The return of monetary policy uncertainty

Box extracted from Overview chapter "Markets count on a smooth landing'"

Uncertainty about policy rates is a key factor that influences financial markets. Market participants therefore keep their eyes firmly on central banks' deliberations. Broadly speaking, policy rate uncertainty fuels the volatility of all financial assets – not only bonds – and hence has significant implications for asset prices and economic decisions. Uncertainty and, more generally, the distribution of policy expectations, may also impact the transmission of monetary policy.

The yields on short-term government paper closely track policy rates. This is why policy rate uncertainty, which is not directly observable, can be proxied by looking at the disagreement (ie dispersion) among individual forecasters about three-month yields. Based on forecasts by respondents to the Consensus Economics survey, this box documents how such disagreement has evolved over time. By further examining forecasters' disagreement at different horizons (three or 12 months ahead), it also highlights a recent upward trend and dissects its drivers.

Based on forecasts by respondents to the Consensus Economics survey, this box documents how such disagreement has evolved over time. By further examining forecasters' disagreement at different horizons (three or 12 months ahead), it also highlights a recent upward trend and dissects its drivers.

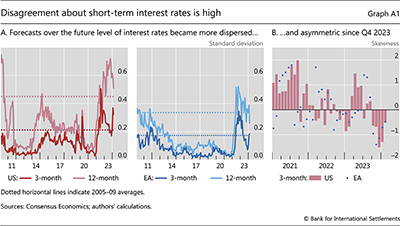

Disagreement over interest rates evolved in line with the monetary policy cycle. In major advanced economies, disagreement was exceptionally low following the Great Financial Crisis (GFC), echoing the low policy rate uncertainty at that time (Graph A1.A, dark coloured line). Before 2013, several central banks deliberately sought to compress policy uncertainty by signalling that rates would be kept extraordinarily low for extended periods – the so-called forward guidance. Afterwards, disagreement briefly resurfaced in the United States during the tightening phase preceding the pandemic as well as at its outbreak. But it then abated swiftly when central banks underscored their commitment to keep policy rates low to support lockdown-stricken economies.

Disagreement over short-term bond yields at the 12-month-ahead horizon (Graph A1.A, light coloured lines) started to grow in 2021, as inflation surged and the economic outlook became more uncertain. Yet this disagreement remained high and failed to subside even when inflation and macroeconomic uncertainty receded last year. This has fuelled exceptionally high volatility in bond markets, even exceeding than that of equities, as described in the main text.

even when inflation and macroeconomic uncertainty receded last year. This has fuelled exceptionally high volatility in bond markets, even exceeding than that of equities, as described in the main text.

Since mid-2022, the dynamics of disagreement over future interest rates at different forecast horizons diverged substantially. At first, disagreement over the level of interest rates that would prevail in three months dwindled as tightening progressed and forecasters anticipated rates nearing their peaks; disagreement 12 months ahead kept rising instead. However, these dynamics have reversed since late-2023. As the debate focused on the timing of the first cut, disagreement at the three-month horizon surged but that at the 12-month horizon declined in the United States and remained stable in Europe. This highlighted that forecasters had different views over when the easing cycle would start.

Looking at the asymmetry of individual forecasts reveals that interest rate uncertainty is unevenly balanced. In 2021, before the tightening cycle even started, a greater proportion of forecasters were more hawkish than the average. Such positive skewness characterised the distribution of forecasts for most of the last three years (Graph A1.B). It reflected that survey participants anticipated a large upside risk to interest rates; that is, central banks might have tightened more aggressively than expected in the short run. Skewness became negative in the last few months: forecasters were anticipating a higher likelihood of deep rate cuts in the next quarter.

Looking beyond the three- and 12-month horizons, there is also wide disagreement on terminal rates – the level of policy rates that will eventually prevail once inflation is again at the desired level. This is what in macroeconomic jargon is called r* (see G Benigno, B Hoffman, G Nuño and D. Sandri, "Quo vadis, r*? The natural rate of interest after the pandemic," in this issue for a comprehensive discussion).

This is what in macroeconomic jargon is called r* (see G Benigno, B Hoffman, G Nuño and D. Sandri, "Quo vadis, r*? The natural rate of interest after the pandemic," in this issue for a comprehensive discussion).

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  See, for example, M De Pooter, G Favara, M Modugno and J Wu, "Monetary policy uncertainty and monetary policy surprises", Journal of International Money and Finance, vol 112, April 2021, 102323.

See, for example, M De Pooter, G Favara, M Modugno and J Wu, "Monetary policy uncertainty and monetary policy surprises", Journal of International Money and Finance, vol 112, April 2021, 102323.  As the projections of the Consensus survey participants do not cover the policy rate, we proxy it by looking at the three-month rate projections.

As the projections of the Consensus survey participants do not cover the policy rate, we proxy it by looking at the three-month rate projections.  On the contrary, the standard deviation of the one-year inflation forecast of the same Consensus Economics survey increased substantially in 2022, but it then declined and remained low.

On the contrary, the standard deviation of the one-year inflation forecast of the same Consensus Economics survey increased substantially in 2022, but it then declined and remained low.  Note that this will be reflected only partly in disagreement at the 12-month horizon, unless one believes inflation would have already reverted to target within the next year.

Note that this will be reflected only partly in disagreement at the 12-month horizon, unless one believes inflation would have already reverted to target within the next year.