A global survey of household perceptions and expectations

The article introduces a novel survey of household economic perceptions and expectations conducted across 31 economies in March and April 2025. Household inflation expectations are elevated, exceeding prevailing inflation rates and professional forecasts. Households recognise that prices have increased faster in the post-pandemic period compared with earlier years and overestimate losses in real wages. Perceptions of the inflation surge appear to be lifting inflation expectations, suggesting that temporary price level increases can have persistent effects on expectations. Households generally do not hold central banks responsible for the inflation surge and support their independence. Knowledge of central banks remains limited in an environment where social media have become an important information source. Informed households tend to have more anchored inflation expectations, underscoring the importance of effective communication strategies.1

JEL classification: E31, E58

The post-pandemic inflation surge has highlighted the critical importance of monitoring and understanding inflation expectations. A key concern for central banks was the risk of inflation expectations becoming de-anchored, potentially triggering second-round effects. Such dynamics could have necessitated sharper and more prolonged monetary policy tightening, heightening the likelihood of a hard landing for the economy.

While current survey and market data provide rich insights into the inflation expectations of professional forecasters and market participants across many countries, less is known about the expectations of households. This gap is problematic since households drive aggregate private consumption – the largest component of GDP – and influence wage-setting processes as providers of labour.2

Several central banks have made notable progress in recent years by collecting detailed data on domestic household inflation expectations. However, differences in survey methodologies complicate cross-country comparisons. Moreover, some countries still lack representative surveys capturing household expectations.

Key takeaways

- Across all countries, the short-term inflation expectations of households are consistently and significantly above prevailing inflation rates and professional forecasts.

- Households perceiving larger post-pandemic price increases have higher inflation expectations, pointing to the risk that inflation bursts may have lasting effects on their expectations.

- Knowledge of the central bank remains limited. Informed households tend to have better-anchored inflation expectations, highlighting the importance of effective communication.

To address this gap and enable a uniform and comparable measurement of economic expectations and perceptions across a broader range of countries, the BIS sponsored an international household survey conducted between March and April 2025.3 This survey spans 31 countries, encompassing both advanced economies (AEs) and emerging market economies (EMEs).4 It includes approximately 1,000 respondents per country, aged 18 to 70, who are broadly representative of the local populations based on gender and age composition. Besides eliciting 12-month-ahead inflation expectations, the survey gathered a wealth of additional information, including individual respondents' socioeconomic characteristics, expectations of other economic variables, perceptions of the strength and causes of the post-pandemic inflation surge, trust in public and private institutions, and knowledge of and preferences regarding central bank mandates.5

The survey includes several modules. The module on household economic expectations will be conducted annually to build comparable time series data. Other questions will be periodically adapted to provide timely insights that support central banks in their efforts to maintain price and macro-financial stability.

This article first introduces the survey by describing the structure of the questionnaire and providing an overview of the data collected in March and April 2025.6 It then delves into household inflation expectations, documenting baseline forecasts and their risk balance, the role of salient items, the relationship with other economic expectations and differences across households. The subsequent section focuses on perceptions of the post-pandemic inflation surge, its drivers and the impact on real wages. Finally, the article examines knowledge of central banks, including awareness of their mandates and operational tools, households' sources of information and their support for central bank independence.

Structure of the survey questionnaire

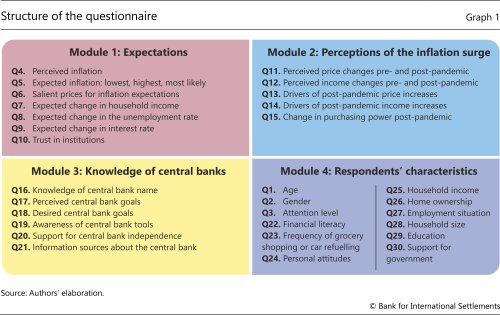

This section provides a brief overview of the survey structure, with the complete questionnaire available in a separate Online Annex. The first two questions elicit information about the age and gender of respondents, and the third assesses their attention, discarding those that provide answers inconsistent with the instructions.7 The rest of the questionnaire is broadly organised in four modules, as summarised in Graph 1.

