The interplay of fund liquidity and high market pressure

Box extracted from chapter "Commonality under pressure: banks and funds"

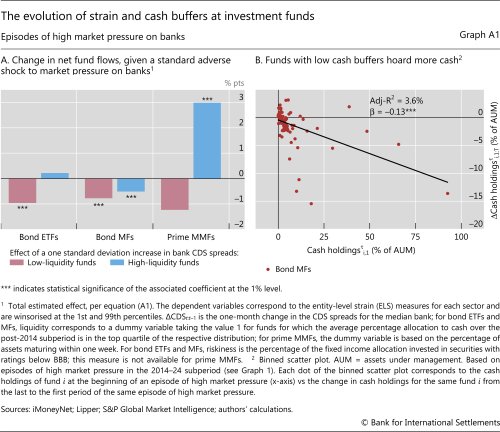

Previous studies have found that investment funds can mitigate redemption risk by building liquidity buffers. In this box, we add to this evidence by studying net flows at individual funds in three sectors – open-ended corporate bond mutual funds (MFs), corporate bond exchange-traded funds (ETFs) and US prime money market funds (MMFs). We find that at times of high market pressure in the banking sector, funds with low liquidity buffers tend to experience stronger outflows and hoard cash.

In this box, we add to this evidence by studying net flows at individual funds in three sectors – open-ended corporate bond mutual funds (MFs), corporate bond exchange-traded funds (ETFs) and US prime money market funds (MMFs). We find that at times of high market pressure in the banking sector, funds with low liquidity buffers tend to experience stronger outflows and hoard cash.

Our empirical setup incorporates monthly data from January 2014 to August 2024. Within this period, we focus on months of high market pressure, ie those witnessing the top 10% of four-month changes in the median credit default swap (CDS) spread across 53 large banks. We draw our sample from the top 500 funds in each sector, working with those for which there are data on cash holdings (bond MFs and bond ETFs) or the holdings of (liquid) assets maturing within a week (prime MMFs). For each sector, a dummy variable "liquidity," indicates which funds are in the top quartile with respect to the average ratio of cash or liquid assets to total assets under management (AUM). Then, denoting by NFF the ratio of net fund lows relative to AUM, and by  the one-month change in the median CDS spread in the banking sector, we estimate the following regression equation:

the one-month change in the median CDS spread in the banking sector, we estimate the following regression equation:

Here, i denotes funds, k a fund sector, t time and riskiness a control variable that is equal to the share of fixed income securities with a rating below investment grade in the total AUM.

We find that, all else equal, funds come under greater strain when their liquidity position is weaker (Graph A1.A). In the bond MF sector, the average net flow – a 1% outflow – tends to decline by 0.5 percentage points for high-liquidity funds when the banking sector CDS spread increases by one standard deviation. At 0.8 percentage points, the corresponding decline at low-liquidity bond MFs – from an average 0.8% outflow – is larger in statistical terms. The results are qualitatively the same for bond ETFs and prime MMFs. That said, the estimated effects on these funds are statistically significant only for one of the subgroups, and neither effect results in an outflow when applied to the corresponding average net flow.

Given the high incidence of outflows from bond MFs, we also investigate the evolution of cash buffers in that sector at the level of individual funds, again focusing on episodes of high market pressure on banks. For each of the four such episodes from 2014 to 2024, we use the initial cash buffer of a bond MF and the change of this buffer over the episode. This leads to the binned scatter plot in Graph A1.B. Consistent with previous research (Morris et al (2017)), funds with lower cash buffers tend to reduce these buffers by less, or even expand them. Thus, such funds not only face larger outflows – as implied by the estimate of equation (1) – but are also more likely to sell illiquid assets, which would contribute to a tightening of market conditions.

Thus, such funds not only face larger outflows – as implied by the estimate of equation (1) – but are also more likely to sell illiquid assets, which would contribute to a tightening of market conditions.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  See U Lewrick and S Claessens, "Open-ended bond funds: systemic risks and policy implications", BIS Quarterly Review, December 2021; and S Morris, I Shim and H S Shin, "Redemption risk and cash hoarding by asset managers", Journal of Monetary Economics, vol 89, pp 71–87, 2017.

See U Lewrick and S Claessens, "Open-ended bond funds: systemic risks and policy implications", BIS Quarterly Review, December 2021; and S Morris, I Shim and H S Shin, "Redemption risk and cash hoarding by asset managers", Journal of Monetary Economics, vol 89, pp 71–87, 2017.  We are unable to measure the riskiness of prime MMFs because of a lack of data.

We are unable to measure the riskiness of prime MMFs because of a lack of data.  See A Schrimpf, I Shim and H S Shin, "Liquidity management and asset sales by bond funds in the face of investor redemptions in March 2020", BIS Bulletin, no 39, March 2021.

See A Schrimpf, I Shim and H S Shin, "Liquidity management and asset sales by bond funds in the face of investor redemptions in March 2020", BIS Bulletin, no 39, March 2021.