Open-ended bond funds: systemic risks and policy implications

Alongside other non-bank financial intermediaries, open-ended funds that invest in bonds ("bond OEFs") have grown rapidly over the past two decades. Besides their size, their business model and role in recent events suggest that bond OEFs can amplify stress in financial markets. The March 2020 market turmoil tested the effectiveness of bond OEFs' tools in dealing with large investor redemptions in the presence of liquidity mismatches. Their tools notwithstanding, bond OEFs had to liquidate assets on an elevated scale, thus collectively adding to bond market pressures. Without central bank interventions, broader fire sale dynamics could have been triggered. Regulation that takes a macroprudential perspective of the sector could support financial stability by ensuring that tools internalise the effect of spillovers arising from bond OEFs' actions.1

JEL classification: G01, G23, G28, C72

The March 2020 market turmoil revived concerns about the amplification of financial stability risks by non-bank financial intermediaries, including open-ended bond funds ("bond OEFs"). A bond OEF pools capital to invest in fixed income instruments – corporate and other bonds – while typically granting its investors the right to redeem their shares for cash on a daily basis. Through this liquidity transformation, bond OEFs collectively can give rise to financial stability risks. During the early days of the Covid19 pandemic, bond OEFs experienced intensive but short-lived outflows amid a significant decline in market liquidity and high valuation uncertainty. Conditions remained tense until major central banks stepped in to backstop bond markets.

This episode has sparked a discussion about bond OEFs' resilience, the comprehensiveness of their liquidity management tools, especially in times of stress, and the tools' adequacy for financial stability more broadly. Advocates of the current industry setup point to the swift market recovery and the reversal of fund outflows that followed the turmoil of March 2020. Critics, pointing to previous, similar episodes, question bond OEFs' ability to withstand large shocks without public sector support and call for these funds' regulation to be revisited.

Key takeaways

- Open-ended bond funds, which have grown substantially since the Great Financial Crisis, have tools to manage investor redemptions, but these are not necessarily designed to support financial stability.

- During the March 2020 market turmoil, redemptions were elevated and led to procyclical asset sales that added to pressures on bond prices and liquidity conditions, even though liquidity management tools were widely used.

- New macroprudential measures, such as countercyclical liquidity buffers, and a comprehensive adjustment of existing tools could bolster the resilience of the bond fund sector.

In this special feature, we analyse redemption dynamics and bond OEFs' response during the March 2020 turmoil, asking whether funds' existing liquidity management tools are conducive to financial stability. Our focus is on actively managed high-yield, investment grade and general bond OEFs. Given their liquidity transformation, these OEFs employ several tools to manage the risk of large redemptions, such as holding liquidity buffers or using swing pricing. We find, however, that bond OEFs' lines of defence did not prevent spillovers across funds and procyclical asset sales.

The experience with bond OEFs during periods of financial turmoil and these funds' systemic importance call for revisiting the regulation of their liquidity management. Bond OEFs are exposed to the risk of concerted investor redemptions or strained market liquidity, which could lead to procyclical fire sales (ESRB (2021)). Macroprudential responses could include introducing new countercyclical tools and strengthening existing liquidity management tools.

We organise our analysis in three sections. In the first, we describe bond OEFs, outline their lines of defence against large investor redemptions and discuss how these mechanisms may or may not prevent shocks from propagating through the financial system. In the second, we review the March 2020 market turmoil, analyse how the drivers of fund flows during the turmoil differ from those in normal times, and study the effectiveness of bond OEFs' tools in mitigating large redemptions and related fire sales. In the final section, we discuss policy options, considering requirements for an effective macroprudential toolkit for bond OEFs.

Bond OEFs and liquidity risk management

Bond OEFs are collective investment vehicles that hold portfolios of debt securities. They complement bank lending by providing an additional source of funding to financial and non-financial corporates, allowing borrowers to diversify their funding mix. For investors, bond OEFs offer diversified exposures at comparatively low cost.

