Editorial

Abstract

Coming off a vintage year for global growth, prospects look favourable. But there are material risks ahead. These largely reflect the unbalanced nature of the recovery, with central banks bearing most of the burden. Financial markets are overstretched and debt has grown further globally. Policymakers should use the current window of opportunity to rebalance the policy mix and lay the basis for a more sustainable expansion, while paying more attention to the long term.

Full text

Starting this year, the traditional BIS Annual Report - comprising an analysis of the global economy and a presentation of the BIS's activities - will be split into two separate publications. In addition, the economic part, renamed Annual Economic Report, has been restructured. The first three chapters review global developments, prospects and risks, while two special chapters focus on topical issues, with analyses of macroprudential frameworks and cryptocurrencies. This editorial summarises the content and key messages.

The global economy: developments, prospects and risks

It is now 10 years since the Great Financial Crisis (GFC) engulfed the world. At the time, following an unparalleled build-up of leverage among households and financial institutions, the world's financial system was on the brink of collapse. Thanks to central banks' concerted efforts and their accommodative stance, a repeat of the Great Depression was avoided. Since then, historically low, even negative, interest rates and unprecedentedly large central bank balance sheets have provided important support for the global economy and have contributed to the gradual convergence of inflation towards objectives. Still, central banks were largely left to bear the burden of the recovery, with other policies, not least supply side structural ones, failing to take the baton. These actions by central banks helped lay the groundwork for the resumption of growth that we now see. But, in the process, they have been one factor behind the legacy of swollen private and public sector balance sheets and higher debts that shapes the road ahead. As the global economy reaches or even exceeds potential, it is time to take advantage of the favourable conditions to put in place a more balanced policy mix to promote a sustainable expansion. However, the path ahead is a narrow one.

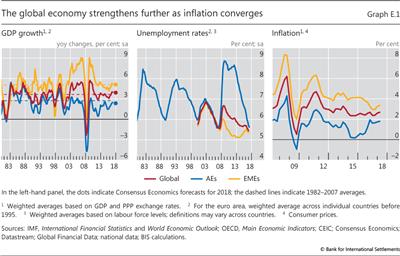

The dividends of past policies were clearly in evidence in the year under review - a vintage one for the global economy (Graph E.1 and Chapter I). The expansion strengthened and broadened. Global growth rates were roughly on a par with pre-crisis long-term averages, and the expansion was highly synchronised across countries (Graph E.1, left-hand panel). Unemployment continued to decline, reaching multi-decade lows in a number of economies, including some of the largest (centre panel). Overall, headline inflation rates moved closer to central bank objectives, although core inflation remained more subdued. In fact, the year capped a steady improvement in the global economy that has been evident for some time. As already noted two Annual Reports ago, the picture then was considerably better than the gloomy rhetoric indicated. And in last year's Report we highlighted how talk of secular stagnation had given way to renewed optimism and a revival of animal spirits.

For the next couple of years, consensus forecasts see the trend continuing, marking one of the longest postwar expansions (Graph E.1 and Chapter I). Despite the softer patch in the first quarter of 2018 and some jitters in emerging market economies (EMEs) (see below), the forecasters' central scenario is still for global growth to exceed potential, reducing unemployment further, with economies testing capacity limits. Investment is expected to strengthen, boosting productivity over time. And fiscal expansion should provide additional near-term stimulus: quite apart from the measures in the United States, the OECD foresees an easier fiscal stance in around three quarters of its members this year and next. At the same time, inflation is forecast to edge up.

The current scenario is somewhat unusual in the postwar period (Chapter I). It is not common to anticipate such strong growth so late in the expansion, when capacity constraints start biting, with only modest signs of an inflation threat. The reasons for this picture are much debated. There may be more slack than meets the eye: the crisis may have left a legacy of discouraged workers ready to re-enter the labour force as conditions improve; the investment pickup may be erasing some of the crisis scars, raising potential; and longer-term demographic factors and pension reforms may also be at work, as indicated by the widespread increase in participation rates among the older segments of the population, with the United States a notable exception. Moreover, as emphasised in previous Annual Reports, the persistent influence of globalisation and technological advances on inflation should not be underestimated, not least through their impact on workers' and firms' pricing power.

Buoying the expansion, and partly as a result of the heavy reliance on monetary policy to support the post-crisis recovery, financial conditions once again played a key role in the year under review (Chapters I and II). At least until recently, global financial conditions remained very easy. In fact, they loosened further even as US monetary policy proceeded along its very gradual and well anticipated normalisation path. True, long-term US Treasury yields moved up. But term premia remained historically low and equity price valuations quite rich, except when assessed in relation to the prevailing low interest rates. Importantly, credit spreads have been unusually compressed, often at or even below pre-GFC levels, and the corresponding markets appear to have become increasingly illiquid. Moreover, for most of the year under review the US dollar depreciated, supporting buoyant financial conditions especially in EMEs, which post-crisis have borrowed heavily in that currency and during the past year saw strong portfolio inflows. These buoyant conditions in EMEs, however, reversed more recently (see below).

