BIS global liquidity indicators at end-June 2021

Key takeaways

- Foreign currency credit growth, an indicator of global liquidity, held up for credit to non-residents denominated in US dollars and euros. Yen-denominated credit, particularly to EMDEs, slumped.

- The rate of growth in credit to residents returned to pre-pandemic levels while bond financing continued to outpace bank lending.

The BIS global liquidity indicators (GLIs) track credit to non-bank borrowers, covering both loans extended by banks and funding from bond markets. The main focus is on foreign currency credit denominated in three major reserve currencies (US dollar, euro and Japanese yen) to non-residents, ie borrowers outside the respective currency areas. The GLIs monitor growth in this credit relative to that denominated in those same currencies to residents within these currency areas (as reported in national financial accounts).

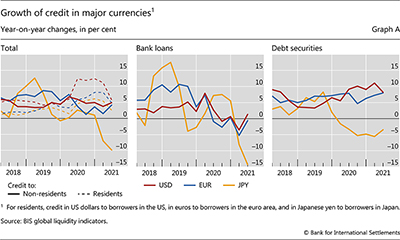

In the second quarter of 2021, foreign currency credit in US dollars and euros held up while that denominated in Japanese yen slowed. Dollar credit to borrowers outside the United States stood at $13 trillion at end-Q2, up 5% year on year (yoy) (Graph A, left-hand panel). Growth in euro credit to borrowers outside the euro area gathered pace compared with the previous quarter: the 4% yoy expansion brought the stock to €3.6 trillion (equivalent to $4.3 trillion). Meanwhile, growth in yen credit to borrowers outside Japan fell by 10% yoy, reducing the amount outstanding to ¥45 trillion ($0.4 trillion).

Further reading

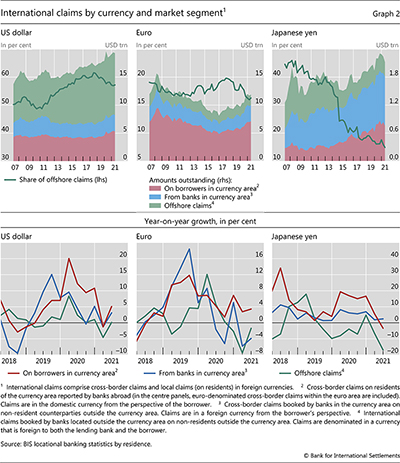

In all three currencies, foreign currency credit from bond markets grew more vigorously than did lending from international banks (Graph A, centre and right-hand panels). Growth in bank credit to non-residents recovered somewhat in Q2 2021, reaching 1% and –1% yoy in dollar and euro lending, respectively (centre panel). Over the same period, bond issuance in US dollars and euros grew strongly at 8% yoy (right-hand panel). While contracting at –3 % yoy, net bond issuance in yen was not as weak as bank lending in that currency (–14% yoy). In line with Graph 2 of the IBS release commentary, this decline relates mainly to the offshore use of yen, whereas banks' international claims booked in Japan on borrowers elsewhere and claims on borrowers in Japan have continued to grow in recent years.

Turning to credit to residents, the second quarter saw a return to growth rates prevailing before the pandemic, to around 5% yoy for credit in US dollars and euros, and to 3% for that in yen (Graph A, left-hand panel, dashed lines). As a result, credit to resident borrowers has been growing much faster than credit to non-residents in each of the main currencies since early 2020. This was fuelled by a surge in dollar- and euro-denominated government borrowing (Annex Graph C.6). But growth rates converged in Q2 2021 for the dollar and the euro.

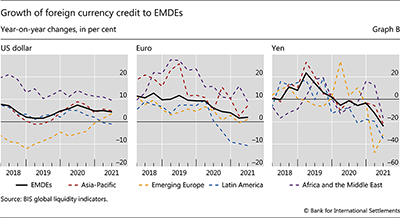

The latest contraction in yen-denominated credit to EMDEs was particularly striking, with credit to non-bank borrowers falling at a rate of 23% yoy (Graph B, right-hand panel). The retreat was evident across regions, including Africa and the Middle East, where yen credit dropped by 17% yoy after two quarters of double-digit growth. Out of the 14 EMDEs for which GLI data are published, only Chile saw positive growth in yen-denominated credit (Table E2-JPY). Meanwhile, growth in dollar and euro credit to EMDEs remained positive in most regions (left-hand and centre panels). Latin America, however, attracted less dollar and euro credit (–1% and –11% yoy, respectively), with Argentina and Brazil accounting for the largest declines over the past year.

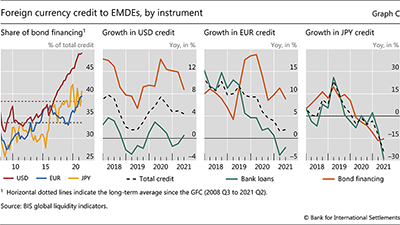

The share of bond financing to EMDEs is at (or close to) its highest level in all three major currencies (Graph C, left-hand panel), far above the long-term average measured since the start of the Great Financial Crisis (GFC). Bond financing now accounts for almost half (49%) of total dollar credit, up from a 31% low in the GFC (in Q3 2008). Over the past few years, the growth of dollar- and euro-denominated bond issuance has been consistently higher than that of bank loans. In the dollar segment (second panel), debt issuance slowed to 9% yoy in Q2, but still outpaced dollar bank lending. In the case of the euro (third panel), the shift towards bond financing accelerated during the pandemic (third panel). After four consecutive quarters when yen-denominated bond issuance contracted more rapidly than bank lending (fourth panel), Q2 witnessed a reversal: the yoy growth in bank loans fell to –28% while that for bond issuance was –15% yoy.

For more details, see the GLI methodology.

For more details, see the GLI methodology.