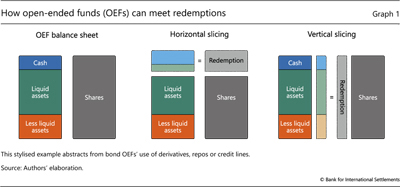

A bond OEF's liquidity mismatch drives its response to investor redemptions. Graph 1 provides a stylised illustration of this. In its simplest form, the balance sheet consists of cash and securities holdings on the asset side, with an equivalent amount of issued shares on the liability side (left-hand panel). Bond OEF shares can be redeemed at market value and at short notice, often daily. By contrast, the securities investments are less liquid, resulting in a mismatch. Unlike banks, which, in principle, can collectively expand their balance sheets and thus provide liquidity on demand to other sectors (McLeay et al (2014)), bond OEFs cannot elastically meet demand for cash because their shares are not a means of payment. And unlike exchange-traded funds (ETFs), bond OEFs typically do not "redeem in kind", ie pass on their assets to investors or dedicated financial intermediaries (Shim and Todorov (2021)), which would alleviate liquidity pressures. When net redemptions reduce the amount of outstanding shares, bond OEFs need to pay out in cash, either from an available buffer or after liquidating assets.

Given their liquidity mismatch, bond OEFs rely on a broad set of tools to manage large redemptions, some improving funds' redemption capacity and others reducing investors' redemption incentives. The first line of defence rests on cash and other liquid buffers. A fund's management choses the portfolio share that it holds as cash or invests in highly liquid securities (eg short-maturity sovereign bills and bonds) based on the bond OEF's characteristics (eg investment strategy and focus) and perceived redemption risks (eg investor composition and profiles). Clearly, in doing so, each fund faces a trade-off. While a high liquidity buffer reduces the need to sell less liquid assets in response to large redemptions, it also weighs on the fund's returns during normal times, thus putting the fund at a competitive disadvantage.

For a given liquidity buffer, the cash management styles used to address redemptions can be classified into two contrasting types: "horizontal slicing" (also referred to as the "waterfall approach") and "vertical slicing". Under horizontal slicing, the fund manager starts by using the existing cash and selling the most liquid assets (Graph 1, centre panel). Under vertical slicing, the fund manager sells assets in proportion to their corresponding weights in the fund's portfolio (right-hand panel).

Neither approach fully addresses redemption pressures since each can give rise to a first-mover advantage, although through different channels. While horizontal slicing helps contain selling of relatively illiquid assets in a possibly strained market, it exposes the investors remaining with the fund to increased liquidity risk. The anticipation of this approach may thus lead more investors to swiftly redeem their shares, reinforcing the redemption pressure on the bond OEF. In turn, vertical slicing leaves the average liquidity of the portfolio unchanged but may amount to selling less liquid assets into already strained markets. Unless the corresponding costs are charged to the redeeming investors, the expected dilution of the fund could prompt the remaining investors to redeem their shares ahead of others.

Since the first-mover advantage is inherently destabilising, even for a single bond OEF, a second line of defence seeks to encourage redeeming investors to internalise the costs of their redemptions. It comprises price tools, such as swing pricing, anti-dilution levies and dual pricing, as well as quantity tools, such as redemption gates and the temporary suspension of redemptions (eg IOSCO (2018)).

Swing pricing is the most prevalent tool and has received the most attention.2 While primarily designed as an anti-dilution mechanism, it enables the bond OEF to reduce the first-mover advantage by adjusting the redemption price according to the redemption size. If the fund exhibits net redemptions above a pre-defined threshold, the share price on that day is reduced by a swing factor set in advance by the management company.3 If set high enough, the swing factor can reduce the first-mover advantage. However, since it is difficult to estimate the price impact and transaction costs of sales during episodes of market stress, swing factors typically rely on rough measures. In addition, swing factors and thresholds are typically not disclosed to investors on a regular basis. Given these various ambiguities, investors may still perceive a strong first-mover advantage, especially at times of unusual stress.

By preventing investors from redeeming their shares, quantity tools such as redemption gates or the temporary suspension of redemptions directly relieve pressure from the fund to raise cash. Yet the prospect of such restrictions could also set off self-reinforcing redemptions. Investors observing a decline in the fund's liquidity position could exit pre-emptively, as has been documented for money market funds (FSB (2021)). Moreover, failure to meet redemptions in full could be perceived as indicating fund weaknesses. This suggests that fund managers could refrain from deploying such tools in order to avoid reputational damage (IOSCO (2018)).

