Financial inclusion - issues for central banks

Financial inclusion - access to financial services - is increasing worldwide, often with official support. This special feature discusses the implications for central banks. Greater financial inclusion changes the behaviour of firms and consumers in ways that could influence the effectiveness of monetary policy. The impact on financial stability may depend on how any improvements in financial access are achieved. Risks may rise if greater financial inclusion results from rapid credit growth, or if relatively unregulated parts of the financial system grow quickly.1

JEL classification: E5, G2, O16.

Financial inclusion - access to financial services - varies widely across the globe. Even in some advanced economies, survey data suggest that almost one in five adults has no bank account or other form of access to the formal financial sector (Demirgüç-Kunt and Klapper (2012)). In many emerging and developing economies, the share of unbanked adults can be as high as 90%. But inclusion is likely to keep expanding in the coming years, supported by economic development and initiatives by central banks and other policymakers. In this special feature, we explore the implications of this trend for central banks.

For central banks, financial inclusion matters for a number of reasons. First, there is the impact of financial inclusion, and financial development more generally, on long-term economic growth and poverty reduction, and thus on the macroeconomic environment (see eg Burgess and Pande (2005) and Levine (2005)). Access to appropriate financial instruments may allow the poor or otherwise disadvantaged to invest in physical assets and education, reducing income inequality and contributing to economic growth.

Second, financial inclusion has important implications for monetary and financial stability, policy areas that sit at the very core of central banking. As this article will outline, increased financial inclusion significantly changes the behaviour of firms and consumers, in turn influencing the efficacy of monetary policy. For example, greater inclusion should make interest rates more effective as a policy tool and it may facilitate central banks' efforts to maintain price stability. Financial stability too may be affected, since the composition of savers and borrowers is altered. On the one hand, a broader base of depositors and more diversified lending could contribute to financial stability. On the other hand, greater financial access may increase financial risks if it results from rapid credit growth or the expansion of relatively unregulated parts of the financial system.

In this special feature, we first discuss measures of the level of financial inclusion, followed by policy actions intended to support access to financial services. We then outline some key implications of increased inclusion for monetary and financial stability before concluding.

How much financial inclusion is there?

Many definitions of financial inclusion have been suggested, based on characteristics that are symptomatic of broad access to financial services. Common elements of these definitions include "universal access" to a "wide range of financial services" at a "reasonable cost" (see eg Bhaskar (2013)).

To facilitate the discussion, we need to go beyond definitions to something that is easily quantifiable. In this article, we consider a variety of measures.

Let's look at individuals first. Our primary focus is on the share of adults with access to the formal financial sector, following Hannig and Jansen (2010) and Demirgüç-Kunt and Klapper (2013). We evaluate access to a range of financial services, including owning an account, saving at a financial institution and borrowing from one.

Cross-country survey data on financial inclusion are available from the World Bank Global Financial Inclusion (Global Findex) database, compiled from surveys of households in 148 countries. In what has become a widely quoted statistic, the World Bank data suggest that only 50% of adults globally had an account at a formal financial institution in 2011 (Demirgüç-Kunt and Klapper (2012)).2

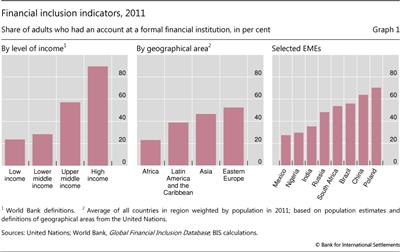

The degree of financial inclusion varies widely by region and income level. The share of adults who owned an account ranges from just above 20% on average in low-income countries to almost 90% in high-income economies (Graph 1, left-hand panel). Focusing on geographical regions with many emerging and developing economies, account ownership is lowest in Africa, with around 20% of adults financially included by that measure (Graph 1, centre panel). And within the largest emerging market economies (EMEs), the survey suggests that less than 40% of adults have an account in India, Mexico and Nigeria, while over 60% do so in China and Poland (Graph 1, right-hand panel).

