The capital buffers in Basel III - Executive Summary

The package of reforms commonly known as Basel III is a comprehensive set of measures developed by the Basel Committee on Banking Supervision (BCBS) to address the fault lines in the financial system exposed by the Great Financial Crisis. One of these fault lines was the lack of a system-wide approach to financial sector risks, a so-called macroprudential perspective that aims to promote financial stability and mitigate systemic risk.

To address this shortcoming, Basel III introduces two buffers that apply to all banks: the capital conservation buffer and the countercyclical capital buffer. Two other macroprudential elements in the post-crisis regulatory response, the specific capital surcharge for global systemically important banks (G-SIBs) and the total loss-absorbing capacity (TLAC) requirement, apply only to G-SIBs and are covered in two dedicated Executive Summaries.

The capital conservation buffer

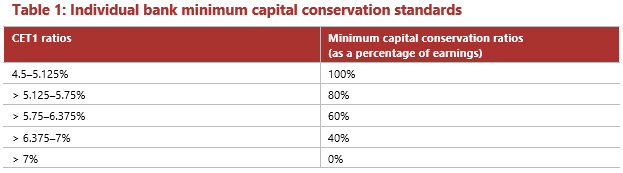

The capital conservation buffer was introduced to ensure that banks have an additional layer of usable capital that can be drawn down when losses are incurred. The buffer was implemented in full as of 2019 and is set at 2.5% of total risk-weighted assets. It must be met with Common Equity Tier 1 (CET1) capital only, and it is established above the regulatory minimum capital requirement. Whenever the buffer falls below 2.5%, automatic constraints on capital distribution (for example, dividends, share buybacks and discretionary bonus payments) will be imposed so that the buffer can be replenished. The distribution constraints increase as the bank's capital ratio approaches the minimum capital requirement (Table 1). The applicable conservation standards must be recalculated at each capital distribution date. Apart from these constraints, a bank will be able to continue to conduct business as normal when it draws down its capital conservation buffer.

The countercyclical capital buffer

The countercyclical capital buffer (CCyB) aims to protect the banking sector from periods of excess aggregate credit growth that have often been associated with the build-up of system-wide risks. The CCyB framework became fully effective as of 2019.

Basel III requires that the CCyB be activated and increased by authorities when they judge aggregate credit growth to be excessive and to be associated with a build-up of system-wide risk. The buffer would subsequently be drawn down in a downturn to help ensure that banks maintain the flow of credit in the economy.

The BCBS also published guidelines for authorities making CCyB decisions. This includes a requirement for authorities to adopt an internationally consistent common buffer guide, based on the aggregate private sector credit-to-GDP ratio. This guide provides a common anchor for authorities to decide on the appropriate level of the buffer, with authorities free to rely on other indicators as well when deciding on the appropriate CCyB rate.

The CCyB varies between 0 and 2.5% of total risk-weighted assets and must be met with CET1 capital. Basel III requires banks to calculate and publish their CCyB requirements with at least the same frequency as their minimum capital requirements. As banks need time to adjust to an increase in buffer requirements, a jurisdiction is required to pre-announce its decision to raise the CCyB level by up to 12 months. On the other hand, decisions by a jurisdiction to decrease the level of the CCyB will take effect immediately.

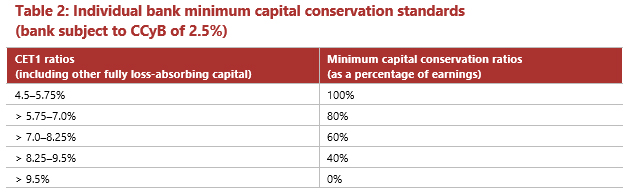

The CCyB is implemented as an extension of the capital conservation buffer. Accordingly, banks that fall below their CCyB requirement are subject to automatic distribution restrictions. Table 2 shows how the capital distributions would affect a hypothetical bank subject to a CCyB equal to 2.5%.

The CCyB also introduces a unique feature of jurisdictional reciprocity. An authority that activates the buffer in a jurisdiction is expected to promptly inform its foreign counterparts. In turn, authorities in other jurisdictions should require their banks to apply the buffer for exposures in that jurisdiction. This reciprocal mechanism seeks to minimise the degree of cross-border spillovers and regulatory arbitrage. Reciprocity is mandatory for all BCBS member jurisdictions for a CCyB up to 2.5%. A bank's CCyB rate is calculated as the weighted average of CCyB rates set by the jurisdictions where it has exposures.

* This Executive Summary and related tutorials are also available in FSI Connect, the online learning tool of the Bank for International Settlements.