Forward guidance at the zero lower bound

Four major central banks have adopted new approaches to policy rate forward guidance with the aim of enhancing the effectiveness of monetary policy at the zero lower bound. In this special feature, we examine these approaches and assess their impact. So far, the forward guidance appears to have led to lower volatility of near-term expectations of the future path of policy rates, but the effects on the level of interest rate expectations and on the responsiveness of financial markets to news are less clear. At the same time, the forward guidance raises a number of significant challenges. How they are managed will ultimately determine the enduring value of this communication tool.1

JEL classification: E52, E58.

Since 2008, forward guidance has become a key element of monetary policy. The Federal Reserve, the Bank of Japan, the ECB and the Bank of England have all provided forward guidance about future policy rates in various forms, some qualitative, others quantitative, and in some cases conditional on specific economic developments, including the behaviour of real variables such as the unemployment rate.

In this article, we first review key features of these recent forward guidance practices and the communication challenges involved. We then assess the empirical evidence on their impact. We investigate the extent to which forward guidance has affected the level and volatility of interest rate expectations and the sensitivity of markets to economic news. The article then discusses potential risks, specifically those to central banks' reputations and to financial stability.

We conclude that the recent increased reliance on forward guidance has been helpful in clarifying policy intentions in highly unusual economic circumstances. However, the mixed evidence concerning the effectiveness of these practices, and the challenges they raise, caution against drawing firm conclusions about their ultimate value.

Objectives and recent approaches

Forward guidance is not new. Starting in the 1990s, central banks relied on qualitative descriptions of the main thrust of their interest rate policies to inform the public, which sometimes required deciphering "code words" in official policy statements. Since the late 1990s, a number of small inflation targeting economies have adopted quantitative forward guidance by regularly publishing their own quantitative forecast of the future path of policy interest rates.2

Forward guidance at the zero lower bound was first adopted by the Bank of Japan in the context of its zero interest rate policy in 1999. The Federal Reserve also adopted forward guidance on policy rates in 2003 when it stated that policy accommodation would be maintained for a considerable period. At that time, the policy rate was low but not at the zero lower bound. In the wake of the global financial crisis, the Federal Reserve, the Bank of England, the Bank of Japan and the ECB all adopted forward guidance on policy rates, albeit at different times and in different forms.3

Objectives and conditions for effectiveness

The objective of forward guidance at the zero lower bound has been to clarify the central banks' intended policy rate path. This can provide additional stimulus at the zero lower bound when central banks communicate that policy rates will remain lower for longer than is priced into markets. Forward guidance can also reduce uncertainty, thereby lowering interest rate volatility and through this channel possibly also risk premia.4

The potential usefulness of forward guidance depends on it being (i) seen as a commitment; (ii) clearly communicated; and (iii) interpreted in the way intended by the central bank.

For forward guidance to be effective, it must be seen as a credible commitment of the central bank, ie the public must believe that the central bank will deliver on its guidance. Only then can the guidance have an impact on the public's expectations of the future path of policy rates.

Some academic observers, in particular Woodford (2012), have suggested that central banks should use forward guidance to commit to a very low policy rate beyond the point in time when economic developments would normally indicate a tighter policy. In principle, this strategy would yield greater monetary stimulus. However, this approach would require the central bank to pre-commit to a policy course that it would have an incentive to eventually renege on when conditions normalise (a "time inconsistent" policy).5 This highlights the trade-off that central bankers face when designing forward guidance aimed at stimulating the economy at the zero lower bound, ie the trade-off between the strength of the commitment and future policy flexibility. The stronger the perceived commitment is in the eyes of the public, the bigger the likely impact on financial market expectations and economic decisions, but the greater also the risk of a retrospectively undesirable tying of the central bank's hands or of taking actions that are at odds with the original guidance.

