Foreign exchange market intervention in EMEs: what has changed?

Since the Great Financial Crisis, emerging market economies have been more active in FX markets. As rising dollar debt and increased exposure to global financing flows have affected the demand and supply of foreign currency, financial stability has become an increasingly important motive for interventions. Adjustments in intervention tactics and instruments are consistent with a greater importance of financial stability considerations. Timely interventions can be effective in improving FX market liquidity, and there are credibility gains from holding foreign reserve buffers in countries with low credit ratings. Since the carrying costs of holding reserves have increased, countries with higher credit ratings may have incentives to reduce the size of reserve buffers.1

JEL classification: E44, F30, F40, G10.

In the aftermath of the Great Financial Crisis (GFC), emerging market economies (EMEs) have experienced large shifts in FX market conditions. A period of sustained capital inflows and high commodity revenues between 2009 and 2013 resulted in appreciation pressure for many EME currencies. Since then, many countries have confronted strong depreciations of their domestic currencies against the backdrop of falling commodity prices, weaker domestic growth and tightening global liquidity conditions.

Many EME central banks have adjusted their FX market operations to the evolving market and policy backdrop. Large and rapidly shifting capital flows and widening currency mismatches seem to have added weight to policies aimed at containing exchange rate volatility and providing the private sector with insurance against exchange rate risks. Changes in the depth and functioning of FX markets have also led to adjustments in intervention methods and tactics. And, in some cases, FX intervention has been complemented by more active use of other instruments to manage capital flows - including reserve requirements as well as more traditional capital controls.

This special feature discusses how EMEs have adapted FX market operations in the light of these challenges. It argues that financial stability has become a more important motive for FX intervention, and that this has influenced the choice of instruments and intervention tactics. The boundary between FX intervention policy (which is aimed at influencing the exchange rate) and other aspects of central banks' FX market operations (which aim at influencing market liquidity conditions more broadly) has often become blurred.2 Moreover, a more prominent role for financial stability considerations has affected assessments of the effectiveness of FX intervention policy.

The next section provides some stylised facts on changes in intervention patterns since the GFC. The third section discusses how increasing foreign currency exposures and exchange rate volatility have affected the motives and goals of FX market intervention. The fourth section explores changes in central banks' intervention methods and tactics. The fifth section considers recent evidence on the effectiveness of intervention and changes in the costs of holding FX reserves as buffers. The conclusion sums up.

FX reserve changes and intervention patterns

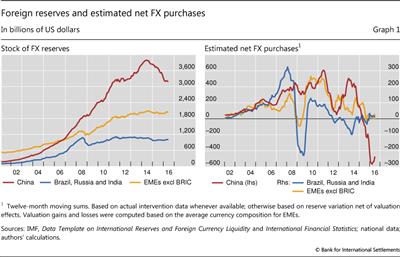

The aftermath of the GFC has seen large changes in EMEs' FX reserves. Between 2009 and 2014, FX reserves rose from $4 trillion to $7 trillion (Graph 1, left-hand panel). Since then, they have declined by $900 billion. However, these changes in reported FX reserves may overstate the size of FX intervention because they include valuation effects.

Better estimates of intervention can be obtained by taking into account foreign reserve composition.3 Such adjusted estimates indicate that in the past two years, valuation effects accounted for about half of the reported changes in aggregate FX reserves. Following a period of steady purchases in the run-up to the GFC, and large sales at the peak of the crisis, FX purchases resumed during 2010-11. Since 2013, major EMEs have on balance sold FX reserves, with China's sales since late 2015 standing out (Graph 1, right-hand panel).

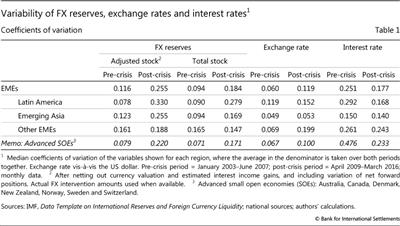

Many countries seem to have become more active in FX markets since the GFC. Judging from the volatility of FX positions, this appears to be particularly the case for central banks in Asia and Latin America. As the first two columns of Table 1 show, the variation of reserve holdings (adjusted for valuation effects) has doubled since the crisis for Asian EMEs, and more than tripled for those in Latin America.