Their liquidity management tools notwithstanding, two factors raise concerns that bond OEFs may contribute to systemic risk.4 One is the size of the industry. Bond OEF assets under management have outpaced even the strong growth in corporate issuance since the Great Financial Crisis. They now represent about 18% and 17% of the outstanding corporate bonds in the United States and euro area, respectively – up from 7% and 8% in 2008. A disruption of bond OEFs could thus result in a severe tightening of corporate funding conditions.

- Avalos, F and D Xia (2021): "Investor size, liquidity and prime money market fund stress", BIS Quarterly Review, March, pp 17–29.

- Schrimpf, A, I Shim and H S Shin (2021): "Liquidity management and asset sales by bond funds in the face of investor redemptions in March 2020", BIS Bulletin, no 39, March.

- Shim, J and K Todorov (2021): "ETFs, illiquid assets, and fire sales", BIS Working Papers, no 975, November.

The second cause for concern is that, in the presence of large redemptions, inherent liquidity mismatches and the constraints imposed by the structure of bond OEF balance sheets can lead to destabilising behaviour and fire sale dynamics. The liquidity management tools are primarily geared towards managing risks at the fund level, with little weight given to broader market impact. Since the bond OEF sector is unable to generate liquidity, cash-raising in response to large redemptions can lead to a fire sale of assets (eg Goldstein et al (2017); Feroli et al (2014); Chen et al (2010)). Such fire sales could depress specific bonds' market valuations and thereby propagate shocks to other market participants with similar bond exposures (eg Jiang et al (2020); Manconi et al (2012)).5

Several factors increase the likelihood of fire sales and their impact. One stems from highly correlated holdings across funds – arising, for instance, from the targeting of common benchmarks – which would lead to the offloading of similar assets during stress. Another is the use of similar risk models and monitoring frameworks, making funds react similarly to market signals. Yet another factor is leverage via bond OEFs' use of derivatives, which can lead to concerted spikes in margin calls and hence cash needs during periods of high market volatility (eg Fache Rousová et al (2020)). A fourth factor is the reduction in dealers' intermediation capacity relative to the size of the market in recent years (eg Adrian et al (2017)), which implies that funds could face steeper discounts when trying to sell bonds en masse.

Bond OEFs during the March 2020 market turmoil

We revisit the market turmoil of March 2020 in order to assess the drivers of redemptions from actively managed bond OEFs and study these funds' use of liquidity management tools. Our analysis covers Undertakings for Collective Investments in Transferable Securities (UCITS) registered in Luxembourg, home to one of the largest OEF industries globally. We build on two data sets: a "broad" and a "survey" sample, which provide broader coverage and more detail, respectively.

The broad sample contains monthly data on fund characteristics from Refinitiv Lipper and daily flow data from Bloomberg. It is combined with semiannual supervisory information. Reporting funds have either more than €500 million of total net assets (TNA) or high leverage (above 2.5 times TNA, based on notional amounts). This sample comprises around 550 UCITS (henceforth, bond OEFs), with total TNA of around €690 billion in the run-up to the turmoil.6 The OEFs are categorised in three broad classes: high-yield (HY), investment grade (IG) and general bond funds.

The survey sample originates from a supervisory data collection. It contains detailed daily information on up to 57 UCITS for the first half of 2020, including granular data on swing pricing and cash balances. Total TNA of the OEFs in the survey sample was about €77 billion just before the turmoil.

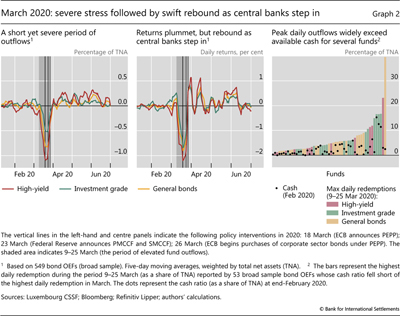

We start by documenting the scale and dynamics of redemptions in the broad sample. Up to the first week of March 2020, bond OEFs appeared broadly immune to the Covid-19-related uncertainty that had weighed on investor risk appetite earlier in the year (eg BIS (2020); FSB (2020)). Average net flows hovered around zero.