Forward guidance effectiveness also requires that it is clearly communicated to the public. In principle, clarity can be enhanced by spelling out more explicitly the conditionality of the guidance, ie by explaining what the central bank aims to achieve and how it will respond to economic developments. However, if too complex, conditionality may end up confusing the public and leading to conflicting interpretations of policy intentions, with the risk of disruptive market reactions. Central banks then face the risk of getting involved in continuous discussions with the media and other observers about nuanced wording and technical details.

Even if forward guidance is quite explicit, it may not have the desired stimulative effects if it is not interpreted by the public in the intended way. In general, forward guidance conveys two types of information: the central bank's assessment of the economic outlook and the degree of policy accommodation given the outlook.6 Communicating the intention to keep policy rates at the zero lower bound for longer in order to increase the degree of policy accommodation may be misinterpreted rather as signalling a more pessimistic economic outlook by the central bank. In this case, negative confidence effects would counteract the intended stimulus.

The common practice of monetary policy decision-making by monetary policy committees (MPCs) complicates forward guidance in a number of ways. Differences in viewpoints amongst committee members take on greater importance when a committee must endorse a trajectory for the future policy stance, making it more difficult for committee members to find common ground. This may lead to compromises that water down the clarity and credibility of guidance. In addition, committee cacophony in external communication can further undermine the clarity and credibility of forward guidance. And the public may question the credibility of an MPC's forward guidance far out into the future, owing to the inability of MPC members to pre-commit future ones.

Recent approaches at the major central banks

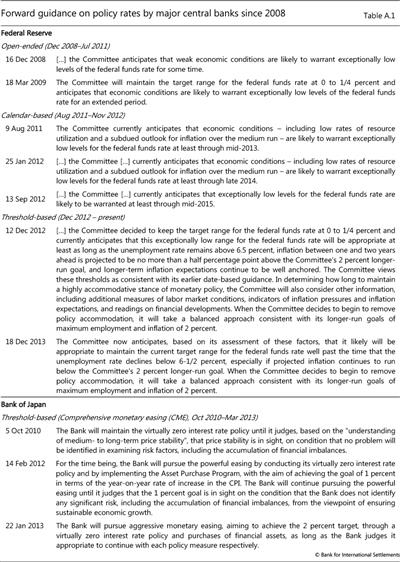

Three different broad forms of policy rate forward guidance can be distinguished: (i) qualitative, where the guidance does not provide detailed quantitative information about the path of the policy rate or the envisaged time frame (eg "the policy rate will be maintained for an extended period"); (ii) calendar-based, where the guidance applies to a clearly specified time horizon (eg "the policy rate will be kept at the current level for x years");7 and (iii) threshold-based, where the guidance is linked to specific quantitative economic thresholds (eg "the policy rate will not be raised at least until the unemployment rate has fallen below y%"). Various forward guidance approaches have been pursued over time by the Federal Reserve, the Bank of England, the Bank of Japan and the ECB since 2008; more detailed information is provided in Table A1 in the annex.8

The Federal Reserve adopted qualitative forward guidance on policy rates when it cut the federal funds rate to its effective lower bound in December 2008. Subsequently, in 2011, the Fed shifted to calendar-based guidance by communicating that economic conditions would warrant policy rates at their lower bound for at least two years. Since December 2012, the Federal Reserve has been pursuing threshold-based forward guidance, clarifying the key factors that would influence the timing of future changes in the policy stance. Specifically, the Fed stated its intention to maintain the federal funds rate at its prevailing level conditional on explicit quantitative thresholds for both the unemployment rate (>6.5%) and inflation projections (<2.5%) as well as on evidence of well anchored long-term inflation expectations.