Increased intervention activity has coincided with higher exchange rate variability (Table 1, fifth and sixth columns). This suggests that authorities have intervened more in the face of greater exchange rate movements, without, however, eliminating fluctuations. At the same time, policy rate variability has decreased since the crisis in EMEs (last two columns). This is partly because global interest rates in core economies have approached their lower bound, compressing yields in other regions.

Central banks have also implemented FX or related derivatives transactions, which suggests that valuation-adjusted FX reserve changes may underestimate intervention activity. For example, the combined net long forward position of seven East Asian countries (aggregate of the net positions of Hong Kong SAR, Indonesia, Korea, Malaysia, the Philippines, Singapore and Thailand) increased from just $22 billion in April 2009 to $235 billion in mid-2011. Since then, it has gradually declined, reaching $68 billion last February. In Latin America and other EMEs, FX derivatives and related instruments have also been used by authorities. However, in many cases these instruments are not readily comparable to spot market transactions: in Asia, some central banks seem to have used FX swaps for sterilisation purposes and a few central banks have used non-deliverable instruments, which do not involve actual exchange of FX (see discussion below).4

Financial stability and FX intervention

Central banks intervene in FX markets for various reasons: to control inflation, maintain competitiveness, support financial stability and build FX reserves for precautionary reasons (see Moreno (2005) for a review). These motives - which are not mutually exclusive - depend not only on countries' choice of monetary regime but also on their exposure to external developments, their aggregate balance sheet positions and macroeconomic circumstances.

The underlying reasons for FX intervention - maintaining macroeconomic and financial stability - have not changed fundamentally. However, a recent BIS survey (Mohanty and Berger (2013)) shows that a growing number of EME central banks have placed more emphasis on capital flow and exchange rate volatility. This indicates that greater weight may have been put on financial stability considerations. Indeed, the central banks of Hungary, Indonesia, Russia, South Africa and Turkey have stated that they engage in intervention with the aim of ensuring financial stability.5

Post-crisis trends in financial markets...

Since the GFC, two developments in particular may have increased the importance of financial stability considerations as a motive for FX market intervention.

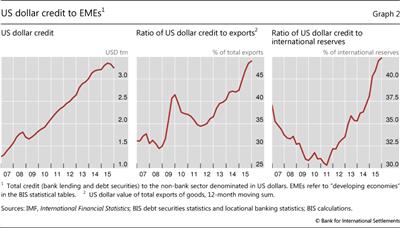

One is the rapid growth of EME foreign currency debt. Borrowing in foreign currency, especially in US dollars, has risen at a rapid pace post-crisis. In particular, US dollar-denominated debt of EME non-bank borrowers has surged. At the end of 2015, it stood at $3.3 trillion (Graph 2, left-hand panel). Total FX debt now stands at 40% of GDP in emerging Asia and non-euro area European countries, and 25% in Latin America.

In many cases, rising foreign currency debt has not been matched with FX assets and revenues, and currency mismatches have therefore increased, especially on corporate balance sheets (Chui et al (2016)). The ratio of EME dollar debt to exports rose from 30% in mid-2008 to 49% at the end of 2015 (Graph 2, centre panel). Dollar liabilities have also increased relative to the stock of official FX reserves, even though this variation was somewhat less pronounced (Graph 2, right-hand panel). As a consequence, the non-financial corporate sector in many EMEs has to manage larger FX risks.

