Covid-19 accelerated the digitalisation of payments

Key takeaways

- The Covid-19 pandemic has boosted the use of digital and contactless payments.

- Cash in circulation reached a decade high due to a surge in demand for high-value banknotes, suggesting that cash was increasingly held as a store of value rather than for making payments.

- The pandemic has added to the motivations of central banks to develop central bank digital currencies (CBDCs).

Summary of latest developments 1

The Covid-19 pandemic accelerated the digitalisation of payments. The latest Red Book Statistics from the BIS Committee on Payments and Market Infrastructures (CPMI) show that consumers have shifted from physical cash to digital and contactless payment instruments at a rate unprecedented since the start of the Red Book Statistics. At the same time, and as in earlier stress episodes, the value of cash in circulation surged.

Non-cash payments

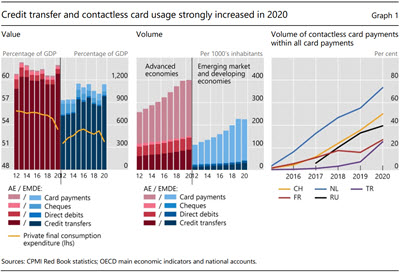

The pandemic2 has made a marked impact on non-cash payments.3 In particular, the total value of non-paper-based or digital credit transfers grew strongly in both advanced economies (AEs) and emerging market and developing economies (EMDEs). These payments include transfers initiated via online banking, a mobile banking app or an automated transfer. As a result, the growth in total credit transfer usage was so strong that the share of non-cash payments in total GDP sharply increased across the globe (Graph 1 left-hand panel). This, together with a decline in the share of private consumption expenditure in GDP suggests a meaningful move away from cash payments.

In addition to the decline in cash payments, the growth in the number of card payments lost momentum or even declined in various jurisdictions (Graph 1 centre panel). The shift away from cash and cards towards digital credit transfers is probably driven by a combination of ongoing trends and Covid-19-related developments. The latter include (i) the worldwide migration to working-from-home; (ii) temporary shutdowns of shops, hotels and restaurants; (iii) some merchants refusing cash payments;4 (iv) the surge in e-commerce;5 (v) the growth in digital person-to-person payments;6 and (vi) the distribution of Covid-19 benefit payments by governments.7

In all jurisdictions from which the CPMI collects contactless card data, the share of contactless payments in total card transactions increased in 2020 at its highest rate since 2015 (Graph 1 right-hand panel).8 This may be explained by public fears of contagion9 and associated policy measures. For example, banks and card companies in many countries raised their value limits for contactless card payments in response to the pandemic.10

In 2020, on average, AE residents made close to twice as many cashless payments as residents of EMDEs. Yet, both groups of countries are similar in that most of these payments were made using a debit or credit card (Graph 1 centre panel). Also, as credit transfers are more often used for settling payments of higher value, all over the world, credit transfers accounted for the largest share of cashless payments in terms of value (Graph 1 left-hand panel).

Cash withdrawals and cash holdings

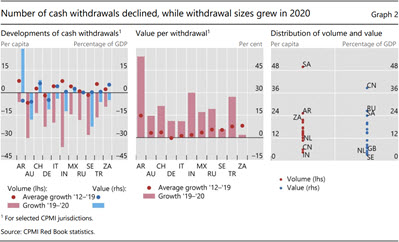

The decline in cash usage during the Covid-19 pandemic is also reflected in the cash withdrawals data. Compared with 2019, both the number and value of cash withdrawals dropped in 2020 in most countries (Graph 2 left-hand panel). Consumers made between 10 and 25 cash withdrawals on average in most CPMI jurisdictions in 2020. Generally, the total number of cash withdrawals declined by 23%, exceeding the 10% decline in value. This suggests that consumers took out cash less frequently, but when they did, they withdrew larger amounts (see also Graph 2 centre panel). The decline in the number of withdrawals might be due to fewer commuting and shopping trips 11 during the pandemic and a tendency to avoid the use of automated teller machines (ATMs) or to visit bank branches because of fear of being infected with the virus.12 However, country differences in withdrawals are large, with five annual withdrawals in China and India and 50 in Saudi Arabia (Graph 2 right-hand panel). In terms of value, cash withdrawals were the lowest in Sweden and the Netherlands (3% and 4% of GDP, respectively) and highest in China and Russia (39% and 26%, respectively).