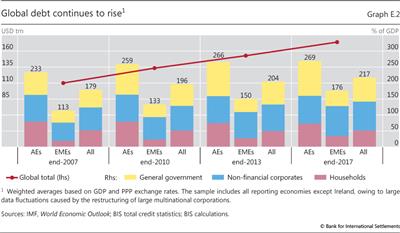

In the Report, we also assess the risks ahead in some detail (Chapter I). The conclusion is that medium-term risks are material, although there are cross-country differences. In some respects, the risks mirror the unbalanced post-crisis recovery and its excessive reliance on monetary policy. Where financial vulnerabilities exist, they have been building up, in their usual gradual and persistent way. More generally, financial markets are overstretched, as noted above, and we have seen a continuous rise in the global stock of debt, private plus public, in relation to GDP (Graph E.2). This has extended a trend that goes back to well before the crisis and that has coincided with a long-term decline in interest rates (Chapter II).

In some countries largely spared by the GFC, for quite some time there have been signs of a build-up of financial imbalances. This is because, in contrast to countries at the heart of the turmoil, no private sector deleveraging has taken place, so that the financial expansion has continued. The signs of imbalances have taken the form of strong increases in private sector credit, often alongside similar increases in property prices - the tell-tale sign of the expansion phase of domestic financial cycles, qualitatively similar to those observed pre-crisis in the economies that subsequently ran into trouble. Fortunately, much has been done to strengthen the financial system's resilience. The post-crisis financial reforms, not least Basel III and the implementation of macroprudential frameworks, have substantially bolstered the banking system (Chapters III and IV). And in China, the largest economy where the signs of imbalances are evident, the authorities have taken steps to rebalance the expansion and rein in some of the more serious financial excesses.

Against this backdrop, a number of developments could lead to the materialisation of risks, threatening the economic expansion in the medium term (Chapter I). In all of them, financial factors seem destined to play a prominent role, either as a trigger or as an amplifying mechanism. Indeed, the role of financial forces in business fluctuations has grown substantially since the early 1980s, when financial liberalisation took hold. And post-crisis the weight of non-bank intermediaries, such as asset managers and institutional investors, has risen substantially, and is likely to influence the dynamics of any future episodes of financial stress, in familiar but also some unexpected ways (Chapter III).

One possible trigger of an economic slowdown or downturn could be an escalation of protectionist measures. Its impact could be very significant, if such escalation was seen as threatening the open multilateral trading system. Indeed, there are signs that the rise in uncertainty associated with the first protectionist steps and the ratcheting-up of rhetoric have already been inhibiting investment. Moreover, were the recent reversal in the US dollar depreciation to continue, trade negotiations would become more complicated.

A second possible trigger could be a sudden decompression of historically low bond yields or snapback in core sovereign market yields, notably in the United States. This could take place in response to an inflation surprise and the perception that central banks will have to tighten more than anticipated. In the United States, the prospective heavy issuance of government debt, combined with the gradual unwinding of central bank purchases, could add to this risk. Importantly, the surprise need not be a large one, as indicated by the financial markets' wobble in February in response to slightly stronger than anticipated US wage growth. And the impact would spread globally, given the weight of the US economy and the dominant role of the dollar in global financial markets.

A third trigger could be a more general reversal in risk appetite. Such a reversal could reflect a range of factors, including disappointing profits, the drag of the contraction phase of financial cycles where these have turned, a souring of sentiment vis-à-vis EMEs, or untoward political events threatening stability in some large economies. From this perspective, recent events in the euro area are a source of concern, as reflected in the widening of spreads on Italian and Spanish bonds. In contrast to the snapback scenario, this third trigger would usher in a further compression of term premia in those core sovereign markets that benefited from a flight to safety.

Indeed, in April signs of strain did emerge in the most vulnerable EMEs, beginning in Argentina and Turkey, as the US dollar began to appreciate and financial conditions in international markets started to tighten. At the time of writing, it is too early to tell whether the strains will remain contained or will spread further. Most EMEs are better placed to confront financial stress now than they were in the mid-1990s. They have taken steps to strengthen their defences, by building reserves, adopting more systematic macroprudential measures (Chapter IV), improving their current account positions and adopting more flexible exchange rate regimes. This should provide them with some more room for manoeuvre were global financial conditions to tighten further.

