Monetary policy struggles to normalise

Abstract

Monetary policy has remained very accommodative while facing a number of tough challenges. First, in the major advanced economies, central banks struggled with an unusually sluggish recovery and signs of diminished monetary policy effectiveness. Second, emerging market economies and small open advanced economies contended with bouts of market turbulence and with monetary policy spillovers from the major advanced economies. National authorities in the latter have further scope to take into account the external effects of their actions and the corresponding feedback on their own jurisdictions. Third, a number of central banks struggled with how best to address unexpected disinflation. The policy response needs to carefully consider the nature and persistence of the forces at work as well as policy's diminished effectiveness and side effects. Finally, looking forward, the issue of how best to calibrate the timing and pace of policy normalisation looms large. Navigating the transition is likely to be complex and bumpy, regardless of communication efforts. And the risk of normalising too late and too gradually should not be underestimated.

Full text

Monetary policy globally remained very accommodative over the past year as policy rates stayed low and central bank balance sheets expanded further. Central banks in the major advanced economies continued to face an unusually sluggish recovery despite prolonged extraordinary monetary easing. This suggests that monetary policy has been relatively ineffective in boosting a recovery from a balance sheet recession.

Emerging market economies and small open advanced economies struggled to deal with spillovers from monetary ease in the major advanced economies. They have also kept their policy rates very low, which has contributed to the build-up of financial vulnerabilities. This dynamic suggests that monetary policy should play a greater role as a complement to macroprudential measures when dealing with financial imbalances. It also points to shortcomings in the international monetary system, as global monetary policy spillovers are not sufficiently internalised.

Many central banks faced unexpected disinflationary pressures in the past year, which represent a negative surprise for those in debt and raise the spectre of deflation. However, risks of widespread deflation appear very low: central banks see inflation returning to target over time and longer-term inflation expectations remaining well anchored. Moreover, the supply side nature of the disinflation pressures has generally been consistent with the pickup in global economic activity. The monetary policy stance needs to carefully take into account the persistence and supply side nature of the disinflationary forces as well as the side effects of policy ease.

The prospect is now clearer that central banks in the major advanced economies are at different distances from normalising policy and hence will exit at different times from their extraordinary accommodation. Navigating the transition is likely to be complex and bumpy, regardless of communication efforts; and partly for those reasons, the risk of normalising too late and too gradually should not be underestimated.

This chapter reviews the past year's developments in monetary policy and then explores four key challenges that policy faces: low effectiveness; spillovers; unexpected disinflation; and the risk of falling behind the curve during the exit.

Recent monetary policy developments

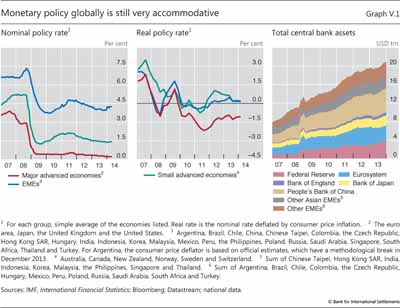

Over the past 12 months, nominal and real policy rates remained very low globally, and central bank balance sheets continued to expand up to year-end 2013 (Graph V.1). On average, the major advanced economies maintained real policy rates at less than -1.0%. In the rest of the world, real policy rates were not much higher: in a group of small open advanced economies (which we refer to hereafter as small advanced economies) - Australia, Canada, New Zealand, Norway, Sweden and Switzerland - and in the emerging market economies (EMEs) we survey here, real rates were only marginally above zero. The expansion of central bank assets slowed somewhat between 2012 and mid-2013 and then accelerated in the second half of 2013.

This extraordinary policy ease has now been in place for about six years (Graph V.1). Interest rates fell sharply in early 2009. Central bank assets began to grow rapidly in 2007, and they have more than doubled since then, to an unprecedented total of more than $20 trillion (more than 30% of global GDP). The increase has reflected large-scale asset purchases and the accumulation of foreign exchange reserves.

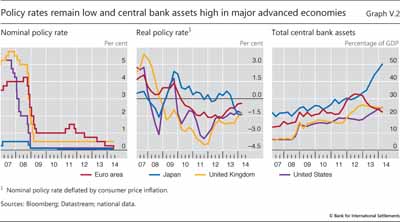

Central banks in major advanced economies kept nominal policy rates near the zero lower bound and real rates negative (Graph V.2) even as signs of an improvement in growth accumulated during the past 12 months.1 In the euro area, where economic activity has been weak, the ECB halved its main refinancing rate in November, to 25 basis points, and cut it further to 15 basis points in June, given concerns about low inflation and currency appreciation. The ECB's latest move took its deposit rate to 10 basis points below zero.

The central banks of the euro area, the United Kingdom and the United States have relied heavily on various forms of forward guidance to convey their intention to keep policy rates low well into the future (Box V.A). The ECB adopted qualitative forward guidance in July 2013, saying that it would keep policy rates low for an extended period. In August 2013, the Bank of England introduced threshold-based forward guidance, linking the low policy rate environment to criteria about the unemployment rate, inflation projections and expectations, and risks to financial stability. This new type of guidance was similar in many ways to the approach taken in December 2012 by the Federal Reserve, which also emphasised thresholds for unemployment and inflation. In early 2014, as the forward guidance thresholds for unemployment were being approached in the United Kingdom and the United States faster than anticipated, central banks in both those countries made their guidance more qualitative, featuring a broader notion of economic slack.