The Bank of Japan implemented threshold-based forward guidance linked to the inflation rate in the context of its Comprehensive Monetary Easing (CME) programme in October 2010. It announced that the zero interest rate policy would remain in place until the Bank of Japan's price stability goal was achieved and conditional on the absence of significant risks, including the accumulation of financial imbalances. Under the Quantitative and Qualitative Easing (QQE) programme launched in April 2013, the Bank of Japan replaced the uncollateralised overnight rate with the monetary base as its operating target of money market operations. The stated goal of the programme is to achieve a 2% price stability target with a time horizon of two years through large-scale asset purchases and monetary base expansion. In other words, QQE included elements of both threshold- and calendar-based forward guidance but without explicit forward guidance on the policy rate. Nonetheless, one aim of the new programme is to shape the longer end of the yield curve via expectations of future rates and term premia, but now the communication focus is solely on quantitative targets for the central bank's balance sheet.9

The Bank of England and the ECB introduced new forward guidance policies in mid-2013. The Bank of England initially laid out its threshold-based forward guidance, linking the maintenance of prevailing low policy rate levels to a quantitative threshold for the unemployment rate (>7%) with three so-called "knockout" criteria including a quantitative threshold for inflation projections 18-24 months ahead (<2.5%) as well as anchored medium-term inflation expectations and the absence of financial instability risks. It noted that, with the recovery gaining traction at the time, there was a risk that financial markets might overreact to signs of recovery and excessively revise up their expectations of future policy rates. In February this year, against the backdrop of a much faster than expected fall in the unemployment rate, the Bank of England set out the factors that will guide its decisions about the path of policy rates when the unemployment threshold is reached, emphasising in particular the objective to further reduce economic slack.

The ECB adopted open-ended qualitative forward guidance on policy interest rates in July 2013, stating its intention to keep interest rates at prevailing or lower levels "for an extended period of time". This represented a break with the long-standing practice of not commenting on policy rates beyond the following policy meeting. Similar to the case of the United Kingdom, this decision was partly motivated at the time by a rise in the expected path of euro area policy rates that was seen to be inconsistent with the subdued outlook for inflation and broad-based economic weakness.

The different approaches taken by central banks and their changes over time reflect the evolution of the challenges, the public and academic debate, and lessons from experience at home and abroad. Against the backdrop of the discussion of forward guidance effectiveness in the preceding subsection, the different approaches a priori offer different pros and cons. Qualitative forward guidance, for instance, is a relatively vague form of forward guidance, but at the same time it minimises the risk of excessively tying one's hand and the complications of forging a consensus on the guidance in monetary policy committees.

Calendar-based forward guidance is more explicit than qualitative forward guidance, but could be seen as strongly tying the central bank's hand. At the same time, subsequent revisions to calendar-based forward guidance could be interpreted as indicating either a change in the outlook or a change in the degree of monetary accommodation deemed appropriate given the outlook. If the revision is misinterpreted as a change in the outlook, the guidance may prove to be counterproductive. In addition, early termination or extension of calendar-based forward guidance could be perceived as reflecting an inherently time-inconsistent policy, which could undermine the credibility of the approach.

Threshold-based forward guidance is less affected by time inconsistency since it spells out more clearly the conditionality, but at the risk of high complexity. Indeed, the shift to threshold-based forward guidance has generally been associated with an increased length of forward guidance statements. For instance, in the case of the Federal Reserve, statements at the time of policy meetings increased from around 20 words under qualitative forward guidance to an average of about 100 words under the recent threshold-based forward guidance; the word count for the Bank of England's threshold-based forward guidance in August 2013 and February 2014 was roughly 200 words.

Empirical evidence

Forward guidance on policy rates can impact financial markets and the economy in three main ways.

First, to the extent that the guidance implies an easier future monetary policy stance than expected by market participants, it should affect the level of future expected short-term rates as well as long-term bond yields.

Second, to the extent that central banks provide greater clarity about the future path of policy interest rates, the volatility of market expectations of future policy rates should fall, possibly also compressing risk premia.

Third, to the extent that the conditional nature of forward guidance highlights specific indicators, the guidance should make markets more sensitive to data releases related to these indicators and less sensitive to other information.