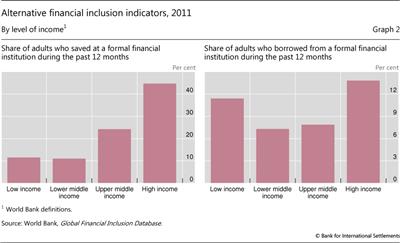

One essential element of financial inclusion is access to instruments that allow for saving or borrowing or both. The share of adults that reported saving at a formal financial institution during the 12 months preceding the survey is considerably greater in countries with higher income levels than in low-income economies (Graph 2, left-hand panel). In contrast, in terms of new borrowing, the numbers are more alike across the different income groups, and do not increase in lockstep with the level of income (Graph 2, right-hand panel).

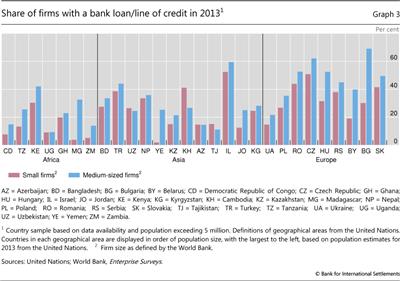

Consider firms next. Financial inclusion is central to firms' financing of production and purchases of capital goods, just as it helps households to smooth consumption. Through its Enterprise Surveys for a selection of countries, the World Bank collects data on the share of firms that have loans or credit lines at formal financial institutions. In many emerging and developing economies, less than 40% of small and medium-sized firms had a bank loan or line of credit in 2013 (Graph 3). Firms in emerging Europe tend to enjoy greater financial access than those in Africa and Asia. And, in countries across all three regions, substantially fewer small firms generally have access to credit than do medium-sized ones.

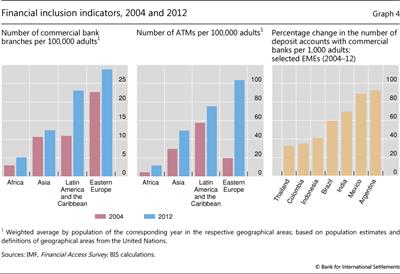

Data from IMF Financial Access Surveys3 suggest that there have been significant increases in financial inclusion over the past decade. In terms of the geographical outreach of financial services, the number of commercial bank branches per 100,000 adults increased from three to five during 2004-12 in Africa, and from 11 to 23 in Latin America and the Caribbean (Graph 4, left-hand panel). Meanwhile, the number of ATMs per 100,000 adults surged in eastern Europe (centre panel). More bank branches or ATMs should help to improve access: surveys report that "too far away" is an important barrier to having an account (Demirgüç-Kunt and Klapper (2012)). The use of financial services has increased as well, with the number of deposit accounts per 1,000 adults rising by over 30% in Colombia and Thailand and by over 80% in Argentina and Mexico (Graph 4, right-hand panel).4

All these data come with caveats. For example, the aggregate number of bank accounts is not the same as the number of depositors, since some individuals may have multiple accounts. Similarly, and relevant for any data on account ownership, some accounts may be dormant (Subbarao (2012)). Further, the share of adults who reported new borrowing in any given period may partly reflect a change in demand for financial services due to cyclical factors rather than improved access. And if new bank branches or ATMs are clustered in urban areas, they may do little to improve financial access in rural regions.

Policies supporting financial inclusion

Policymakers and regulators have taken a variety of steps to support financial inclusion at both the national and international level. Some have also sought to enhance financial literacy, while others have committed to achieving numerical inclusion targets.

Regulators in many jurisdictions have played a central role. For example, the Reserve Bank of India has relaxed the requirements for opening bank accounts, recommended the availability of accounts with a minimum number of functions and encouraged banks to expand their branch networks (see eg Bhaskar (2013)). Bangko Sentral ng Pilipinas (BSP) has sought to ensure that the regulatory environment supports greater inclusion, especially in the area of microfinance (BSP (2013)). And in many Latin American countries, including Brazil, Colombia and Peru, agent banking regulations have been passed to encourage "branchless banking", ie the delivery of financial services outside conventional bank branches (AFI (2012)).