The trajectories of central bank balance sheets in the major advanced economies diverged in the past year (Graph V.2, right-hand panel). The Bank of England and the Federal Reserve gradually shifted away from balance sheet expansion as the primary means of providing additional stimulus. In August 2013, the Bank of England announced that it would maintain the stock of its purchased assets at £375 billion, subject to the same conditions as its forward guidance on policy rates. In December 2013, the Federal Reserve announced it would gradually dial back its large-scale asset purchases starting in January. The pace of this tapering has been smooth since then, but the lead-up to the December announcement proved to be a communication challenge (Chapter II). At the time of writing, markets expect the purchase programme to conclude before year-end 2014.

In contrast, in April 2013, the Bank of Japan announced its Quantitative and Qualitative Easing (QQE) programme as a principal means of overcoming Japan's legacy of protracted deflation. Its balance sheet expanded rapidly thereafter, rising from less than 35% of GDP to more than 50% by early 2014.

Reflecting improved euro area financial conditions, the ECB's balance sheet shrank relative to GDP as banks scaled back their use of central bank funding, including through the ECB's longer-term refinancing operations. And to date, the ECB has not activated its Outright Monetary Transactions programme (large-scale purchases of sovereign bonds in secondary markets under strict conditionality). However, in early June, the ECB announced that it would initiate targeted longer-term refinancing operations later this year to support bank lending to households and non-financial corporations. In addition, the ECB decided to intensify its preparatory work related to outright purchases in the asset-backed securities market.

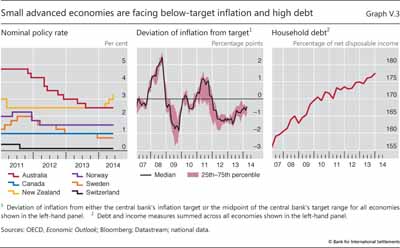

Policy rates in the small advanced economies also remained very low (Graph V.3, left-hand panel). The Bank of Canada left its policy rate at 1.0% and adjusted its forward guidance, pushing back the prospective date of a modest withdrawal of accommodation. With headline inflation in Switzerland remaining around zero or less, the Swiss National Bank kept the range of its policy rate for three-month Libor unchanged at 0-25 basis points and maintained its exchange rate ceiling against the euro. The Central Bank of Norway kept rates at 1.5% as disinflationary pressures abated over the course of the year. A few central banks in this group changed their policy rates. To support recovery, the Reserve Bank of Australia twice cut its rate to reach 2.5%. Sveriges Riksbank lowered its policy rate by 25 basis points, to 75 basis points, against the background of inflation that was persistently below target. In contrast, on evidence of increased economic momentum and expectations of rising inflation pressures, the Reserve Bank of New Zealand raised its rate three times, for a total of 75 basis points, to reach 3.25%.

Overall, central bank policies in many of the small advanced economies were strongly influenced by the evolution of inflation rates: on average they had fallen short of targets by almost 1 percentage point since early 2012 (Graph V.3, centre panel), and lingering disinflation led many central banks to mark down inflation forecasts.

Moreover, many of these central banks had to balance the short-term macroeconomic effects of low inflation and a lacklustre recovery against the longer-term risks of building up financial imbalances (Chapter IV). Household debt, which was high and rising, reached an average of roughly 175% of net disposable income by end-2013 (Graph V.3, right-hand panel). Those elevated levels, and the prospect of even further debt increases encouraged by accommodative monetary policies, made these economies vulnerable to a sharp deterioration in economic and financial conditions. In those jurisdictions in which house prices were high, the risk of a disorderly adjustment of household sector imbalances could not be ruled out.

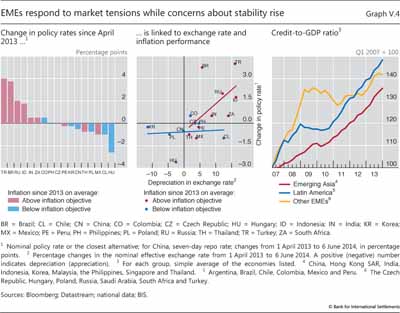

In EMEs, central banks had to contend with various monetary policy challenges after a strong post-crisis recovery, which has weakened recently. One such challenge came from bouts of financial market volatility associated with depreciation pressures during the year (Chapter II). In general, their past strong macroeconomic performance had helped to insulate many EMEs from the fallout and afforded them some room for manoeuvre, but only up to a point. Most affected were countries with weaker economic and financial conditions. In many of them, central banks used the policy rate to defend their currencies (Graph V.4, left-hand panel). Between April 2013 and early June 2014, several central banks tightened considerably on net: in Turkey, by 400 basis points, including a 550 basis point hike in one day in January; and in Russia and Indonesia, by 200 and 175 basis points, respectively. India and South Africa raised rates by 50 basis points. Brazil boosted rates gradually by 375 basis points over the period as currency depreciation and other forces helped keep inflation pressures elevated. The EME policy responses to currency depreciation appeared to reflect in part their recent inflation experience (Graph V.4, centre panel). Where inflation was above target, depreciation pressures tended to be stronger and policy rates rose by more. Where inflation was at or below target, no such relationship is visible.