What does the evidence tell us so far about forward guidance on policy rates?10

Lowering the path of expected future interest rates

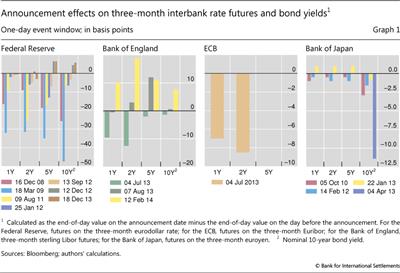

Forward guidance on policy rates has had some impact on expectations of the future path of short-term rates and on long-term bond yields (Graph 1). The evidence from the reactions of three-month futures rates and 10-year benchmark bond yields to forward guidance announcements suggests, however, that the effects have varied across jurisdictions and over time.

For the United States, futures rates and long-term bond yields tended to decline on most announcement days (Graph 1, left-hand panel). The announcements associated with qualitative forward guidance saw the largest reactions, but on the days concerned these reactions also reflected announcements of actual policy rate cuts (December 2008) as well as asset purchases (both December 2008 and March 2009). The market reaction to calendar-based forward guidance shows a decline over time. For instance, the August 2011 announcement was associated with a drop in the two-year-ahead futures rate of more than 20 basis points, compared with a 5 basis point drop after the January and September 2012 statements.

The threshold-based forward guidance of December 2012 and December 2013 had essentially no measurable impact on futures rates and long-term bond yields, but these effects are again contaminated by the effects of asset purchase announcements released at the same time. Specifically, the December 2013 guidance coincided with the announcement that the Federal Reserve would reduce the pace of its large-scale asset purchases. In that case, the absence of a significant market reaction in terms of futures and bond yields could be interpreted as a sign of the effectiveness of forward guidance, ie of its ability to offset the upward pressure on rates from the tapering announcement.

The impact of forward guidance on the expected path for future interest rates is also visible for the other major central banks (Graph 1). True, in the case of the Bank of England, futures rates did not drop following the formal introduction of forward guidance in August 2013. However, two-year futures rates did drop by more than 10 basis points in July 2013 when the MPC raised concerns about the appropriateness of market expectations for future policy rates. The ECB's forward guidance in July also had a negative impact on futures rates at the one- and two-year horizons (7 and 8 basis points, respectively).

For the Bank of Japan, the announcement effects on futures rates have generally been tiny, in part reflecting the entrenched expectation that the first policy rate increase lies way out in the future. That said, the 10-year bond yield registered a relatively sizeable decline, of more than 10 basis points, after the announcement of QQE in April 2013, while futures rates essentially remained unchanged. This suggests that the shift from policy rate forward guidance to balance sheet forward guidance mainly impacted term premia via the announced large-scale asset purchases.11

All these results suggest that in general there has been an immediate impact of policy rate forward guidance on the level of expected future interest rates, but it has varied over time with some indication of a diminishing effect. However, caution is called for when interpreting results from event studies of this type. In particular, they do not take into account prior market expectations or possible delayed reactions. For instance, the declining impact may reflect an improved ability of markets to anticipate the actions of the central bank over time. Moreover, they do not control for the influence of other relevant news; many forward guidance announcements have coincided with asset purchase announcements, making it harder to isolate their market impact. Also for these reasons, it is not possible to draw strong conclusions about the relative effectiveness of the different types of forward guidance from the announcement effect evidence alone.

Reducing the volatility of expected future rates

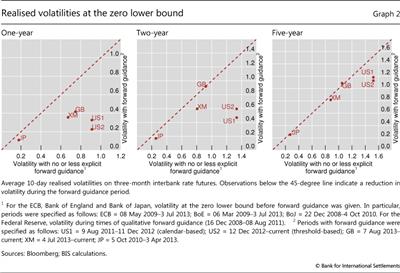

Graph 2 presents evidence that policy rate forward guidance at the zero lower bound has reduced the volatility of expected interest rates at short horizons, but less so at longer horizons. The graph plots 10-day realised futures volatilities during periods of forward guidance (vertical axis) against those in periods without forward guidance (horizontal axis).12 For the United States, the scatter plot distinguishes between the period of calendar-based (US1) and threshold-based (US2) forward guidance.

