What could explain the recent drop in VIX?

Box extracted from Overview chapter "Markets count on a smooth landing'"

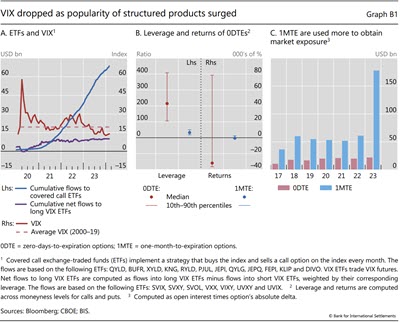

The compression of equity market volatility (VIX) throughout most of 2023 seems puzzling. Despite the prevailing uncertainty stemming from interest rate paths (Box A) and geopolitical tensions, the VIX remained below its long-term average of around 20 for most of 2023 (Graph B1.A, red line). Some observers relate the drop in VIX to the recent rise of trading in short-term options on the S&P 500 index that expire on the day of trading (zero-days-to-expiry or 0DTE). The rise of these short-term options, so the argument goes, has drawn trading activity away from the one-month-to-expiry (1MTE) options that underlie VIX. This drop in activity, in turn, has decreased demand for one-month options, thereby depressing VIX.

In this box, we show that the increased trading in 0DTEs in the past few years did not, on net, lure activity away from one-month options and thus is unlikely to be the main explanation behind the drop in VIX. We then propose an alternative explanation: option dealers effectively dampen volatility when they hedge structured products, which have become more popular recently.

In this box, we show that the increased trading in 0DTEs in the past few years did not, on net, lure activity away from one-month options and thus is unlikely to be the main explanation behind the drop in VIX. We then propose an alternative explanation: option dealers effectively dampen volatility when they hedge structured products, which have become more popular recently.

Trading volume in 0DTEs has risen in recent years because these options are relatively cheap and provide a lottery-like payoff with extremely high, if very unlikely, returns, which appeals to certain investors. These 0DTE options on the S&P 500 index (SPX) accounted for more than 50% of the SPX options' trading volume in August 2023, up from just 5% in 2016.

These 0DTE options on the S&P 500 index (SPX) accounted for more than 50% of the SPX options' trading volume in August 2023, up from just 5% in 2016. Low premiums on 0DTEs allow investors to build in very high leverage, hence the lottery-like payoff profile. In fact, leverage ratios of 0DTEs are several orders of magnitude higher than those of one-month options and can reach levels above 400 (Graph B1.B, left-hand scale). Investing in 0DTE options loses money on average, with annualised returns of -32,000%, but on rare occasions generates extremely high returns of up to 79,000% (Graph B1.B, right-hand scale). These returns are much more volatile than the returns on one-month options, which have an average return of -550% annualised and a maximum of 2,500%.

Low premiums on 0DTEs allow investors to build in very high leverage, hence the lottery-like payoff profile. In fact, leverage ratios of 0DTEs are several orders of magnitude higher than those of one-month options and can reach levels above 400 (Graph B1.B, left-hand scale). Investing in 0DTE options loses money on average, with annualised returns of -32,000%, but on rare occasions generates extremely high returns of up to 79,000% (Graph B1.B, right-hand scale). These returns are much more volatile than the returns on one-month options, which have an average return of -550% annualised and a maximum of 2,500%.

While the trading in 0DTEs soared in the past few years, this surge is unlikely to explain the drop in VIX for two reasons. First, even though both instruments have grown in past years, one-month options are still used disproportionally more than 0DTEs to get actual exposure to the market index itself (Graph B1.C, blue bars vs red bars). Second, 0DTE trading activity does not directly affect the pricing of one-month options and thus the VIX. This is because the latter is based on one-month maturity, whereas 0DTEs expire on the day of trading.

Second, 0DTE trading activity does not directly affect the pricing of one-month options and thus the VIX. This is because the latter is based on one-month maturity, whereas 0DTEs expire on the day of trading.

The sale of VIX futures by short VIX exchange-traded funds (ETFs), which was presumably one of the factors behind the drop in VIX in 2017–18, is also unlikely to explain the recent decrease in VIX. These ETFs could put downward pressure on VIX as they sell futures on the volatility index. Such a mechanism was potentially at play in the years before the "Volmageddon" of February 2018, when VIX spiked more than 100% on a single day. Recent years though have seen a net positive demand for VIX futures by VIX ETFs (Graph B1.A, purple line). This is inconsistent with pressure from VIX futures sales by ETFs as being a key driver of the drop in VIX.

Recent years though have seen a net positive demand for VIX futures by VIX ETFs (Graph B1.A, purple line). This is inconsistent with pressure from VIX futures sales by ETFs as being a key driver of the drop in VIX.