International standard setters, including the Basel Committee on Banking Supervision and the Committee on Payments and Market Infrastructures, have addressed regulatory and supervisory issues. As an example, financial inclusion has been a driving force behind financial innovation (CPSS (2012)). Given the rapidly increasing range of products and service providers, a key supervisory concept is proportionality - calibrating regulatory and supervisory approaches according to the risks for the financial system (BCBS (2012), BCBS (2015)). New financial products may be taken up only slowly and present little risk to financial stability, at least initially. Proportionality should ensure that regulatory requirements do not unnecessarily stifle financial innovation at an early stage. But if new services take on a scale and economic significance that could pose potential financial stability risks, the regulatory response should be tightened accordingly.

Measures are being taken in many jurisdictions to improve financial literacy as more households join the formal financial system. Financial education can help consumers to manage their financial risks by ensuring that they can better judge their capacity to spend, save and borrow, as well as choose suitable financial services (Zeti (2005)). For instance, the Central Bank of Malaysia has an in-house centre that provides information about the financial services available to small and medium-sized enterprises, and the general public.

Finally, some national policymakers have committed to achieving financial inclusion targets. Internationally, over 60 central banks, plus other public sector institutions, from more than 90 countries are part of the Alliance for Financial Inclusion (AFI), a member-driven peer learning network. Some have agreed to quantifiable goals by signing the Maya Declaration. As an example, the Central Bank of Nigeria has committed to reducing the share of the adult population that is excluded from financial services from 46% to 20% by 2020, with additional specific targets for different types of key services (AFI (2014)).

Financial inclusion and monetary stability

An increase in financial inclusion interacts with monetary policy in two ways. First, it helps more consumers to smooth their consumption over time. This could potentially influence basic monetary policy choices, including which price index to target. Second, it encourages consumers to move their savings away from physical assets and cash into deposits. This may have implications for monetary policy operations and the role of intermediate policy targets.

Financial inclusion facilitates "consumption smoothing", as households are able to adjust their saving and borrowing in response to interest rate changes and unexpected economic developments. Of course, even with limited access to formal financial institutions, there are many ways for the financially excluded to smooth their consumption. They could build savings in the form of jewellery or other non-financial assets. Financially excluded farmers can trade livestock or other income-generating assets (see eg Rosenzweig and Wolpin (1993)) or they can adjust how much they work in response to shocks (see eg Jayachandran (2006)). As for borrowing, friends and family can act as important lenders in place of banks (see eg Banerjee and Duflo (2007)).

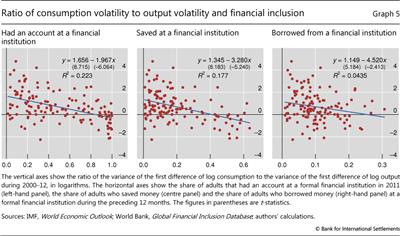

Still, access to the formal financial system does facilitate consumption smoothing. Consistent with this view, there is evidence that, across 130 economies, aggregate consumption growth is less volatile relative to output growth in countries where the share of financially included consumers is higher (Graph 5). This result holds for the three different measures of financial inclusion we consider, and is highly statistically significant, especially when we measure inclusion in terms of account ownership or saving at a formal financial institution.5

Constraints on the ability to smooth consumption due to financial exclusion have been shown to affect monetary policy along three dimensions. The first concerns the size of the interest rate response to shocks. One outcome from this line of research is that, the larger the share of financially excluded households, the stronger the required policy response to stabilise aggregate demand and inflation following a shock (eg Galí et al (2004)). That said, as always, this result is sensitive to assumptions about how the economy works (see eg Bilbiie (2008) and Colciago (2011)).