A second, related trend is growth in the holdings of EME securities, in particular debt, by foreign institutional investors.6 Global asset managers hold a significant part of the foreign currency debt issued by EME corporates since the financial crisis. In addition, foreigners are major investors in EME local currency bonds, typically sovereign debt. In March 2016, they held an average of 24% of EME local sovereign debt, but foreign holdings reached around 34% in Malaysia and Mexico, and close to 38% in Indonesia and Peru.7

While EME sovereigns have been less active than the private sector in issuing foreign currency debt, they have nevertheless become increasingly exposed to global financing flows. Large foreign holdings of domestic EME bonds mean the currency as well as domestic financing conditions (notably bond yields) tend to be more exposed to swings in foreign investors' behaviour.

... and their implications for FX operations

These trends affect the supply of and demand for foreign currency, and the potential approach to FX intervention, in two ways.

First, the demand for foreign currency for hedging purposes has increased. Domestic entities, especially corporates, run larger FX exposures due to the issuance of foreign currency debt (Chui et al (2016)). Similarly, foreign investors may want to hedge the FX risk they face from holding EME domestic currency bonds. Both cases result in higher demand for insurance against a depreciation of the domestic currency.8 In this setting, an illiquid FX market, as reflected, for example, in very large bid-ask spreads, can imply large costs for the financial and non-financial sectors. If such costs are sufficiently high, investors may find it hard to close their positions, exposing them to losses and possibly posing systemic risks. These effects may be larger the more the economy is internationally integrated.

Second, there is a greater risk that booms and busts in capital flows will cause large shifts in exchange rates. Capital flows have grown in size, and have become more dependent on the risk perceptions of international investors and global liquidity conditions more generally. The risk-taking channel of the exchange rate may add an amplifier (Bruno and Shin (2015) and Hofmann et al (2016)): a depreciation of the local currency against the funding currency tightens the value-at-risk (VaR) constraints of global banks that supply credit to EMEs. A depreciation could therefore imply an undesired tightening of domestic financial conditions, which would hit asset prices and amplify losses faced by domestic agents that are indebted in foreign currency.

Under these conditions, central banks have incentives to build up their stocks of FX reserves. On the one hand, they can then deploy these reserves to meet the increased demand for foreign currency hedges. Central banks could intervene as needed in order to keep the short-term costs of liquidity insurance in check, preserve market functioning and also help investors needing to close positions in an EME currency to do so in a timely and cost-effective manner. This would include intervening on a larger scale during times of market stress.

On the other hand, sizeable FX reserve buffers can also help to protect the financial system from fluctuations in risk aversion in international markets by signalling the capacity to respond to FX funding stress.

The accumulation of reserves for these purposes raises issues. One is the trade-off between the advantages of building a large stock of FX reserves and the fact that such larger reserves may encourage risky position-taking. Another is that deploying foreign reserves to meet liquidity needs and mitigate the effects of sudden shifts in investor risk aversion may impair the credibility of the foreign reserve buffer and weaken investor confidence.

Instruments and tactics

The central bank's objectives in FX intervention have implications for the methods, tactics and instruments it uses in carrying out that policy. In the light of the discussion above, three points stand out.

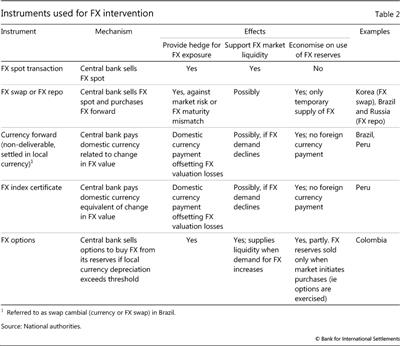

First, authorities have increasingly used FX derivatives or related instruments. This has allowed them to provide hedges against FX risk and influence FX market liquidity and the exchange rate while economising on the use of FX reserves and retaining foreign reserve buffers. Table 2 provides an overview of such instruments.