Box V.A

Forward guidance at the zero lower bound

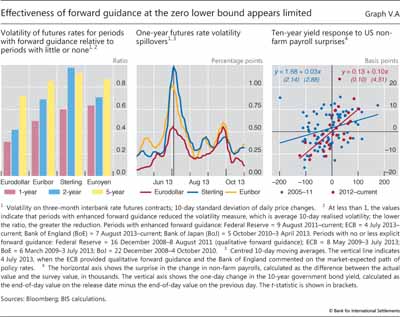

The objective of central banks' forward guidance at the zero lower bound has been to clarify their intended path for the policy rate. Such guidance can itself provide stimulus when it reveals that policy rates are likely to remain low for a period longer than markets had expected. Forward guidance can also reduce uncertainty, thereby dampening interest rate volatility and, through that channel, lowering risk premia.

Forward guidance must meet three conditions to be effective. First, forward guidance must be clear. In principle, clarity can be enhanced by spelling out the conditionality of the guidance. However, if the conditionality is too complex, explicit details may be confusing. Second, forward guidance must be seen as a credible commitment, ie the public must believe what the central bank says. The stronger the public's belief, the bigger is the likely impact of the guidance on market expectations and economic decisions, but the greater also is the risk of an undesirable reduction in central bank flexibility. Finally, even if it is understood and believed, the guidance must be interpreted by the public as intended. For instance, communicating the intention to keep policy rates at the zero lower bound for longer than the market expected may be mistakenly seen as signalling a more pessimistic economic outlook, in which case negative confidence effects could counteract the intended stimulus.

The experience with forward guidance indicates that it has succeeded in influencing markets over certain horizons. Forward guidance reduced the financial market volatility of expected interest rates at short horizons but less so at longer horizons (Graph V.A, left-hand panel). This is consistent with the notion that markets see forward guidance as a conditional commitment, valid only for the near-term future path of policy interest rates. There is also evidence that forward guidance affects the sensitivity of interest rates to economic news. The responsiveness of interest rate volatility in the euro area and the United Kingdom to US rate volatility fell considerably after the ECB and the Bank of England adopted forward guidance in summer 2013 (Graph V.A, centre panel). There is also evidence that forward guidance made markets more sensitive to indicators emphasised in the guidance. For instance, US 10-year bond yields became more sensitive to non-farm payroll surprises beginning in 2012 (Graph V.A, right-hand panel); one interpretation is that news reflecting a stronger recovery tended to bring forward the expected time at which the unemployment threshold would be breached and policy rate lift-off would ensue.

Policy rate forward guidance also raises a number of risks. If the public fails to fully understand the conditionality of the guidance, the central bank's reputation and credibility may be at risk if the rate path is revised frequently and substantially, even though the changes adhere to the conditionality originally announced. Forward guidance can also give rise to financial risks in two ways. First, if financial markets become narrowly focused on it, a recalibration of the guidance could lead to disruptive market reactions. Second, and more importantly, forward guidance could lead to a perceived delay in the speed of monetary policy normalisation. This could encourage excessive risk-taking and foster a build-up of financial vulnerabilities.

For a more detailed analysis, see A Filardo and B Hofmann, "Forward guidance at the zero lower bound", BIS Quarterly Review, March 2014, pp 37-53.

For a more detailed analysis, see A Filardo and B Hofmann, "Forward guidance at the zero lower bound", BIS Quarterly Review, March 2014, pp 37-53.

The monetary authorities in the EMEs less affected by capital outflows and exchange rate pressures had more policy room to respond to other developments. In Chile and Mexico, the central banks cut policy rates as their economies showed signs of slowing. In the Czech Republic, the policy rate remained low as inflation fell below target, and the central bank decided to use the exchange rate as an additional instrument for easing monetary conditions by establishing a ceiling for the exchange value of the koruna against the euro. Poland cut rates several times early on as disinflationary pressures took hold. In China, the central bank maintained its monetary policy stance with some deceleration in monetary and credit growth as financial stability concerns grew, especially in relation to the expanding non-bank financial sector.

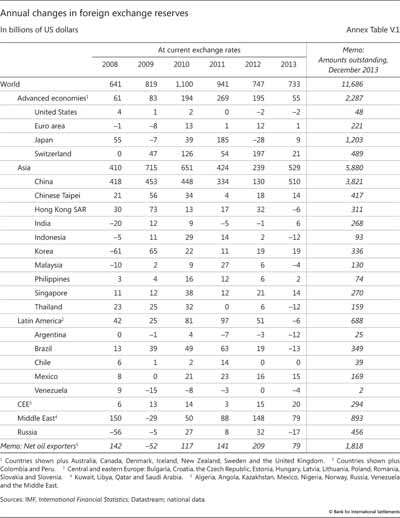

A number of EMEs also conducted foreign exchange operations last year to help absorb unwelcome depreciation pressures. Nonetheless, foreign exchange reserves for EMEs as a whole continued to increase, especially for China (Annex Table V.1). However, in a number of EMEs, for example Brazil, Indonesia, Russia and Thailand, foreign exchange reserves dropped; for several such economies, it was the first reported annual decline in many years.

Credit expansion in many EMEs has been raising financial stability concerns, especially against the backdrop of volatile financial markets. For the group of EMEs surveyed here, the credit-to-GDP ratio rose on average by around 40% from 2007 to 2013 (Graph V.4, right-hand panel). For these central banks, questions remain about the best mix of monetary, macroprudential and capital flow management tools.