The second dimension relates to the trade-off between output and inflation volatility. Mehrotra and Yetman (2014) show that, as financial inclusion increases, the ratio of output volatility to inflation volatility should also rise if the central bank cares about both and sets monetary policy to optimise their trade-off. The intuition behind this result is that financially included consumers are better able than excluded consumers to adjust their saving and investment decisions to partially insulate their consumption from output volatility. Thus, as the degree of financial inclusion rises, central banks can focus more on stabilising inflation.6

The third dimension along which financial inclusion can affect monetary policy is the choice of the price index used to define the inflation objective. In some economies, central banks pay attention to "core inflation", a measure of price changes that excludes the most volatile components of consumer prices (typically food and energy). Anand and Prasad (2012) argue that inflation measures excluding food prices may be a poor guide to policy for economies with low levels of financial inclusion. In part, this is because financial inclusion is often lowest in rural, agriculture-dependent areas, where food products represent the main source of income. When food prices rise, financially excluded rural households, lacking access to the financial sector, do not save the extra income but increase consumption instead. This leads to higher aggregate demand and inflationary pressures. And when food prices fall, the process works in reverse. In such an economy, where the producers of food are also disproportionately financially excluded, it could be difficult for the central bank to stabilise overall inflation (and the macroeconomy more broadly) if food prices are ignored. Thus the case for focusing on headline inflation may be stronger, the lower the level of financial inclusion.7

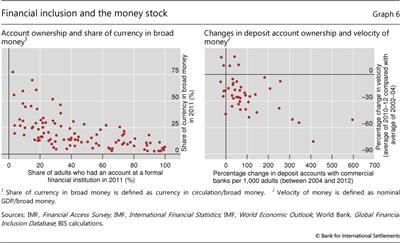

Greater financial inclusion also strengthens the case for using interest rates as the primary policy tool. When financial inclusion is low, a large share of the money stock is typically accounted for by currency in circulation, with many households saving in cash "under the mattress". As inclusion increases, a growing share of broad money is likely to be made up of interest bearing bank deposits. Graph 6 (left-hand panel) illustrates this point for a cross section of 101 economies. Given that the rewards for saving (and the cost of borrowing) are affected by interest rates, greater financial access implies that a bigger share of economic activity comes under the sway of interest rates, making them a more potent tool for policymakers (Khan (2011), Tombini (2012)).

That said, policymakers should be mindful of such shifts in the composition of money, especially when using monetary aggregates as an intermediate policy target. Utilising monetary aggregates in this way relies on a stable relationship between them and GDP. The basic idea is that a given quantity of money translates into a predictable level of nominal spending, and hence inflationary pressure. In practice, the ratio of GDP to money (or "velocity of money") can change over time. But increases in financial inclusion may amplify these changes, as the share of bank deposits increases at the expense of currency. Graph 6 (right-hand panel) shows that larger increases in financial inclusion are associated with greater declines in the velocity of money. Atingi-Ego (2013) illustrates related evidence for Kenya, where the growth of mobile payments has played a key role in boosting inclusion, and Uganda, where the expansion of microfinance and savings and credit cooperatives has been prominent. In both countries, increases in financial inclusion have coincided with declines in the share of currency in base money and also in the velocity of money.

Financial inclusion and financial stability

Increasing financial access alters the composition of savers and/or borrowers in the economy, for households and firms alike. These compositional changes may support risk diversification and thus financial stability. But if financial institutions expand too rapidly, especially into unfamiliar areas, financial risks could increase.

There are several reasons why increased financial inclusion may support the central bank's task of safeguarding financial stability. First, consumers gaining access to the formal financial system are likely to increase aggregate savings and diversify the banks' depositor base. Any increase in savings has the potential to improve the resilience of financial institutions, given the stability of deposit funding, especially where they are backed by an effective deposit insurance scheme (Hannig and Jansen (2010), Yorulmazer (2014)). Further, there is some evidence that aggregate balances in the accounts of low-income customers move only gradually, and are not prone to sudden month-to-month swings (Abakaeva and Glišović-Mézières (2009)). This resilience could be especially relevant during crises, if low-income savers are apt to maintain their deposits when large depositors head for the exits. Indeed, during the global financial crisis, total deposits fell by less in economies where the degree of financial inclusion was higher in terms of bank deposits, especially for middle-income countries, even after controlling for other factors (Han and Melecký (2013)).