The clustering of the points below the 45-degree line indicates that the interest rate volatility in the forward guidance period tends to be lower than in the non-forward guidance period. This pattern is evident in the case of the one-year horizon. Not surprisingly, the volatility relationship between forward guidance and non-forward guidance periods appears weaker at longer horizons. At the two- and five-year horizons, the clustering of the dots is much closer to the 45-degree line. This presumably reflects market views that the policy rate forward guidance from the respective central banks is a commitment of limited duration and fades with the horizon.

Changing sensitivity to economic news

Policy rate forward guidance appears to have influenced the sensitivity of financial variables to economic news. Some studies have documented a reduction in the sensitivity of interest rate futures to news at the zero lower bound for short policy horizons under calendar-based forward guidance (Swanson and Williams (2013)).

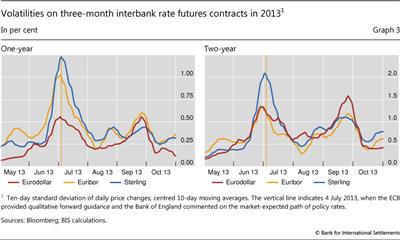

Additional evidence comes from the Bank of England's and the ECB's forward guidance experience in mid-2013. Graph 3, which shows the volatility of three-month futures rates at the one- and two-year horizon between May and October 2013, supports the view that the guidance helped to insulate their respective economies from the news about Federal Reserve tapering. The first spike in US interest rate volatility occurred in mid-year and was associated with prospects of early Federal Reserve tapering of large-scale asset purchases. The graph documents the outsize volatility reaction at the time for the euro area and the United Kingdom. By contrast, in late summer, the second spike in US rate volatility had a more muted impact on Europe, for both the one- and two-year horizons, after the ECB and the Bank of England had adopted forward guidance.

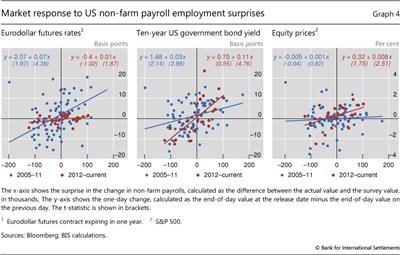

In addition, there is evidence, at least for the United States, that financial markets responded to news about threshold variables differently in the forward guidance period. In the case of the Federal Reserve, Graph 4 (left-hand panel) shows that one-year futures rates became less sensitive to news about non-farm payroll employment surprises (the twist of the blue line to the red line). This is consistent with the interpretation that the surprises had little information content about whether the unemployment rate threshold would be breached within a year. This relationship, however, is likely to change as the unemployment rate approaches the threshold and a near-term policy shift is likely. In particular, interest rate futures are likely to become more sensitive to labour market developments as the threshold is approached.

On the other hand, Graph 4 (centre and right-hand panels) illustrates the increased sensitivity of the 10-year bond yield and equity prices to non-farm payroll surprises since 2012 (slope of the red line relative to the slope of the blue line (representing the relationship from 2005 to 2011)). One interpretation is that big positive surprises reflected a stronger recovery and hence brought forward the expected time at which the unemployment threshold would be breached and policy rate lift-off would ensue.

Challenges ahead

Policy rate forward guidance raises a number of challenges. These include in particular the risks to central banks' reputations and to financial stability.

Central bank reputation

Forward guidance exposes central banks to various reputation risks. If the public fails to fully understand the conditionality of the guidance and the uncertainty surrounding it, the reputation and credibility of the central bank may be at risk if the guidance is revised frequently and substantially. This is particularly relevant in the case of calendar-based forward guidance, in which deviations in the preannounced timetable may be perceived as reneging on a commitment even if conditions change unexpectedly.

And while state-contingent forward guidance helps to address the risk of an appearance of reneging, it raises others. For example, the announcement of unemployment-based thresholds could be seen as signalling a fundamental shift in monetary strategies and goals. And, as history has shown, the perception that central banks have elevated the role of real variables in monetary policy frameworks can adversely affect a central bank's credibility for price stability. A widespread perception of this could also create policy uncertainty about what central banks are truly aiming at, which would be counterproductive in the current post-crisis environment. Further, central banks may ex post be seen as having seriously misjudged the outlook, especially if such misjudgments are not widely shared with other forecasters.