Key monetary policy challenges

Central banks are facing a number of significant challenges. For the major advanced economies recovering from balance sheet recessions (that is, a recession induced by financial crisis and an unsustainable accumulation of debt), the key challenge has been calibrating the monetary policy stance at a time when policy appears to have lost some of its ability to stimulate the economy. For many EMEs and small advanced economies, the main challenge has been the build-up of financial vulnerabilities and the risk of heightened capital flow volatility, problems complicated by global monetary policy spillovers. Worldwide, many central banks are struggling with the puzzling disinflationary pressures that materialised in the past year. And looking ahead, questions arise about the timing and pace of policy normalisation.

Low monetary policy effectiveness

Central banks played a critical role in containing the fallout from the financial crisis. However, despite the past six years of monetary easing in the major advanced economies, the recovery has been unusually slow (Chapter III). This raises questions about the effectiveness of expansionary monetary policy in the wake of the crisis.

Effectiveness has been limited for two broad reasons: the zero lower bound on the nominal policy rate, and the legacy of balance sheet recessions. First, the zero lower bound constrains the central banks' ability to reduce policy rates and boost demand. This explains attempts to provide additional stimulus by managing expectations about the future policy rate path and through large-scale asset purchases. But those policies also have limitations. For instance, term premia and credit risk spreads in many countries were already very low (Graph II.2): they cannot fall much further. In addition, compressed and at times even negative term premia reduce the profits from maturity transformation and so may actually reduce banks' incentives to grant credit. Moreover, the scope for negative nominal interest rates is very limited and their effectiveness uncertain. The impact on lending is doubtful, and the small room for reductions diminishes the effect on the exchange rate, which in turn depends also on the reaction of others. In general, at the zero lower bound, providing additional stimulus becomes increasingly hard.

Second, the legacy of balance sheet recessions numbs policy effectiveness. Some of this has to do with financial factors. When the financial sector is impaired, the supply of credit is less responsive to interest rate cuts. And the demand for credit from non-financial sectors is sluggish - they are seeking instead to pay down debt incurred on the basis of overly optimistic income expectations. This is why "credit-less recoveries" are the norm in these situations (Chapter III). But some of the legacy of balance sheet recessions has to do with non-financial factors. The misallocations of capital and labour that go hand in hand with unsustainable financial booms can sap the traction of demand management policies, as these address only symptoms rather than underlying problems. For instance, the residential construction sector would normally be more sensitive than many others to lower interest rates, but it expanded too much during the boom. In fact, the historical record indicates that the positive relationship between the degree of monetary accommodation during recessions and the strength of the subsequent recovery vanishes when the recession is associated with a financial crisis (Box V.B). Moreover, deleveraging during the recession, regardless of how it is measured, eventually ushers in a stronger recovery.

None of this means that monetary accommodation has no role to play in a recovery from a balance sheet recession. A degree of accommodation was clearly necessary in the early stages of the financial crisis to contain the fallout. But the relative ineffectiveness of monetary policy does signify that it cannot substitute for measures that tackle the underlying problems, promoting the necessary balance sheet repair and structural reforms.

Unless it is recognised, limited effectiveness implies a fruitless effort to apply the same measures more persistently or forcefully. The consequence is not only inadequate progress but also amplification of unintended side effects, and the aftermath of the crisis has highlighted several such side effects.2 In particular, prolonged and aggressive easing reduces incentives to repair balance sheets and to implement necessary structural reforms, thereby hindering the needed reallocation of resources. It may also foster too much risk-taking in financial markets (Chapter II). And it may generate unwelcome spillovers in other economies at different points in their financial and business cycles (see below). Put differently, under limited policy effectiveness, the balance between benefits and costs of prolonged monetary accommodation has deteriorated over time.

Monetary policy spillovers

EMEs and small advanced economies have been struggling with spillovers from the major advanced economies' accommodative monetary policies. The spillovers work through cross-border financial flows and asset prices (including the exchange rate) as well as through policy responses.3

Box V.B

Effectiveness of monetary policy following balance sheet recessions

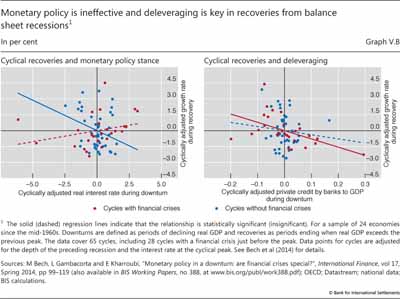

The historical record lends support to the view that accommodative monetary policy during a normal business cycle downturn helps strengthen the subsequent recovery. But this relationship is not statistically significant after downturns associated with financial crises. That is, in business cycles accompanied by crises, the relationship between the average short-term real interest rate during a downturn and the average growth rate during the subsequent recovery does not have the sign expected in the case of a non-crisis business cycle (Graph V.B, left-hand panel).

A possible reason is that post-crisis deleveraging pressures make an economy less interest rate-sensitive. Indeed, the evidence suggests that, in contrast to normal recessions, a key factor that eventually leads to stronger recoveries from balance sheet recessions is private sector deleveraging (Graph V.B, right-hand panel).

