BIS global liquidity indicators at end-June 2018

- US dollar credit to non-bank borrowers outside the United States rose to nearly $11.5 trillion at end-June 2018, up by 6% over the previous year, with debt securities continuing to grow much faster than loans: by 8.5% compared with 2.5%.

- Euro-denominated credit to non-bank borrowers outside the euro area also increased rapidly (7% year on year), reaching €3.1 trillion (equivalent to $3.7 trillion) at end-June 2018.

- US dollar credit to non-bank borrowers in emerging market and developing economies (EMDEs) rose to $3.7 trillion at end-June 2018. Its annual growth (7%) continued to be driven by debt securities, which expanded by 14% year on year.

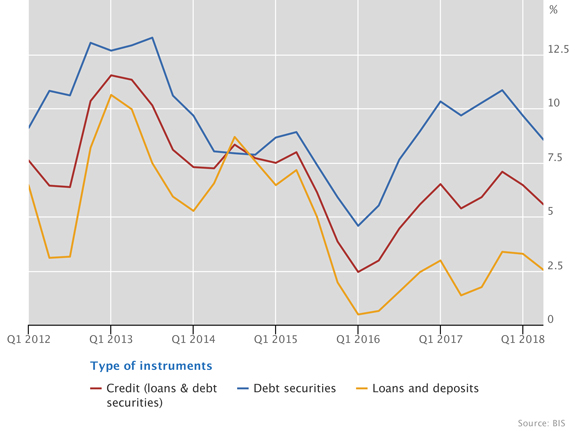

US dollar credit expansion led by growth in debt securities

Graph 1: Annual percentage change in US dollar-denominated credit to non-bank borrowers outside the United States (interactive graph).

Source: BIS global liquidity indicators (Table E2.1).

US dollar credit to non-bank borrowers outside the United States rose to nearly $11.5 trillion at end-June 2018, up by 6% over the previous year (Graph 1, red line). The growth was largely due to debt securities, which expanded at an annual rate of 8.5% (blue line) to stand at $6 trillion. Loans increased more slowly, at 2.5% (yellow line), to reach $5.5 trillion. Notably, the share of US dollar-denominated credit in the form of debt securities has risen substantially recently, from 48% at end-2015 to 52% at end-June 2018.

The above estimates of US dollar credit do not include borrowing through foreign exchange swaps and forwards, which create debt-like obligations. Such borrowing is similar in size to, and probably exceeds, borrowing through loans and debt securities.

Euro-denominated credit to non-bank borrowers outside the euro area grew at an annual rate of 7%, rising to over €3.1 trillion ($3.7 trillion) at end-June 2018. This was driven by both bank loans (8%) and debt securities (6%).

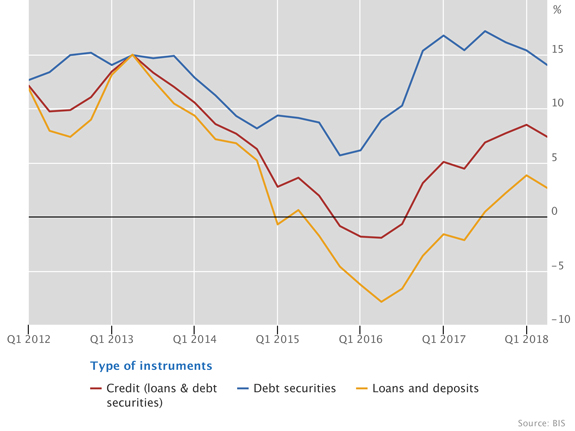

US dollar credit to EMDEs remained strong

Graph 2: Annual percentage change in US dollar-denominated credit to non-banks in EMDEs (interactive graph).

Source: BIS global liquidity indicators (Table E2.1).

US dollar credit to EMDEs continued to grow rapidly, up by 7% (Graph 2, red line) in the year to end-June 2018, taking the outstanding stock to $3.7 trillion. The expansion continued to be propelled by strong issuance of dollar-denominated debt securities, which grew at an annual pace of 14% (blue line). As of end-June 2018, 44% of outstanding dollar credit to EMDEs was in the form of debt securities, up from 35% at end-2015.

While as of end-June 2018 outstanding euro-denominated credit to EMDEs (€661 billion, or $771 billion) remained much smaller than dollar credit, it grew at a rapid annual pace of 11%. The growth rate of euro credit to EMDEs has exceeded that of dollar credit since late 2014. Euro credit to emerging Asia recorded the most rapid expansion among EMDE regions in the year to end-June 2018. Still, over 50% of the outstanding euro credit to EMDEs as of end-June 2018 was to borrowers in emerging Europe.