The second week of March, however, marked a sudden break. Daily outflows accelerated quickly amid fast declining returns (Graph 2, left-hand and centre panels). By 25 March, within just 16 days, cumulative net outflows had grown to about 6% of TNA. Some funds experienced daily outflows of more than 10% (right-hand panel).7 Stress was widespread, with developments closely mimicking the patterns observed for UK and US bond OEFs (eg Bank of England (2021), Falato et al (2021)).

The turmoil was short-lived, with markets rebounding in response to a series of central bank interventions. On 18 March, the ECB announced that, starting on 26 March, it would purchase up to €750 billion worth of bonds under its Pandemic Emergency Purchase Programme (€600 billion were added in June). On 23 March, the Federal Reserve announced the introduction of the Primary Market Corporate Credit Facility (PMCCF) and Secondary Market Corporate Credit Facility (SMCCF), specifying on 9 April that the combined size of the facilities would be up to $750 billion. These interventions, alongside other public sector support measures, not only provided backstops to markets where bonds in OEFs' portfolios were traded but also restored general investor confidence. Thus, they supported bond valuations more broadly and eased redemptions (eg Gilchrist et al (2021); Breckenfelder et al (2021)).

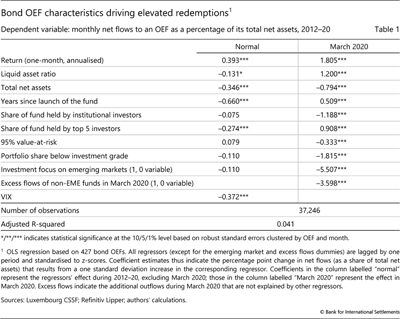

We find that bond OEF investors differentiate across funds according to several factors. Table 1 reports the coefficient estimates from multivariate regressions of monthly net fund inflows on several candidate explanatory variables, distinguishing between effects during normal market conditions and those in March 2020. For instance, the left-hand column shows that in normal times, all else equal, funds with a return that is one standard deviation below the sample mean (ie with an annualised monthly return of –0.7% as opposed to the sample mean's return of 0.9%) face extra net outflows of about 0.4 percentage points of TNA. In addition, older funds or those with larger TNA would typically experience smaller inflows.

In March 2020, bond OEF characteristics affected fund flows differently than during normal market conditions (Table 1, right-hand column). In that month, funds' lower returns made investors much more prone to redeem, consistent with the findings in Carpantier (2021). Whereas in normal times, lower asset liquidity matters little for net flows, it was of great concern to investors during the turmoil, leading to large outflows from funds with less liquid portfolios. Also different from normal times, bond OEFs with a larger share of institutional investors exhibited greater outflows in March 2020 than their peers. This is similar to dynamics observed for money market funds at the time (eg Avalos and Xia (2021)) and consistent with institutional investors monitoring conditions more closely than retail investors. At the same time, bond OEFs where few investors held a large share of the fund faced smaller outflows, suggesting that large investors internalise the effect of their redemptions more, consistent with prior research (eg Chen et al (2010)). Importantly, higher credit and market risks, as measured by value-at-risk, a larger share of lower-rated securities and greater exposures to emerging market economies (see also the box), were associated with larger net outflows (including within fund asset classes, eg HY vs IG). These last findings suggest that the prospect of asset illiquidity also contributed to investors' redemptions.

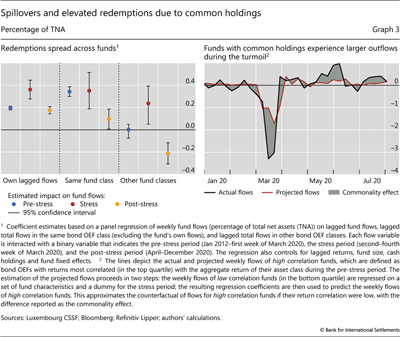

We find evidence of redemptions spreading across bond OEFs, including through asset price declines. Graph 3 (left-hand panel) depicts the relationship between fund redemptions and preceding flows to/from the same fund, other funds in the same class or funds in different classes. Examining this relationship over three distinct periods – pre-stress, stress and post-turmoil – suggests that the turmoil (red dots) stood out in terms of momentum in redemption activity (first triplet) and greater spillovers across similar funds and different fund classes (second and third triplets). This is consistent with spillovers throughout the bond OEF sector, as also documented for US bond OEFs during this period (Falato et al (2021)).

