The United Kingdom as a hub for international banking

(Extract from pages 30-32 of BIS Quarterly Review, September 2016)

The recent British vote to leave the European Union has focused attention on the role of the United Kingdom in the European and international banking systems.

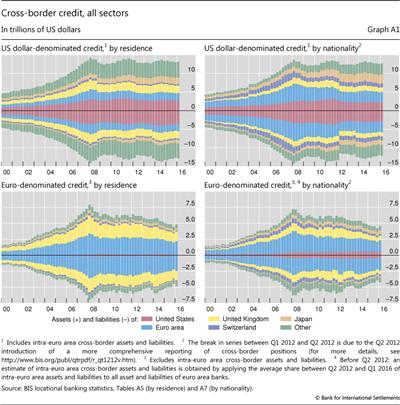

On a locational basis, the United Kingdom stands out as a prominent international banking hub. However, a large share of this activity is accounted for by banks from other countries with affiliates located in the United Kingdom. A comparison of the residence and nationality breakdowns of banks' total (worldwide) cross-border positions illustrates the distinction between the location of international bank activity and the nationality of the banks that perform it (Graph A1). In both dollar and euro business, the amount of cross-border activity by banks located in the United Kingdom (the yellow areas in Graph A1, left-hand panels) is notably bigger than the cross-border business of banks headquartered in the United Kingdom (the yellow areas in Graph A1, right-hand panels). For other countries, eg Switzerland (the purple areas), the reverse is true.

In both dollar and euro business, the amount of cross-border activity by banks located in the United Kingdom (the yellow areas in Graph A1, left-hand panels) is notably bigger than the cross-border business of banks headquartered in the United Kingdom (the yellow areas in Graph A1, right-hand panels). For other countries, eg Switzerland (the purple areas), the reverse is true.

As of end-Q1 2016, banks located in the United Kingdom reported total cross-border lending worth $4.5 trillion. They ranked first among all banks located in BIS reporting countries, followed by banks in Japan ($3.4 trillion) and the United States ($3.1 trillion). At the same time, with a total of $3.8 trillion, the United Kingdom was the second largest recipient of cross-border bank credit, surpassed only by the United States ($4.8 trillion). Interbank claims made up almost two thirds of all cross-border claims on the United Kingdom, with claims on related banks accounting for about one third of the interbank positions.

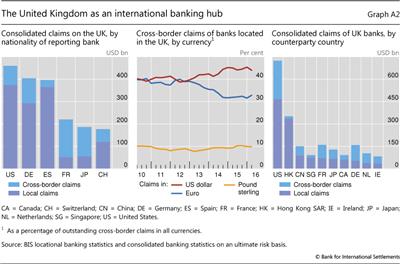

A substantial share of foreign banks' business with the United Kingdom is booked through local offices in the United Kingdom, rather than cross-border (Graph A2, left-hand panel). On a consolidated ultimate risk basis, foreign claims on UK residents amounted to $2.4 trillion as of end-March 2016, of which almost two thirds were booked locally. Among those internationally active foreign banks with local operations, US banks reported the largest outstanding foreign claims on the United Kingdom ($460 billion), followed by German ($404 billion) and Spanish banks ($396 billion). Claims of banks from BIS reporting EU member countries totalled $1.3 trillion. This amounted to 56% of all foreign claims on UK residents.

on UK residents amounted to $2.4 trillion as of end-March 2016, of which almost two thirds were booked locally. Among those internationally active foreign banks with local operations, US banks reported the largest outstanding foreign claims on the United Kingdom ($460 billion), followed by German ($404 billion) and Spanish banks ($396 billion). Claims of banks from BIS reporting EU member countries totalled $1.3 trillion. This amounted to 56% of all foreign claims on UK residents.

At the same time, UK banks are also closely involved in the European banking system (Graph A2, right-hand panel). As of end-Q1 2016, UK banks' consolidated foreign claims on other EU countries reached $666 billion, or 21% of their global total, while those on euro area countries totalled $634 billion, or 20%. Nevertheless, their consolidated foreign claims on the United States ($724 billion) and Hong Kong SAR ($351 billion) were larger than those on any single EU member country.

The United Kingdom has a particularly important role as a redistribution hub for euro-denominated funds. Banks and other financial intermediaries located there (many of which are headquartered outside the United Kingdom) borrow euros from abroad and then invest them in euro-denominated cross-border claims. Banks located in the United Kingdom are the largest borrowers and lenders of euros outside the euro area. As of end-March 2016, about 54% of all worldwide unconsolidated euro-denominated cross-border claims booked outside the euro area and 60% of all liabilities were accounted for by banks resident in the United Kingdom. In recent years, this share has tended to decline, owing in part to a pickup in euro-denominated activity elsewhere in the world and also to exchange rate movements.

Indeed, ever since the launch of the single currency, euro-denominated positions have been a major part of the cross-border portfolios of banks located in the United Kingdom. For most of the 2000s, the share of the euro in the cross-border claims of banks in the United Kingdom hovered around 40% and was roughly equal to the share of claims denominated in US dollars (Graph A2, centre panel). Since 2012, while partly reflecting exchange rate movements, these shares have diverged. The euro's share declined from 39% at end-September 2012 to 33% at end-March 2016. Over the same period, the share of the US dollar in the cross-border claims of banks in the United Kingdom increased from 39% to 44%.

For more information, see BIS locational banking statistics, Tables A5 and A7; and H S Shin, "Global liquidity and procyclicality", speech at the World Bank conference on The state of economics, the state of the world, Washington DC, 8 June 2016.

For more information, see BIS locational banking statistics, Tables A5 and A7; and H S Shin, "Global liquidity and procyclicality", speech at the World Bank conference on The state of economics, the state of the world, Washington DC, 8 June 2016.  Foreign claims comprise cross-border claims plus local claims in all currencies, where local claims refer to credit extended by banks' affiliates located in the same country as the borrower.

Foreign claims comprise cross-border claims plus local claims in all currencies, where local claims refer to credit extended by banks' affiliates located in the same country as the borrower.  Not all EU members report to the BIS banking statistics. The figures above include Austria, Belgium, Germany, Finland, France, Greece, Ireland, Italy, the Netherlands, Portugal, Spain and Sweden.

Not all EU members report to the BIS banking statistics. The figures above include Austria, Belgium, Germany, Finland, France, Greece, Ireland, Italy, the Netherlands, Portugal, Spain and Sweden.