Second, financial inclusion, by improving firms' access to credit, can help financial institutions to diversify their loan portfolios. Moreover, lending to firms that were previously financially excluded may also lower the average credit risk of loan portfolios. One study finds that an increased number of borrowers from small and medium-sized enterprises (SMEs) is associated with a reduction in non-performing loans and a lower probability of default by financial institutions (Morgan and Pontines (2014)). Another notes the high repayment rates of borrowers from microfinance institutions (Hannig and Jansen (2010)).

However, increased financial inclusion is no guarantee of improved financial stability. If financial inclusion is associated with excessive credit growth, or the rapid expansion of unregulated parts of the financial sector, financial risks may rise.

One way to increase financial inclusion would be to incentivise banks to aggressively expand credit to poorer, previously excluded, households without paying sufficient attention to their ability to repay loans. As a result, lending standards may be compromised. History is replete with examples of households taking on excessive debt, be this through an inadequate understanding of the risks involved (Šoškić (2011))8 or other factors.

Financially excluded households, by definition, lack a financial history. The absence of a verifiable track record may be especially prevalent where personal identification systems are weak (Giné et al (2012)). And there are bound to be speed limits to banks' ability to absorb new customers without seeing a deterioration in credit quality, owing to limits in screening capacity.

In addition, greater financial inclusion due primarily to increased access to credit could contribute to financial excesses in the economy. It is important to distinguish between structural financial deepening, leading to a widening pool of borrowers, and an unsustainable lending boom that sees a smaller number of borrowers amassing large debts. In reality, both phenomena could occur side by side.

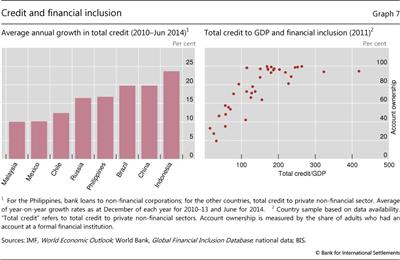

Unusually rapid credit growth could thus indicate that economies are relying too heavily on credit expansion to improve financial access. In recent years, many emerging market economies have posted double-digit rates of annual growth in total credit, including both loans and debt securities (Graph 7, left-hand panel). That said, what counts as "excessive" credit growth depends on a variety of factors, including the current and future cost of borrowing as well as income and profit growth rates.

Central banks therefore face the challenge of promoting inclusion while at the same time avoiding excessive credit expansion. In a cross-country sample of 38 economies, financial depth, measured as the share of total credit to GDP, is positively correlated with the level of financial inclusion. The correlation shows up especially strongly when total credit is less than around 200% of GDP (Graph 7, right-hand panel). Yet the correlation between financial depth and access is far from perfect. There exist deep financial systems that are not highly inclusive, with credit heavily concentrated among the largest firms and/or the highest-income individuals, for example.

It is possible to nurture increased financial inclusion without a large increase in aggregate credit. For low-income populations, for example, the most pressing financial needs may consist in having reliable savings and payment instruments rather than credit (Hawkins (2011), World Bank (2008)).

Another risk is that advances in financial inclusion may reflect growth by institutions in relatively unregulated parts of the financial sector (see eg Khan (2011)). Banks' attempts to reduce the overall riskiness of their business ("de-risking"), or minimise regulatory compliance costs, may contribute to this if they turn away potential customers. Small unregulated institutions may pose little threat to financial stability. As they grow, however, financial inclusion could be associated with an overall decline in the coverage, and therefore the effectiveness, of financial regulation in the economy, leading to increased systemic risks. As a related observation, microfinance institutions account for a disproportionate share of increased financial inclusion in some jurisdictions, highlighting the need for supervisors to identify and measure risks that are specific to this sector (BCBS (2010)).

Finally, and more generally, an increase in financial inclusion can be associated with rapid structural change in the financial system. At such times, financial system vulnerabilities may build. Supervisors and central banks should ensure that they retain sufficient capacity to monitor and react to any system-wide risks that could develop.