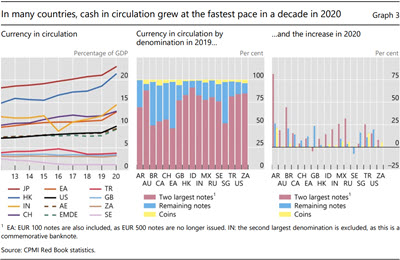

The increase in the average withdrawal value globally is probably driven, in part, by the public's desire to hold cash for precautionary reasons, as the value of coins and banknotes in circulation outside banks surged in many jurisdictions in 2020. Even in jurisdictions where the value of cash in circulation had been declining prior to the pandemic, the outstanding cash value grew further or stabilised in 2020 (Graph 3 left-hand panel). In particular, the demand for high-value denominations, which are typically held as a store of value, increased further, and more strongly than for other notes and coins (Graph 3 centre and right-hand panel). Apparently, cash was increasingly held as a store of value rather than used for transactional purposes. This suggests that consumers accumulated cash as a precautionary measure, for example against potential disruptions to the availability of payment infrastructures or potential bank closures. Similar cash hoarding behaviour was observed during earlier crises or periods of uncertainty, such as the Y2K episode or the Great Financial Crisis.13 Moreover, in some jurisdictions the surge in cash in circulation could be explained partly by the increase in aggregate disposable household income due to Covid-19-related income support measures and tax and loan repayment deferrals, and by falling interest rates, which further reduced the opportunity costs of holding cash in a physical form instead of in a bank account.14

The role of cash post-pandemic

How long these changes in cash usage will persist after the pandemic is unclear. As a means of payment, cash lost ground to digital and contactless methods of payment in 2020, while the demand for cash as a store of value rose precipitously. An ECB survey of all euro area countries showed that 87% of the respondents who had made fewer payments in cash during the pandemic would continue to do so when the coronavirus crisis is over.15 Whether the pandemic will have a similar prolonged effect on cash hoarding remains to be seen. Earlier research shows that the growth in cash holdings has slowed after a crisis or period of uncertainty had passed.16

Although it changed the public's payment behaviour, the pandemic does not appear to have affected the public's perception of cash being a safe haven. Many central banks are exploring the potential of and need for a digital form of cash, a retail central bank digital currency (retail CBDC) that would provide consumers with the same protection as cash does today, while allowing them to make payments without carrying physical banknotes and coins. A 2020 BIS survey among more than 60 central banks (Boar and Wehrli (2021)) showed that the pandemic added to the motivations of central banks to develop retail CBDCs, especially with the aim of giving access to central bank money during times of emergency and of complementing cash and in-person payment methods when social distancing is required. Since then, retail CBDCs have been launched in the Bahamas, the Eastern Caribbean and Nigeria, and retail CBDC pilots are under way in 14 other jurisdictions.17 Whether a retail CBDC, if issued, will change the use of cash in its physical form, either as a means of payment or as a store of value, will depend on central bank decisions as to the CBDC's design and the perceived value for households and businesses. These decisions and the degree and speed of adoption may differ among jurisdictions depending on their current payment infrastructures and instruments.

This commentary was written by Anneke Kosse and Robert Szemere. We are grateful to Ilaria Mattei and Ismail Mustafi for their excellent research assistance and we would like to thank Bilyana Bogdanova, Jenny Hancock, Stijn Claessens, Tara Rice and Takeshi Shirakami for their valuable comments.

References

Auer, R, G Cornelli and J Frost (2020a): "Covid-19, cash, and the future of payments", BIS Bulletin, no 3, April.