The first part of the survey, covering questions 4 to 10, focuses on eliciting households' near-term expectations about inflation and a few other key macroeconomic variables. After a simple explanation of the concept of inflation, survey participants are asked about their perception of current inflation and their expectations of the inflation rate over the next 12 months.8 Specifically, households have to provide their lowest, highest and most likely expected inflation rates, which allows us to measure both the first and second moment of inflation expectations under standard distributional assumptions and with minimal cognitive effort from the respondents. Additionally, participants are asked about the specific goods or services that most strongly influence their inflation expectations. This section also gathers household expectations about their future income, the unemployment rate and interest rates, as well as their trust in the government, central banks and domestic banks.

The second part of the survey, covering questions 11 to 15, gauges households' views of the post-pandemic inflation surge and contrasts this period with pre-pandemic years. Specifically, respondents are asked about perceived changes in prices and wages during the five years before and after the Covid-19 pandemic. The survey also goes a step further by asking for the perceived causes of the inflation surge, the factors driving wage dynamics and the perceived change in purchasing power since the onset of the pandemic.

The third section, spanning questions 16 to 21, assesses households' knowledge of central banks and their mandates. Participants are asked whether they recognise the name of their central bank and to indicate their perceived and desired objectives for central banks. Further questions explore households' understanding of monetary policy tools, their support for central bank independence and their sources of information about central banks and monetary policy.

The final section of the survey collects rich information about respondents' demographic, socioeconomic and other personal characteristics. This includes questions on their financial literacy, the frequency of grocery and gasoline shopping, personal attitudes such as risk-taking, impatience and mathematical ability, as well as household income, home ownership, employment status, household size, education level and support for the political parties in power in their country.

The first and fourth sections of the survey will likely be repeated on a yearly basis on a new set of households to build consistent time series data. This will also make it possible to verify the extent to which the insights based on this first wave are time-specific or hold more broadly over time. The second and third sections will be adapted periodically to address topical issues.

Household inflation expectations

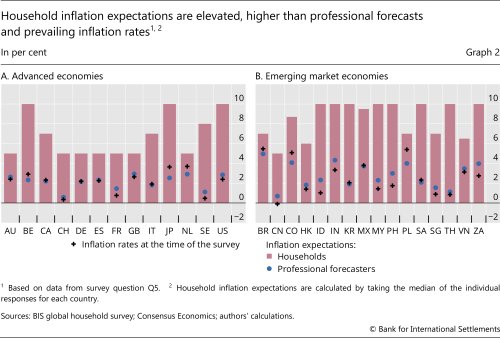

Across both AEs and EMEs, the 12-month-ahead inflation expectations of households are elevated, considerably exceeding the prevailing inflation rates at the time of the survey.9 Household inflation expectations are also notably higher than professional forecasts. In AEs, the former are approximately double the latter, with the largest gaps observed in Switzerland, Japan, Sweden and the United States (Graph 2.A). In EMEs, the discrepancies tend to be even more pronounced, with the widest gaps recorded in Thailand, Saudi Arabia, Malaysia, Indonesia and Korea (Graph 2.B). Overall, the survey results demonstrate that the upward bias in household inflation expectations relative to actual realisations as well as to professional forecasts is a truly global phenomenon.

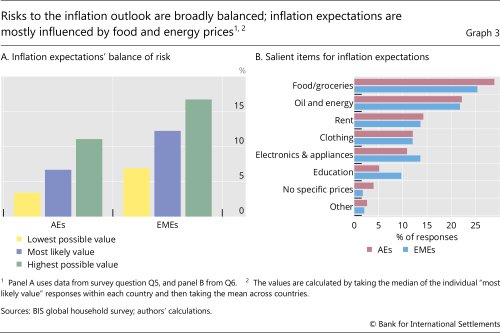

On average across all countries, households report broadly balanced views of the risk to the inflation outlook (Graph 3.A). Besides providing the "most likely value" of the 12-month-ahead inflation rate, households are also asked about the "lowest possible value" and the "highest possible value". The "most likely value" for expected inflation falls roughly in the middle of the reported range, indicating that households expect inflation to be equally likely to overshoot or undershoot the baseline forecasts. However, we observe some differences between AEs and EMEs, with risks to the inflation outlook modestly tilted to the upside for AEs and to the downside for EMEs.