Central banks have provided hedges against FX risk in two ways. One has been to deliver foreign currency that allows central bank counterparties to close FX positions. Spot market interventions provide FX now, FX forwards at a pre-defined future point in time, and FX options during a certain, pre-specified period. By writing FX options, the central bank provides protection against large FX moves. FX repos and swaps supply FX for the duration of the repo or swap, providing a hedge against maturity mismatches in FX. For example, FX repos may have allowed firms to repay foreign currency debt now, assuming an obligation to deliver foreign currency to the central bank in the future.9

Moreover, and increasingly, central banks have also provided protection against changes in the value of FX positions by paying the equivalent in domestic currency. Hence, currency swaps or indexed certificates settled in domestic currency do not provide the foreign currency that may be required to settle claims but may reduce the demand for FX resulting from a desire to avoid valuation losses.10

Second, intervention in the FX spot market continues to be important. Graph 1 shows that monetary authorities have implemented large sales of foreign reserves.11 FX spot sales may at times be particularly effective in mitigating FX illiquidity or dampening sharp depreciation pressures because FX trading is concentrated in spot markets and because of the signalling effect of spot market intervention.

Third, as regards intervention tactics, a number of central banks have made use of transparent and rule-based FX interventions. For instance, Chile and Colombia implemented foreign reserve accumulation programmes with preannounced daily purchase amounts over a fixed period of time. The amounts in principle could not be readily adjusted in response to changes in the exchange rate.12 Such rule-based intervention can be used to signal that any change in foreign reserves will be limited and predictable and that there is not an explicit intention to target the exchange rate.13

Another approach has been to announce criteria that would have to be met for FX intervention to take place. For example, beginning in December 2014 the Foreign Exchange Commission of Mexico announced conditions under which the Bank of Mexico would intervene in the FX market, by implementing rule-based auctions in which it was to sell $200 million per day, in order to maintain the orderly functioning of the local FX market and provide it with liquidity if needed.

However, in the post-crisis market context, transparent rule-based FX intervention mechanisms may face challenges. In Mexico, the rule-based mechanism was discontinued in February 2016, against the backdrop of pressures on the exchange rate from the use of the Mexican peso to hedge positions in other EME currencies ("proxy hedging") and signs of speculation by FX traders against the rule-based mechanism. At the same time, the authorities left open the possibility of future discretionary intervention.

The Mexican experience may also raise broader questions about the balance between rules and discretion. With the spread of electronic trading - which in 2015 accounted for about two thirds of FX cash market turnover, compared with less than half pre-crisis - the effectiveness of interventions seeking to influence the exchange rate level or dampen exchange rate volatility may increasingly depend on the central bank being able to surprise markets.14

Effectiveness and costs of FX market operations

The effectiveness of FX intervention with respect to different objectives is the subject of a large body of research (see eg Galati and Disyatat (2005) and BIS (2013) for overviews). This section explores how effective FX interventions since the GFC may have been in pursuing the goals that are the focus of this paper: has intervention supported market liquidity and relieved short-term pressures that may disrupt market functioning? And have foreign reserve buffers helped to protect countries against sudden shifts in global market conditions?

FX intervention and liquidity

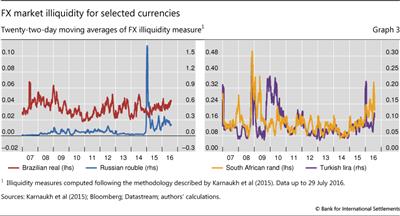

Timely interventions to ease FX market liquidity can be particularly effective when liquidity shortages are associated with amplifying effects, such as short covering of FX positions when the domestic currency is depreciating. Spikes in market illiquidity can trigger such feedback loops. Indeed, Graph 3, which shows the evolution of an FX market illiquidity index for four EMEs,15 does point to sudden spikes or episodes of FX market illiquidity.16 In some cases, episodes of illiquidity are confined to a specific currency. In other cases, the spikes reflect global factors, such as fluctuations in the US dollar17 or global investor risk tolerance or risk perceptions.

