Tech stock performance around the globe: what explains the differences?

Box extracted from Overview chapter "Volatility challenges risk-taking"

Tech stock performance has diverged markedly around the globe in recent years. Large technology firms in the United States and China have followed different trajectories, driven by earnings prospects, business models, regulatory conditions and risk premia. While advances in artificial intelligence (AI) – and the investor interest surrounding them – have boosted valuations of a subset of firms, they do not fully explain the differences across global technology markets. This box examines the market performance and global footprint of US and Chinese big tech firms and compares their valuation patterns with those of major technology firms in other economies.

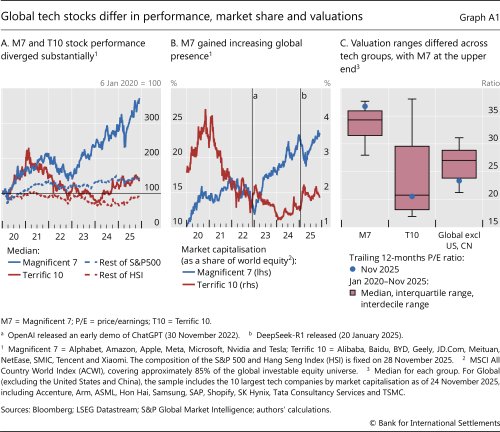

The stocks of US technology firms have risen much faster than the overall market and Chinese counterparts (Graph A1.A). The US "Magnificent 7" (M7) have consistently outperformed the S&P 500, especially since the public release of ChatGPT in late 2022. Such strong gains were underpinned by solid earnings (as discussed in the main text), improved operating efficiency and sustained AI-related investment and demand. These dynamics have strengthened the M7's global footprint, with their share in global equity benchmarks recently approaching one quarter of total market capitalisation (Graph A1.B).

By contrast, China's "Terrific 10" (T10) experienced a sharp rally through 2020 and early 2021, fuelled by strong earnings momentum and the pandemic-driven surge in digital adoption. The upswing, however, gave way to a prolonged correction due to regulatory tightening, weak domestic demand and a shift in global investor appetite away from Chinese assets. More recently, prices have begun to recover amid renewed interest in domestic AI developments following the DeepSeek release in January 2025 and signs of a more supportive policy stance for the tech sector, which have helped lift investor sentiment. Nonetheless, their global presence remains well below previous peaks and modest compared with M7.

Valuation patterns mirror these divergences. The M7 have elevated valuations within a relatively narrow range, consistent with investor beliefs of strong earnings growth prospects, established business models and investor optimism about potential AI-driven productivity gains. T10 valuations are generally more subdued and more varied, reflecting higher risk premia, regulatory uncertainty and pronounced swings in investor sentiment. Global tech peers outside the United States and China show intermediate valuation levels with moderate dispersion, possibly due to broader business model diversification and lower sensitivity to region-specific shocks (Graph A1.C).

The views expressed here are those of the authors and not necessarily those of the BIS or its member central banks.

The views expressed here are those of the authors and not necessarily those of the BIS or its member central banks.