An alternative and presumably more likely reason behind the compression of volatility is the surge in issuance of yield-enhancing structured products. These types of structured products provide a yield enhancement by offering higher returns to investors thanks to the sale of options. A classic example of a yield-enhancing structured product is a so-called "covered call": a purchase of the S&P 500 index and a simultaneous sale of a one-month call option on the index. The product gives an exposure to the index and generates a yield enhancement with the sale of the call option (the premium income), but it gives up part of the upside if the index rises above a threshold, say 5% over the next month. In other words, an investor in this covered call effectively takes the view that the market will not rise more than 5% over the next month and monetises this view by selling the call option. A covered call is just a simple illustration of a yield-enhancing structured product, but there are many more-complicated types. These structured products are frequently offered to retail investors by banks, which are often dealers.

These structured products are frequently offered to retail investors by banks, which are often dealers.

The rise of yield-enhancing structured products may dampen volatility due to the mechanics of how dealers hedge option exposures. When dealers sell such structured products, they effectively buy an option from their clients. To hedge the option exposure, dealers trade in the underlying asset (the equity index) as a function of its price. Specifically, they need to buy when the index goes down and sell when it goes up – a practice known as "dynamic hedging".

Specifically, they need to buy when the index goes down and sell when it goes up – a practice known as "dynamic hedging". By doing so, dealers act in a contrarian way, effectively dampening the price movements of the underlying asset. As volatility declines, so does the cost of ensuring against it, as reflected in option prices. Such market dynamics could explain why the VIX can be depressed even in an environment of heightened uncertainty. Suggestive of this mechanism at play, the meteoric rise of yield-enhancing structured products linked to the S&P 500 over the last two years has gone hand in hand with the drop of VIX over the same period (Graph B1.A, blue line).

By doing so, dealers act in a contrarian way, effectively dampening the price movements of the underlying asset. As volatility declines, so does the cost of ensuring against it, as reflected in option prices. Such market dynamics could explain why the VIX can be depressed even in an environment of heightened uncertainty. Suggestive of this mechanism at play, the meteoric rise of yield-enhancing structured products linked to the S&P 500 over the last two years has gone hand in hand with the drop of VIX over the same period (Graph B1.A, blue line).

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.

The views expressed are those of the authors and do not necessarily reflect the views of the BIS.  R. Wigglesworth, "The 'broken' Vix", Financial Times, 30 January 2023, ft.com.

R. Wigglesworth, "The 'broken' Vix", Financial Times, 30 January 2023, ft.com.  G. Vilkov, "0DTE trading rules", December 2023, available at SSRN: https://ssrn.com/abstract=4641356.

G. Vilkov, "0DTE trading rules", December 2023, available at SSRN: https://ssrn.com/abstract=4641356.  M. Xu, "Volatility Insights: Much Ado About 0DTEs - Evaluating the Market Impact of SPX 0DTE Options", CBOE, 8 September 2023, cboe.com.

M. Xu, "Volatility Insights: Much Ado About 0DTEs - Evaluating the Market Impact of SPX 0DTE Options", CBOE, 8 September 2023, cboe.com.  As each option is equivalent to certain number of market shares (delta), the absolute exposure of all one-month options to the market is obtained by multiplying the total amount of option contracts traded with their absolute market share equivalent (absolute delta).

As each option is equivalent to certain number of market shares (delta), the absolute exposure of all one-month options to the market is obtained by multiplying the total amount of option contracts traded with their absolute market share equivalent (absolute delta).  K. Todorov, "When passive funds affect prices: evidence from volatility and commodity ETFs", Review of Finance, forthcoming.

K. Todorov, "When passive funds affect prices: evidence from volatility and commodity ETFs", Review of Finance, forthcoming.  Other examples include equity-linked notes or barrier options. Structured products might also involve selling a put option, or a simultaneous purchase and sale of calls and puts. However, as long as the product is yield-enhancing and generates higher coupons than the risk-free rate, which is achieved by the sale of options, the mechanism is similar to a covered call: the client is net short an option and thus sells volatility.

Other examples include equity-linked notes or barrier options. Structured products might also involve selling a put option, or a simultaneous purchase and sale of calls and puts. However, as long as the product is yield-enhancing and generates higher coupons than the risk-free rate, which is achieved by the sale of options, the mechanism is similar to a covered call: the client is net short an option and thus sells volatility.  The dealer can also offload the resulting exposure by matching it against opposing exposure due to transactions in other instruments or other clients; alternatively, the dealer can sell the option on the market, which would also decrease VIX because it depresses option prices.

The dealer can also offload the resulting exposure by matching it against opposing exposure due to transactions in other instruments or other clients; alternatively, the dealer can sell the option on the market, which would also decrease VIX because it depresses option prices.  H S Shin, Risk and Liquidity, Oxford University Press, 2019.

H S Shin, Risk and Liquidity, Oxford University Press, 2019.