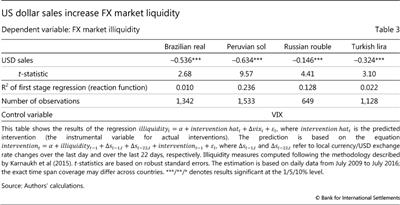

How have central bank net US dollar sales affected FX market illiquidity? To explore this question, we implement an empirical exercise based on complete FX market operations data for four EMEs at daily frequency. Our estimations are based on relatively long time series, which encompasses a continuous stretch of between 649 and 1,533 working days after the GFC, depending on the country in question.18

We deal with the potential endogeneity of interventions by using an instrumental variable method. Thus, actual interventions are replaced by predicted interventions, based on the estimates of a first-stage regression that is run over the entire sample period for each country.19 The prediction regression considers previous day FX market illiquidity and intervention, as well as exchange rate depreciation during the previous day and over the last 22 working days. To estimate the impact of intervention on liquidity, in the second-stage regression we regress the illiquidity indicator on predicted intervention and market volatility.

The results suggest that FX intervention clearly has a significant and systematic impact on FX market liquidity (Table 3), as USD sales reduce the Karnaukh et al (2015) measure of market illiquidity in all four cases. The relative magnitude of the coefficients suggests that during our sample period a same-size USD sale has more significant effects on the market illiquidity measure in Peru than in Russia.20

Benefits and costs of FX reserve buffers

A larger foreign reserve buffer can affect a country's credibility, which has implications for the costs of external financing and the economy's resilience to external shocks. At the same time, there are costs to holding foreign reserves, including the cost of maintaining low-yielding assets on the public sector balance sheet.

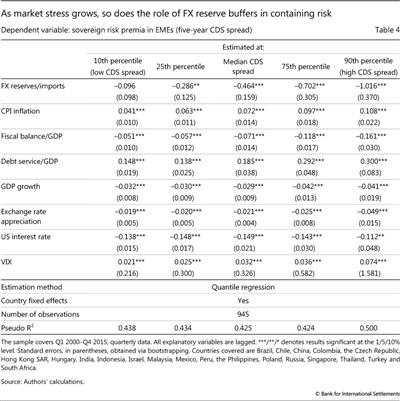

To assess potential credibility effects of the foreign reserve buffer, we implement an empirical analysis that attempts to measure the impact of a given level of reserves on a country's sovereign risk premium, correcting for other relevant factors such as a country's growth rate and fiscal position (Table 4). More specifically, we implement a quantile regression on the determinants of risk premia (Koenker and Bassett (1978) and Koenker and Hallock (2001)). We study how the relative importance of key determinants of risk premia in EMEs (here proxied by the five-year sovereign CDS spread) increase as one moves from low-risk to high-risk country-year observations. As a proxy for the insurance provided through reserves, including against real shocks, we use the ratio of FX reserves to imports. Throughout, our control variables include measures of inflation, the government budget position and a proxy for the aggregate debt service burden of the respective economy.21

While the size of the reserve buffer does not affect risk perceptions for countries at the low end of the sovereign risk spectrum, reserve holdings do reduce risk premia when risk levels are already high. A given reduction in FX reserves increases sovereign risk premia by more than twice as much at the 90th risk percentile than at the 50th percentile, and about 3.5 times as much as at the 25th percentile (Table 3, first row). In other words, market participants appear to attach increasing weight to buffer sizes as underlying risk grows.

One potential explanation for the above is that when financial stress is more likely, liquidity buffers could signal more capability to react and limit the effects of adverse shocks. This interpretation is corroborated by detailed studies such as that of Aizenman et al (2013), who find that international reserve buffers are the key mitigating factors of the most adverse effects of abrupt financial contractions.22 That said, for many countries with lower risk premia the overall effect of FX reserve buffers on risk premia seems limited.