Very accommodative monetary policies in major advanced economies influence risk-taking and therefore the yields on assets denominated in different currencies. As a result, extraordinary accommodation can induce major adjustments in asset prices and financial flows elsewhere. As financial markets in EMEs have developed and become more integrated with the rest of the world, the strength of these linkages has grown. For instance, local currency bond yields have co-moved more tightly in recent years.4

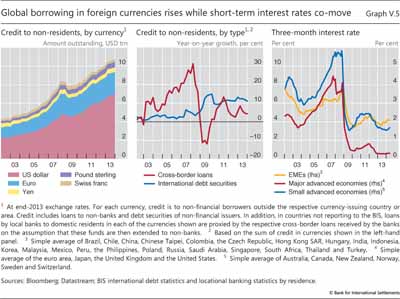

The US dollar and the other international currencies play a key role here. Since they are widely used outside the countries of issue, they have a direct influence on international financial conditions. For example, the amount of US dollar credit outstanding outside the United States was roughly $7 trillion at end-2013 (Graph V.5, left-hand panel). When interest rates expressed in these currencies are low, EME borrowers find it cheaper to borrow in them, and those who have already borrowed at variable rates enjoy lower financing costs. Before the crisis, flows of dollar credit in particular were driven by cross-border bank lending; since 2008, activity in global capital markets has surged (Graph V.5, centre panel).5

Policy responses matter too. Central banks find it difficult to operate with policy rates that are considerably different from those prevailing in the key currencies, especially the US dollar. Concerns with exchange rate overshooting and capital inflows make them reluctant to accept large and possibly volatile interest rate differentials, which contributes to highly correlated short-term interest rate movements (Graph V.5, right-hand panel). Indeed, the evidence is growing that US policy rates significantly influence policy rates elsewhere (Box V.C).

Very low interest rates in the major advanced economies thus pose a dilemma for other central banks. On the one hand, tying domestic policy rates to the very low rates abroad helps mitigate currency appreciation and capital inflows. On the other hand, it may also fuel domestic financial booms and hence encourage the build-up of vulnerabilities. Indeed, there is evidence that those countries in which policy rates have been lower relative to traditional benchmarks, which take account of output and inflation developments, have also seen the strongest credit booms (Chapter IV).

Box V.C

Impact of US monetary policy on EME policy rates: evidence from Taylor rules

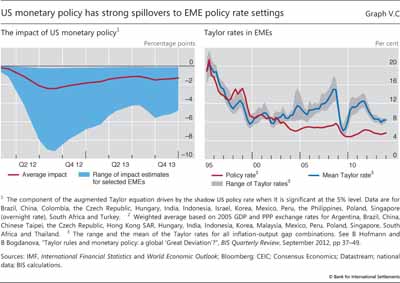

One way to assess the impact of US monetary policy on EME policy rates is to estimate augmented Taylor rules for individual EMEs. The policy rate of each sample economy is modelled as a function of the domestic inflation rate, the domestic output gap and the "shadow" policy rate of the United States. The shadow rate is designed to capture the impact of the Federal Reserve's unconventional monetary policy measures, such as its large-scale asset purchase programmes. The sample covers 20 EMEs from Q1 2000 to Q3 2013.

The shadow rate is designed to capture the impact of the Federal Reserve's unconventional monetary policy measures, such as its large-scale asset purchase programmes. The sample covers 20 EMEs from Q1 2000 to Q3 2013.

The impact of US monetary policy is found to be statistically significant for 16 of 20 EMEs. Since 2012, easier US monetary policy has been associated with an average reduction of 150 basis points in EME policy rates (Graph V.C, left-hand panel), although the impact has varied substantially across economies and time. The response of EME policy rates to inflation was often weaker than the prescription of the conventional Taylor rule. These results are consistent with the finding that EME policy rates have, over the past decade, run below the level suggested by domestic macroeconomic conditions as captured in standard Taylor rules (Graph V.C, right-hand panel).

Although the findings are statistically robust and consistent with the findings of other studies, they should be interpreted with caution. Measuring unobservable variables, such as the output gap, is fraught with difficulties. Even the policy rate might not be an accurate measure of monetary conditions because EME central banks have increasingly used non-interest rate measures to affect monetary conditions. And even if representative for EME central banks as a group, the results do not necessarily apply to any given central bank.

they should be interpreted with caution. Measuring unobservable variables, such as the output gap, is fraught with difficulties. Even the policy rate might not be an accurate measure of monetary conditions because EME central banks have increasingly used non-interest rate measures to affect monetary conditions. And even if representative for EME central banks as a group, the results do not necessarily apply to any given central bank.

For more details on the estimation, see E Takáts and A Vela, "International monetary policy transmission", BIS Papers, forthcoming. The shadow policy rate was developed in M Lombardi and F Zhu, "A shadow policy rate to calibrate US monetary policy at the zero lower bound", BIS Working Papers, no 452, June 2014.

For more details on the estimation, see E Takáts and A Vela, "International monetary policy transmission", BIS Papers, forthcoming. The shadow policy rate was developed in M Lombardi and F Zhu, "A shadow policy rate to calibrate US monetary policy at the zero lower bound", BIS Working Papers, no 452, June 2014.  For example, C Gray, "Responding to the monetary superpower: investigating the behavioural spillovers of US monetary policy", Atlantic Economic Journal, vol 41, no 2, 2013, pp 173-84; M Spencer, "Updating Asian 'Taylor rules'", Deutsche Bank, Global Economic Perspectives, 28 March 2013; and J Taylor, "International monetary policy coordination: past, present and future", BIS Working Papers, no 437, December 2013.

For example, C Gray, "Responding to the monetary superpower: investigating the behavioural spillovers of US monetary policy", Atlantic Economic Journal, vol 41, no 2, 2013, pp 173-84; M Spencer, "Updating Asian 'Taylor rules'", Deutsche Bank, Global Economic Perspectives, 28 March 2013; and J Taylor, "International monetary policy coordination: past, present and future", BIS Working Papers, no 437, December 2013.

