EME funds during Covid-19

OEFs that invest in debt securities of emerging market economies ("EME funds") exhibited especially large investor outflows during the March 2020 market turmoil.

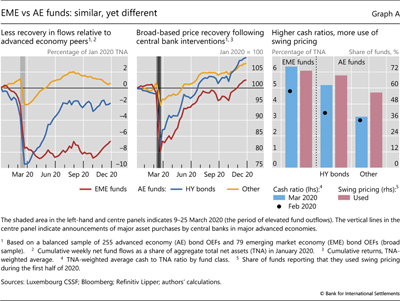

While the pace eased towards the end of March, inflows did not resume until later in the year. This contrasts with the swift rebound in fund subscriptions for many OEFs investing in advanced economy debt ("AE funds"), including those targeting high-yield securities (Graph A, left-hand panel).

While the pace eased towards the end of March, inflows did not resume until later in the year. This contrasts with the swift rebound in fund subscriptions for many OEFs investing in advanced economy debt ("AE funds"), including those targeting high-yield securities (Graph A, left-hand panel).

Differences between EMEs and advanced economies as regards the scope and scale of central bank interventions help explain the differences in flow dynamics. During the height of the turmoil, central banks in major AEs expanded their purchases of corporate bonds and other private assets or introduced new large-scale purchase programmes. The policy response of EME central banks, by comparison, relied less on asset purchases and focused more on foreign exchange, interest rate and reserve policies (Cantú et al (2021).

While the flows of EME funds evolved differently from those of AE funds, price-based measures exhibited similarities. The response of EME funds' net asset value (NAV) per share to the intervention by major AE central banks at end-March 2020 was similar to, although slower than, that of AE HY funds' NAV per share (Graph A, centre panel). This suggests that asset purchases supported the valuations not only of eligible bonds (ie primarily higher-rated AE debt), but also of ineligible bonds, albeit to a lesser extent and with some delay (eg Gilchrist et al (2021); Breckenfelder et al (2021)).

EME funds used some lines of defence more heavily than their AE peers. Although EME funds held more cash than their AE peers at the outset of the turmoil, they still increased their cash ratios during it. This resembled the behaviour of AE HY funds. EME funds, given their higher redemption risk, made heavy use of swing pricing, typically imposing higher swing factors and lower swing thresholds than their AE peers (Graph A, right-hand panel).

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.

The views expressed in this box are those of the authors and do not necessarily reflect those of the BIS.  For the purposes of this analysis, "EME funds" refers to UCITS that are registered in Luxembourg and invest predominantly in emerging market debt.

For the purposes of this analysis, "EME funds" refers to UCITS that are registered in Luxembourg and invest predominantly in emerging market debt.