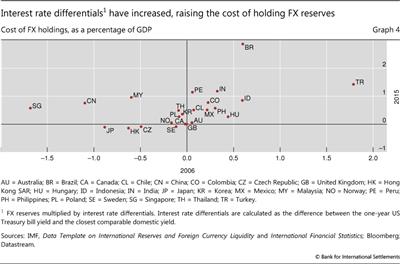

For a number of countries, the benefit of maintaining a foreign reserve buffer may be at least partly offset by the costs of holding foreign reserves. Graph 4 compares estimated quasi-fiscal costs of holding foreign reserves in 2006 and 2015 scaled by GDP. Carrying costs have increased for most countries in the scatter plot (ie the relevant dots are above and to the left of the 45 degree line).23 A number of countries had negative interest rate differentials and therefore negative carrying costs in 2006, but in most cases these had turned positive by 2015.

Conclusion

Central banks have been very active in FX spot and related derivatives markets since the GFC. Financial stability considerations appear to have been an important motive. In particular, central banks have sought to dampen the impact of capital flows and shifts in global liquidity conditions on the domestic economy. Supporting FX market functioning and liquidity seems to have been one specific goal. The build-up of FX reserve buffers seems to have been another, as indicated by the implementation of dedicated reserve accumulation programmes.

The empirical analysis reported in this article indicates that FX intervention can be effective in improving liquidity in the FX market. At the same time, the costs of running down foreign reserve buffers in terms of higher sovereign risk premia appear to be small, especially for countries that already enjoy strong credit ratings. Furthermore, the carrying costs of foreign reserves have risen in many countries since the GFC.

Against this backdrop, the greater weight of financial stability considerations may have made trade-offs related to FX intervention policies more complex. One issue is to weigh the benefits of maintaining large FX reserve buffers in terms of greater credibility of FX intervention policies, and possibly lower risk premia, against higher carrying costs of reserves and the opportunity cost of not using reserves (in terms of higher FX volatility).

Perhaps reflecting these trade-offs, central banks have implemented FX intervention or related operations in a way that suggests a desire to economise on the use of foreign reserves. Some have made more use of FX derivative and related markets. Others have selected instruments in which sales of FX are eventually reversed, or have supplied hedges against exchange rate movements that reduce the demand for foreign currency but do not actually involve central bank drawdowns of foreign reserves. They also have in some cases adopted rule-based FX intervention that signals that any changes in foreign reserves would be predictable and limited.

References

Aizenman, J, B Pinto and V Sushko (2013): "Financial sector ups and downs and the real sector in the open economy: up by the stairs, down by the parachute", Emerging Markets Review, vol 16(C), pp 1-30.

Alper, K, H Kara and M Yörükoğlu (2013): "Alternative tools to manage capital flow volatility", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

Archer, D (2005): "Foreign exchange market intervention: methods and tactics," in "Foreign exchange market intervention in emerging markets: motives, techniques and implications", BIS Papers, no 24.

Balogh, C, Á Gereben, F Karvalits and G Pulai (2013): "Foreign currency tenders in Hungary: a tailor-made instrument for a unique challenge", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

Bank for International Settlements (2013): "Market volatility and foreign exchange intervention in EMEs: what has changed?", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

Bruno, V and H S Shin (2015): "Cross-border banking and global liquidity", Review of Economic Studies, vol 82, no 2, pp 535-64.

Canales-Kriljenko, J (2003): "Foreign exchange intervention in developing and transition economies: results of a survey", IMF Working Papers, no WP/03/95.

Central Bank of the Russian Federation (2015): "The Bank of Russia FX policy", www.cbr.ru/Eng/DKP/?PrtId=e-r policy (last updated 17 December 2015, accessed 31 August 2016).

Chui, M, E Kuruc and P Turner (2016): "A new dimension to currency mismatches in the emerging markets - non-financial companies", BIS Working Papers, no 550.

Corwin and Schultz (2012): "A simple way to estimate bid-ask spreads from daily high and low prices", Journal of Finance, vol 67, pp 719-59.

Dominguez, K and J Frankel (1993): "Does foreign-exchange intervention matter? The portfolio effect", American Economic Review, vol 83, pp 1356-69.

