BIS international banking statistics at end-March 2020

- Against the backdrop of the rapidly escalating Covid-19 pandemic, global cross-border bank claims surged in Q1 2020, to $33 trillion. Their annual growth rate rose to 10% at end-March 2020, up from 6% at end-2019.

- Non-US banks reported substantial increases in their foreign claims on the official sector of the United States.

- Elevated market volatility in the first quarter of 2020 contributed to notable jumps in banks' derivatives positions.

- Amid the pandemic-induced turbulence in global financial markets, cross-border claims on emerging market and developing economies (EMDEs) stagnated.

Global cross-border bank lending surged in Q1 2020

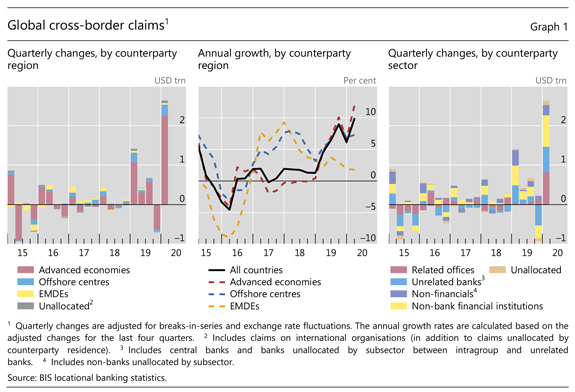

Against the backdrop of the rapidly escalating Covid-19 pandemic, banks' global cross-border claims surged during the first quarter of 2020. This partly reflected a seasonal pattern: over the past decade, these claims have tended to grow more strongly in the first quarter of each year, following recurrent end-of-year balance sheet contractions. Yet, even after such effects are discounted, the recent expansion was exceptional: cross-border claims, as tracked in the BIS locational banking statistics (LBS), grew (on a break- and exchange rate-adjusted basis) by $2.6 trillion (Graph 1, left-hand panel).1 This increased their year-on-year growth rate to 10% at end-March 2020, up from 6% a quarter before that and 5% a year earlier (centre panel). The overall increase in claims was driven mainly by interbank positions (right-hand panel).

Cross-border claims on borrowers in advanced economies and offshore financial centres expanded the most in Q1 2020. Claims on the United States rose by $705 billion, followed by those on the United Kingdom ($606 billion), Japan and Germany (about $190 billion each). Similarly, claims on offshore financial centres rose by $281 billion, with the Cayman Islands accounting for almost 60% of the increase (Annex Graph A.3, centre panels).2

The BIS consolidated banking statistics (CBS), which track the globally consolidated positions of banks headquartered in a given country, also showed a significant increase in banks' positions in the first quarter. Overall, banks' foreign claims - ie cross-border claims and local claims booked by affiliates abroad (excluding inter-office positions) - grew by $2.4 trillion (on an exchange rate-adjusted basis) in Q1 2020.3

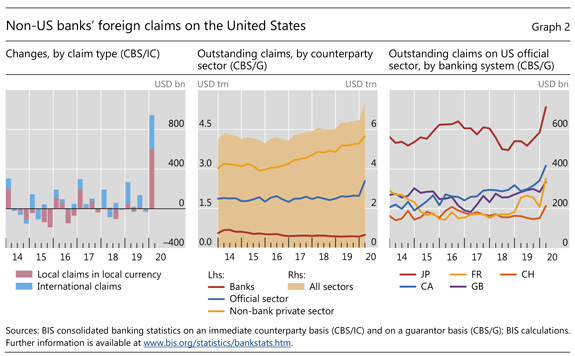

Most notably, non-US banks' foreign claims on the United States surged by nearly $950 billion, the largest quarterly increase on record (Graph 2, left-hand panel). Their local claims in local currencies (red bars) - ie dollar-denominated claims on US residents booked by the US-based affiliates of non-US banks - accounted for much of this expansion. Non-US banks' foreign claims (CBS/G basis)4 on the US official sector - which includes the US government and the Federal Reserve - rose by $560 billion (centre panel).5 French and Japanese banks accounted for the largest shares of this increase, followed by Canadian and Swiss banks (right-hand panel).

