BIS international banking statistics at end-September 2018

- Global cross-border credit grew at an annual rate of 2% for the fourth consecutive quarter.

- Cross-border claims denominated in yen and euros expanded on an annual basis, while those denominated in US dollars contracted.

- The annual growth rate of cross-border credit to emerging market and developing economies (EMDEs) slowed to 4% as of end-September 2018, down from 9% recorded as of end-2017.

The annual growth rate of cross-border bank claims remained at 2%

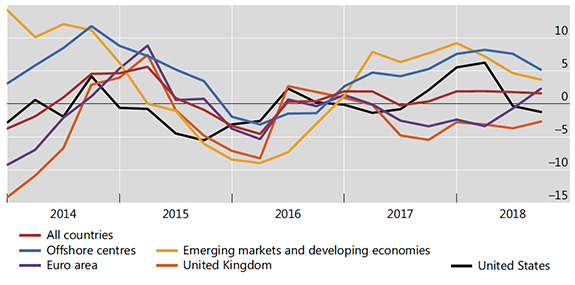

Graph 1: Annual percentage change in banks' cross-border claims by counterparty country (interactive graph).

Source: BIS locational banking statistics (Table A1).

Global cross-border claims rose by $21 billion during Q3 2018 and stood at $29 trillion at end-September 2018. Their annual growth rate remained unchanged at 2% for the fourth consecutive quarter (Graph 1, red line).

There was a mixed picture among advanced economies. On the one hand, cross-border claims on the United States and the United Kingdom contracted. Annual growth rates for the United States dropped below zero in the two latest quarters, while those for the United Kingdom have been negative for almost two years. On the other hand, lending to euro area residents was up by $93 billion in Q3 2018, which brought its annual growth rate up to 2%.

Cross-border claims on borrowers in EMDEs expanded by $25 billion during Q3 2018. Despite the latest quarterly increase, their annual growth rate fell to 4% as of end-September 2018, down from 9% as of end-2017. At the same time, claims on offshore centres declined by $55 billion during Q3 2018. As a result, their annual growth rate decelerated to 5%.

Cross-border lending diverged across major currencies

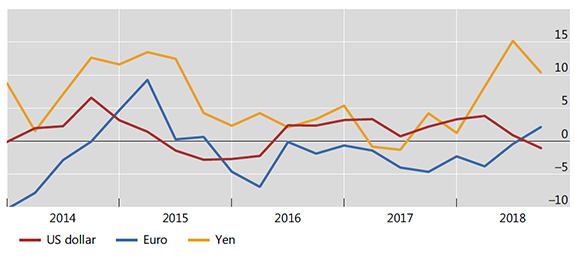

Graph 2: Annual percentage change in banks' cross-border claims by currency of denomination (interactive graph).

Source: BIS locational banking statistics (Table A1).

The latest quarter saw divergent patterns in cross-border lending across major currencies.

Claims denominated in yen continued to expand at a fast pace, recording an annual growth rate of 10% as of end-Q3 2018 (Graph 2, yellow line). This rapid expansion was mainly driven by increases in yen-denominated cross-border claims on the Cayman Islands and Japan (+$16 and +$15 billion during Q3 2018, respectively).

Following a sustained contraction in 2016-17, euro-denominated claims have rebounded since the beginning of 2018 (blue line). As a result, their annual growth rate has now returned to positive territory (2%). Roughly 40% of their latest annual increase is accounted for by intra-euro area cross-border claims.

By contrast, cross-border claims denominated in US dollars were down by 1% in the year to end-September 2018 (red line). The main drivers were annual contractions in lending to Japan (-12%), the United Kingdom (-8%) and the United States (-2%).

Lending to China drove the latest increase in claims on EMDEs

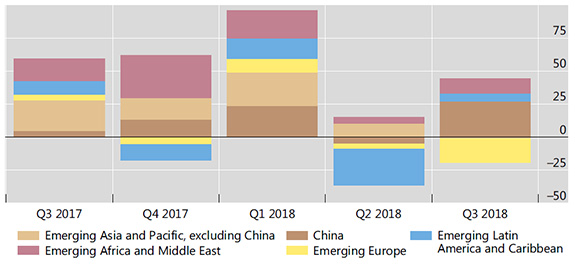

Graph 3: Adjusted changes in banks' cross-border claims on EMDE regions, USD billions (interactive graph).

Source: BIS locational banking statistics (Table A1).

The overall increase in cross-border credit to EMDEs in Q3 2018 was primarily driven by a $27 billion expansion in claims on China. By contrast, claims on the rest of emerging Asia and the Pacific recorded a small quarterly decline (-$1 billion). During the same period, cross-border lending to emerging Africa and the Middle East expanded by $11 billion, which took its annual growth rate to 10% as of end-September 2018. Meanwhile, despite increasing by $6 billion over the latest quarter, cross-border lending to Latin America and the Caribbean continued to contract on an annual basis (-3%).

In contrast to the other EMDE regions, emerging Europe saw a significant contraction in cross-border lending during Q3 2018, when claims on the region declined by $18 billion. This brought their annual growth rate down to -3%.

The latest quarterly decline in cross-border lending to emerging Europe was primarily driven by a $15 billion contraction in claims on Turkey. The annual growth rate of cross-border claims on the country fell sharply, from 3% as of end-June 2018 to -6% as of end-September 2018. The decline was concentrated on the banking sector, which saw cross-border claims on it decrease by $11 billion during the latest quarter, bringing its annual growth rate down to -9%.