Nevertheless, some pitfalls remain. The shift in the pattern of financial intermediation towards greater borrowing through the bond market has reduced rollover risk but introduced greater duration risk. Portfolio investors with limited tolerance for losses may amplify price fluctuations should they attempt to reduce exposures simultaneously. More generally, non-banks have been the largest borrowers; if they found themselves under financial strain, they might curtail operations and employment. A slowdown in the real economy may be the risk to watch for if EMEs continue to experience tightening financial conditions.

Looking further ahead, if the global economy successfully navigates the choppy waters just described, the expansion could continue. But then, almost inevitably, supported by easy financial conditions, financial imbalances and, above all, the aggregate debt-to-GDP ratio could rise further. Financial market complacency, low volatility and excessive risk-taking would continue. Limited market discipline would induce further poor resource allocation, including through the survival of ultimately unprofitable firms and weaker incentives for sovereigns to ensure fiscal space. All this would make the subsequent adjustment more painful. Such a further rise in global debt would be especially worrying (Chapter I). Not only would it make it harder to raise interest rates to more normal levels without threatening the expansion, given the associated rise in debt service burdens - a kind of "debt trap". It would also narrow the room for manoeuvre to address any downturn, which will come sooner or later.

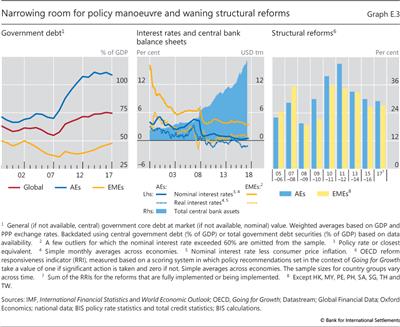

What can policy do to ensure the current expansion is more sustainable and balanced? The question is especially pressing, given that compared with pre-crisis the room for policy manoeuvre has indeed narrowed considerably (Graph E.3). Public sector debt in relation to GDP has increased further, constraining fiscal policy (left-hand panel). At the same time, interest rates are significantly lower, constraining monetary policy - a phenomenon exacerbated in advanced economies by the much larger central bank balance sheets (centre panel). Building room is a priority.

There are several possible lines of action that, if combined, would support each other (Chapter I). Their common theme is to focus firmly on longer horizons, since both monetary and fiscal expansions work to a considerable extent by borrowing demand from the future. And when the future becomes today, there is inevitably a price to be paid. This puts a premium on taking advantage of the current highly favourable conditions to redress the balance. Such policy adjustments would be consistent with the implementation of a broader macro-financial stability framework, in which the various policies would work in tandem to ensure macroeconomic and financial stability while raising long-term sustainable growth (Chapter IV).

The first line of action is to redouble efforts to implement structural policies - the only way to raise sustainable growth without generating inflationary pressures. This is essential, as economies are already operating at or beyond standard estimates of full employment and potential output even though post-crisis growth has been, on balance, rather disappointing - an indication of supply constraints. In particular, structural policies can alleviate the dilemmas monetary policy is currently facing and that are narrowing its room for manoeuvre. The essence of the reforms is to make product and labour markets more flexible, enabling them to allocate resources more efficiently and to absorb technical innovations more easily. One important element here is also to safeguard the open multilateral trading order that has served the global economy so well during the past decades. Unfortunately, the post-crisis record in structural reforms has fallen far short of what is desirable: since 2011 the pace has actually slowed down (Graph E.3, right-hand panel). Moreover, recent protectionist rhetoric and actions do not augur well.

The second line of action is to strengthen further the resilience of the financial system (Chapters III and IV). This requires completing and consistently implementing the post-crisis financial regulatory reforms. Ideally, where appropriate, this should be supported by steps to remove structural impediments to banks' efforts to attain sustainable profitability, which is critical to absorb any losses smoothly and swiftly should these materialise at some point. Examples of such steps include tackling the obstacles to the necessary consolidation and cost cutting. Sustainable profitability is especially important at the current juncture: banks have been facing the dual challenge of persistently and unusually low interest rates eating away at their net interest margins, and growing competition from new technology-savvy players - big tech and fintech. Strengthening resilience also calls for the active deployment of macroprudential measures in those economies where financial imbalances have been building up and the improvement of macroprudential frameworks more generally. In both cases, the non-bank sector, notably asset managers and institutional investors, deserves closer attention, to complete unfinished business there.

The third line of action is to ensure the sustainability of public sector finances and to avoid procyclical fiscal expansions. The importance of this issue cannot be emphasised enough. Public debt has risen to new peacetime highs in both advanced and emerging market economies. And, as history indicates, fiscal space is likely to be overestimated in countries where financial imbalances have been building up. With due regard for country-specific circumstances, fiscal consolidation is a priority.