The survey also provides new evidence regarding the specific goods and services influencing household inflation expectations. Notably, households place more emphasis on particular categories of prices when forming expectations of aggregate inflation, although with significant variation across country groups. In both AEs and EMEs, expectations appear most heavily influenced by the price of food and groceries as well as of oil and energy (Graph 3.B).10 However, food appears to have a stronger influence on household inflation expectations in AEs than in EMEs, despite the typically higher weight for food in EMEs' consumer price indices. Conversely, electronics and education hold relatively greater salience in EMEs.

Relationship between inflation expectations and other economic expectations

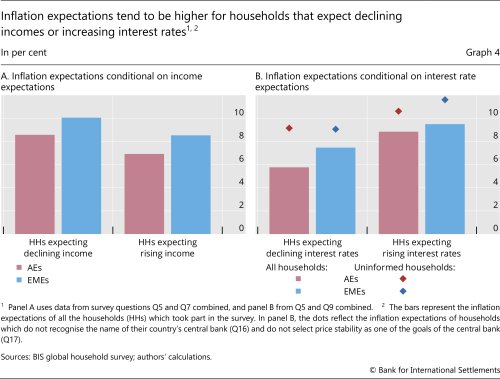

Regarding the relationship between inflation expectations and other economic beliefs, in both AEs and EMEs inflation expectations tend to be more elevated among households that expect their income to decrease (Graph 4.A). These patterns should be interpreted with caution since they are based on cross-sectional variation across households, which prevents a clear identification of the underlying drivers. However, a plausible interpretation consistent with other evidence in the literature (Kamdar (2019); Coibion et al (2022); Grigoli and Sandri (2024)), is that households' views of inflation tend to be stagflationary rather than demand driven. In other words, households tend to associate higher inflation with lower income, consistent with perceptions of a worsening economic outlook following an adverse supply shock.

Inflation expectations also tend to be higher among households that expect interest rates to increase (Graph 4.B), as also documented in Coibion et al (2023) for the United States. These findings lend themselves to different interpretations. One possibility is that households understand that central banks typically increase interest rates to maintain price stability when inflation rises. However, this interpretation is unlikely to explain the positive correlation between expected inflation and interest rate changes since this pattern is present even among respondents that have very limited understanding of monetary policy.11 Alternatively, causality may run in the opposite direction, reflecting the cost channel of monetary policy (Barth and Ramey (2001)). Specifically, households may expect that higher interest rates will feed into inflation by raising borrowing costs. Finally, these patterns may also simply reflect differences in attitudes, with some households being more pessimistic and thus expecting higher inflation and increasing interest rates.

Differences across households

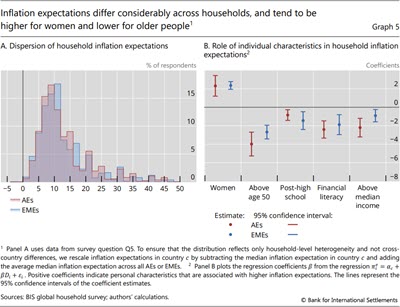

The survey results also reveal that household inflation expectations vary considerably across households. Across both AEs and EMEs, the distribution of inflation expectations displays a long right tail (Graph 5.A).12

By collecting a rich set of information about the respondents, the survey makes it possible to examine how personal characteristics influence the formation of household expectations and helps to explain their dispersion. To this end, we estimate the following regression:

The dependent variable, πei is the inflation expectation of an individual household i. The vector Di includes dummy variables capturing the following household characteristics: financial literacy (high),13 gender (female), age (above 50), education level (college or higher), political views (supports the political party currently forming the government), employment status (employed), home ownership (owns a home), and income level (above the median value for each country).14

Regression results highlight gender, age, education, financial literacy and income level as key factors influencing inflation expectations, in both AEs and EMEs (Graph 5.B). Specifically, inflation expectations tend to be higher for women, possibly due to their greater exposure to volatile food prices (D'Acunto, Malmendier and Weber (2021)). Expectations are also generally lower among older individuals and those with higher levels of education, better financial literacy and higher income levels (consistent with evidence from individual countries reported in Das et al (2020), D'Acunto et al (2023) and Weber et al (2022)). The lower expectations among older individuals may stem from their longer experience of relatively stable inflation, which may have reduced the sensitivity of their inflation expectations to the recent post-pandemic inflation surge, in line with the results in Malmendier and Nagel (2016). The role of higher education and financial literacy, in turn, probably reflects greater attention to the news and a better understanding of the economic outlook. Lastly, higher income levels may reduce vulnerability to inflation and mitigate concerns about its future evolution.