Similarity in funds' exposures seems to also have been a driver of redemption spillovers. Outflows were greater for bond OEFs whose returns co-move more strongly with the aggregate returns of funds in the same asset class (Graph 3, right-hand panel). This suggests that common holdings or benchmarking across funds added to redemption dynamics, with the attendant asset sales depressing the valuations of bonds. This could have spilled over to the returns of other funds.

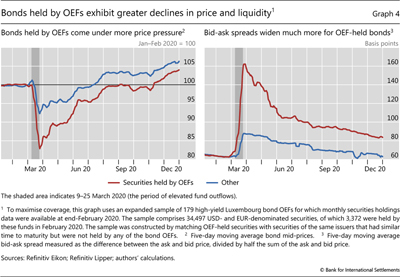

Consistent with the notion of fund-driven fire sales, bonds owned by OEFs at the onset of the turmoil underperformed comparable bonds of the same issuers and displayed worse liquidity during the turmoil. For instance, prices of bonds held by HY bond OEFs declined by an additional 10 percentage points on average relative to those of comparable bonds during the period of elevated fund outflows (Graph 4, left-hand panel). Likewise, the bid-ask spreads for assets held by HY bond OEFs increased nearly twice as much as those observed for similar bonds at the height of the turmoil (right-hand panel). The differences in prices and spreads persisted for several months.

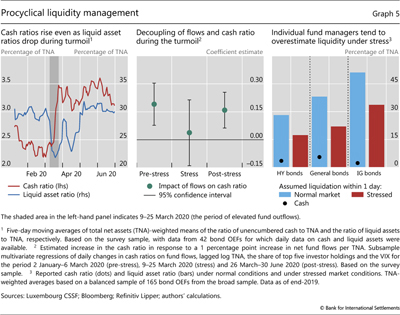

Using the detailed survey sample, we assess the performance of bond OEFs' first line of defence through the behaviour of two metrics. The first is the ratio of unencumbered cash to TNA ("cash ratio"), which provides a narrow measure of immediately available liquidity. The second is the "liquid assets ratio", which is the share of securities in the portfolio that can be liquidated within one day or less according to the fund manager's own classification.

Despite the elevated redemptions in March 2020, bond OEFs actually raised their cash ratios (Graph 5, left-hand panel). This suggests that funds liquidated more assets than needed to meet the redemptions alone. Such procyclical behaviour is consistent with prior research on cash hoarding by fund managers during periods of stress (eg Schrimpf et al (2021); Morris et al (2017)). Indeed, the relationship between fund flows and cash ratios changed during the turmoil (centre panel).

By contrast, funds' (self-reported) liquid asset ratio declined in March 2020 (Graph 5, left-hand panel). This means that bond OEFs sold some of their non-cash liquid assets to boost their cash ratios, tallying with findings for US OEFs (Ma et al (2020)) and suggesting a horizontal slicing approach.8

In interpreting the above results, it is important to keep in mind that each individual bond OEF may overstate its assets' liquidity. Supervisory data of bond OEF reports during normal market conditions, and for some funds under a self-selected stress scenario, show that funds classify many bonds as highly liquid (Graph 5, right-hand panel). At end-2019, HY bond fund managers assumed that 28% of assets could be liquidated within one day or less, with this number remaining as high as 17% in a stress scenario. This corresponds to asset sales equivalent to €19 billion and €12 billion, respectively. For the broad sample, bond OEFs assumed that they could collectively sell more than €300 billion (or 45% of their TNA) within one day under normal conditions, suggesting strong reliance by funds on their first line of defence. But, as shown in March 2020, these assumptions underestimate the adverse effects of collective sales on market liquidity in times of stress.

