BIS global liquidity indicators at end-June 2025

Key takeaways

- The BIS global liquidity indicators show that foreign currency credit in dollars, euros and yen grew by 6%, 13% and 0% year-on-year at end-Q2 2025, respectively.

Global liquidity indicators at end-June 2025

The BIS global liquidity indicators (GLIs) track total credit to non-bank borrowers, covering both loans extended by banks and funding from international bond markets.5 The latter is captured through the net issuance (gross issuance less redemptions) of international debt securities (IDS). The focus is on foreign currency credit denominated in the three major reserve currencies (US dollar, euro and Japanese yen) to non-residents, ie borrowers outside the respective currency areas.

Dollar credit growth to non-bank borrowers outside the United States accelerated to 6% yoy in Q2 2025 from 3% in Q4 2024 (Graph 6, red line). This came on the back of a steady depreciation of the US dollar (blue line) through the first half of 2025 and expectations of a faster pace of monetary policy easing in the United States.

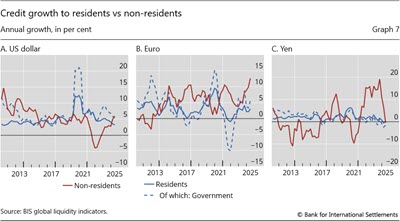

A useful comparison for foreign currency credit to non-banks outside the currency area is credit to non-financial sector borrowers located within the currency area, also available from the BIS GLIs. From Q2 2020 to Q4 2024, dollar credit growth to US residents outpaced that to non-residents (Graph 7.A). Starting in Q1 2025, this trend reversed, and residents saw a 3% yoy growth rate compared to 6% for non-residents as of end-Q2 2025. Meanwhile, dollar credit growth to the US government declined from 9% yoy at end-Q1 2024 to 5% at end-Q2 2025.

Euro-denominated credit similarly saw faster growth for non-resident borrowers compared to borrowers in the euro area. Growth outside the euro area expanded rapidly, reaching 13% yoy at end-Q2 2025 (Graph 7.B). Credit growth to residents stood at a lower 3%, led by stronger credit growth to the public sector (+6%).

Yen credit growth to borrowers both in and outside of Japan stalled. For non-residents, the 0% yoy growth in Q2 2025 followed several years of rapid growth over 10% yoy (Graph 7.C). Growth in credit to residents also stood around 0% yoy amid contracting credit to the public sector.

5 The GLIs cover total foreign currency credit denominated in US dollars, euros or Japanese yen, which includes loans from banks plus outstanding international bonds. This is broader than the bank credit covered in previous sections, which captures banks loans and their holdings of debt securities.