Perceptions of the post-pandemic inflation surge

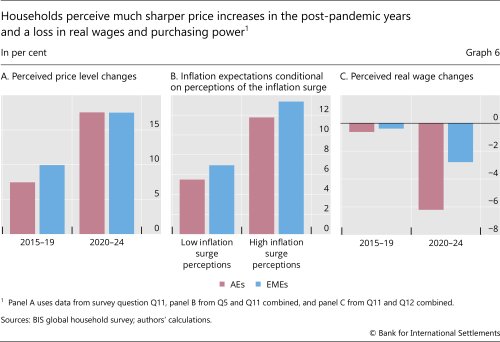

One module of the survey is designed to gather information about households' views of the post-pandemic inflation surge. A first key finding here is that households clearly recognise that the pace of price increases in the post-pandemic years has been significantly faster than in the pre-pandemic period (Graph 6.A). The perceived acceleration in price growth is particularly pronounced in AEs, where households report that prices rose more than twice as fast during 2020–24 than in 2015–19.

The survey also reveals that inflation expectations are considerably higher among households that perceive a stronger surge in inflation. Specifically, households with an above-median perception of the inflation surge tend to have inflation expectations that are twice as high as those with below-median perceptions (Graph 6.B). As noted earlier, these results reflect cross-sectional differences and do not allow for a clear identification of the underlying drivers. Nonetheless, they suggest that the inflation surge might be playing an important role in shaping the current elevated level of inflation expectations. These considerations underscore the risk that a temporary inflation burst could have lasting effects on household inflation expectations.

Besides being aware of the post-pandemic acceleration in price growth, households believe the inflation surge has led to a notable erosion of real wages (Graph 6.C). In the pre-pandemic years, households had only a mildly negative perception of real wage dynamics, across both AEs and EMEs. However, these perceptions have significantly deteriorated in the post-pandemic period, especially in AEs, where households report a 6% loss in real wages. This stands in contrast to actual data, which indicate that wages have broadly kept pace with price increases.15 The perceived strong erosion of real wages is further confirmed by most survey participants reporting a decline in their purchasing power since the onset of the pandemic.

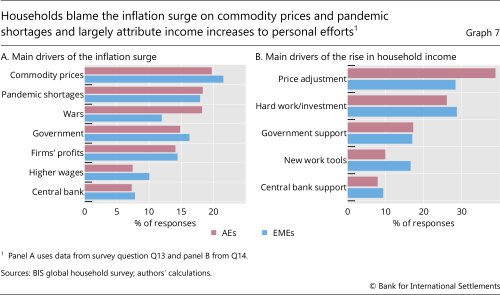

The survey also sheds light on households' perceptions about the causes of the inflation surge and the factors driving the post-pandemic increase in household income. Households attribute the inflation surge primarily to the rise of commodity prices and shortages caused by pandemic-related disruptions (Graph 7.A). Governments and wars are also perceived as important factors driving price increases, with the latter playing a particularly important role in AEs. In contrast, central banks are the least frequently mentioned factor, suggesting that households generally do not hold central banks responsible for the inflation surge. That said, rather than indicating broad-based support for the central bank's actions during the inflation surge, this finding may reflect limited public understanding of the central bank's role, as discussed in the next section.

Regarding the factors contributing to income increases in the post-pandemic years, households typically recognise that wage adjustments have been partly driven by the need to compensate workers for rising prices, especially in AEs (Graph 7.B). This understanding might have offered households some consolation during the inflation surge. However, as previously noted, households do not believe that wage adjustments have fully kept pace with inflation. Additionally, households attribute post-pandemic wage increases to their hard work and personal efforts. The perceived erosion of real wages, coupled with the belief that wage increases were largely driven by individual efforts, probably underpins the strong social resentment linked to the inflation surge (Edelman (2025)).

Further reading

- De Fiore, F, A Maurin, A Mijakovic and D Sandri (2024): "Monetary policy in the news: communication pass-through and inflation expectations", BIS Working Papers, no 1231.

- Grigoli, F and D Sandri (2024): "Public debt and household inflation expectations", BIS Working Papers No 1082 [or journal version]

- De Fiore, F, D Sandri and J Yetman (2025): "Household perceptions and expectations in the wake of the inflation surge: survey evidence", BIS Bulletin, No 104.