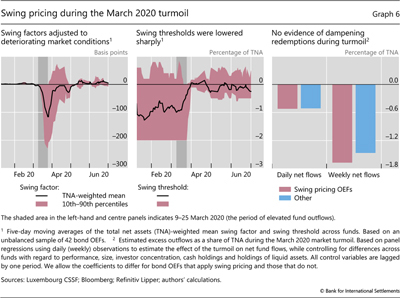

Turning to the second line of defence, bond OEFs intensified their usage of swing pricing during the turmoil and adjusted swing pricing parameters to mitigate dilution. While the average swing factor for the survey sample hovered around zero before the turmoil, it increased by more than 100 basis points on average during the market stress (Graph 6, left-hand panel). Funds also lowered swing thresholds, on average from net outflows of 1% of TNA before the turmoil to less than 0.5% (centre panel).

Despite the adjustments in the swing factors and thresholds, we find no evidence of a dampening effect on investor redemptions in March (Graph 6, right-hand panel). The estimated effect of swing pricing on daily net outflows is insignificant in regressions that control for fund characteristics and market conditions. In fact, funds that apply swing pricing exhibited somewhat larger net outflows on a weekly basis. That said, these funds recouped roughly 0.06% of TNA on average from investors redeeming during the three weeks of elevated redemptions.

The swing factor might have been too modest to dissuade redemptions in this episode, in contrast to the dampening effect documented during more tranquil market conditions (Lewrick and Schanz (2017)). As liquidity in corporate bond markets evaporated, the pricing of bonds and the assessment of their liquidation costs became increasingly difficult. The swing factors may have thus fallen short of what investors perceived to be the true impact of liquidating assets on the funds' share price (Bank of England (2021)). The gap between the net asset value (NAV) per share and secondary market price of HY bond ETFs, for example, exceeded 800 basis points at the height of the turmoil, suggesting steep discounts on the underlying bonds (eg Shim and Todorov (2021); Aramonte and Avalos (2020)). Bonds' illiquidity may have also led to predictable declines in funds' share prices (Choi et al (2021)), many bond OEFs exhibited several days of consecutive price reductions during the height of the turmoil, which may have dominated the effect of the swing factor.

Lastly, the bond OEFs in our sample made relatively little use of quantity-based forms of defence. Only two management companies reported temporary suspensions of redemptions. In line with the findings in Grill et al (2021), these companies attributed their decision to the difficulty of pricing assets, which made it hard to have an objective basis for payouts, rather than to imminent redemption pressures.9

Conclusion: integrating a macroprudential perspective

The March 2020 episode revived concerns about the potential for OEFs to contribute to systemic risks. Even though it is notoriously difficult to disentangle the individual drivers of system-wide stress, the scale of fund redemptions indicated the pressure on OEFs to sell assets in increasingly illiquid markets. Decisive policy interventions to backstop bond markets quickly relieved pressure. At the same time, such interventions may nurture expectations of future policy support and provide the breeding ground for the build-up of new risks.

The turmoil raised questions about whether bond OEFs' own lines of defence can prevent the potential amplification of risks during periods of stress. Funds are more than a mere pass-through of investments: they provide liquidity to their investors. This liquidity provision hinges on a portfolio rebalancing, selling assets to raise cash. Large redemptions can then give rise to a first-mover advantage at the fund level: each fund benefits from selling ahead of the others. Since buyers are few in such a scenario, the liquidity of the underlying assets is impaired, with adverse spillovers.

Addressing this collective action problem calls for incorporating systemic considerations into bond OEFs' lines of defence. Adjusting existing tools could strengthen funds' resilience. Liquidity buffers could be expanded by a countercyclical add-on during times of ostensibly ample liquidity and released during periods of stress to provide leeway to OEFs. In addition, bond OEFs could be obliged to collectively move to redemption terms that are more closely aligned with the liquidity profile of their portfolio. This could, for example, include the introduction of notice periods that take account of negative externalities associated with large sales by individual funds and concerted selling by many funds under stress scenarios. For some bond OEFs, emulating ETF features, such as redemptions in kind supported by financial intermediaries to mitigate liquidity stresses, could be an alternative approach to enhance resilience. Swing pricing parameters, in turn, could be calibrated in a more comprehensive way to take account of the market-wide volume of potential sales. Notably, swing factors could be higher during periods of market stress to account for the impact of concerted selling.

