The FX trade execution landscape through the prism of the 2025 BIS Triennial Survey

Box extracted from chapter "Global FX markets when hedging takes centre stage"

The foreign exchange (FX) market has a unique structure, distinct from other major asset classes. It has by and large evolved organically based on market participants' needs and technological advancements, with less regulatory oversight than other key markets. Unlike equities or futures contracts, which are traded on centralised exchanges, spot and most FX derivatives transact over the counter (OTC), with dealers acting as intermediaries. Compared with other OTC markets, such as bond markets, the FX market is more liquid and diverse and features more electronic trading and a broader range of trading venues. It is thus decentralised and fragmented. Moreover, much of the trading is "invisible" to the market, since it takes place directly between customers and dealers, with dealers matching more than 80% of customer trades within their own internal liquidity pools via so-called "internalisation" (see Box A).

It has by and large evolved organically based on market participants' needs and technological advancements, with less regulatory oversight than other key markets. Unlike equities or futures contracts, which are traded on centralised exchanges, spot and most FX derivatives transact over the counter (OTC), with dealers acting as intermediaries. Compared with other OTC markets, such as bond markets, the FX market is more liquid and diverse and features more electronic trading and a broader range of trading venues. It is thus decentralised and fragmented. Moreover, much of the trading is "invisible" to the market, since it takes place directly between customers and dealers, with dealers matching more than 80% of customer trades within their own internal liquidity pools via so-called "internalisation" (see Box A).

FX trades can be executed directly with dealers or indirectly through a range of venues. These include anonymous central limit order books (CLOBs) and disclosed, quotedriven platforms where participants submit and respond to requests for quotes (RFQs). Venues serve different counterparty segments, from inter-dealeronly markets to platforms open to both dealers and customers. In addition, many dealerowned (often singledealer) platforms facilitate customer flow. Execution may be by voice or fully electronic.

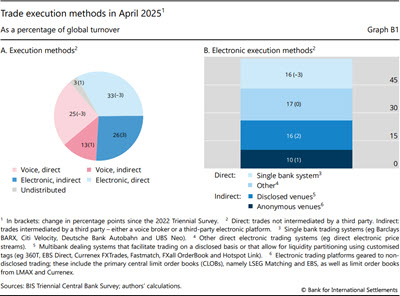

The latest snapshot of the microstructure of trading was taken during April 2025, a month marked by a spike in volatility and trading activity around the US tariff announcements. The data show that market participants continued use all modes of trading, with electronic trading accounting for 59% (Graph B1.A), a share virtually unchanged since the previous Triennial Survey. Within the electronic segment, there was some shift towards indirect (ie brokered) forms of trading, as more participants sought access to multiple providers at once, both via platforms where the identities are disclosed and where they remain anonymous (Graph B1.B). At the same time, voice methods remained vital, allowing participants to execute larger spot trades while minimising market impact or to transact in FX derivatives at bespoke contract terms.

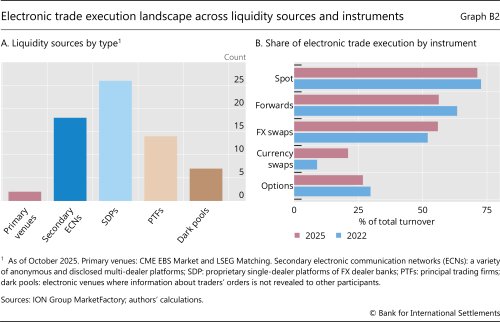

Different execution methods cater to the trading needs of various market participants, and trading is characterised by a large degree of fragmentation. Customers who turn to indirect disclosed electronic trading could, in theory, transact on over 15 multi-dealer platforms (Graph B2.A). On such venues, customers send dealers RFQs or connect to executable streaming prices from multiple liquidity providers. This enables them to effectively "shop" for liquidity or best execution while spreading trades across venues to minimise market impact. Customers also continue to rely on direct electronic trade execution methods and single-dealer platforms (SDPs). In addition to dealers, customers can connect to over a dozen non-bank liquidity providers, so-called principal trading firms (PTFs). While this variety of options might suggest market fragmentation, liquidity aggregators – tools that consolidate access to multiple trading venues and providers – help to overcome this issue, enhance transparency and enable smoother market functioning.

While this variety of options might suggest market fragmentation, liquidity aggregators – tools that consolidate access to multiple trading venues and providers – help to overcome this issue, enhance transparency and enable smoother market functioning.

Electronic trading, entrenched for a long time in spot and non-deliverable forwards, has been recently making inroads in lagging segments, notably outright forwards and swaps (Graph B2.B). In fact, inter-dealer electronic brokers are beginning to onboard more forwards, allowing for anonymous inter-dealer trading via CLOBs. Similarly, as customers trade more FX swaps via electronic RFQs or even streaming platforms, demand from an electronic inter-dealer environment yields market reference prices. The challenge for trading forwards and FX swaps in an anonymous electronic environment is that, unlike with spot trading, these trades leave counterparties with future exposures to each other. Currently, platform providers are developing various solutions to address counterparty credit risk in a (pre-trade) anonymous trading environment. Hence, over the next three years, one may anticipate notable shifts in the electronic trading landscape of FX swaps and forwards, amid progress in inter-dealer electronic risk-sharing in these instruments.

The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks.

The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks.  See also A Schrimpf and V Sushko, "FX trade execution: complex and highly fragmented", BIS Quarterly Review, December 2019, pp 39–51.

See also A Schrimpf and V Sushko, "FX trade execution: complex and highly fragmented", BIS Quarterly Review, December 2019, pp 39–51.  High-frequency trading by PTFs also plays a crucial role in price discovery inter-dealer electronic brokers; see W Huang, P O'Neill, A Ranaldo and S Yu, "HFT and dealer banks: liquidity and price discovery in FX trading", Swiss Finance Institute Research Paper, no 23-48, June 2023.

High-frequency trading by PTFs also plays a crucial role in price discovery inter-dealer electronic brokers; see W Huang, P O'Neill, A Ranaldo and S Yu, "HFT and dealer banks: liquidity and price discovery in FX trading", Swiss Finance Institute Research Paper, no 23-48, June 2023.  R Oomen), "Execution in an aggregator", Quantitative Finance, vol 17, no 3, 2017, pp 383–404.

R Oomen), "Execution in an aggregator", Quantitative Finance, vol 17, no 3, 2017, pp 383–404.