Households' knowledge of central banks

Finally, the survey gathers information about households' knowledge of the central bank, preferences regarding its mandates, knowledge of its operational tools and support for its independence.

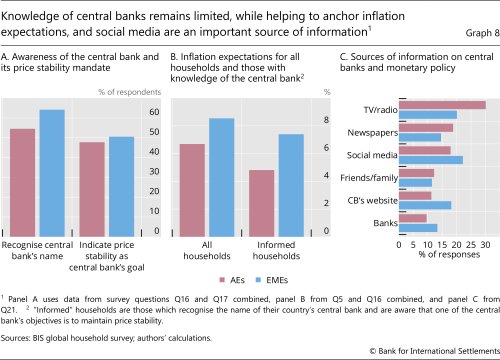

Survey participants are presented with the name of the country's central bank and asked to identify which institution it refers to. They have five options to choose from, for example a large private bank or a bank that provides services to the government. Most households recognise the central bank's name but knowledge is far from universal (Graph 8.A). Awareness is higher in EMEs than in AEs, suggesting that households may pay more attention to the central bank in a context of relatively less stable inflation (Weber et al (2025)).16 Fewer households, just about half, understand that preserving price stability is one of the central bank's goals.17

Interestingly, households' knowledge of the central bank and its price stability mandate appears to help anchor inflation expectations. Across both AEs and EMEs, households which recognise the name of their country's central bank and identify price stability as one of its goals tend to have lower inflation expectations (Graph 8.B).

These results highlight the potential value of targeting central bank communication to effectively reach uninformed or disengaged households.

Survey participants report that they obtain central bank and monetary policy information through a variety of channels. Social media emerges as an important source, especially in EMEs, where it surpasses news channels such as TV, radio and newspapers (Graph 8.C).

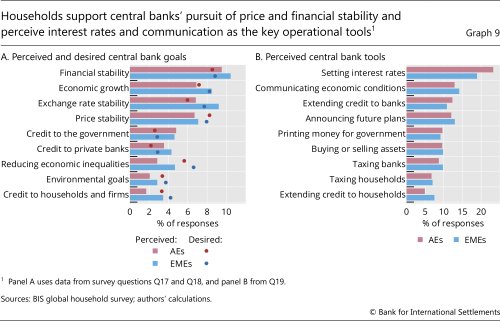

Besides assessing households' knowledge of price stability mandates, the survey inquires more broadly about the perceived goals of the central bank. Financial stability, economic growth and exchange rate stability are the most frequently mentioned perceived goals, scoring even above price stability (Graph 9.A).

The survey also asks respondents about which goals they would like central banks to pursue. Across AEs and EMEs, households' responses denote a desire for the central bank to place less emphasis on financial and exchange rate stability and more on price stability. Furthermore, households would like central banks to be more involved in reducing economic inequality and addressing environmental concerns relative to their currently perceived engagement, although these objectives are ranked as less important than ensuring price and financial stability. Lastly, households would prefer that central banks reduce credit provisions to governments and banks in favour of increasing credit to households and firms.

Households demonstrate a broad understanding of how central banks conduct monetary policy. Survey respondents are asked how central banks try to achieve their goals (Graph 9.B). "Setting interest rates", "communicating economic conditions" and "announcing future plans" emerge among the most frequently mentioned tools. Additionally, households exhibit awareness of the importance of tools such as "extending credit to banks" and "buying or selling assets", probably reflecting increased focus on unconventional monetary policy measures in central bank communication and media coverage since the Great Financial Crisis.

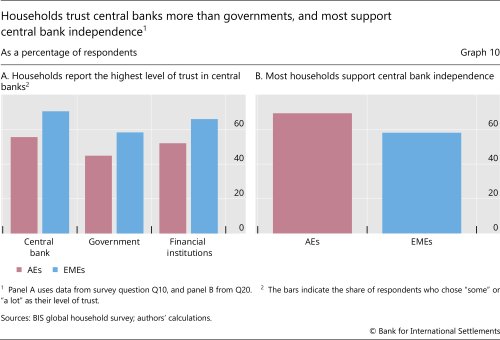

The survey also collects information on households' trust in institutions and their support for central bank independence. Households report higher levels of trust in central banks than in governments (Graph 10.A). This aligns with earlier findings that households attribute more blame to governments than to central banks for the inflation surge. The greater trust in central banks is further reflected in the majority support for central bank independence, with this support being stronger in AEs than in EMEs (Graph 10.B).

