The concentration of clearing as a challenge for emerging market economy OTC interest rate derivatives markets

Box extracted from chapter "Goodbye Libor, hello basis traders: unpacking the surge in global interest rate derivatives turnover"

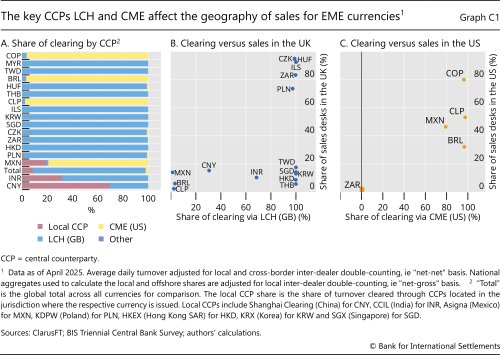

The dominance of two global central counterparties (CCPs) in clearing over-the-counter (OTC) interest rate derivatives (IRDs) affects the location of sales for contracts in emerging market economy (EME) currencies. The London Clearing House (LCH) in the United Kingdom and the Chicago Mercantile Exchange (CME) in the United States are the two dominant CCPs for OTC interest rate derivatives (IRDs) in EME currencies (Graph C1.A). Only China, India and Mexico have local CCPs that attract meaningful OTC clearing activity. The locations of the two main CCPs, in turn, are often closely related to where an IRD contract is being sold. IRDs for currencies like the Hungarian forint, Czech koruna, Israeli new shekel, South African rand and Polish zloty are almost entirely cleared through LCH, which also aligns with the majority of IRD sales in these currencies being recorded in the United Kingdom (Graph C1.B). In contrast, IRDs for major Latin American currencies are primarily cleared through CME, with a corresponding concentration of sales recorded in the United States (Graph C1.C). Emerging Asian currencies are an exception, as they are predominantly cleared through LCH but traded mainly in Hong Kong SAR and Singapore, where several large banks that are also clearing members of LCH are located.

The clearing through foreign CCPs can create challenges for domestic counterparties in EMEs. As in advanced economies, the hurdles for IRD trading may be relatively low in cases where an EME is home to financial institutions that are clearing members of the global CCPs or have affiliates in the country where the key CCP is located. This is not the case, however, for all EMEs. The reliance on foreign CCPs is bound to result in cross-border legal complexities as well as higher settlement costs and risks, given the involvement of correspondent banking services. In some jurisdictions, capital controls pose an additional hurdle. The alternative, setting up local CCPs in EMEs, faces significant competitive disadvantages due to the scale and network effects of global CCPs (see Ehlers and Hardy (2019)).

The views expressed are those of the authors and do not necessarily reflect those of the BIS or its member central banks.

The views expressed are those of the authors and do not necessarily reflect those of the BIS or its member central banks.