Conclusions

Access to formal financial services is increasing in many economies worldwide. This special feature has outlined various ways in which increasing financial inclusion affects central bank policies intended to maintain monetary and financial stability.

We conclude with three main takeaways. First, increased financial inclusion facilitates consumption smoothing, as households have easier access to instruments for saving and borrowing. As a result, output volatility is no longer as costly. This may facilitate central banks' efforts to maintain price stability.

Second, growing financial inclusion is likely to increase the importance of interest rates in monetary transmission as a greater share of economic activity comes under the sway of interest rates. While this will tend to improve the effectiveness of monetary policy using interest rate tools, policymakers may need to pay attention to shifts in the velocity of money when using monetary aggregates as intermediate targets.

Third, while the literature has documented various ways in which increased financial inclusion could be beneficial for financial stability, these may be sensitive to the nature of the improved financial access. Too strong a focus on improving access to credit could increase risks, especially if it leads to a deterioration in credit quality or too rapid growth in unregulated parts of the financial system.

References

Abakaeva, J and J Glišović-Mézières (2009): "Are deposits a stable source of funding for microfinance institutions?", CGAP Brief, June.

Alliance for Financial Inclusion (2012): "Agent banking in Latin America", AFI Discussion Paper, March.

--- (2014): The 2014 Maya Declaration progress report: measurable goals with optimal impact.

Anand, R and E Prasad (2012): "Core vs headline inflation targeting in models with incomplete markets", manuscript.

Atingi-Ego, M (2013): "Financial inclusion in Africa, monetary policy and financial stability: country experiences", presentation to the Association of African Central Banks, Assembly of Governors' Meeting, Balaclava, 23 August.

Banerjee, A and E Duflo (2007): "The economic lives of the poor", Journal of Economic Perspectives, vol 21(1), pp 141-67.

Bangko Sentral ng Pilipinas (2013): "Financial inclusion initiatives 2013".

Basel Committee on Banking Supervision (2010): Microfinance activities and the Core Principles for Effective Banking Supervision, August.

--- (2012): Core Principles for Effective Banking Supervision, September.

--- (2015): Range of practice in the regulation and supervision of institutions relevant to financial inclusion, January.

Bhaskar, P (2013): "Financial inclusion in India - an assessment", speech at the MFIN and Access-Assist Summit, New Delhi, 10 December.

Bilbiie, F (2008): "Limited asset market participation, monetary policy and (inverted) aggregate demand logic", Journal of Economic Theory, vol 140(1), pp 162-96.

Burgess, R and R Pande (2005): "Can rural banks reduce poverty? Evidence from the Indian social banking experiment", American Economic Review, vol 95(3), pp 780-95.

Colciago, A (2011): "Rule-of-thumb consumers meet sticky wages", Journal of Money, Credit and Banking, vol 43(2-3), pp 325-53.

Committee on Payment and Settlement Systems (2012): Innovations in retail payments, report by the Working Group on Innovations in Retail Payments, May.

Demirgüç-Kunt, A and L Klapper (2012): "Measuring financial inclusion: the Global Findex database", World Bank, Policy Research Working Paper, no 6025.

--- (2013): "Measuring financial inclusion: explaining variation in use of financial services across and within countries", Brookings Papers on Economic Activity, Spring, pp 279-321.

Dittus, P and M Klein (2011): "On harnessing the potential of financial inclusion", BIS Working Papers, no 347, May.

Galí, J, J López-Salido and J Vallés (2004): "Rule-of-thumb consumers and the design of interest rate rules", Journal of Money, Credit and Banking, vol 36(4), pp 739-63.

Giné, X, J Goldberg and D Yang (2012): "Credit market consequences of improved personal identification: field experimental evidence from Malawi", American Economic Review, vol 102(6), pp 2923-54.

Han, R and M Melecký (2013): "Financial inclusion for financial stability: access to bank deposits and the growth of deposits in the global financial crisis", World Bank, Policy Research Working Paper, no 6577.

