A database on banking distress mitigation tools

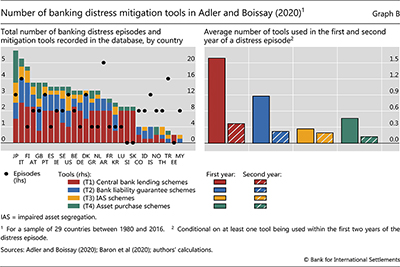

This box describes Adler and Boissay's (2020) new database on banking distress mitigation tools. The database contains information on more than 300 interventions in 29 countries between 1980 and 2016. It documents the tools' deployment dates (quarter) and key design features. The tools are divided into four broad types of schemes: (T1) central bank lending; (T2) bank liability guarantees; (T3) impaired asset segregation; and (T4) asset purchases.

Central bank lending schemes (T1) consist of interventions providing funding directly to banks and other financial intermediaries. These include outright liquidity provision, special (eg long-term) lending and changes in central banks' collateral eligibility rules (eg extension of collateral frameworks to more institutions or asset classes). Among these tools, the last one is the most frequently employed.

Bank liability guarantee schemes (T2) consist of fiscal authorities (partly) guaranteeing commercial banks' privately issued debts, sometimes in exchange for a guarantee fee. An example is an enhancement to an existing deposit insurance scheme. Most schemes are optional, and cover a relatively large array of debt instruments (eg senior debt instruments, interbank debts), but are restricted to newly issued (as opposed to legacy) liabilities.

The database records 40 impaired asset segregation schemes, (T3) or so-called "bad banks". Most bad banks in the database have a limited lifetime. About half are set up for one specific bank. The other half are "centralised", ie they purchase assets on a voluntary basis from several banks, often with a limit on the amount purchased per bank. On average, the size of a bad bank amounts to 7% of GDP, and a haircut of 25% is applied on the assets purchased.

Asset purchase schemes (T4) consist of interventions where the central bank purchases specific assets on secondary markets (eg corporate bonds, asset-backed securities), or offers to banks to swap risky for safer assets (typically government bonds).

The intensity of interventions varies by country. Graph B (left-hand panel) shows that Japan, Italy and Finland record the most interventions overall. Finland has the most interventions per distress episode. When they take place, most interventions occur in the first year (right-hand panel). Central banks' lending schemes are the most prevalent type of intervention, with an average of 1.6 schemes set up in the first year, followed by bank liability guarantee schemes.

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements

The views expressed are those of the authors and do not necessarily reflect those of the Bank for International Settlements