BIS global liquidity indicators at end-September 2018

- The annual growth rate of US dollar credit to non-bank borrowers outside the United States slowed down to 3%, compared with its most recent peak of 7% at end-2017. The outstanding stock stood at $11.5 trillion.

- In contrast, euro-denominated credit to non-bank borrowers outside the euro area rose by 9% year on year, taking the outstanding stock to €3.2 trillion (equivalent to $3.7 trillion). Euro-denominated credit to non-bank borrowers located in emerging market and developing economies (EMDEs) grew even more strongly, up by 13%.

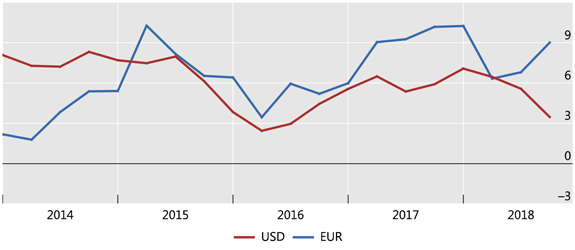

Growth of US dollar credit slows while euro credit accelerates

Graph 1: Annual growth of foreign currency-denominated credit to non-resident non-banks (interactive graph), in per cent.

Source: BIS global liquidity indicators (Tables E2.1 and E2.2).

The annual growth rate of US dollar credit to non-bank borrowers outside the United States slowed to 3% at end-Q3 2018. This compares with its most recent peak of 7% at end-2017 and is the slowest growth seen since mid-2016 (Graph 1, red line). The outstanding stock stood at $11.5 trillion.1 The slowdown was especially marked for debt securities, the annual growth rate of which fell to 6% at end-September 2018 from 11% at end-2017. The growth of US dollar-denominated loans slowed to 1% annually, from 3% at end-2017.

In contrast, euro-denominated credit to non-bank borrowers outside the euro area expanded rapidly (blue line). After slowing in the first half of 2018, growth picked up again in Q3 2018, taking the outstanding stock to a record high of €3.2 trillion (equivalent to $3.7 trillion) at end-September 2018. The annual growth of both - bank loans (+12%) and debt securities (+7%) - was strong.

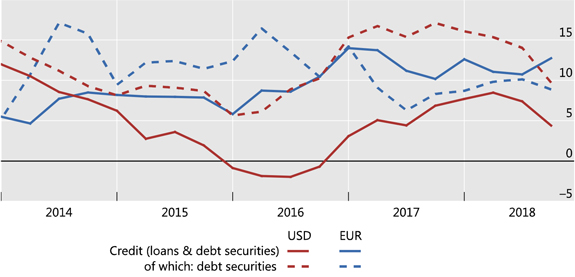

Euro credit to EMDEs continued to outpace US dollar credit

Graph 2: Annual percentage change in US dollar- and euro-denominated credit to non-banks in EMDEs (interactive graph), in per cent.

Source: BIS global liquidity indicators (Tables E2.1 and E2.2).

The trend in foreign currency credit to EMDEs was similar to the global one, with US dollar credit slowing and euro-denominated credit accelerating. US dollar-denominated credit to EMDEs grew by 4% in the year to end-September 2018 (Graph 2, solid red line). Its outstanding stock stood at $3.7 trillion. Net issuance of debt securities during Q3 2018 was close to zero, which brought their annual growth rate down to 10%, from 17% at end-Q3 2017. Loans grew by 1% over the previous year.

Euro-denominated credit to EMDEs (solid blue line) continued to grow at a much faster annual pace (13%) than US dollar credit. The expansion was mainly driven by loans, which grew by 15% over the year to end-September 2018. The growth of debt securities also remained high.

The latest divergence between US dollar and euro credit to EMDEs is part of a longer trend. Over the past five years, euro credit has expanded at an average annual rate of 10%, compared with 4% for US dollar credit. The gap between the two currencies was even larger for bank loans: 9% annual growth for the euro segment versus around zero for the US dollar segment.