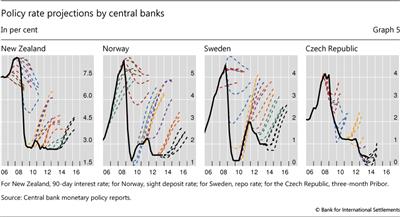

That being said, it is important not to underestimate the public's ability to understand the conditionality of policy rate forward guidance. For example, the publication of projections for policy rate paths seems not to have had any major effect on central banks' reputation or credibility in New Zealand, Norway, Sweden and the Czech Republic, even though actual interest rates often differed considerably from projections (Graph 5).13 The deviations have been quite sizeable at times. One possible explanation for the seemingly limited impact of these deviations on credibility is that the central banks have been seen as behaving consistently with their policy objectives given what was known about the economic and financial environment at the time decisions were made. Another explanation is that these central banks have not been operating at the zero lower bound for policy rates, which is a more complicated environment where the commitment dimension of forward guidance takes on greater prominence; at the zero lower bound, the constraint on the policy rate reduces the signalling value of policy rate changes and naturally leads to greater weight on the choice of words to describe the policy stance.

Financial stability risks

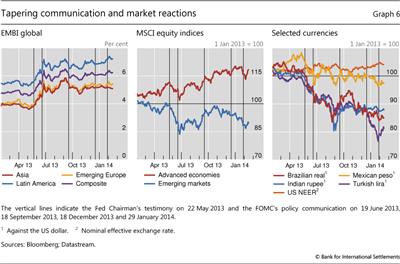

Forward guidance can give rise to financial stability risks in two ways. First, if financial markets become narrowly focused on certain aspects of a central bank's forward guidance, a broader interpretation or recalibration of the guidance could lead to disruptive market reactions. The global financial market developments last May and June in response to the Federal Reserve's tapering communication highlight such a risk. In that episode, financial markets fundamentally reassessed the path of future interest rates in the United States, and a global bond market sell-off ensued, along with a break in equity markets and a sharp depreciation of some emerging market exchange rates (Graph 6).14

Second, and perhaps more importantly, forward guidance can indirectly create financial stability risks if monetary policy becomes increasingly concerned about adverse financial market reactions (also referred to as the risk of financial dominance). At the current juncture, this could translate into an undue delay in the speed of monetary policy normalisation and raise the risk of an unhealthy accumulation of financial imbalances.15 Moreover, the mere perception of this possibility, over time, could encourage excessive risk-taking and thereby foster a build-up of financial vulnerabilities.

In the end, the reputational and financial stability risks associated with forward guidance have to be weighed against the risks associated with less forward-looking information. The cost-benefit calculus will depend on the particular situation in each economy and is likely to change over time.

Concluding remarks

The empirical evidence on the effectiveness of policy rate forward guidance at the zero lower bound presented in this article provides some support for the view that it has helped to shape market expectations. We find that recent forward guidance by four major central banks has so far reduced the volatility of near-term expectations about the future path of policy interest rates, suggesting that near-term policy intentions have been clarified. Beyond the impact on near-term policy rate volatility, the evidence is more mixed. In particular, the impact of the new forward guidance practices on expected interest rates has varied across episodes and economies and has not been very systematic in one direction or another. This has made it difficult to draw firm conclusions about their effectiveness in reliably providing further stimulus.

How long the new forward guidance practices will remain in place in the post-exit period is an open question, especially when it comes to the more explicit, state-contingent measures. One view is that greater central bank transparency has been a natural continuation of an earlier trend and that recent efforts represent an acceleration in its pace. An alternative view is that the recent forward guidance measures represent an unconventional monetary policy tool to be used in times of stress but not under normal conditions. Which view ultimately prevails will depend on how well recent forward guidance measures work in navigating the final stages of the recovery from the crisis and ultimately in the normalisation of prolonged monetary accommodation.

