balance sheets of foreign branches in the United Kingdom differ sharply from those in other countries, with a far higher proportion of deposits (around 70% of liabilities, compared with about 40% in the United States and Germany and 22% in Japan). The probable reason is that, until recently, retail deposits in foreign branches of banks headquartered in the European Economic Area were insured by their home country deposit insurance scheme. With access to such insurance, many branches in the United Kingdom developed local deposit and lending relationships resembling those of subsidiaries or local banks (Hoggarth et al (2013)).

5 These developments are the cornerstone of a "banking deglobalisation" narrative that suggests a diminished role for banking in international capital flows (Forbes et al (2016)). The precipitous post-GFC decline in cross-border credit was due mostly to banks headquartered in a handful of European jurisdictions.

6 These patterns remain when the comparison is with respect to the parents. Between end-2010 and end-2020, branches' share of parents' consolidated assets rose from 1.3% to 2.9% for the banks in the sample. Over the same period, subsidiaries' share remained flat at 1.5% of total consolidated assets.

7 The data include local and cross-border lending, without distinction.

8 This includes both formal and informal measures. Explicit initiatives, including liquidity rules and ring-fencing of assets into subsidiaries (sometimes referred to as "structural subsidiarisation"), have been enacted in only a few jurisdictions, primarily the United States and the European Union.

9 This development may also partly reflect the introduction of the Liquidity Coverage Ratio (LCR) along with the Basel III reforms. The LCR applies to internationally active banks on a consolidated basis, although jurisdictions are free to apply it at a subconsolidated level should they wish to do so.

10 Nine jurisdictions report gross positions (ie both "due from" and "due to" related offices) and one jurisdiction reports only net positions.