A new database on foreign banking offices

Box extracted from special feature "Global banks' local presence: a new lens"

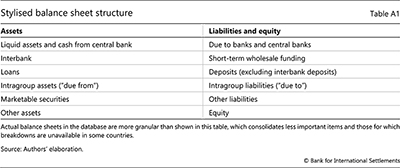

This box summarises a new database on foreign banking offices (FBOs) in 24 host jurisdictions. To produce histories of the country-level aggregate balance sheets of these FBOs as well as, for comparison, those of local peers, the database combines aggregate and entity-level information. Data are presented on a locational basis – ie from the perspective of host jurisdictions – but office balance sheets are also linked to those of parent banking groups and their home jurisdictions. The standardised balance sheet information is sufficiently granular to measure liquidity ratios, loan and deposit positions, capital (for subsidiaries) and (in nine countries) "due from and to" intragroup balances (Table A1). The quarterly time series provide nearly complete coverage from Q4 2008 (with earlier data in many countries) until Q4 2020. Source data are reported in local currency and are converted to US dollars using end-of-period exchange rates.

To produce histories of the country-level aggregate balance sheets of these FBOs as well as, for comparison, those of local peers, the database combines aggregate and entity-level information. Data are presented on a locational basis – ie from the perspective of host jurisdictions – but office balance sheets are also linked to those of parent banking groups and their home jurisdictions. The standardised balance sheet information is sufficiently granular to measure liquidity ratios, loan and deposit positions, capital (for subsidiaries) and (in nine countries) "due from and to" intragroup balances (Table A1). The quarterly time series provide nearly complete coverage from Q4 2008 (with earlier data in many countries) until Q4 2020. Source data are reported in local currency and are converted to US dollars using end-of-period exchange rates.

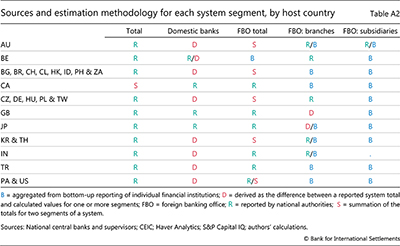

The database combines "top-down" (by authorities) and "bottom-up" (by entities) financial disclosures. Some balance sheet series are aggregates by office type, as reported by country authorities (Table A2, represented by R). Others are constructed from bottom-up aggregation of entity-level reporting (captured by B). This information is sourced from balance sheets for 503 branches and 253 subsidiaries in eight advanced and 16 emerging market economies. In some countries, balance sheet items for specific entity categories are derived as the difference between reported totals at the system level and known values for other segments (denoted by D).

This database complements a rich body of data and associated empirical literature on international banking. The BIS international banking statistics, a key resource in this literature, are a long-standing, geographically broad and increasingly rich data set. However, they are reported at the aggregate country level and provide relatively short histories for local offices and broad balance sheet groupings. The other core resource is a set of databases that focus on foreign entities in the United States and the overseas operations of US banks (Cetorelli and Goldberg (2011, 2012), Fillat et al (2018)). These are supplemented by single-country work on FBO behaviour for a handful of jurisdictions (see eg Hills et al (2015), Turtveit (2017) and Wong et al (2014)). Some offer long histories with granularity but are limited to a single host economy and a narrow cohort of international banks.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.