Macroprudential tools would ideally be combined to meet several objectives. First, they would be stringent enough to help ensure liquidity mismatches are adequately managed and do not give rise to externalities. Second, they would help to identify and address systemic risks in the cross-section of bond OEFs. Third, they would materially support the liquidity of funds facing large redemptions. Finally, to serve as effective gatekeepers, the tools would be "usable" during episodes of stress both from a regulatory perspective and from the point of view of the fund manager and investors (Borio et al (2020)).

Policy efforts at the national and international level to strengthen the resilience of bond OEFs and other non-bank financial intermediaries are under way (eg Financial Stability Board (2020, 2021)). Clearly, expanding the macroprudential framework to fully integrate bond OEFs will raise implementation challenges and require cost-benefit considerations. Yet the important role that bond OEFs play in funding the economy suggests that enhancing their resilience would yield significant macroeconomic benefits.

References

Adrian, T, N Boyarchenko and S Or (2017): "Dealer balance sheets and bond liquidity provision", Journal of Monetary Economics, vol 89.

Aramonte, S and F Avalos (2020): "The recent distress in corporate bond markets: cues from ETFs", BIS Bulletin, no 6, April.

Avalos, F and D Xia (2021): "Investor size, liquidity and prime money market fund stress", BIS Quarterly Review, March, pp 17–29.

Bank for International Settlements (2020): "A rude awakening for investors", BIS Quarterly Review, March, pp 1–15.

Bank of England (2021): Liquidity management in UK open-ended funds, March.

Borio, C, M Farag and N Tarashev (2020): "Post-crisis international financial regulatory reforms: a primer", BIS Working Papers, no 859.

Breckenfelder, J, N Grimm and M Hoerova (2021): "Do non-banks need access to the lender of last resort? Evidence from mutual fund runs", mimeo.

Cantú, C, P Cavallino, F De Fiore and J Yetman (2021): "A global database on central banks' monetary responses to Covid-19", BIS Working Papers, no 934.

Capponi, A, P Glassermann and M Weber (2020): "Swing pricing for mutual funds: breaking the feedback loop between fire sales and fund redemptions", Management Science, vol 66, no 8, pp 3295–798.

Carpantier, J-F (2021): "The impact of Covid-19 on large redemptions in the Luxembourg investment fund market", CSSF Working Paper, September.

Chen, Q, I Goldstein and W Jiang (2010): "Payoff complementarities and financial fragility: evidence from mutual fund flows", Journal of Financial Economics, vol 97, no 2, pp 239–62.

Chernenko, S and A Sunderam (2016): "Liquidity transformation in asset management: evidence from the cash holdings of mutual funds", NBER Working Paper, no 22391, July.

Choi, J, M Kronlund and J Oh (2021): "Sitting bucks: zero returns in fixed income funds", Journal of Financial Economics, vol 101.

European Systemic Risk Board (ESRB) (2021): A review of macroprudential policy in the EU in 2020, July.

Fache Rousová, L, M Gravanis, A Jukonis and E Letizia (2020): "Derivatives-related liquidity risk facing investment funds", ECB Financial Stability Review, May.

Falato, A, I Goldstein and A Hortaçsu (2021): "Financial fragility in the Covid-19 crisis: the case of investment funds in corporate bond markets", Journal of Monetary Economics, vol 123.

Feroli, M, A Kashyap, K Schoenholtz and H S Shin (2014): "Market tantrums and monetary policy", proceedings of the US Monetary Policy Forum 2014, Chicago Booth Initiative on Global Markets, pp 7–60.

Financial Stability Board (FSB) (2020): Holistic review of the March market turmoil, November.

--- (2021): Policy proposals to enhance money market fund resilience: final report, October.

Gilchrist, S, B Wei, V Yue and E Zakrajšek (2021): "The Fed takes on corporate credit risk: an analysis of the efficacy of the SMCCF", BIS Working Papers, no 963.

Goldstein, I, H Jiang and D Ng (2017): "Investor flows and fragility in corporate bond funds", Journal of Financial Economics, vol 126.

Grill, M, L Molestina Vivar and M Wedow (2021): "The suspension of redemptions during the COVID 19 crisis – a case for pre-emptive liquidity measures?", Macroprudential Bulletin Article, no 12.

