Non-visible trading and FX liquidity conditions in April 2025

Box extracted from chapter "Global FX markets when hedging takes centre stage"

Despite the market turbulence in April 2025, there were no clear signs of liquidity impairment or market dysfunction. Large foreign exchange (FX) dealer banks were able to continue to match a large amount of client trading on their own books (a process known as internalisation), minimising the overall market impact. The fragmented FX trading landscape (detailed further in Box B) proved resilient overall, enabling participants to adapt strategies and access liquidity. While the decentralised nature of the FX market had raised concerns in the past about a potential "liquidity mirage", the market's very characteristics – such as private and bespoke trading – facilitated smooth functioning even during periods of market strain.

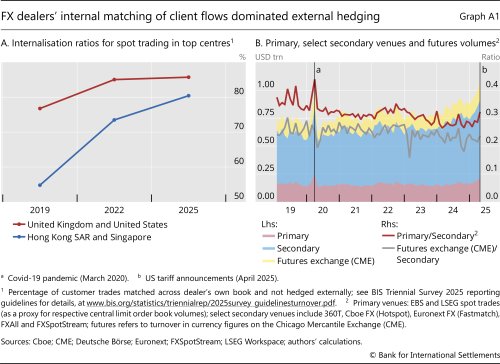

The non-visible part of the FX markets has shown greater growth in recent years, which may partly explain the fairly muted impact of the shock on market quality. Despite heightened market volatility in April, dealers demonstrated greater capacity to internalise trades than in previous years, particularly in Asian financial centres (Graph A1.A). Internalisation ratios reached levels upwards of 80% across all currencies in major FX trading hubs (those for G10 currencies were even higher). High internalisation dampens the immediate price pressure from client trades, supporting steadier quotes and reducing information revelation to the market and thus reducing the aggregate price impact. It means less need for dealers to turn to external trading venues to hedge the imbalances in customer demand, a process sometimes referred to as inter-dealer "hot potato trading".

Despite heightened market volatility in April, dealers demonstrated greater capacity to internalise trades than in previous years, particularly in Asian financial centres (Graph A1.A). Internalisation ratios reached levels upwards of 80% across all currencies in major FX trading hubs (those for G10 currencies were even higher). High internalisation dampens the immediate price pressure from client trades, supporting steadier quotes and reducing information revelation to the market and thus reducing the aggregate price impact. It means less need for dealers to turn to external trading venues to hedge the imbalances in customer demand, a process sometimes referred to as inter-dealer "hot potato trading".

While there was a pickup in such hedging via inter-dealer markets, it was relatively small, indicating that the market may have been strained but not stressed. In line with robust dealer internalisation, there was only a modest pickup in trading via inter-dealer electronic brokers, known as the "primary venues", where dealers turn to manage inventory imbalances in volatile markets (Graph A1.B).

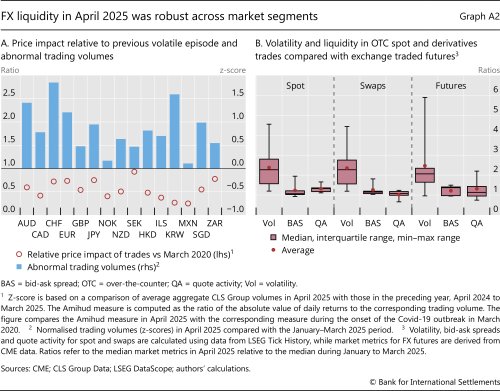

Despite the surge in overall trading demand, liquidity conditions remained resilient. Spot trading volumes across currencies rose notably in April compared with the preceding three months (Graph A2.A). Yet, unlike previous periods of turbulence, there were no signs of market distress. A comparison of price impact measures in April 2025 with the onset of the Covid-19 pandemic in March 2020 indicates that liquidity conditions remained resilient, with notably lower estimates of the price impact.

Liquidity conditions held up across different segments of the FX market. Based on intraday data, Graph A2.B shows the cross-currency distribution of the ratios of volatility, bid-ask spreads and quote activity during April 2025 compared with the preceding quarter (a reading of 1 means no change). While volatility increased notably in dealer-customer segments for both OTC spot and FX swaps and for exchange-traded FX futures, liquidity, as measured by bid-ask spreads, remained rather resilient in these segments. This suggests that concerns about "phantom liquidity" – where liquidity appears available but vanishes when market participants rush to execute trades – did not materialise.

The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks.

The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks.  M Butz and R Oomen, "Internalisation by electronic FX spot dealers", Quantitative Finance, vol 19, no 1, 2019, pp 35–56.

M Butz and R Oomen, "Internalisation by electronic FX spot dealers", Quantitative Finance, vol 19, no 1, 2019, pp 35–56.  R Lyons, "A simultaneous trade model of the foreign exchange hot potato", Journal of International Economics, vol 42, no 3–4, 1997, pp 275–98.

R Lyons, "A simultaneous trade model of the foreign exchange hot potato", Journal of International Economics, vol 42, no 3–4, 1997, pp 275–98.  A Chaboud, D Rime and V Sushko, "The foreign exchange market", in R Gürkaynak and J Wright, (eds), Research Handbook of Financial Markets, 2023, pp 253–75.

A Chaboud, D Rime and V Sushko, "The foreign exchange market", in R Gürkaynak and J Wright, (eds), Research Handbook of Financial Markets, 2023, pp 253–75.