Compressed credit spreads and the quest for a risk-free rate

Box extracted from Overview chapter "Volatility challenges risk-taking"

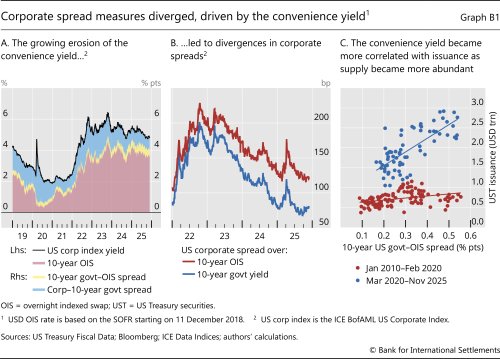

Corporate spreads compressed considerably over the past months, hovering well below historical norms. In this environment, the share of corporate issuers with a security trading at yields below their sovereign counterparts picked up, with the French case being especially noteworthy. This raises the broader question of whether the compression in corporate spreads reflects a genuine reduction in the pricing of corporate credit risk or an increase in sovereign yields that serve as a benchmark.

Conceptually, corporate credit risk can be thought of as the premium demanded by investors to hold corporate bonds over an equivalent "safe" bond. One common way in which corporate credit risk is measured is through spreads calculated relative to sovereign yields, which serve as benchmarks for a "safe" equivalent rate. However, this practice rests on an embedded assumption that movements in sovereign yields only reflect factors that also affect corporate bonds: pure interest rate risk, or a default risk component that is also shared with corporate bonds (eg fiscal or country risk). Moreover, sovereign bonds also embed a convenience yield – reflecting their high liquidity and their pledgeability as collateral – that may also fluctuate with the scarcity or abundance of sovereign bonds on the market. An alternative way to compute corporate spreads relies on using overnight index swaps (OIS) as benchmarks, which should in principle be exempt from these features.

The choice of the benchmark is crucial when interpreting the dynamics of corporate spreads. To show this, let us decompose corporate yields according to the following simple equation:

where the OIS captures pure interest rate risk, the spread between sovereign yield and OIS reflects country-specific credit risk and the spread between corporate and sovereign yield accounts for corporate credit risk. The opposite of the second element in the equation above – the difference between OIS rates and sovereign yields – is typically known as the swap spread and constitutes a measure of the convenience yield. Amid ongoing fiscal expansion and the unwinding of central banks' balance sheets, a growing amount of government bonds need to be digested by private investors, which explains the downward trend in swap spreads.

Since early 2020, the downward trend in convenience yields opened a wedge between sovereign yield and OIS in the decomposition above (Graph B1.A, yellow area). This, in turn, explains the substantial difference in the level of corporate spreads measured relative to sovereign and OIS rates for both the United States (Graph B1.B) and the euro area.

The period during which corporate spreads based on sovereign yields diverged from those using OIS rates coincided with a growing issuance of Treasury securities and the unwinding of the Fed's balance sheet. As the amount of Treasury securities available on the market became more abundant, the correlation between new issuances and the convenience yield doubled (Graph B1.C). This underscores how fiscal factors played a role in keeping measured corporate spreads compressed.

The views expressed in this publication are those of the authors and do not necessarily reflect the views of the BIS or its member central banks.

The views expressed in this publication are those of the authors and do not necessarily reflect the views of the BIS or its member central banks.  From about 2.5% in June to nearly 5% in September.

From about 2.5% in June to nearly 5% in September.