References

Andersson, M and B Hofmann (2010): "Gauging the effectiveness of central bank forward guidance", in D Cobham, Ø Eitrheim, S Gerlach and J Qvigstad (eds), Twenty years of inflation targeting: lessons learned and future prospects, Cambridge University Press.

Banerjee, R, D Latto and N McLaren (2012): "Using changes in auction maturity sectors to help identify the impact of QE on gilt yields", Bank of England Quarterly Bulletin, second quarter.

Bank of England (2013): "Monetary policy trade-offs and forward guidance", August.

______ (2014): Inflation Report, February.

Bauer, M and G Rudebusch (2012): "The signalling channel of Federal Reserve bond purchases", Federal Reserve Bank of San Francisco Working Paper Series, no 2011-21, August.

Bean, C (2013): "Nominal income targets: an old wine in a new bottle", speech given at the Institute for Economic Affairs Conference on the State of the Economy, London, 27 February.

Bernanke, B (2013a): "Transcript of chairman Bernanke's press conference".

______ (2013b): "Communication and monetary policy", speech at the National Economists Club Annual Dinner, Herbert Stein Memorial Lecture, Washington, DC, 19 November.

Cahill, M, S D'Amico, C Li and J Sears (2013): "Duration risk versus local supply channel in Treasury yields: evidence from the Federal Reserve's asset purchase announcements", Federal Reserve Board Finance and Economics Discussion Series, no 2013-35, April.

Campbell, J, C Evans, J Fisher and A Justiniano (2012): "Macroeconomic effects of Federal Reserve forward guidance", Brookings Papers on Economic Activity, Spring, Issue 1, pp 1-80.

Caruana, J (2013): "The changing nature of central bank independence", panel remarks at the Bank of Mexico international conference "Central bank independence - Progress and challenges", Mexico City, 14-15 October.

Cœuré, B (2013): "The usefulness of forward guidance", speech to the Money Marketers Club of New York, New York, 26 September.

Dale, S and J Talbot (2013): "Forward guidance in the UK", VOX, 13 September.

English, W, J Salido-Lopez and R Tetlow (2013): "The Federal Reserve's framework for monetary policy - recent changes and new questions", Federal Reserve Board Finance and Economics Discussion Series, November.

Hannoun, H (2012): "Monetary policy in the crisis: testing the limits of monetary policy", speech at the 47th SEACEN Governors' Conference, Seoul, Korea, 14 February.

Kool, A and D Thornton (2012): "How effective is central bank forward guidance?", Utrecht School of Economics Tjalling C Koopmans Research Institute Discussion Paper Series, no 12-05, March.

Kuroda, H (2013): "Overcoming deflation and after", speech at the Meeting of Councillors of Nippon Keidanren, Tokyo, 25 December.

Shirai, S (2013): "Monetary policy and forward guidance in Japan", speech at the International Monetary Fund, Washington DC, 19 September.

Swanson, E and J Williams (2013): "Measuring the effect of the zero lower bound on medium- and longer-term interest rates", Federal Reserve Bank of San Francisco Working Paper, no 2012-02.

Tucker, P (2013): "Monetary strategy and prospects", speech to the Association for Financial Markets in Europe, London, 24 September.

Woodford, M (2012): "Methods of policy accommodation at the interest-rate lower bound", Federal Reserve Bank of Kansas City Jackson Hole Symposium Conference Volume, August.

Annex

1 The views expressed in this article are those of the authors alone and do not necessarily reflect those of the BIS. We are grateful to Claudio Borio, Dietrich Domanski, Hans Genberg, Robert McCauley and Christian Upper for useful comments and to Bilyana Bogdanova and Michela Scatigna for excellent research assistance.

2 The central banks routinely publishing interest rate projections include the Czech Republic, Iceland, Israel, New Zealand, Norway and Sweden. For an analysis of the performance of these quantitative forward guidance approaches, see Andersson and Hofmann (2010) and Kool and Thornton (2012).

