BIS international banking statistics and global liquidity indicators at end-December 2021

Key takeaways

- Banks' outstanding cross-border claims changed little overall in the fourth quarter of 2021. Their year-on-year growth rate slowed to 1.6%.

- Cross-border claims on emerging market and developing economies (EMDEs) increased by $103 billion, mainly vis-à-vis Latin America and Africa and the Middle East.

- Cross-border claims on Russia were about $90 billion at end-2021, down markedly from 2014. Banks in Europe account for most of the outstanding claims.

- Issuance of international debt securities continued to drive growth in global foreign currency credit to non-bank borrowers.

Global cross-border claims changed little in Q4 2021

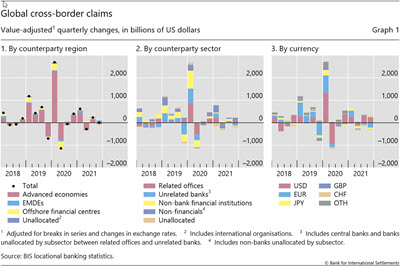

The BIS locational banking statistics (LBS) show that internationally active banks' outstanding claims amounted to $35 trillion at end-Q4 2021, virtually unchanged from the previous quarter on an exchange rate-adjusted basis (Graph 1.1).1 Their year-on-year (yoy) growth from end-2020 was 1.6%. This compares with pre-pandemic yoy growth rates of more than 5%.

The overall stability during the quarter concealed large changes in claims on particular regions and sectors, and across currencies (Graph 1). Claims on EMDEs rose substantially ($103 billion) during the quarter while those on advanced economies (AEs) and offshore financial centres (OFCs) declined (Graph 1.1). By sector, claims on unrelated banks (-$129 billion) were lower, but claims on related offices rose ($115 billion) as did claims on non-financial borrowers ($106 billion) (Graph 1.2). As for currencies, as in the previous quarter, US dollar-denominated claims expanded while euro claims contracted (Graph 1.3).

Within the overall decline in claims on AEs and OFCs were large differences across countries and jurisdictions. Banks' claims on the United States grew (+$182 billion) during the quarter while those on Japan and Europe shrank (-$95 and -$254 billion), notably vis-à-vis borrowers in France, Finland, Germany and the United Kingdom. Among OFCs, the declines in claims on the Cayman Islands and Hong Kong SAR (-$49 and -$29 billion) were larger than the increases in claims on Macao SAR and Singapore.

Claims on all EMDE regions expand in Q4 2021

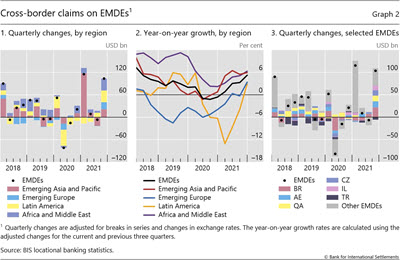

Cross-border claims on EMDEs increased by $103 billion in Q4 2021, with increases for the main regions (Graph 2.1). Claims on Latin America and the Caribbean and on Africa and the Middle East (AME) rose by over $30 billion each, while those on Asia-Pacific and emerging Europe increased by some $20 billion each (Graph 2.1).

The most recent rise in cross-border claims on Latin America partially reversed their sharp contraction between Q2 2020 and Q2 2021. As a result, their yoy growth rate moved into positive territory for the first time since Q1 2020 (Graph 2.2). The bulk (70%) of new credit to the region went to Brazil (Graph 2.3), mainly in the form of interbank claims reported by banks in the United Kingdom on unrelated banks. Another interesting development was the small rebound in claims on Mexico after six consecutive quarterly contractions.

The rise in claims on other EMDE regions was also concentrated on just a few economies. In the AME region, claims extended their positive trend observed over the past six years; those on the United Arab Emirates, Qatar and Israel grew the most, by more than $10 billion each in the latest quarter. In emerging Europe, the Czech Republic, Hungary and Poland saw the largest increases. Turning to Asia-Pacific, claims on China expanded by $8 billion, following a contraction in the previous quarter. And those on India and Korea grew by a respective $7 billion and $5 billion, after modest expansions in the previous quarter.

