Geographical shifts in turnover and the migration of euro contracts to Germany

Box extracted from chapter "Goodbye Libor, hello basis traders: unpacking the surge in global interest rate derivatives turnover"

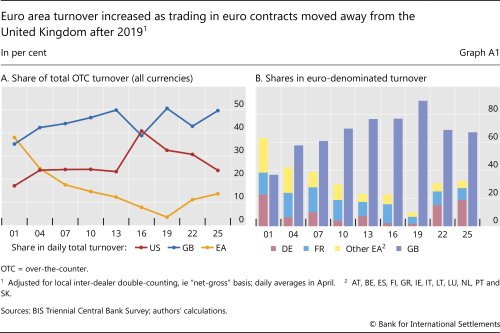

Structural changes and the benchmark reform have given euro area countries a greater share of global interest rate derivatives turnover. Turnover reported by sales desks in euro area countries reached $1.2 trillion per day in April 2025, up from $610 billion in 2022. Euro area countries' share of global turnover also rose, to 14%, up from 11% in 2022 (Graph A1.A, yellow line). By contrast, the share of turnover at sales desks in the United States has declined, reflecting the near elimination of US dollar forward rate agreement (FRA) trading and the shift of US dollar interest rate swap activity to other jurisdictions. The surge is consistent with the migration of trading demand for credit-sensitive interbank offered rates towards Euribor-based contracts and the expansion of the euro overnight index swap markets. For its part, turnover at sales desks in the United Kingdom rebounded somewhat, rising to 50% of the global total in 2025, similar to its share in 2019 and 2013.

Turnover reported by sales desks in euro area countries reached $1.2 trillion per day in April 2025, up from $610 billion in 2022. Euro area countries' share of global turnover also rose, to 14%, up from 11% in 2022 (Graph A1.A, yellow line). By contrast, the share of turnover at sales desks in the United States has declined, reflecting the near elimination of US dollar forward rate agreement (FRA) trading and the shift of US dollar interest rate swap activity to other jurisdictions. The surge is consistent with the migration of trading demand for credit-sensitive interbank offered rates towards Euribor-based contracts and the expansion of the euro overnight index swap markets. For its part, turnover at sales desks in the United Kingdom rebounded somewhat, rising to 50% of the global total in 2025, similar to its share in 2019 and 2013.

This overall shift in turnover towards euro area countries has largely reflected a migration of euro-denominated contracts from London to the continent (Graph A1.B). While London remained the top trading location for euro-denominated interest rate derivatives (IRDs), its share in turnover fell from 69% in 2022 to 67% in 2025, continuing its downward trend after 2016. In contrast, the share of euro area countries rose marginally, from 31% in 2022 to 33% in 2025. The rise was supported by a more than twofold increase in turnover in Germany, which now accounts for 58% of euro-denominated IRD trading in euro area countries (red bars). This increase probably reflects the efforts to shift the clearing of euro interest rate swaps to the euro area. In the near term, a dualcentre structure seems likely, with execution still concentrated in the United Kingdom and a growing share of euro clearing and trading moving to euro area venues.

In the near term, a dualcentre structure seems likely, with execution still concentrated in the United Kingdom and a growing share of euro clearing and trading moving to euro area venues.

The views expressed are those of the authors and do not necessarily reflect those of the BIS or its member central banks.

The views expressed are those of the authors and do not necessarily reflect those of the BIS or its member central banks.  Fourteen euro area countries participated in the 2025 IRD segment.

Fourteen euro area countries participated in the 2025 IRD segment.  J Demski, R McCauley and P McGuire, "London as a financial centre since Brexit: evidence from the 2022 BIS Triennial Survey", BIS Quarterly Review, December 2022.

J Demski, R McCauley and P McGuire, "London as a financial centre since Brexit: evidence from the 2022 BIS Triennial Survey", BIS Quarterly Review, December 2022.