3 In this special feature, we focus on policy rate forward guidance and leave issues of balance sheet forward guidance for future research.

4 Forward guidance therefore influences long-term interest rates mainly via the expected path of policy rates. Asset purchase announcements, in contrast, are widely seen as affecting mainly term premia in long-term interest rates via a portfolio rebalancing channel (Bernanke (2013b)). For instance, Banerjee et al (2012) and Cahill et al (2013) present evidence suggesting that the Bank of England's and Federal Reserve's asset purchases have mainly worked through a portfolio balance channel. A different strand of evidence has suggested that asset purchases mainly work through a signalling channel, shifting the expected path of future policy rates (see Bauer and Rudebusch (2012) and Woodford (2012)). This would imply that forward guidance could achieve the same effect as asset purchases, but without the large-scale accumulation of assets on the central bank's balance sheet. That said, asset purchases could be a more effective signalling tool as the central bank could be regarded as "putting its money where its mouth is". Addressing this question is, however, beyond the scope of this article.

5 Woodford (2012) argues that overcoming the time-inconsistency issue requires "advance commitment to definite criteria for future policy decisions". One approach mentioned is history-dependent targeting regimes, such as price level or nominal GDP targeting, in order to achieve a credible commitment to keep rates low for longer than under established inflation targeting regimes. See English et al (2013) for simulations of the potential size of the gains. See Bean (2013) for arguments against this time-inconsistency issue.

6 The former is sometimes referred to as Delphic forward guidance (the central bank acting as an oracle, like that of Delphi) and the latter as Odyssean forward guidance (the central bank providing information about the mast it ties itself to in order to withstand the call of the sirens, like Odysseus). This taxonomy was originally proposed by Campbell et al (2012).

7 Calendar-based guidance is also typically conditional on the economic outlook at the time of issuance. Such conditionality is intended to mitigate, on the one hand, the risk of excessively tying one's hands in case the outlook changes significantly and, on the other hand, the risk of the time inconsistency problem mentioned above.

8 For more detailed expositions of these central banks' approaches to forward guidance, see Bernanke (2013b) for the Federal Reserve, Dale and Talbot (2013) and Bank of England (2014) for the Bank of England, Cœuré (2013) for the ECB and Shirai (2013) for the Bank of Japan.

9 A key objective of the programme is to raise inflation expectations through a strong commitment to monetary easing until the price stability goal is achieved (Kuroda (2013)).

10 An overview of previous studies on the impact of forward guidance is provided in Bank of England (2013).

11 While the announcement effects have been accompanied by modest changes in the nominal yields, inflation expectations in Japan have increased significantly since the launch of the programme towards the Bank of Japan's 2% price stability target.

12 Note that, for the Federal Reserve, the reference period is that of qualitative forward guidance because this type of guidance was adopted as the policy rate was cut to the zero lower bound.

13 Reputational success is assessed by the anchoring of inflation expectations.

14 These global market dynamics were driven in part by an unwinding of risky, leveraged trade positions which were predicated on policy interest rates remaining very low for a long time. See Bernanke (2013a) for an assessment of the financial market developments in the aftermath of the June tapering announcement. State-contingent forward guidance may be especially vulnerable here because of the lack of appropriate hedging instruments, ie the lack of state-contingent financial assets tailored to the conditions included in the guidance (Tucker (2013)). In this environment, financial investors by and large have to translate state-contingent forward guidance into trading strategies using time-contingent financial assets. This raises the likelihood of disruptive volatility whenever evolving conditions revise the expected timetable for actions, eg when financial market participants fundamentally rethink the likely lift-off and pace of a policy rate normalisation. This financial market risk could call into question the overall value of the more information-intensive forward guidance practices when markets lack appropriate hedging instruments.

15 Caruana (2013) addresses the risk to financial stability from undue delay in policy rate normalisation. See Hannoun (2012) for a description of the risk of financial dominance.