The safe haven properties of US Treasuries and portfolio flows of global investors

Box extracted from Overview chapter "Markets shrug off trade conflicts"

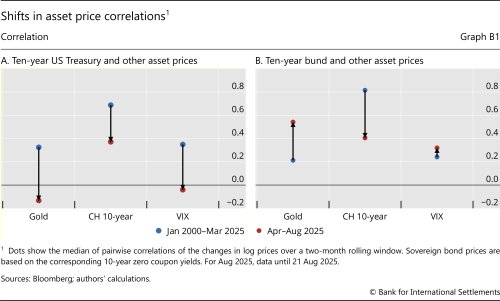

The US tariff announcements in early April 2025 marked a shift in long-established relationships involving US Treasuries. Historically, as safe haven assets, US Treasuries tended to exhibit positive correlations with other safe assets – eg bonds issued by highly rated sovereigns or gold – as well as with gauges of uncertainty and risk appetite – such as the VIX (Graph B1.A, blue dots).

However, these correlations have approached zero since April (red dots), possibly indicating a weakening of US Treasuries' safe haven properties. By contrast, the prices in other core bond markets have not been subject to similar shifts. Notably, the positive correlation between the price of the German bund and the VIX has (if anything) increased (Graph B1.B).

However, these correlations have approached zero since April (red dots), possibly indicating a weakening of US Treasuries' safe haven properties. By contrast, the prices in other core bond markets have not been subject to similar shifts. Notably, the positive correlation between the price of the German bund and the VIX has (if anything) increased (Graph B1.B).

The fading correlations coincided with elevated policy uncertainties in the United States, prompting broader questions about a potential structural repositioning by global investors away from US assets, for both bonds and equities. Also, discussions intensified on which other countries and assets might benefit from any rotations in portfolio flows.

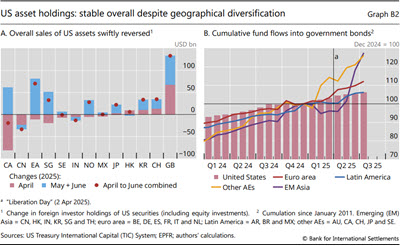

However, the evidence available – at least so far – does not show signs of a material portfolio reallocation away from US assets. While some non-US investors sold significant volumes of US assets in April, most of these flows reversed in May and June (Graph B2.A). Strong underlying fundamentals continue to anchor global demand for US assets, providing additional support for their momentum, as described in the main text. The favourable sentiment towards US assets aligns with the resilience of US corporate earnings and the unmatched depth of US financial markets. It may have also been bolstered by diminishing concerns about the long-term effects of trade conflicts (Box A). The outsize holdings of US assets by global investors, coupled with the slow pace of strategic asset allocation decisions and mandates, indicate that any significant portfolio shift away from US assets is likely to be gradual.

That said, global investors have been showing signs of adjusting their geographical exposures. During the second quarter of 2025, flows into sovereign bond funds targeting euro area countries and other advanced economies surpassed those targeting the United States (Graph B2.B, bars versus red and yellow lines). Since the respective assets are seen as close substitutes, this development would be consistent with global investors seeking greater portfolio diversification. In addition, fund flows to sovereign bonds of Asian emerging market economies (EMEs) were particularly strong in June and July (purple line). The recent fund flows to Asian EMEs were probably fuelled by a combination of factors, including relatively low global interest rates, a persistently weaker US dollar and strong domestic macroeconomic fundamentals.

and strong domestic macroeconomic fundamentals.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS or its member central banks.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS or its member central banks.  The US dollar weakened significantly against a broad basket of currencies in early April. The weakening persisted beyond April as global investors reportedly increased their hedge ratios for dollar exposures ex post via foreign exchange derivatives (see H S Shin, P Wooldridge and D Xia, "US dollar's slide in April 2025: the role of FX hedging," BIS Bulletin, no 105, June 2025). Thus, while global investors by and large held on to US assets, approaches towards the management of the inherent currency risk appear to have become more cautious.

The US dollar weakened significantly against a broad basket of currencies in early April. The weakening persisted beyond April as global investors reportedly increased their hedge ratios for dollar exposures ex post via foreign exchange derivatives (see H S Shin, P Wooldridge and D Xia, "US dollar's slide in April 2025: the role of FX hedging," BIS Bulletin, no 105, June 2025). Thus, while global investors by and large held on to US assets, approaches towards the management of the inherent currency risk appear to have become more cautious.