Hannig, A and S Jansen (2010): "Financial inclusion and financial stability: current policy issues", ADBI Working Paper, no 259.

Hawkins, P (2011): "Financial access: what has the crisis changed?", BIS Papers, no 56, September, pp 11-20.

Jayachandran, S (2006): "Selling labor low: wage responses to productivity shocks in developing countries", Journal of Political Economy, vol 114(3), pp 538-75.

Khan, H (2011): "Financial inclusion and financial stability: are they two sides of the same coin?", address at BANCON 2011, Chennai, 4 November.

Levine, R (2005): "Finance and growth: theory and evidence", in P Aghion and S Durlauf (eds), Handbook of Economic Growth, Elsevier.

Mehrotra, A and J Yetman (2014): "Financial inclusion and optimal monetary policy", BIS Working Papers, no 476, December.

Morgan, P and V Pontines (2014): "Financial stability and financial inclusion", ADBI Working Paper, no 488.

Rosenzweig, M and K Wolpin (1993): "Credit market constraints, consumption smoothing, and the accumulation of durable production assets in low-income countries: investments in bullocks in India", Journal of Political Economy, vol 101(2), pp 223-44.

Šoškić, D (2011): "Financial literacy and financial stability", keynote speech at the Bank of Albania Ninth International Conference Building our future through financial literacy, Tirana, 15 September.

Subbarao, D (2012): "Financial regulation for growth, equity and stability in the post-crisis world", BIS Papers, no 62, January, pp 1-8.

Tombini, A (2012): "Opening remarks", IV Fórum Banco Central sobre Inclusão Financeira, Porto Alegre, 29 October.

World Bank (2008): "Finance for all? Policies and pitfalls in expanding access", Policy Research Report.

--- (2014): Global Financial Development Report 2014: Financial Inclusion.

Yorulmazer, T (2014): "Literature review on the stability of funding models", Federal Reserve Bank of New York, Economic Policy Review, vol 20(1), pp 3-16.

Zeti, A (2005): "Enhancing financial literacy for sustained economic prosperity", dinner address at the Citigroup-INSEAD Financial Education Summit, Kuala Lumpur, 12 December.

1 We thank Steven Kong for excellent research assistance and Claudio Borio, Racquel Claveria, Karl Cordewener, Dietrich Domanski, Marc Hollanders, Klaus Loeber, Jeff Miller, Frank Packer, Hyun Song Shin, Ju Quan Tan and Christian Upper for helpful comments. The views expressed are ours and do not necessarily reflect those of the BIS.

2 The term "formal financial institution" here refers to a bank, credit union, post office, cooperative or microfinance institution. This metric is likely to underestimate the degree of financial inclusion in some economies, particularly in Africa, where mobile money plays an important role (see eg Dittus and Klein (2011)).

3 See http://fas.imf.org.

4 In Argentina, this rapid growth may partly reflect the low number of accounts in 2004 as a legacy of the freezing of bank accounts in 2001-02.

5 The regressions displayed in Graph 5 treat financial inclusion as if it is the driving factor ("exogenous"). To the extent that financial inclusion is a choice on the part of consumers, this may bias the estimation results. For example, if consumers in some countries value stable consumption more highly than those in others, they may be more willing to both use financial services and take other actions that reduce volatility. Then the regression results will overstate the effect of financial inclusion on consumption volatility.

6 We test the key implication of our model - that the ratio of output volatility to inflation volatility rises with the level of financial inclusion if monetary policy is set optimally - with data for over 130 economies. We find support for the model's prediction. This is driven primarily by data for economies where central banks have a high degree of monetary policy autonomy, arguably those that are most likely to set policy optimally.

7 Central banks may wish to focus on headline inflation for other reasons as well. For example, the prices of food and energy could rise faster than other prices for prolonged periods, creating communication challenges if the central bank chooses to ignore them when setting policy.

8 As discussed in World Bank (2014, Box 1.5), the rapid growth of microfinance in both Andhra Pradesh in India starting in the late 1990s and Bosnia and Herzegovina in 2004-08 fits this narrative, as does the US subprime crisis.