Conclusions

The findings from the global household survey presented in this article carry significant implications for central banks.

The elevated level of household inflation expectations – consistently higher than current inflation rates and professional forecasts – underscores the value in central banks engaging with wider public audiences to better anchor inflation expectations. In this regard, the survey highlights the importance of improving public understanding of central banks' role and price stability mandates, which remains quite limited. Households with greater knowledge indeed tend to have lower inflation expectations.

The data also reveal that inflation expectations are considerably higher among households with a stronger perception of the post-pandemic increase in the price level. This underscores the risk that even a temporary inflation burst could have lasting effects on household inflation expectations. It also invites consideration of whether central banks should base decisions not only on deviations of inflation from target but also on the dynamics of the price level. Household perceptions that real wages have significantly eroded in the post-pandemic period, despite wages having largely kept pace with inflation, further point to the importance of central banks enhancing transparency and addressing misconceptions about price and wage dynamics.

Finally, the importance of social media as households' source of information on monetary policy raises the question of whether central banks should enhance their engagement on these platforms to foster public understanding of their policies and achieve broader outreach.

References

Afrouzi, H, A Blanco, A Drenik and E Hurst (2025): "A theory of how workers keep up with inflation", Becker-Friedman Institute Working Paper, no 2024-153.

Armantier, O, G Topa, W Van der Klaauw and B Zafar (2017): "An overview of the survey of consumer expectations", Economic Policy, vol 23, no 2, pp 51–72.

Barth III, M and V Ramey (2001): "The cost channel of monetary transmission", NBER macroeconomics annual, vol 16, pp 199–240.

Blinder, A, M Ehrmann, J de Haan and D Jansen (2024): "Central bank communication with the general public: promise or false hope?", Journal of Economic Literature, vol 62, no 2, pp 425–57.

Brandão-Marques, L, G Gelos, D Hofman, J Otten, G Pasricha and Z Strauss (2023): "Do household expectations help predict inflation?", IMF Working Paper, no 2023/224.

Coibion, O, D Georgarakos, Y Gorodnichenko and M Weber (2023): "Forward guidance and household expectations", Journal of European Economic Association, vol 21, no 5, pp 2131–71.

Coibion, O and Y Gorodnichenko (2025): Expectations matter: the new causal macroeconomics of surveys and experiments, Princeton University Press.

Coibion, Y Gorodnichenko and M Weber (2022): "Monetary policy communications and their effects on household inflation expectations", Journal of Political Economy, vol 130, no 6, pp 1537–84.

D'Acunto, F, E Charalambakis, D Georgarakos, G Kenny, J Meyer and M Weber (2024): "Household inflation expectations: an overview of recent insights for monetary policy", NBER Working Paper, no 32488.

D'Acunto, F, D Hoang, M Paloviita and M Weber (2023): "IQ, expectations, and choice", Review of Economic Studies, vol 90, no 5, pp 2292–325.

D'Acunto, F, U Malmendier, J Ospina and M Weber (2021): "Exposure to grocery prices and inflation expectations", Journal of Political Economy, vol 129, no 5, pp 1615–39.

D'Acunto, F, U Malmendier and M Weber (2021): "Gender roles produce divergent economic expectations", Proceedings of the National Academy of Sciences, vol 118, no 2.

D'Acunto, F and M Weber (2024): "Why survey-based subjective expectations are meaningful and important", Annual Review of Economics, vol 16, pp 329–57.

Das, S, C Kuhnen and S Nagel (2020): "Socioeconomic status and macroeconomic expectations", Review of Financial Studies, vol 33, no 1, pp 395–432.

De Fiore, F, M Lombardi and J Schuffels (2022): "Are households indifferent to monetary policy announcements?", CEPR Discussion Paper, no DP17041.

De Fiore, F, A Maurin, A Mijakovic and D Sandri (2024): "Monetary policy in the news: communication pass-through and inflation expectations", BIS Working Papers, no 1231.

Edelman (2025): "Trust and the crisis of grievance", 2025 Edelman Trust Barometer Global Report.

