Money market funds, other non-bank financial institutions and sponsored cleared repo

Box extracted from chapter "Who borrows from money market funds?"

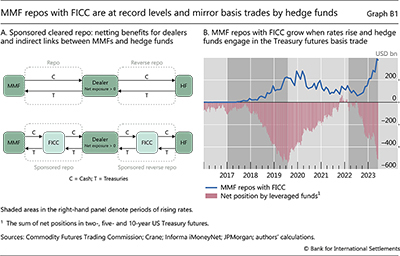

Non-bank financial institutions' (NBFI) borrowing from money market funds (MMFs) is predominately done through "sponsored cleared repo" with the Fixed Income Clearing Corporation (FICC). This box explains how sponsored repo connects MMFs and hedge funds (HFs), and how the link grows stronger when HFs bet on Treasuries (funded by repo). Such bets, or arbitrage trades, have recently caught the attention of regulators and the financial press.

Sponsored repo is a financial transaction in which a dealer facilitates non-dealer counterparties' access to the FICC cleared repo platform. In a standard matched-book repo trade, a dealer borrows money from a cash lender (eg an MMF) and then lends these funds to a cash borrower (eg a hedge fund) in exchange for collateral (Graph B1.A, upper part). This process requires the dealer to allocate capital against the repo exposure. In sponsored repo, on the other hand, FICC intermediates both sides of the trade between the counterparties that the dealer "sponsors". While the dealer still provides a guarantee to FICC in respect of all obligations of the sponsored counterparties, it offsets the multiple transactions on its balance sheet (Graph B1.A, lower part). This allows dealers to economise on capital, thus building larger leveraged exposures.

MMF reverse repos with FICC have risen substantially over the past five years, ebbing and flowing with interest rates (Graph B1.B). When interest rates rise, asset managers' demand for hedging interest rate risk leads them to take long positions in Treasury futures. In turn, the resulting price discrepancies between these futures and the underlying cash bonds (the "cash-futures basis") incentivise leveraged funds to engage in relative value trades that involve short positions in the futures and require repo funding (Avalos and Sushko (2023), Barth et al (2023)). Dealers provide this funding but – to the extent that the higher interest rates have tightened funding conditions – also seek to reduce the footprint of repo on their balance sheet through, for example, clearing. Consistent with this, MMF reverse repos with FICC grow during periods of rising rates, just as net short positions on US Treasury futures by leveraged funds build up.

Dealers provide this funding but – to the extent that the higher interest rates have tightened funding conditions – also seek to reduce the footprint of repo on their balance sheet through, for example, clearing. Consistent with this, MMF reverse repos with FICC grow during periods of rising rates, just as net short positions on US Treasury futures by leveraged funds build up.

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements.

The views expressed are those of the authors and do not necessarily represent the views of the Bank for International Settlements.  See Duguid et al (2023).

See Duguid et al (2023).  The cash-futures basis trade is an arbitrage strategy whereby investors go long cash Treasuries and short Treasury futures. Borrowing in the repo market to finance the trade and build leverage is key for this strategy, as the basis is generally narrow.

The cash-futures basis trade is an arbitrage strategy whereby investors go long cash Treasuries and short Treasury futures. Borrowing in the repo market to finance the trade and build leverage is key for this strategy, as the basis is generally narrow.