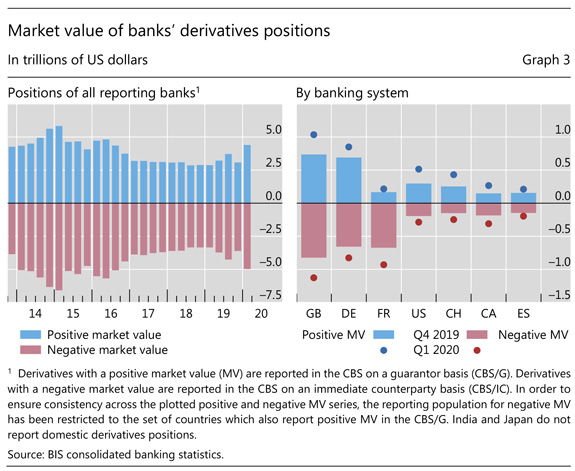

The CBS also reveal a significant increase in the market value of banks' derivatives positions at the time of the pandemic escalation. This is likely to have reflected the bout of market volatility observed in the first quarter of 2020, which widened the gap between market and contract prices and pushed derivatives contracts "into the money" for either the reporting banks or their counterparties. Derivatives with a positive market value reached $4.4 trillion by end-March, up 43% from end-December 2019, the highest level recorded since the second quarter of 2016 (Graph 3, left-hand panel).6 Derivatives with a negative market value, which tend to move in tandem with their counterparts on the assets side, also rose considerably. Banks headquartered in the United Kingdom, Germany and France reported the largest outstanding total derivatives positions (right-hand panel).

Banks' claims on emerging market and developing economies stagnated

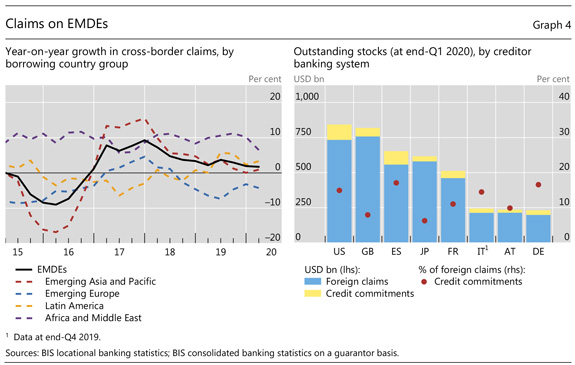

Amid the pandemic-induced turbulence in global financial markets, the annual growth rate of cross-border claims on EMDEs continued to decline from already low levels (Graph 4, left-hand panel). It fell to 1.8% as of end-March 2020, down from 2.0% at end-2019 and 3.7% at mid-2019. The annual growth rates of cross-border claims on emerging Europe and on emerging Africa and the Middle East both declined (from -3.2% to -4.3% and from 10.2% to 6.5%, respectively). In the meantime, claims on emerging Asia and Latin America continued to grow at a sluggish pace (1.0% and 3.4%, respectively).

The CBS reveal that foreign bank lending to EMDEs is highly concentrated (Graph 4, right-hand panel). At end-March 2020, five bank nationalities (UK, US, Japanese, Spanish and French banks) accounted for almost two thirds of all foreign claims on EMDEs (blue bars). Many bank nationalities also have sizeable undisbursed credit commitments to EMDE borrowers (yellow bars). Such commitments, which tend to be drawn on during periods of financial stress, exceeded 10% of the foreign claims of US, Spanish, French, Italian and German banks (red dots).

1 The LBS follow balance of payments residence-based concepts, and track the claims (assets) and liabilities of banks located in a particular reporting country, broken down by counterparty country, sector, instrument and currency (and including inter-office positions). Reporting banks' positions (claims and liabilities) are denominated in many currencies, but the amounts outstanding are reported in US dollars. The BIS publishes estimates of break- and exchange rate-adjusted quarterly flows ("adjusted changes") using the breaks-in-series and currency breakdown information available in the LBS. Unless mentioned otherwise, all flows and growth rates reported in this release are based on adjusted changes.

2 Claims on the Cayman Islands rose by $160 billion, more than three quarters of which were on nonbank financial institutions.

3 Exchange rate-adjusted changes for the CBS are estimated using the currency breakdowns available in the LBS (since the CBS do not contain currency breakdowns). In Q1 2020, many currencies depreciated vis-à-vis the US dollar, which tends to decrease the reported stock of outstanding claims when reported in US dollars. As a consequence, exchange rate-adjusted changes and growth rates tend to be higher than their unadjusted counterparts.

4 The counterparty sector breakdown in the CBS on an immediate counterparty basis (CBS/IC) is available only for banks' international claims, and not for their local claims in local currency. By contrast, in the CBS on a guarantor basis (CBS/G), which allocates claims to the country and sector of the ultimate obligor after taking into account credit risk mitigants, the counterparty sector applies to all foreign claims, ie banks' local claims in local currency plus their international claims.

5 These results are consistent with Federal Reserve data showing that non-US banks' branches and agencies in the United States held $870 billion of reserves at the Federal Reserve at end-Q1 2020, up from $550 billion at end-2019. In the CBS, the official sector differs from the general government sector in the System of National Accounts, which does not include the central bank.

6 The positive (negative) market value of a bank's outstanding derivatives contracts is the sum of the replacement values of all contracts that are in a current gain (loss) position to the reporter at current market prices and therefore, if they were settled immediately, would represent claims on (liabilities to) counterparties.