The final line of action concerns monetary policy. Monetary policy normalisation is essential in rebuilding policy space. It can create room for countercyclical policy, help reduce the risk of the emergence of financial vulnerabilities, and contribute to restraining debt accumulation. That said, as discussed in detail in Chapter II, given the unprecedented starting point, the uncertainties involved and persistently low inflation in many jurisdictions, the path ahead is quite narrow, with pitfalls on either side. It requires striking and maintaining a delicate balance between competing considerations, notably achieving inflation objectives in the short run and avoiding the risk of encouraging the further build-up of financial vulnerabilities in the longer run.

While the right approach will naturally depend on country-specific conditions, a couple of general observations are possible. One is that treading the path will call for flexibility in the pursuit of inflation objectives. This applies in particular to moderate inflation shortfalls, given the benign structural disinflationary pressures still at work. The other is that policymakers will need to maintain a steady hand, avoiding the risk of overreacting to transitory bouts of volatility. After all, given initial conditions, the journey is bound to be bumpy. Financial market ructions will no doubt occur. Higher volatility per se is not a problem as long as it remains contained; it is actually healthy whenever it helps inhibit unbridled risk-taking.

Special chapters

Macroprudential frameworks

The implementation of macroprudential frameworks represents a major and welcome element of the post-crisis financial reforms. It has stemmed from the recognition that the pre-crisis approach to regulation and supervision was insufficient, as it was largely focused on an assessment of the risks incurred by individual institutions on a standalone basis. Such a (micro-oriented) approach can miss and fail to manage vulnerabilities at the system-wide level - the main source of systemic crises with serious macroeconomic costs. A prominent source of such crises is the procyclicality of the financial system, ie its tendency to amplify financial expansions and contractions, which can in turn amplify business fluctuations. The financial cycle is a reflection of such forces.

The activation of macroprudential measures is especially important at the current juncture. It can help contain the financial vulnerabilities bequeathed by the unbalanced post-crisis recovery and mitigate the build-up of further risks. And, in the process, it can support monetary policy along its normalisation path, increasing the room for manoeuvre. Current favourable economic conditions provide a window of opportunity for active deployment that should not be missed.

Against this backdrop, Chapter IV takes stock of the experience so far with macroprudential frameworks and explores the way forward. It reaches a number of conclusions. First, while implementation issues are challenging, the authorities have made substantial progress. Issues include identifying the build-up of systemic risks in good time to take remedial action, choosing appropriate instruments, political economy constraints on their deployment, and establishing effective governance arrangements. Second, so far the tools at the authorities' disposal have largely targeted banks; there is a need to extend them to other financial institutions, not least to the asset management sector. Third, macroprudential measures have succeeded in strengthening the financial system's resilience, but as deployed so far their restraining impact on financial booms has not always prevented the emergence of the familiar signs of financial imbalances. Fourth, this suggests that macroprudential measures are most effective as part of a more holistic macro-financial stability framework, also involving structural, fiscal and monetary policies. Finally, there is scope to further strengthen international cooperation in this area.

Cryptocurrencies

Cryptocurrencies promise to replace trust in long-standing institutions, such as commercial and central banks, with trust in a new, fully decentralised system founded on the blockchain and related distributed ledger technology (DLT). The transformative nature of this promise makes this development of core concern to central banks.

Chapter V evaluates whether cryptocurrencies can deliver on their promise as a form of money. Looking beyond the hype, it finds that this is not the case. Much has already been said about the impractical nature of cryptocurrencies as a means of payment, the scope for fraud and the enormous environmental cost. As the BIS General Manager put it recently,1 cryptocurrencies have become a "combination of a bubble, a Ponzi scheme and an environmental disaster".

The chapter highlights the further economic limitations of cryptocurrencies. These relate to their limited ability to satisfy the signature property of money as a coordination device and their questionable promise of trust. Cryptocurrencies cannot scale with transaction demand, are prone to congestion, and fluctuate greatly in value. And trust in them can evaporate at any time, owing to the fragility of the decentralised consensus mechanisms used to record and validate transactions. Not only does this call into question the finality of individual payments, it also means that a cryptocurrency can simply stop functioning, resulting in a complete loss of value.

The decentralised technology of cryptocurrencies, however sophisticated, is a poor substitute for the solid institutional backing of money through independent and accountable central banks. DLT itself, however, does have promise in applications other than cryptocurrencies. Examples include, in particular, simplifying administrative processes in the settlement of financial transactions. But this still remains to be tested.

The emergence of cryptocurrencies calls for policy responses. A globally coordinated approach is necessary to prevent abuses and strictly limit interconnections with regulated financial institutions. In addition, delicate issues arise regarding the possible issuance of digital currencies by central banks themselves.

Endnote

1 See A Carstens, "Money in the digital age: what role for central banks?", lecture at the House of Finance, Goethe University, Frankfurt, 6 February 2018.