To address this dilemma, central banks have relied extensively on macroprudential tools. These tools have proved very helpful in increasing the resilience of the financial system, but they have been only partially effective in restraining the build-up of financial imbalances (Chapter IV and Box VI.D). A key reason is that, as in the case of capital flow management measures, macroprudential tools are vulnerable to regulatory arbitrage. The implication is that relying exclusively on macroprudential measures is not sufficient and monetary policy must generally play a complementary role. In contrast to macroprudential tools, the policy rate is an economy-wide determinant of the price of leverage in a given currency, so its impact is more pervasive and less easily evaded. Countries using monetary policy more forcefully as a complement to macroprudential policy need to accept a greater degree of exchange rate flexibility.

Failing to rely on monetary policy can raise even more serious challenges down the road. Allowing the financial imbalances to build over time would exacerbate a country's vulnerability to an unwinding, thereby imposing greater damage and, most likely, precipitating an external crisis as well. But if they do not unwind and the country is hit by an external shock, the central bank will find it very hard to raise interest rates without generating the financial stress it was trying to avoid in the first place. Full-blown financial busts have not as yet occurred in EMEs or small advanced economies, but countries in which credit growth had been relatively high proved more vulnerable to the May-June 2013 period of market tensions (Chapter II). This indicates that a more gradual but early tightening is superior to a delayed but abrupt one later on - delayed responses cause a more wrenching adjustment.

Disruptive monetary policy spillovers have highlighted shortcomings in the international monetary system. Ostensibly, it has proved hard for major advanced economies to fully take these spillovers into account. Should financial booms turn to bust, the costs for the global economy could prove to be quite large, not least since the economic weight of the countries affected has increased substantially. Capturing these spillovers remains a major challenge: it calls for analytical frameworks in which financial factors have a much greater role than they are accorded in policy institutions nowadays and for a better understanding of global linkages.

Unexpected disinflation and the risks of deflation

Many central banks faced unexpected disinflationary pressures in the past year; as a result, inflation fell or remained below their objectives. The pressures were particularly surprising in the advanced economies because the long-awaited recovery seemed to be gaining traction (Chapter III). A key monetary policy challenge has been how best to respond to such pressures.

Generally, all else equal, inflation unexpectedly below objectives would call for an easier monetary policy stance. However, the appropriate response depends on a number of additional factors. Especially important are the perceived costs and benefits of disinflation. Another factor, as noted above, is the evidence suggesting that the effectiveness of expansionary monetary policy is limited at the zero lower bound, especially during the recovery from a balance sheet recession.

Recent developments indicate that the likelihood of persistent disinflationary pressures is low. Long-term inflation expectations (six to 10 years ahead) have been well anchored up to the time of writing (Graph V.6), which suggests that shortfalls of inflation from objectives could be transitory. Under such conditions, wage inflation and price inflation are less likely to reinforce each other - ie so-called second-round effects would not operate. For example, the decline in commodity prices from recent historical highs has contributed to the disinflationary pressures in the past few years. Even if these prices stabilise at current levels rather than bounce back, as appears to be the case at the time of writing, the disinflationary pressures would wane. This is exactly the same reasoning that induced some central banks to accept inflation persistently above policy objectives in previous years. Of course, if inflation expectations become less firmly anchored, disinflationary pressures would become a more significant concern.

Even if the unexpected disinflationary pressures are prolonged, the costs may be less than commonly thought. The source of the pressures matters. When they arise from positive supply side developments rather than deficient demand, the associated costs are known to be lower. Recent disinflationary pressures in part reflect such positive supply side forces, especially the greater cross-border competition that has been stoked by the ongoing globalisation of the real economy (Chapter III).

The analysis regarding shortfalls in inflation also applies to outright and persistent price declines, and so far, for much the same reasons, central banks have judged the risk of deflation as negligible. In fact, the historical record indicates that deflationary spirals have been exceptional and that deflationary periods, especially mild ones, have been consistent with sustained economic growth (Box V.D). Some countries in recent decades have indeed experienced growth with disinflation, no doubt because of the influence of positive supply side factors.

Nonetheless, given currently high levels of debt, should the possibility of falling prices be more of a concern? Without question, large debts make generalised price declines more costly. Unless interest rates in existing contracts adjust by the same amount, all else equal, falling prices raise the burden of debt relative to income. Historically, however, the damage caused by falling asset prices has proven much more costly than general declines in the cost of goods and services: given the range of fluctuations, falling asset prices simply have had a much larger impact on net worth and the real economy (Box V.D). For instance, the problems in Japan arose first and foremost from the sharp drop in asset prices, especially property prices, as the financial boom turned to bust, not from a broad, gradual disinflation.

Box V.D

The costs of deflation: what does the historical record say?

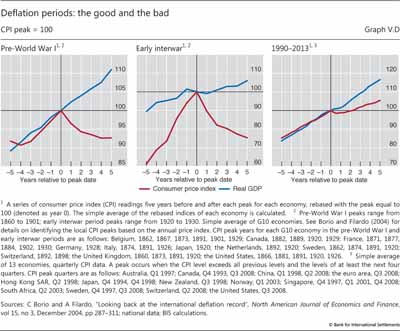

Deflations are not all alike. Owing to the prevalence of price declines in the 19th and early 20th centuries as well as since the 1990s, the historical record can reveal important features of deflation dynamics. Four stand out.

