Yield curve inversion and recession risk

In mid-2019, long-term interest rates fell below short-term rates in a number of countries. In the United States, the spread between 10-year and three- month Treasury rates (henceforth, 10y-3m term spread) had already turned negative in late May and fell below -50 basis points in late August. In France, Germany and the United Kingdom, parts of the yield curve also inverted. While some market participants interpreted these developments as portending an imminent slowdown, exceptionally low term premia currently confound signals from the yield curve.

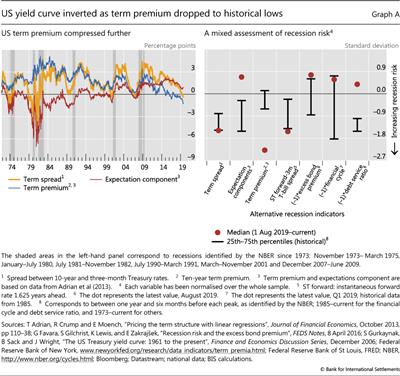

In the United States, an inverted Treasury yield curve has preceded all recessions since 1973. Each time the 10y-3m term spread turned negative during economic expansions, a recession ensued within the next two years (Graph A, left-hand panel).

A commonly cited reason for the predictive power of the 10y-3m term spread is that, when investors forecast weaker economic activity, they also anticipate more stimulative monetary policy and, in turn, lower future short-term rates. If concerns are strong enough, expected rates can be sufficiently low to push current long-term rates below current short-term rates, resulting in an inverted yield curve.

However, in addition to expectations of future short-term rates, long-term rates also reflect term premia, which can thus influence the curve's dynamics. Term premia are extra returns demanded by investors to compensate for risks associated with long-term bonds. These returns can be affected by imbalances in the supply of and demand for particular maturities, in which case they have little information about future economic prospects as such.

In fact, the recent inversion of the US Treasury curve has coincided with exceptionally subdued term premia. Term premia in the US Treasury market have been declining since the Great Financial Crisis, likely because of demand pressure from price-inelastic buyers such as central banks, pension funds and life insurers (Graph A, left-hand panel). Also, the current combination of a negative term premium and an easing monetary policy stance is unusual. During past episodes when the yield curve inverted, the monetary policy stance was tightening.

Also, the current combination of a negative term premium and an easing monetary policy stance is unusual. During past episodes when the yield curve inverted, the monetary policy stance was tightening.

Considering such complications, it is useful to examine other indicators of recession risk. In addition to the 10y-3m term spread, the literature has identified several other measures that can signal an impending economic slowdown. For example, a low near-term forward spread, a stretched excess bond premium and elevated financial cycle measures can signal high downside risk. The right-hand panel of Graph A compares current readings for these variables with their historical distributions before past downturns (in some cases, the variables have been multiplied by -1 so that low values point to high recession risk).

The right-hand panel of Graph A compares current readings for these variables with their historical distributions before past downturns (in some cases, the variables have been multiplied by -1 so that low values point to high recession risk).

The indicators we consider provide a mixed assessment of imminent downside risks to the economy. While the term premium is clearly well below typical pre-recession levels, rate expectations are currently well above. The other indicators also do not yield a clear consensus on recession risk.

A Estrella and F Mishkin, "Predicting US recessions: financial variables as leading indicators", Review of Economics and Statistics, vol 80, no 1, February 1998, pp 45-61, formally establish the relationship between the term spread and recession risk.

A Estrella and F Mishkin, "Predicting US recessions: financial variables as leading indicators", Review of Economics and Statistics, vol 80, no 1, February 1998, pp 45-61, formally establish the relationship between the term spread and recession risk.  See B Cohen, P Hördahl and D Xia, "Term premia: models and some stylised facts", BIS Quarterly Review, September 2018, pp 79-91.

See B Cohen, P Hördahl and D Xia, "Term premia: models and some stylised facts", BIS Quarterly Review, September 2018, pp 79-91.  See G Favara, S Gilchrist, K Lewis and E Zakrajšek, "Recession risk and the excess bond premium", FEDS Notes, 8 April 2016; E Engstrom and S Sharpe, "The near-term forward yield spread as a leading indicator: a less distorted mirror", Finance and Economics Discussion Series, 2018-055; and C Borio, M Drehmann and D Xia, "The financial cycle and recession risk", BIS Quarterly Review, December 2018, pp 59-71.

See G Favara, S Gilchrist, K Lewis and E Zakrajšek, "Recession risk and the excess bond premium", FEDS Notes, 8 April 2016; E Engstrom and S Sharpe, "The near-term forward yield spread as a leading indicator: a less distorted mirror", Finance and Economics Discussion Series, 2018-055; and C Borio, M Drehmann and D Xia, "The financial cycle and recession risk", BIS Quarterly Review, December 2018, pp 59-71.