BIS global liquidity indicators at end-March 2020

- US dollar credit to non-bank borrowers outside the United States grew at an annual rate of 7% (to reach $12.6 trillion) as of end-March 2020, just as the Covid-19 pandemic was escalating.

- The component of this credit directed to emerging market and developing economies (EMDEs) expanded at an annual rate of 6% (reaching $3.9 trillion).

- Among EMDEs, US dollar credit continued to grow most rapidly in Africa and the Middle East, where its outstanding stock has now reached a size similar to that observed in Latin America ($1 trillion).

Growth rate of USD credit outside the US continues to rise

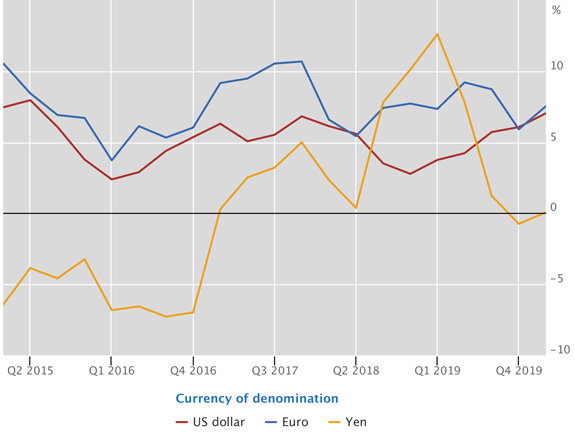

Graph 1: Annual percentage change of US dollar-, euro- and yen-denominated credit to non-resident non-banks (interactive graph).

Source: BIS global liquidity indicators (Table E2.1, E2.2 and E2.3).

Total foreign currency credit is one of the key indicators estimated by the BIS to assess global liquidity. This variable is defined as the sum of bank loans to non-banks and debt securities issuance by non-banks. It is calculated for three major global currencies (US dollar, euro or Japanese yen).1

The year-on-year (yoy) growth rate of US dollar credit to non-banks borrowers residing outside the United States rose to 7% at the end of the first quarter of 2020. This compares with a rate of 6% at end-2019, and 3% at end-2018 (Graph 1, red line). The outstanding stock stood at $12.6 trillion at end-March 2020, up from $6.5 trillion 10 years earlier.

The uptick in US dollar credit was mainly driven by its bank loans component, which expanded at the highest annual rate (8%) in more than five years (Annex Graph A1, blue line). The yoy growth rate of US dollar debt securities remained high (6%), mainly due to strong issuance in January and February 2020 and despite the decline in issuance during March, when Covid-19 escalated into a global pandemic.2

Turning to other major global currencies, euro-denominated credit to non-banks outside the euro area (Graph 1, blue line) grew by 8% yoy, reaching €3.5 trillion (equivalent to $3.8 trillion) at end-March 2020. Meanwhile, yen-denominated credit to non-banks outside Japan remained virtually unchanged on an annual basis (yellow line).

USD credit to Africa and the Middle East continues to expand rapidly

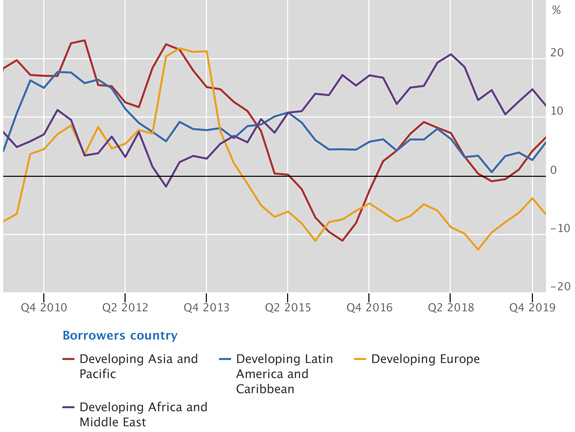

Graph 2: Annual percentage change of US dollar credit to EMDE regions (interactive graph).

Source: BIS global liquidity indicators Table E2.1.

US dollar credit to residents of EMDEs remained strong. It expanded by 6% yoy and reached $3.9 trillion at end-March 2020. This reflected a rapid expansion in credit to Africa and the Middle East (+12% yoy), which grew at double-digit annual rates for a fifth consecutive year. The outstanding stock of US dollar credit to that region is now roughly as high as that to Latin America (both at about $1 trillion). By contrast, US dollar credit to emerging Europe, which has been contracting for almost six years now, declined at an annual rate of 7%.

The components of US dollar credit to emerging Asia-Pacific and Latin America, which have been moving in tandem for the past three years, expanded at annual rates of 7% and 6%, respectively, at end-March 2020. Emerging Asia-Pacific continued to account for the highest share of US dollar credit to EMDEs, with an outstanding stock of $1.5 trillion at end-March 2020.

Total bank credit to the United States accelerates

Total bank credit (denominated in all currencies) to the private non-financial sector is another key metric for assessing liquidity. This indicator picked up significantly in the first quarter of 2020 for several major advanced economies.

The expansion was most notable in the case of the United States. In particular, banks' locally extended credit to the private non-financial sector in the country grew by 8% yoy at end-March 2020 (Annex Graph A2, top centre panel, red line), a rate not seen since the Great Financial Crisis (GFC) of 2007-09. Furthermore, cross-border bank credit to non-bank borrowers in the United States expanded even faster, by 14% yoy, the highest growth rate since the GFC (blue line).3

Total bank credit to borrowers in the euro area also expanded, albeit not as rapidly as in the case of the United States. At end-March 2020, local bank credit grew at an annual rate of 3%, while cross-border bank credit expanded by 8% yoy.

1 Foreign currency credit is defined as credit to residents of countries for which the selected currency is foreign (eg US dollar credit outside the United States).

2 For further discussion on market funding conditions during the spread of the Covid-19 pandemic, see Chapter I of the BIS Annual Economic Report 2020.

3 For further discussion of the Q1 2020 expansion in foreign bank credit to the United States, see the commentary on the BIS international banking statistics at end-March 2020.