First, the record is replete with examples of "good", or at least "benign", deflations in the sense that they coincided with output either rising along trend or undergoing only a modest and temporary setback. In the pre-World War I period, deflation episodes were generally of the benign type, with real GDP continuing to expand when prices declined (Graph V.D, left-hand panel). Average real growth in the five years up to the peak in the price level was roughly similar to the growth rate in the five years after the peak (2.3% vs 2.1%). In the early interwar period (mainly in the 1920s), the number of somewhat more costly ("bad") deflations increased (Graph V.D, centre panel): output still rose, but much more slowly - the average rates in the pre- and post-peak periods were 2.3% and 1.2%, respectively. (Perceptions of truly severe deflations during the interwar period are dominated by the exceptional experience of the Great Depression, when prices in the G10 economies fell cumulatively up to roughly 20% and output contracted by about 10%. That experience is not fully reflected in Graph V.D, centre panel.)

The deflation episodes during the past two and a half decades have, on average, been much more akin to the good types experienced during the pre-World War I period than to those of the early interwar period (although identifying peaks in the price level during this period is much more difficult than in the earlier periods because the recent deflations tend to be fleeting). For the most recent episodes, the average rates of GDP growth in the pre- and post-peak periods were 3.6% and 3.1%, respectively, a difference that is not statistically significant.

The second important feature of deflation dynamics revealed by the historical record is the general absence of an inherent deflation spiral risk - only the Great Depression episode featured a deflation spiral in the form of a strong and persistent decline in the price level; the other episodes did not. During the pre-World War I episodes, price drops were persistent but not large, with an average cumulative decline in the consumer price index of about 7%. More recently, deflation episodes have been very short-lived, with the price level falling mildly; the notable exception is Japan, where price levels fell cumulatively by roughly 4% from the late 1990s until very recently. The evidence, especially in recent decades, argues against the notion that deflations lead to vicious deflation spirals. In addition, the fact that wages are less flexible today than they were in the distant past reduces the likelihood of a self-reinforcing downward spiral of wages and prices.

Third, it is asset price deflations rather than general deflations that have consistently and significantly harmed macroeconomic performance. Indeed, both the Great Depression in the United States and the Japanese deflation of the 1990s were preceded by a major collapse in equity prices and, especially, property prices. These observations suggest that the chain of causality runs primarily from asset price deflation to real economic downturn, and then to deflation, rather than from general deflation to economic activity. This notion is also supported by the trajectories of prices and real output during the interwar period (Graph V.D, centre panel), which show that real GDP tended to contract before deflation set in.

Indeed, both the Great Depression in the United States and the Japanese deflation of the 1990s were preceded by a major collapse in equity prices and, especially, property prices. These observations suggest that the chain of causality runs primarily from asset price deflation to real economic downturn, and then to deflation, rather than from general deflation to economic activity. This notion is also supported by the trajectories of prices and real output during the interwar period (Graph V.D, centre panel), which show that real GDP tended to contract before deflation set in.

Fourth, recent deflation episodes have often gone hand in hand with rising asset prices, credit expansion and strong output performance. Examples include episodes in the 1990s and 2000s in countries as distinct as China and Norway. There is a risk that easy monetary policy in response to good deflations, aiming to bring inflation closer to target, could inadvertently accommodate the build-up of financial imbalances. Such resistance to "good" deflations can, over time, lead to "bad" deflations if the imbalances eventually unwind in a disruptive manner.

For formal evidence on this point, see C Goodhart and B Hofmann, House prices and the macroeconomy, Oxford University Press, 2006, Chapter 5, "Goods and asset price deflations".

For formal evidence on this point, see C Goodhart and B Hofmann, House prices and the macroeconomy, Oxford University Press, 2006, Chapter 5, "Goods and asset price deflations".

More generally, financial stability concerns call into question the wisdom of seeking to push inflation back towards its objective over the conventional two-year horizon. Instead, allowing inflation to undershoot the target may be appropriate, especially in those jurisdictions in which financial imbalances have been building up (Chapter IV). All else the same, failing to do so may actually risk unwelcome disinflationary pressures down the road as the boom turns to bust. This, along with evidence of diminished policy effectiveness, suggests that although recent disinflationary pressures deserve close monitoring, the factors limiting their effects and the costs of further monetary ease should be carefully assessed.

Normalising policy

Looking ahead, the transition from extraordinary monetary ease to more normal policy settings poses a number of unprecedented challenges. It will require deft timing and skilful navigation of economic, financial and political factors, and hence it will be difficult to ensure a smooth normalisation. The prospects for a bumpy exit together with other factors suggest that the predominant risk is that central banks will find themselves behind the curve, exiting too late or too slowly.

The central banks from the major advanced economies are at different distances from normalising policy. The Bank of England has maintained its stock of purchased assets since mid-2012, and in 2014 the Federal Reserve began a steady reduction of its large-scale asset purchases as a precursor to policy rate lift-off. In contrast, the Bank of Japan is still in the midst of its aggressive programme of balance sheet expansion. And the ECB has just announced targeted longer-term refinancing operations and lowered its key policy rates to unprecedented levels.

