Insurance companies' holdings of sovereign debt

Box extracted from special feature "Covid, central banks and the bank-sovereign nexus"

While sovereign borrowing needs remain large, advanced economy central banks have been reducing their sovereign bond purchases or shedding existing holdings. This puts the spotlight on traditional providers of sovereigns' financing from the private sector – banks (see Hardy and Zhu in the same issue), pension funds and insurance companies (ICs). Against this backdrop, we review the size and geographical distribution of ICs' sovereign debt holdings at the end of the low–for–long era. We also discuss how these holdings have been reflected in credit market pricing and how they relate to ICs' risk management, with an eye to understanding the potential vulnerabilities, particularly in the market for long–duration sovereign debt.

We draw mainly on two data sets from the International Association of Insurance Supervisors (IAIS). They comprise yearly observations from 2019 to 2021. The Sector–Wide Monitoring (SWM) data are at the country level, covering 25 advanced economies (AEs) and 23 emerging market economies (EMEs). The Individual Insurer Monitoring (IIM) data contain detailed information on 61 major ICs from 13 AEs and eight EMEs. We complement these data sets with other publicly available data.

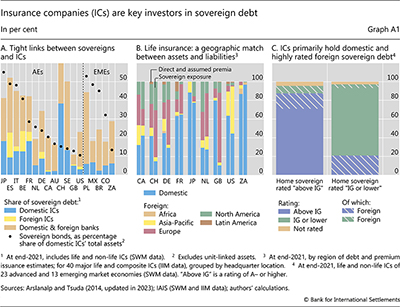

Sovereigns' debt is at the heart of their strong links with ICs. As a share of the total assets of ICs located in several major AEs and EMEs, sovereign bond holdings accounted for more than 20% in 2021 (Graph A1.A, dots). In turn, consistent with the typically large size of the insurance sector, we estimate that these holdings amount to more than one third of the total outstanding sovereign debt in Switzerland and to more than 10% in Japan and large euro area economies. For several European sovereigns, this share is comparable with that of banks' holdings.

Sovereign debt is an integral part of ICs' investment strategy and risk management. Such debt tends to be of longer duration than corporate debt. It thus matches life insurers' long–term liabilities more closely and thereby delivers a better hedge against changes in interest rates. We find a close alignment between the geographic distribution of major life and composite ICs' sovereign holdings and that of the location of their life insurance liabilities (as proxied by the origin of direct and assumed premia, Graph A1.B). This provides a natural hedge against exchange rate risk but is also consistent with duration-matching, as the valuation approach for assets and liabilities is usually location–specific. As much of the insurance business is domestic, the home country dominates in total sovereign debt holdings (Graphs A1.B and A1.C). When investing in debt issued by foreign sovereigns, life and non–life insurers jointly prefer higher-rated securities (Graph A1.C) and often hedge to mitigate or eliminate the attendant currency mismatches. The higher the credit quality of sovereign debt, the more broadly it is accepted as collateral and the greater its shock–absorbing capacity.

We find a close alignment between the geographic distribution of major life and composite ICs' sovereign holdings and that of the location of their life insurance liabilities (as proxied by the origin of direct and assumed premia, Graph A1.B). This provides a natural hedge against exchange rate risk but is also consistent with duration-matching, as the valuation approach for assets and liabilities is usually location–specific. As much of the insurance business is domestic, the home country dominates in total sovereign debt holdings (Graphs A1.B and A1.C). When investing in debt issued by foreign sovereigns, life and non–life insurers jointly prefer higher-rated securities (Graph A1.C) and often hedge to mitigate or eliminate the attendant currency mismatches. The higher the credit quality of sovereign debt, the more broadly it is accepted as collateral and the greater its shock–absorbing capacity.

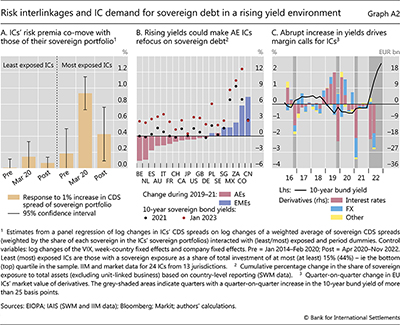

Credit market participants seem to perceive tight financial links between the ICs and the sovereigns that these companies invest in. The March 2020 turmoil provides a case in point (c.A). While CDS spreads increased across the board in response to a common shock (the outbreak of Covid–19), ICs' sovereign debt holdings played a distinct role. Specifically, after controlling for macro risk factors, we find that the co–movement of sovereigns' and ICs' CDS spreads in March 2020 was statistically and economically significant – roughly one–to–one – only if sovereign debt holdings amounted to a high share of ICs' assets. The phenomenon weakened subsequently as central bank interventions appeased markets but has remained important.

The path of interest rates has been a key driver of ICs' sovereign debt holdings and is likely to remain so. During the low–for–long era, many ICs in AEs reduced – albeit marginally – their sovereign bond holdings in favour of higher–yielding securities (Graph A2.B). With rates rising, ICs' balance sheets are strengthening as the present value of their assets typically declines by less than that of their liabilities. Coupled with the increased supply of government debt outside central banks' balance sheets, rising rates could lead ICs to favour sovereign over corporate debt. At the same time, duration–matching motives may have the opposite effect. Rising rates tend to open a duration gap that can be closed by reducing the share of assets with the longest duration.

Abrupt increases in sovereign bond yields can boost ICs' demand for liquidity, with broader financial stability implications. To hedge against falls in interest rates, major ICs hold positions in interest rate swaps that come with margin requirements. Thus, when interest rates rise, ICs incur losses on the market value of their derivatives and need to post variation margins. The faster the hike in sovereign bond yields, the faster the rise in margin calls and the stronger the pressure on ICs to raise liquidity (Graph A2.C), which typically entails sales of sovereign bonds. This could amplify the bond yield increases if ICs' liquidity needs spill over to the sovereign bond market.

The views expressed in this box are those of the authors and do not necessarily reflect those of the Bank for International Settlements or the International Association of Insurance Supervisors.

The views expressed in this box are those of the authors and do not necessarily reflect those of the Bank for International Settlements or the International Association of Insurance Supervisors.  See D Domanski, H S Shin and V Sushko, "The hunt for duration: not waving but drowning?", IMF Economic Review, vol 65, 2017; A Ozdagli and Z Wang, "Interest rates and insurance company investment behaviour", mimeo, 2022.

See D Domanski, H S Shin and V Sushko, "The hunt for duration: not waving but drowning?", IMF Economic Review, vol 65, 2017; A Ozdagli and Z Wang, "Interest rates and insurance company investment behaviour", mimeo, 2022.  The CDS spread interlinkage is also a salient feature of the sovereign–bank nexus (see Hardy and Zhu in the same issue).

The CDS spread interlinkage is also a salient feature of the sovereign–bank nexus (see Hardy and Zhu in the same issue).