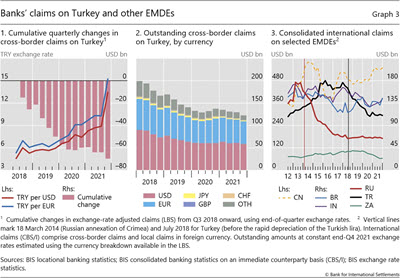

While cross-border claims on many EMDEs rose in Q4 2021, those on Turkey continued to drop, this time by a modest $6 billion. The 60% depreciation of the Turkish lira since mid-2018 has gone hand in hand with a cumulative fall in claims of almost $70 billion (exchange-rate adjusted) over that same period – a 37% decline from the initial level of $194 billion (Graph 3.1). Claims denominated in US dollars have fallen the most, while those in euros have remained relatively stable (Graph 3.2).

The BIS consolidated banking statistics (CBS), which track banks' worldwide consolidated claims (ie excluding inter-office positions) of national banking systems on borrowers in individual countries, paint a similar picture. Global banks' international claims2 – comprising cross-border claims on Turkish residents, plus their local claims in foreign currency booked by their affiliates in Turkey – also declined by more than 30% since mid-2018, to $110 billion at end-2021 (Graph 3.3, black line). The only other major EMDE experiencing reductions in positions on this scale over the past decade was Russia (red line).

Banks' exposures to Russia

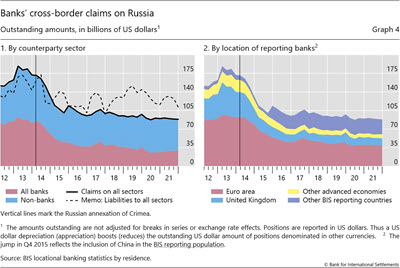

The latest BIS international banking statistics cover up to end-2021, ie before the outbreak of war in Ukraine in February 2022 and the introduction of new international sanctions on Russia. The statistics thus show banks' exposures to Russia and Ukraine on the eve of these events. Cross-border claims have been in decline since 2014, in the period following Russia's annexation of Crimea (Graphs 4 and 5). At end-2021, they stood at $88 billion, down by almost half from $171 billion in early 2014 (Graph 4.1). This substantial drop reflected claims denominated in US dollars, while those in euros grew marginally.

As their cross-border claims on Russia declined, banks abroad became net borrowers from Russia. That is, their cross-border claims on Russia fell below their liabilities, leaving net liabilities of $23 billion at end-2021 (Graph 4.1, the gap between the dashed and solid black lines). Their net liabilities to banks in Russia, which include positions with the Central Bank of the Russian Federation (CBR), rose over this period, from $37 billion to $44 billion. This in part reflected growth in the CBR's placements of foreign exchange reserves with commercial banks outside the country.3 By contrast, BIS reporting banks remained net lenders to non-banks in Russia, to the tune of $21 billion at end-2021.

Following the events in 2014, there was a major shift among the suppliers of cross-border bank credit to Russia (Graph 4.2). Banks in the euro area, traditionally the dominant creditors, saw their share in global cross-border claims on Russia fall from almost 47% at end-2015 to 44% at end-2021.4 Banks in other AEs, notably the United Kingdom, also scaled back their credit. By contrast, banks in other reporting countries (ie EMDEs and OFCs) expanded their share, from 22% to 32% of the total by end-2021.

