The structure of the BIS consolidated banking statistics (CBS)

Box extracted from chapter "International finance through the lens of BIS statistics: Bank exposures and country risk"

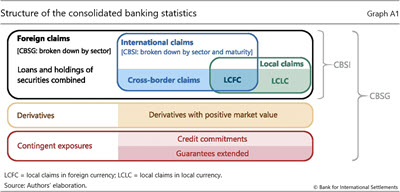

The CBS is one of the few statistical collections that provides a geography of banks' consolidated exposures. The statistics are compiled following supervisory principles to capture current and potential exposures to counterparties in particular countries and sectors. This box provides an overview of the structure of the CBS.

Reporting banks' positions are consolidated and then grouped by nationality, defined by the country of the supervisor of the global consolidated banking group (typically the country of headquarters). Banks report their on-balance sheet claims (assets) (Graph A1); only limited data on liabilities are collected. Claims comprise loans and holdings of securities (debt and equity). Derivatives claims are reported separately: only derivatives that give rise to a counterparty risk are reported; thus, derivative exposures are calculated as the positive market value of outstanding contracts. Banks also report contingent exposures: credit commitments (eg credit lines) are irrevocable contractual obligations which, if utilised, result in the extension of a loan or purchase of a security; guarantees extended are contractual obligations to a third party if the bank's client fails to fulfil them.

Banks also report contingent exposures: credit commitments (eg credit lines) are irrevocable contractual obligations which, if utilised, result in the extension of a loan or purchase of a security; guarantees extended are contractual obligations to a third party if the bank's client fails to fulfil them.

The focus of the CBS is on foreign claims (FC), ie claims on counterparties outside the bank's home country. The counterparty country breakdown has been expanded over time, from emerging market economies (EMEs) since 1983 to all counterparties (more than 200 countries and jurisdictions) in 1999. In 2013, domestic claims on the home country were added, completing the worldwide consolidated view of banks' exposures.

The CBS also shed light on the geography of banks' operations (Graph A1). Banks report foreign claims (FC) separately as cross-border or local, where FC = XBC + LC. Cross-border claims (XBC) are claims on non-residents booked by a bank's head office or a foreign affiliate. Local claims (LC) are those booked by a bank's affiliate on residents in the country in which the affiliate operates. Most local claims are in local currency and funded by local currency liabilities, while local claims in foreign currency are often funded from abroad in major currencies. Hence, foreign claims can also be split into international claims (INTC) and local claims in local currencies (LCLC), where FC = INTC + LCLC. International claims comprise cross-border claims and local claims denominated in a currency foreign to the counterparty country. For derivatives and contingent facilities in the CBSG, banks report only total exposures on a given country regardless of where these are booked.

Hence, foreign claims can also be split into international claims (INTC) and local claims in local currencies (LCLC), where FC = INTC + LCLC. International claims comprise cross-border claims and local claims denominated in a currency foreign to the counterparty country. For derivatives and contingent facilities in the CBSG, banks report only total exposures on a given country regardless of where these are booked.

The CBS distinguish between the residence of the immediate counterparty and that of the ultimate guarantor. The latter refers to the counterparty ultimately responsible for servicing any outstanding obligations in the event of a default by the immediate counterparty, eg a loan to a German corporate entity in Brazil is recorded as a claim on Brazil on an immediate counterparty basis (CBSI). If the German parent guarantees the loan to the entity, the bank records a claim on Germany in the CBSG, along with an outward risk transfer from Brazil and an inward risk transfer to Germany in the CBSI. For any given counterparty country, CBSG foreign claims thus equal CBSI foreign claims plus net risk transfers:

For any given counterparty country, CBSG foreign claims thus equal CBSI foreign claims plus net risk transfers:

Foreign claims(G) = Foreign claims(I) + inward risk transfers – outward risk transfers

Some types of claims are also broken down by maturity and by the sector of the counterparty. Counterparties are classified into the official sector (general government and central bank combined), unrelated banks or the non-bank private sector; the latter comprises non-bank financial institutions, households and non-financial corporations. Maturity information is available only for international claims (CBSI), in buckets of up to one, up to two and over two years of remaining maturity. The sector breakdown applies to international claims in the CBSI and to foreign claims in the CBSG. The technical annex elaborates on the reporting basis and valuation methods, and shows a table with the latest aggregate data covering the dimensions in Graph A1. Data availability depends on the confidentiality settings and reporting practices of individual reporting countries.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  This takes into account legally enforceable bilateral netting arrangements but not collateral. Contracts with negative market value are classified as liabilities.

This takes into account legally enforceable bilateral netting arrangements but not collateral. Contracts with negative market value are classified as liabilities.  Banks also report their affiliates' local liabilities to local residents denominated in local currencies.

Banks also report their affiliates' local liabilities to local residents denominated in local currencies.  The purchase of credit default protection, and legally enforceable guarantees and collateral, if recognised as a risk mitigant under the Basel Framework, all lead to risk transfers. For every outward risk transfer there is an equivalent inward risk transfer elsewhere, so in aggregate net risk transfers should equal zero.

The purchase of credit default protection, and legally enforceable guarantees and collateral, if recognised as a risk mitigant under the Basel Framework, all lead to risk transfers. For every outward risk transfer there is an equivalent inward risk transfer elsewhere, so in aggregate net risk transfers should equal zero.