Grigoli, F and D Sandri (2024): "Public debt and household inflation expectations", Journal of International Economics, vol 152, 104003.

Guiso, L, T Jappelli and L Pistaferri (2002): "An empirical analysis of earnings and employment risk", Journal of Business and Economic Statistics, vol 20, no 2, pp 241–53.

Hofmann, B, K Munakata, T Rosewall and D Sandri (2025): "Completing the post-pandemic landing", BIS Bulletin, no 97.

Kamdar, R (2019): "The inattentive consumer: sentiment and expectations", mimeo.

Malmendier, U and S Nagel (2016): "Learning from inflation experiences", Quarterly Journal of Economics, vol 131, no 1, pp 53–87.

Reis, R (2021): "Losing the inflation anchor," Brookings Papers on Economic Activity, September.

Weber, M, F D'Acunto, Y Gorodnichenko and O Coibion (2022): "The subjective inflation expectations of households and firms: measurement, determinants, and implications", Journal of Economic Perspectives, vol 36, no 3, pp 157–84.

Weber, M et al (2025): "Tell me something I don't already know: learning in low- and high-inflation settings", Econometrica, vol 93, no 1, pp 229–64.

Footnotes

1 The views expressed in this publication are those of the authors and not necessarily those of the BIS or its member central banks, Georgetown University or Purdue University. We thank Rudraksh Kansal for excellent research assistance. We are also grateful to Ryan Banerjee, Blaise Gadanecz, Gaston Gelos, Benoît Mojon, Daniel Rees, Andreas Schrimpf, Frank Smets, Hyun Song Shin and James Yetman for helpful comments. All remaining errors are our own.

2 See D'Acunto et al (2024) for a literature review on the role of household inflation expectations for consumption and investment choices, as well as for price and wage setting.

3 The survey was designed in collaboration with Francesco D'Acunto (Georgetown University) and Michael Weber (Purdue University) who also contributed to financing the study.

4 The countries include AR, AU, BE, BR, CA, CH, CN, CO, DE, ES, FR, GB, HK, ID, IN, IT, JP, KR, MX, MY, NL, PH, PL, SA, SE, SG, TH, TR, US, VN and ZA.

5 The survey elicits expectations and perceptions of individuals. In the article we refer to "individuals", "respondents" and "households" interchangeably.

6 The overview in this article is based on 29 countries, as it excludes Argentina and Türkiye, where inflation expectations are significantly higher than in other countries.

7 Survey participants are selected to broadly match the population structure of each country.

8 The question design follows standard practice in the literature, for example as in Guiso et al (2002), Armantier et al (2017) and Coibion and Gorodnichenko (2025).

9 These results are consistent with evidence from household surveys in individual countries (D'Acunto and Weber (2024)).

10 These findings are consistent with previous survey results, documenting that some goods (eg groceries and gasoline prices) have outsize salience and hence stronger influence on household expectations (see eg D'Acunto, Malmendier, Ospina and Weber (2021) and D'Acunto, Malmendier and Weber (2021)).

11 These are the respondents who do not recognise the name of their country's central bank and do not select price stability among its goals.

12 For example, on average across countries, about one in five households expect the inflation rate over the next 12 months to exceed 15%. A large dispersion in household inflation expectations can be indicative of higher future inflation, as documented, for example, in Reis (2021) and Brandao-Marques et al (2023).

13 The dummy variable for financial literacy takes the value of one if the household understands that the statement in question Q22 is incorrect: "If the money in your savings account grows at an annual rate of 5%, then you will be able to buy more with this money in the future than you are able to buy today regardless of the rate of inflation."

14 The regression includes country fixed effects ac, is estimated for AEs and EMEs separately and takes out outliers, including only households with inflation expectations between –5% and 50%.

15 See Hofmann et al (2025) for evidence about the behaviour of real wages during the pandemic and Afrouzi et al (2024) for a macroeconomic theory that can explain the divergence between data and households' perceptions.

16 Consistent with limited awareness, De Fiore et al (2022) and Blinder et al (2024) provide evidence that household inflation expectations exhibit little sensitivity to Federal Open Market Committee announcements in the United States, although De Fiore et al (2024) find greater sensitivity to the media coverage of these announcements.

17 Among all 29 jurisdictions examined in this article, only the Hong Kong Monetary Authority does not have a price stability mandate, focusing instead on currency stability.