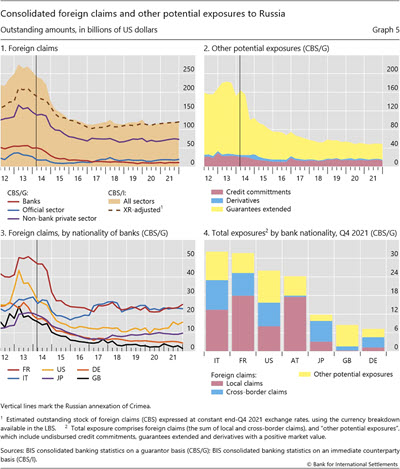

The CBS, which reveal the consolidated exposures of banks headquartered in particular countries, also indicate an overall decline in claims on Russia since 2014 (Graph 5.1). While these statistics exclude data from Chinese banks, which do not report the CBS, they highlight several points. First, the bulk (70%) of foreign claims on Russia have been on the non-bank private sector.5 Second, the fall registered since 2014 was driven by banks headquartered in France and the United States (Graph 5.3), each contracting by about a half. Third, among the banks that report the CBS, French and Italian banks had the largest outstanding foreign claims on Russia at end-2021, of more than $20 billion (Graph 5.4). Fourth, banks' claims on Russia are primarily booked through their local subsidiaries there (Graph 5.4, red bars); this is particularly true for Austrian banks, where local claims accounted for more than 95% of their consolidated foreign claims on the country.

In addition to claims on commercial banks' balance sheets, the consolidated statistics also include banks' other potential exposures to Russia, for which the decline since 2014 was even more pronounced (Graph 5.2). This reflects the sharp fall in guarantees extended to Russian borrowers,6 from almost $140 billion in Q1 2014 to $34 billion at end-2021, while undisbursed credit commitments – eg credit lines – and derivatives with positive market value saw modest contractions. As a result, international banks' other potential exposures combined amounted to $49 billion at end-2021. This put their overall total exposures to Russia up to 50% higher than their reported foreign claims on the country (Graphs 5.2 and 5.4, in yellow).7

Turning to Ukraine, international banks' total exposures are much smaller than those to Russia. At $14 billion at end-2021, foreign claims on Ukraine were about a tenth of those on Russia, with Austrian, French and US banks holding the bulk of the exposure. The additional credit risk incurred through other potential exposures, roughly $4 billion, was also relatively small (BIS Statistics Explorer table B4).

1 Claims comprise loans, holdings of debt securities and derivatives with a positive market value. Data for end-December 2021 have been rolled forward from previous quarters for the following reporting countries: Isle of Man, Korea and Russia (end-September 2021), Singapore (end-June 2021) and Curacao (end-June 2017). For details, see the Explanatory notes on the BIS website.

2 Local claims in local currency (LCLC) of foreign banks on Turkey, although small, are quite robust. International claims together with LCLC make up foreign claims. For an illustration based on banks' exposures to Turkey using CBS, see the BIS Quarterly Review, "Using the BIS consolidated banking statistics to analyse country risk exposures", September 2018.

3 IMF data (international reserves and foreign currency liquidity template) show that the CBR's deposits with banks outside Russia increased from $21 billion at end-2013 to $45 billion by end-2021. The BIS LBS data show that the bulk of this was placed with banks located in Europe.

4 China started reporting LBS in Q4 2015; comparing lender shares before that time would provide an incomplete picture.

5 In the CBS, foreign claims include non-Russian banks' cross-border claims on Russia, as well as local positions booked by these banks' subsidiaries operating in Russia. The figures for foreign claims on a guarantor basis (CBS/G) in Graph 5 are claims adjusted for collateral, guarantees and other credit risk mitigants.

6 Guarantees extended include protection sold via credit derivatives (eg credit default swaps); secured, bid and performance bonds; warranties and indemnities; confirmed documentary credits; and irrevocable and standby letters of credit.

7 In 2014, banks' overall total exposures to Russia (ie foreign claims plus other potential exposure) were up to 80% higher than their reported foreign claims on Russia.

The BIS ceased receiving data from public authorities in Russia after 28 February 2022. Where possible, data publication will be continued if the BIS is able to use data from public or commercial sources.