--- (2021): "Rise of the central bank digital currencies: drivers, approaches and technologies", updated data set, October.

Auer, R, J Frost, T Lammer, T Rice and A Wadsworth (2020b): "Inclusive payments for the post-pandemic world", SUERF Policy Note, no 193, September.

Akana, T (2021): "Changing US consumer payment habits during the COVID-19 crisis", Journal of Payments Strategy & Systems, vol 15, no 3, pp 234–43.

Alfonso, V, C Boar, J Frost, L Gambacorta and J Liu (2021): "E-commerce in the pandemic and beyond", BIS Bulletin, no 36, 12 January.

Boar, C and A Wehrli (2021): "Ready, steady, go? – Results of the third BIS survey on central bank digital currency", BIS Papers, no 114, January.

ECB (2020): "Study on the payment attitudes of consumers in the euro area (SPACE)", December.

Chen, H, M Stratheam and M Voia (2021): "Consumer cash withdrawal behaviour: branch networks and online financial innovation", Bank of Canada, Staff Working Papers, no 28, June.

Guttmann, R, C Pavlik, B Ung and G Wang (2021): "Cash demand during Covid-19", RBA Bulletin, March.

IMF (2021): "Policy response to Covid-19 Policy Tracker", last updated on 2 July.

Judson, R (2017): "The death of cash? Not so fast: demand for U.S. currency at home and abroad, 1990–2016", Conference Paper for International Cash Conference 2017 – War on Cash: Is there a Future for Cash?, April.

NFCW (2021): "Table: Contactless payment transaction limit increases around the world", last updated on 27 August.

Rösl, G and F Seitz (2021): "Cash and crises: No surprises by the virus", IMFS Working Paper Series, no150.

Visa (2021): "The Visa Back to business study 2021 Outlook".

1 This commentary is based on the CPMI Red Book data published for 27 jurisdictions for the period 2012–20. Advanced economies (AEs) refer to Australia, Belgium, Canada, the euro area, France, Germany, Italy, Japan, the Netherlands, Spain, Sweden, Switzerland, the United Kingdom and the United States. Emerging market and developing countries (EMDEs) refer to Argentina, Brazil, China, Hong Kong SAR, India, Indonesia, Korea, Mexico, Russia, Saudi Arabia, Singapore, South Africa and Turkey. In the case of missing observations, data are estimated using the average growth rate of all other countries.

2 Covid-19 was first identified in December 2019 and declared a global pandemic by the World Health Organization (WHO) on 11 March 2020.

3 Non-cash payments refer to payments made using a payment instrument other than cash, such as payment cards, credit transfers, direct debits and cheques. With the exception of payments made using a cheque or paper-based credit transfer, all non-cash payments are digital payments.

4 See, for example, ECB (2020).

5 See Alfonso et al (2021).

6 For example, in the United States, person-to-person and mobile payments increased by 6% and 8%, respectively, during 2020 and the first months of 2021 (Akana (2021)).

7 IMF (2021).

8 Data on contactless card payments have been collected since 2012 but for most countries in the sample, data are available only from 2014.

9 According to ECB (2020), on average, 38% of respondents in the euro area avoided cash for fear of being infected with Covid-19 using banknotes and coins.

10 See NFCW (2021).

11 Chen et al (2021) demonstrate how some consumers try to minimise the time costs of withdrawing cash by making cash withdrawals opportunistically, eg on their commute to work.

12 See, for example, Auer et al (2020a) and (2020b).

13 See, for example, Judson (2017) and Rösl and Seitz (2021).

14 Guttmann et al (2021).

15 See ECB (2020). Similarly, a recent survey conducted by Visa showed that 65% of respondents planned to use contactless card payments as much or even more than before they were vaccinated, while 16% expected to revert to their previous payment habits (Visa (2021)).

16 See, for example, Judson (2017) and Rösl and Seitz (2021).

17 See Auer et al (2021).