Fratzscher, M, O Gloede, L Menkhoff, L Samo and T Stöhr (2015): "When is foreign exchange intervention effective? Evidence from 33 countries", DIW Discussion Papers, no 1518.

Fuentes, M, S García-Verdú, J Julio, E Lahura, R Moreno, P Pincheira, H Rincón, M Vega and M Zerecero (2014): "The effects of intraday foreign exchange market operations in Latin America: results for Chile, Colombia, Mexico and Peru", BIS Working Papers, no 462.

Galati, G and P Disyatat (2005): "The effectiveness of foreign exchange intervention in emerging market countries: evidence from the Czech koruna", BIS Working Papers, no 172.

Gabaix, X and M Maggiori (2015) "International liquidity and exchange rate dynamics", Quarterly Journal of Economics, vol 130, no 3, pp 1369-420.

Hofmann, B, I Shim and H S Shin (2016): "Sovereign yields and the risk-taking channel of currency appreciation", BIS Working Papers, no 538.

Jeanne, O (2016): "The macroprudential role of international reserves", American Economic Review, vol 106, no 5, pp 570-3.

Karnaukh, N, A Ranaldo and P Söderlind (2015): "Understanding FX liquidity", Review of Financial Studies, vol 28, pp 3073-108.

Koenker, R and G Bassett Jr (1978): "Regression quantiles", Econometrica, vol 46, no 1, pp 33-50.

Koenker, R and K Hallock (2001): "Quantile regression", Journal of Economic Perspectives, vol 15, no 4, pp 143-56.

Kohlscheen, E and S Andrade (2014): "Official FX interventions through derivatives", Journal of International Money and Finance, no 47, pp 202-16.

Mihaljek, D (2005): "Survey of central banks' views on effects of intervention", in "Foreign exchange market intervention in emerging markets: motives, techniques and implications", BIS Papers, no 24.

Mminele, D (2013): "Note on the foreign exchange market operations of the South African Reserve Bank", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

Mohanty, M and B Berger (2013): "Central bank views on foreign exchange intervention", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

Moreno, R (2005): "Motives for intervention", in "Foreign exchange market intervention in emerging markets: motives, techniques and implications", BIS Papers, no 24.

Neely, C (2005): "An analysis of recent studies of the effect of foreign exchange intervention", Federal Reserve Bank of St Louis, Review, no 2005-030, pp 685-718.

Sarno, L and M Taylor (2001): "Official intervention in the foreign exchange market: is it effective, and, if so, how does it work?", CEPR Discussion Papers, no 2690.

Shin, H S (2016): "Global liquidity and procyclicality", speech at the World Bank conference "The state of economics, the state of the world", Washington DC, 8 June.

Warjiyo, P (2013): "Indonesia: stabilizing the exchange rate along its fundamental", in "Market volatility and foreign exchange intervention: what has changed?", BIS Papers, no 73.

1 The authors thank Claudio Borio, Ben Cohen, Angelo Duarte, Robert McCauley, Hyun Song Shin and Christian Upper for comments. Research assistance from Tania Romero, Julieta Contreras and Diego Urbina is acknowledged.

2 Hence, in this article we consider all FX market or related operations of the central bank that could affect the exchange rate, even if this is not the primary objective. We use the terms FX market operations and FX intervention interchangeably.

3 The valuation adjustment considers changes in the exchange rates of global reserve currencies, and the average FX reserve composition for EMEs (based on the IMF Currency Composition of Official Foreign Exchange Reserves (COFER) database). We assume that the share in each currency is remunerated at the respective Libor rate.

4 Moreover, FX intervention may have taken place through state-owned commercial banks, and this would not be reflected in reported FX numbers.

5 See Alper et al (2013), Balogh et al (2013), Mminele (2013), Warjiyo (2013) and Central Bank of the Russian Federation (2015).

6 According to the IMF's Coordinated Portfolio Investment Survey (CPIS), the share of debt securities of 30 EMEs in the portfolio of investors from major economies grew from 4.5% in 2007 to 9% in 2015.

