BIS international banking statistics at end-December 2017

- International banking activity gained momentum in Q4 2017, with cross-border claims increasing by $123 billion between end-September and end-December 2017 to $29 trillion. Intragroup activity led the increase, while credit to non-bank borrowers rose for the fourth consecutive quarter.

- Cross-border lending to emerging market economies (EMEs) rose by $55 billion in Q4 2017 to $4 trillion. The latest increase was concentrated on countries in emerging Asia and Africa and the Middle East. Claims on emerging Europe and Latin America declined.

- Banks' outstanding claims on offshore banking centres surpassed their previous peak recorded in 2008 during the Great Financial Crisis (GFC). Outstanding cross-border claims on offshore centres totalled $4.6 trillion at end-2017, compared with $4.3 trillion at end-March 2008.

International banking activity gained momentum in Q4 2017

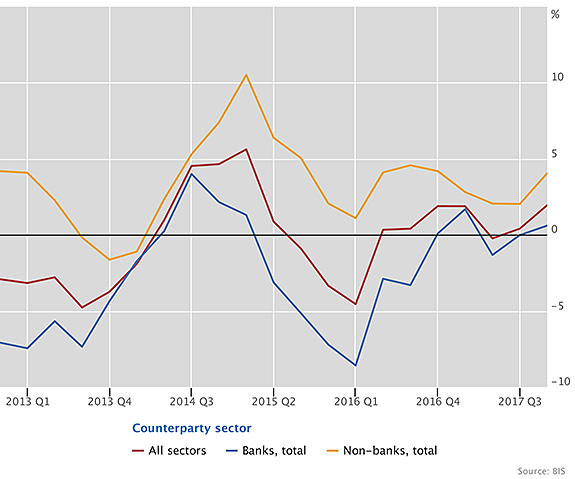

Graph 1: Annual percentage change in banks' cross-border claims (interactive graph).

Source: BIS locational banking statistics (Table A1).

The upturn in international banking activity that began in Q3 2017 gained momentum in Q4 2017. Banks' cross-border claims rose by $123 billion between end-September and end-December 2017, which boosted their annual growth rate from under 1% to 2% (Graph 1). Credit to non-bank borrowers rose by 4% in the year to end-December 2017, and credit to the bank sector by 1%. The pickup in interbank business was most pronounced for activity between offices belonging to the same banking group, which increased by $134 billion in the final quarter of 2017.

By region, the largest increases in Q4 2017 were reported for borrowers in offshore banking centres ($124 billion) and EMEs ($55 billion). Lending to the United States also increased, by $45 billion. By contrast, claims on Japan declined by $63 billion and those on advanced economies in Europe by $57 billion.

Cross-border claims on offshore centres rose to a record high

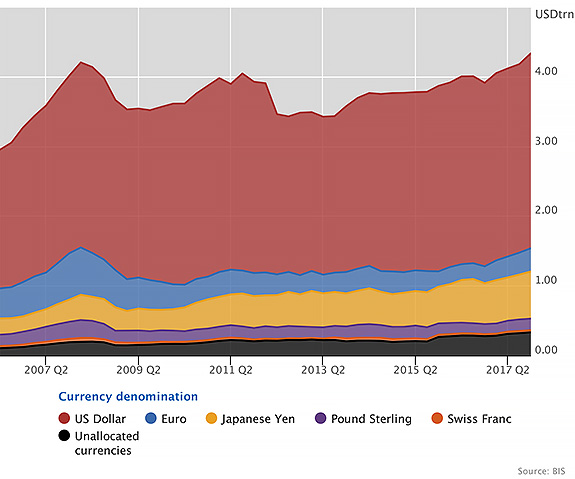

Graph 2: Banks' outstanding cross-border claims on offshore centres (interactive graph).

Source: BIS locational banking statistics (Table A6.1).

In recent years, activity with offshore banking centres has been one of the fastest-growing areas of cross-border banking. After contracting by 2% in 2015, cross-border claims on borrowers in offshore centres rose by 3% in 2016 and more than 7% in 2017. Between end-September and end-December 2017, the centres that saw the largest increases were Hong Kong SAR ($63 billion) and Singapore ($41 billion).

In 2017, banks' outstanding claims on offshore centres surpassed their previous peak seen in 2008 during the GFC. Cross-border claims on offshore centres totalled $4.6 trillion at end-2017, compared with $4.3 trillion at end-March 2008 (Graph 2). These claims were overwhelmingly denominated in US dollars ($2.8 trillion), followed by yen ($0.7 trillion) and euros ($0.3 trillion).