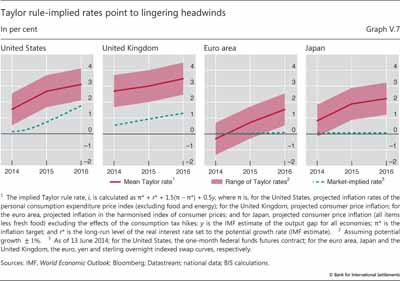

Central banks have also indicated that they will calibrate the pace of policy normalisation on the basis of the strength of the recovery and the evolution of various crisis-related headwinds. The Federal Reserve expects labour market headwinds and balance sheet problems to wane over the next few years; nonetheless, it expects that the real interest rate consistent with macroeconomic balance (ie the natural rate) will normalise, at about 2%, only over a longer period, in part because of a persistent surfeit of global saving. The Bank of England's Monetary Policy Committee has said that the natural rate is being held down by continuing strains in the financial system and the process of repair in private and public balance sheets. The ECB sees different headwinds. It expects bank deleveraging and financial fragmentation, among other factors, to hold back the recovery for several years. Overall, the gap between current market expectations of policy rates and the trajectory of rates implied by Taylor rules (Graph V.7) may be shaping the perception of headwinds and their persistence.

A common view today is that central banks should be extra cautious to avoid endangering the fragile recovery. According to this view, deflation would impose major costs, and even delaying exit would not be a major problem: inflation might rise, but central banks could then quickly catch up. Moreover, according to this view, careful communication, announcing any exit well in advance and making it clear that it would be gradual, would help limit the risk of market disruptions.

This view is supported by a number of historical observations. The Federal Reserve's exit decision in 1994 created serious market tensions globally, whereas the better anticipated and more gradual exit in 2004 had no such large effects. Moreover, the gradual pace of exit in 2004 did not result in inflation increasing beyond the central bank's control. Indeed, this exit was designed to a considerable extent to avoid some of the shortcomings of the 1994 process.

However, the argument urging central bank restraint focuses on inflation and the business cycle at the expense of the financial cycle, ignores the impact on sovereign fiscal positions and may well put too much faith in the powers of communication. Each issue deserves some elaboration.

The argument loses some of its appeal once attention turns to concerns about the financial cycle. Arguably, it was precisely the slow pace of the policy normalisation after 2003 that contributed to the strong booms in credit and property prices leading up to the financial crisis. For example, in the United States in the early 2000s, the business cycle turned and equity prices fell, but the rising phase of the financial cycle continued (Chapter IV). Today, several developments deserve close attention: the signs of a global search for yield (Chapter II); the risk of financial imbalances building up in some regions of the world (Chapter IV); and the high interest rate sensitivity of private sector debt burdens, as debt levels have failed to adjust relative to output (Chapter IV).

A very slow pace of normalisation also raises issues about the impacts on fiscal sustainability. One such impact is indirect. Keeping interest rates unusually low for an unusually long period provides an opportunity to consolidate strained fiscal positions, but more often than not it lulls governments into a false sense of security that delays the needed consolidation.

Another impact is more direct, but not very visible. Wherever central banks engage in large purchases of sovereign or quasi-sovereign debt (financed naturally with short-term claims), they shorten the debt maturity profile of the consolidated public sector balance sheet, which comprises the central bank and the government. This raises the sensitivity of the debt service burden to changes in short-term interest rates. It may also lead to political economy pressures on the central bank to refrain from normalising policy at the appropriate time and pace, ie the risk of fiscal dominance. The government will no doubt dislike seeing its budget position deteriorate; in that context, the losses that are likely to be incurred by the central bank could put its room for manoeuvre and even its autonomy at risk. In addition, the liability costs associated with the bloated central bank balance sheets raise other political economy challenges. For instance, the remuneration on liquidity-draining facilities may benefit the financial sector, which might be perceived by the public as inappropriate. One option to keep the remuneration costs lower could be to rely on unremunerated reserve requirements.

Finally, communication has its limitations. Central banks want to communicate clearly to avoid surprising the markets and generating sharp price reactions. But efforts to be clear may imply greater assurance than the central bank wishes to convey and encourage further risk-taking. As risk spreads narrow, increasingly more leveraged positions are required to squeeze out returns. And even if no leverage is involved, investors will be lured into increasingly risky and possibly illiquid assets. The process, therefore, raises the likelihood of a sharp snap-back.6 Moreover, even if the central bank becomes aware of such risks, it may nonetheless be very reluctant to take actions that might precipitate a destabilising adjustment. A vicious circle can develop. In the end, if the central bank is perceived as being behind the curve, it may well be the markets that react first.

All this suggests that the risk of central banks normalising too late and too gradually should not be underestimated. There are very strong and all too natural incentives pushing in that direction. Another symptom of this bias concerns central banks' quantitative easing programmes, in which they bought long-term assets on an unprecedented scale to push term premia down. But now, as the time for policy normalisation approaches, they appear hesitant to actively sell those assets out of concerns about disrupting markets.

1 In April 2013, the Bank of Japan changed its operating target for monetary policy from the overnight money market rate to the monetary base.

2 See J Caruana, "Hitting the limits of 'outside the box' thinking? Monetary policy in the crisis and beyond", speech at the OMFIF Golden Series Lecture, London, 16 May 2013.

3 See J Caruana, "International monetary policy interactions: challenges and prospects", speech at the CEMLA-SEACEN conference in Punta del Este, Uruguay, 16 November 2012.

4 See P Turner, "The global long-term interest rate, financial risks and policy choices in EMEs", BIS Working Papers, no 441, February 2014.

5 See R McCauley, P McGuire and V Sushko, "Global dollar credit: links to US monetary policy and leverage", Economic Policy, forthcoming.

6 See S Morris and H S Shin, "Risk-taking channel of monetary policy: a global game approach", unpublished paper, Princeton University, 2014.