7 Based on information for 16 EMEs from the Institute of International Finance (IIF).

8 In line with this, some financial market analysts have indicated that foreign investors that invest in illiquid EME bond markets take long positions in FX derivatives as a proxy hedge against liquidity risk. This in effect transmits volatility from the fixed income market to the FX market.

9 As noted earlier, East Asian central banks use FX swaps routinely as sterilisation instruments, in which, after purchasing FX in the spot market, the central bank implements an FX swap in which it sells the FX spot and purchases FX forward. Their use for this purpose would not be comparable to the use of FX swaps for purposes of intervention to dampen illiquidity in the FX market, in which the central bank sells foreign currency spot and purchases it forward. Central banks may use FX swaps as sterilisation instruments when they are short of domestic assets to sell to sterilise FX intervention, or if swaps are cheaper than issuing central bank bills. In some cases, legislation prohibits the issuance of central bank debt.

10 While purchasing contracts that provide such hedges is financially equivalent to taking positions in foreign currency, the effects on the exchange rate of interventions via such derivatives are likely to depend on the fraction of foreign exchange demand that is driven by financial, rather than transactional, reasons (Kohlscheen and Andrade (2014)).

11 Central bank surveys both pre- and post-crisis confirm that many central banks intervene in the spot market (Canales-Kriljenko (2003), Mihaljek (2005) and Mohanty and Berger (2013)).

12 However, central banks have sometimes discontinued foreign reserve accumulation programmes when depreciation pressures on the currency arose (eg Chile in 2008 and Colombia in 2014).

13 In line with this, evidence indicates that these programmes affected the exchange rate upon announcement, but not when the operations were implemented (Fuentes et al (2013)).

14 The issue of transparency in FX intervention has been the subject of much debate. Many authors have argued that central banks should conduct secret intervention so as to maximise the impact on the exchange rate (Dominguez and Frankel (1993), Neely (2005), Sarno and Taylor (2001)). Some central banks prefer secrecy to transparency, for instance when intervention may be perceived as being inconsistent with monetary policy goals. Others have argued that transparent intervention is preferable because it increases the power of the signalling and coordination channels, thereby enhancing the efficacy of intervention (Archer (2005)).

15 The illiquidity index is computed following the methodology proposed by Karnaukh et al (2015). This illiquidity measure aggregates information on daily Bloomberg bid-ask quotes at 5 pm EST and a combination of high and low values over one day with high and low values over two days (this latter measure is based on Corwin and Schultz (2012), with information taken from Thomson Reuters). Karnaukh et al show that this daily indicator is highly correlated with an intraday indicator of FX market liquidity. The correlation has been attributed to the fact that the indicator aggregates from a larger set of information.

16 Overall, looking at all EMEs, there is no clear long-term trend in FX market liquidity. For a recent model that relates FX market liquidity to exchange rate variations, see Gabaix and Maggiori (2015).

17 Because of its role as the key funding currency, the global value of the US dollar can also be seen as a measure of risk (Shin (2016)). Credit flows to borrowers located outside the US increase whenever the dollar weakens. In other words, a strengthening US dollar tends to tighten funding liquidity conditions.

18 Based on data availability.

19 Intervention amounts refer to total USD sales, including through FX repos in the cases of Brazil and Russia.

20 The illiquidity measures have been standardised by de-meaning the series and dividing by the respective standard deviation.

21 This is based on the product of the interest rate and the total (public and private) debt-to-GDP ratio. We also control for growth and exchange rate variation over the last quarter, as well as changes in the US monetary policy interest rate and in the VIX. All explanatory variables are lagged.

22 Also, Jeanne (2016) shows that FX reserves could be welfare-enhancing when global banks face VaR constraints, as they could potentially stabilise the price of liabilities during the downturn.

23 One mitigating factor that tends to diminish carrying costs is if interest rate differentials reflect future depreciations, so that there are currency valuation gains.