Middle East and Asia drove the latest increase in lending to EMEs

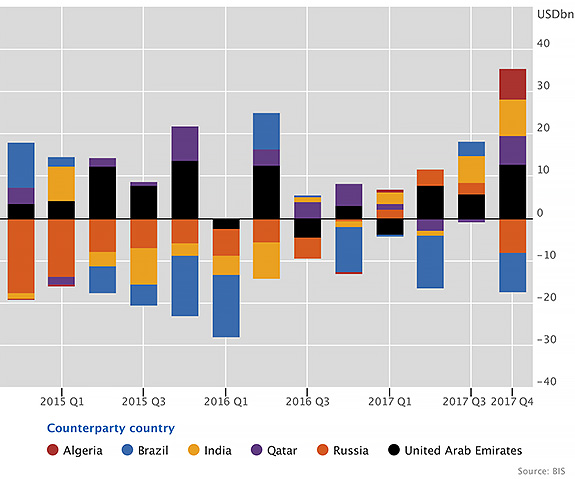

Graph 3: Adjusted changes in banks' cross-border claims (interactive graph).

Source: BIS locational banking statistics (Table A3).

Cross-border lending to EMEs increased between end-September and end-December 2017 for the fourth consecutive quarter. The latest $55 billion quarterly expansion boosted their annual growth rate to 9%. The increase was driven mainly by lending to Africa and the Middle East ($40 billion) as well as emerging Asia ($32 billion). Borrowers located in Algeria, China, India, Qatar and the United Arab Emirates experienced the largest increases in lending (Graph 3).

Cross-border credit to borrowers in emerging Europe declined by $5 billion in Q4 2017. Increases on Turkey ($4 billion) and Poland ($2 billion) were offset by a drop in claims on Russia. After declining sharply between 2013 and 2016, cross-border claims on Russia had edged up in the first three quarters of 2017. However, they fell again between end-September and end-December 2017 (-$8 billion) to end the year at $99 billion, down from $189 billion in early 2013.

Credit to borrowers in Latin America continued to contract, down by $12 billion in Q4 2017. This took the annual rate of contraction to 3% in 2017, similar to the decline recorded in 2016. In Q4 2017, Brazil (-$9 billion) and Mexico (-$6 billion) saw the largest quarterly declines in cross-border credit. By contrast, cross-border claims on Chile and Argentina increased, by $5 billion and $2 billion, respectively.

Japanese banks have become the largest foreign lenders

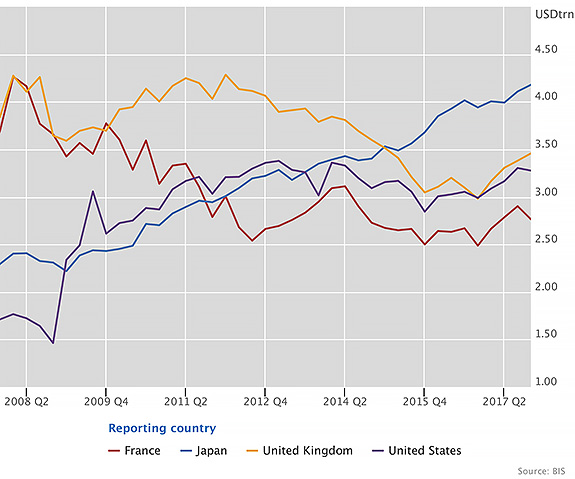

Graph 4: Outstanding consolidated foreign claims on an immediate counterparty basis, by nationality of the banking group (interactive graph).

Source: BIS consolidated banking statistics (Table B2).

Together with this release, the BIS is publishing an updated summary of the reporting population for the locational banking statistics (LBS). The reporting population includes branches and subsidiaries that report separately from their parent banks. Germany has the largest number of reporting entities, at 1,634, and Bermuda the smallest, at four. However, data are not strictly comparable across LBS-reporting countries because some count only internationally active banks whereas others, such as Germany, count all resident banking entities.

The number of banking entities participating in the LBS declined from 8,340 at end-March 2017 to 8,123 at end-December 2017. Mergers, closures and methodological changes contributed to the decline. The number of entities indicates trends in the growth and complexity of international banking but is not representative of the size of banks' international balance sheets. The consolidated banking statistics (CBS) provide a measure of size that excludes intragroup positions. Measured by consolidated foreign claims on borrowers outside banks' home country, Japanese banks have the largest international balance sheets. Their foreign claims totalled $4 trillion at end-2017 (excluding Japanese banks' claims on residents of Japan).

Japanese banks have expanded their international presence substantially since 2009, surpassing French banks in 2011, US banks in 2013 and UK banks in 2015 (Graph 4). Together, banking groups headquartered in France, Japan, the United Kingdom and the United States accounted for about half of the outstanding foreign claims reported by the 31 countries in the CBS at end-2017. However, this share does not take into account Chinese banks, which have become increasingly important providers of international bank credit but do not report the CBS.