International Monetary Fund (IMF) (2021): Investment funds and financial stability: policy considerations, September.

International Monetary Fund, Bank for International Settlements and Financial Stability Board (2009): Guidance to assess the systemic importance of financial institutions, markets and instruments: initial considerations, October.

International Organization of Securities Commissions (IOSCO) (2018): Open-ended fund liquidity and risk management – good practices and issues for consideration, final report, February.

Jiang, H, D Li and A Wang (2020): "Dynamic liquidity management by corporate bond mutual funds", Journal of Financial and Quantitative Analysis, vol 56, no 5.

Jin, D, M Kacperczyk, B Kahraman and F Suntheim (2021): "Swing pricing and fragility in open-end mutual funds", The Review of Financial Studies, forthcoming.

Lewrick, U and J Schanz (2017): "Is the price right? Swing pricing and investor redemptions", BIS Working Papers no 664, October.

Ma, Y, K Xiao and Y Zeng (2021): "Mutual fund liquidity transformation and reverse flight to liquidity", Jacobs Levy Equity Management Center for Quantitative Financial Research Paper.

Manconi, A, M Massa and A Yasuda (2021): "The role of institutional investors in propagating the crisis of 2007–2008", Journal of Financial Economics, vol 104.

McLeay, M, A Radia and R Thomas (2014): "Money creation in the modern economy", Bank of England Quarterly Bulletin, March.

Morris, S, I Shim and H S Shin (2017): "Redemption risk and cash hoarding by asset managers", Journal of Monetary Economics, vol 89.

Schrimpf, A, I Shim and H S Shin (2021): "Liquidity management and asset sales by bond funds in the face of investor redemptions in March 2020", BIS Bulletin, no 39, March.

Shim, J and K Todorov (2021): "ETFs, illiquid assets, and fire sales", BIS Working Papers, no 975, November.

1 The authors thank Iñaki Aldasoro, Matteo Aquilina, Claudio Borio, Wenqian Huang, Benoît Mojon, Andreas Schrimpf, Hyun Song Shin and Nikola Tarashev for valuable comments and suggestions, the Luxembourg CSSF for providing data, and Alan Villegas and Giulio Cornelli for excellent research assistance. All errors are our own. The views expressed in this article are those of the authors and do not necessarily reflect those of the BIS.

2 Roughly 80% of the bond OEFs studied in this special feature reported that they could apply swing pricing. For research on swing pricing, see eg Jin et al (2021), Capponi et al (2020) and Lewrick and Schanz (2017)). For policy discussions, see eg IMF (2021) and FSB (2020).

3 Swing pricing is also applied to reduce the dilution that may result from large inflows. In this case, the price per share is raised by the swing factor if net subscriptions exceed a preset threshold.

4 Systemic risk can be broadly defined as the risk of widespread disruption to the provision of financial services due to an impairment of all or parts of the financial system, potentially resulting in severely adverse consequences for the real economy (eg IMF-BIS-FSB (2009)).

5 OEFs can also spread risks to other market participants through financial interconnections. For instance, OEFs that manage their liquidity by investing in money market fund shares may opt to redeem these shares to raise cash during stressed market conditions, thereby transmitting the redemption pressure to money market funds.

6 This corresponds to about 18% of the total TNA of all UCITS registered in Luxembourg (ie equity and fixed income funds, including money market funds).

7 According to Carpantier (2021), 18% of bond, equity and mixed Luxembourg UCITS exhibited daily outflows of more than 10% at least once during the period from March to December 2020.

8 Consistent with the findings in Chernenko and Sunderam (2016), the bond OEFs in our analysis made little use of credit lines with banks – an additional source of cash – during the turmoil. Carpantier (2021) reports that only 2% (8%) of Luxembourg UCITS, including equity, bond and mixed funds, borrowed to meet daily (weekly) net redemptions that exceeded 10% (30%) of TNA.

9 Grill et al (2021) estimate that 68 bond OEFs in Europe suspended redemptions during the turmoil, on average for five days. These funds' TNA averaged €210 million (for a total of €14.3 billion), meaning that many of them did not meet the reporting thresholds for inclusion in our broad sample.